Wisconsin Current Income of Individual Debtors — Schedule — - Form 6I - Post 2005 is a legal document required in bankruptcy proceedings in Wisconsin. This form is used to provide a comprehensive overview of an individual debtor's current income. It plays a crucial role in determining the debtor's ability to repay debts under a bankruptcy plan. The Wisconsin Current Income of Individual Debtors — Schedule — - Form 6I - Post 2005 includes various sections where the debtor must provide detailed information regarding their income sources, frequency, and amount. The form helps creditors and the bankruptcy court evaluate the debtor's financial standing and whether they can meet their obligations. Key sections of the form include: 1. Employment Income: This section requires debtors to disclose their wages, salaries, and any other income earned through employment. They must specify the source, frequency (weekly, monthly, etc.), and average monthly income generated. 2. Self-Employment Income and Business Operations: Self-employed individuals must detail their business activities and income generated from these ventures. They need to provide information on the type of business, monthly gross receipts, and any necessary deductions. 3. Rental and Real Property Income: If debtors own or rent properties, this section requires them to provide details of their rental income, including the rental property address, monthly rent received, and any expenses associated with the property. 4. Interest, Dividend, and Investment Income: This section covers income generated from savings accounts, investments, stocks, bonds, and other similar financial instruments. The debtor must disclose the sources, frequency, and average monthly amount earned. 5. Retirement Income: Here, debtors must list any income received from pensions, annuities, Social Security, or other retirement plans. They need to provide specific details on the sources, frequency, and average monthly income. 6. Other Sources of Income: This section covers any additional income sources not mentioned above, such as royalties, alimony, child support, or regular gifts received. The debtor must specify the nature, frequency, and average monthly amount earned. It is essential to note that depending on the bankruptcy jurisdiction or specific circumstances, the title or structure of this form may slightly vary. However, the primary purpose of collecting information on the debtor's current income remains consistent. In summary, Wisconsin Current Income of Individual Debtors — Schedule — - Form 6I - Post 2005 is a critical document used to assess an individual debtor's financial status during bankruptcy proceedings. It requires debtors to provide comprehensive information about their various income sources, such as employment, self-employment, rental properties, investments, retirement funds, and other relevant revenue streams.

Wisconsin Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005

Description

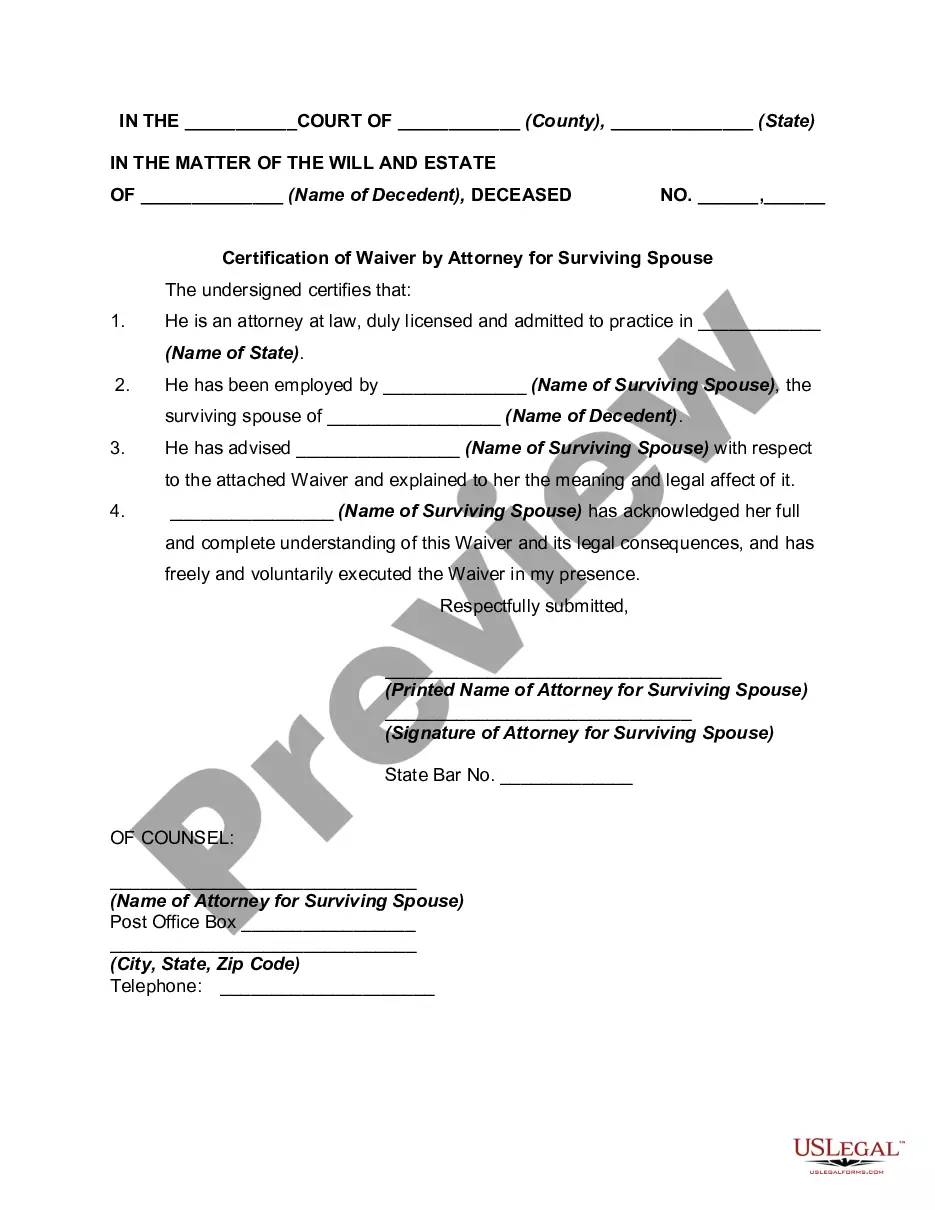

How to fill out Current Income Of Individual Debtors - Schedule I - Form 6I - Post 2005?

You are able to commit several hours on the web looking for the legal papers web template which fits the federal and state requirements you will need. US Legal Forms provides a large number of legal kinds which are evaluated by pros. You can easily down load or print the Wisconsin Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005 from your services.

If you have a US Legal Forms profile, you may log in and click on the Acquire button. After that, you may comprehensive, edit, print, or indication the Wisconsin Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005. Every single legal papers web template you buy is your own property for a long time. To acquire one more version for any purchased type, check out the My Forms tab and click on the related button.

If you work with the US Legal Forms site for the first time, keep to the straightforward guidelines under:

- Initially, make sure that you have selected the proper papers web template for the region/metropolis of your choice. Read the type information to make sure you have chosen the appropriate type. If available, use the Review button to look with the papers web template as well.

- If you wish to discover one more variation of your type, use the Look for discipline to find the web template that meets your requirements and requirements.

- After you have located the web template you desire, simply click Purchase now to proceed.

- Select the costs plan you desire, key in your qualifications, and register for an account on US Legal Forms.

- Comprehensive the transaction. You can utilize your credit card or PayPal profile to purchase the legal type.

- Select the format of your papers and down load it in your gadget.

- Make adjustments in your papers if needed. You are able to comprehensive, edit and indication and print Wisconsin Current Income of Individual Debtors - Schedule I - Form 6I - Post 2005.

Acquire and print a large number of papers web templates using the US Legal Forms website, which provides the greatest collection of legal kinds. Use skilled and state-specific web templates to handle your company or individual requirements.

Form popularity

FAQ

Official Form 106Sum is the Summary of Your Assets and Liabilities and Certain Statistical Information. It contains the ?bottom line? kind of information from your schedules. Things like the total value of your property, the total amount of your debts, and information about your income and expenses.

This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.

Assets are what a business owns, and liabilities are what a business owes. Both are listed on a company's balance sheet, a financial statement that shows a company's financial health. Assets minus liabilities equal equity?or the company's net worth.

Official Form 106Sum. Summary of Your Assets and Liabilities and Certain Statistical Information. 12/15. Be as complete and accurate as possible. If two married people are filing together, both are equally responsible for supplying correct information.

Statement of Financial Af·?fairs. : a written statement filed by a debtor in bankruptcy that contains information regarding especially financial records, location of any accounts, prior bankruptcy, and recent or current debt. called also statement of affairs.

Voluntary bankruptcy is a type of bankruptcy where an insolvent debtor brings the petition to a court to declare bankruptcy because they are unable to pay off their debts. Both individuals and businesses are able to use this approach.