Wisconsin Management Agreement between a Trust and a Corporation

Description

How to fill out Management Agreement Between A Trust And A Corporation?

Have you been inside a situation in which you need to have paperwork for possibly company or person purposes nearly every working day? There are a lot of lawful papers templates available online, but locating types you can depend on is not effortless. US Legal Forms gives a huge number of develop templates, like the Wisconsin Management Agreement between a Trust and a Corporation, which are composed to fulfill state and federal demands.

Should you be presently informed about US Legal Forms website and have a merchant account, just log in. After that, you are able to download the Wisconsin Management Agreement between a Trust and a Corporation format.

Unless you offer an bank account and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you want and make sure it is for the proper city/area.

- Utilize the Review switch to analyze the shape.

- See the outline to ensure that you have selected the proper develop.

- When the develop is not what you`re trying to find, take advantage of the Lookup industry to discover the develop that meets your requirements and demands.

- When you get the proper develop, click on Acquire now.

- Choose the rates plan you want, complete the specified information and facts to generate your account, and purchase an order making use of your PayPal or bank card.

- Select a handy data file format and download your backup.

Find each of the papers templates you have bought in the My Forms food selection. You may get a extra backup of Wisconsin Management Agreement between a Trust and a Corporation at any time, if required. Just go through the required develop to download or print out the papers format.

Use US Legal Forms, by far the most extensive collection of lawful kinds, to save lots of efforts and avoid errors. The support gives expertly made lawful papers templates that can be used for an array of purposes. Make a merchant account on US Legal Forms and begin producing your life a little easier.

Form popularity

FAQ

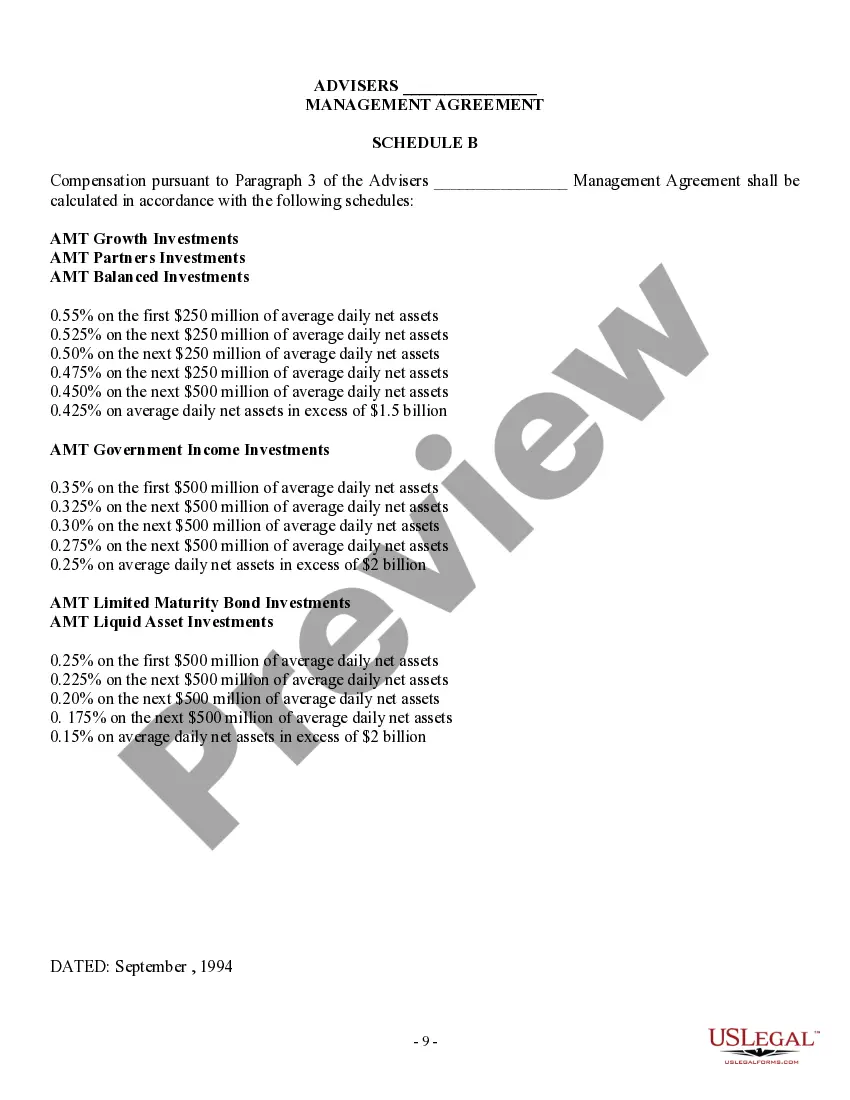

This standard takes into account factors such as the complexity of the trust, the responsibilities involved, the expertise required, and the time commitment. Professional trustees typically charge a flat fee or a percentage of the trust assets, ranging from 0.5% to 2% annually.

The cost of creating a trust in Wisconsin varies depending on the complexity of your estate and the attorney's fees. The average cost for a basic Revocable Living Trust ranges from $1,000 to $3,000, while more complex trusts may cost more.

In Wisconsin, a trust is revocable unless it specifically states it is irrevocable in the trust document. Usually a living revocable trust becomes irrevocable (not open to changes) when you die. A trust involves three parties: The settlor or grantor is you, the person who creates the trust.

701.0813 Duty to inform and report. (1) A trustee shall keep the distributees or permissible distributees of trust income or principal, and other qualified beneficiaries who so request, reasonably informed about the administration of the trust.

Irrevocable trusts become ?active? once funded and typically avoid taxes and probate after the grantor passes away. However, if the grantor is still alive, then the trust's assets are passed to a trustee to manage, and the grantor loses the ownership of the asset, ing to Wisconsin law.

701.0708 Compensation of trustee. (1) If the terms of a trust do not specify the trustee's compensation, a trustee is entitled to compensation that is reasonable under the circumstances.

(a) Upon the request of a qualified beneficiary for a copy of the trust instrument, promptly furnish to the qualified beneficiary either a copy of the portions of the trust instrument relating to the interest of the qualified beneficiary or a copy of the trust instrument.