Wisconsin Prospectus of Scudder growth and income fund

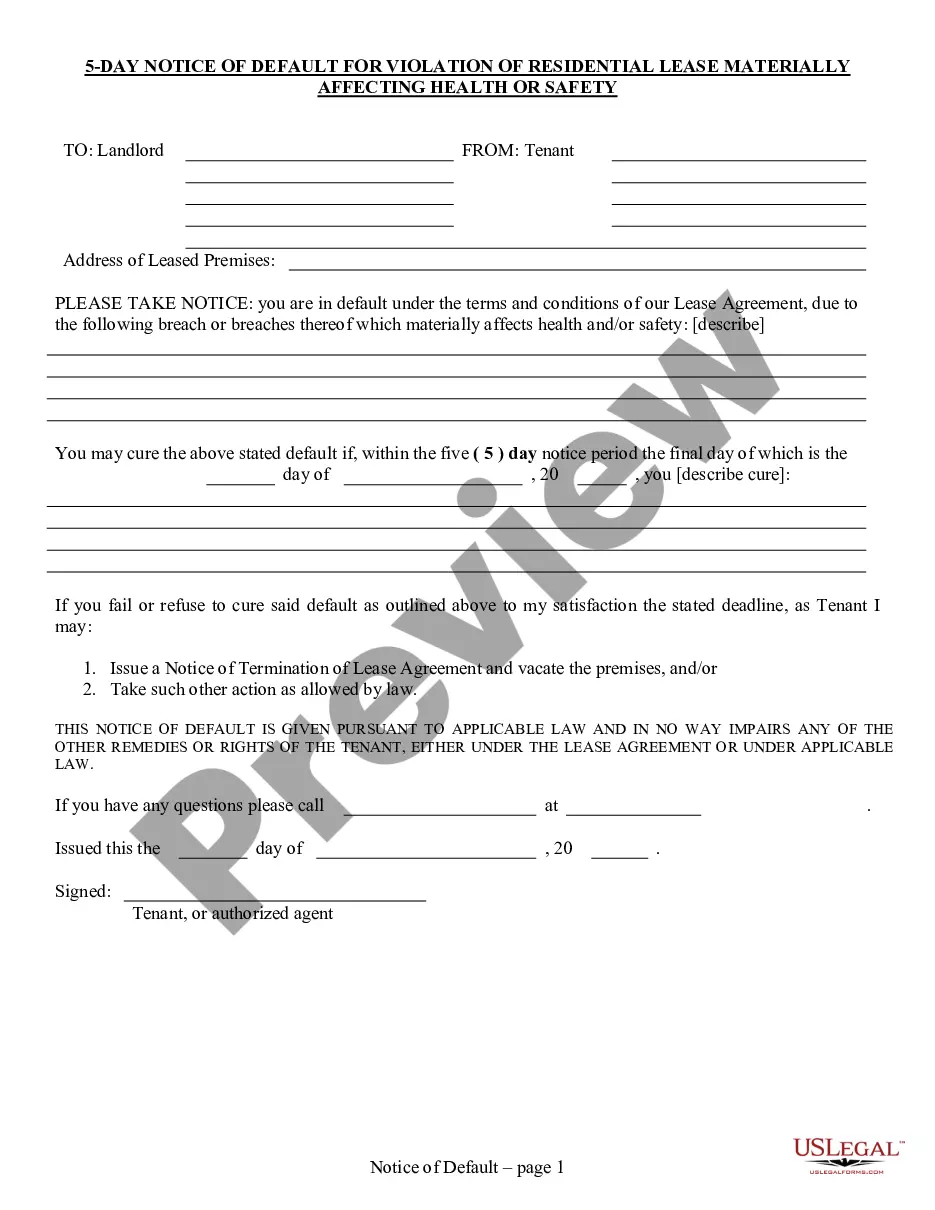

Description

How to fill out Prospectus Of Scudder Growth And Income Fund?

If you want to complete, acquire, or printing legitimate document themes, use US Legal Forms, the greatest selection of legitimate varieties, which can be found on-line. Take advantage of the site`s basic and handy search to obtain the papers you need. Numerous themes for enterprise and personal uses are sorted by groups and says, or keywords and phrases. Use US Legal Forms to obtain the Wisconsin Prospectus of Scudder growth and income fund in a number of click throughs.

When you are previously a US Legal Forms buyer, log in to the profile and then click the Obtain switch to find the Wisconsin Prospectus of Scudder growth and income fund. You can even access varieties you earlier delivered electronically from the My Forms tab of the profile.

Should you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have chosen the form to the correct city/country.

- Step 2. Take advantage of the Review option to examine the form`s information. Never overlook to read through the explanation.

- Step 3. When you are unhappy with all the kind, utilize the Search area towards the top of the display screen to find other types of your legitimate kind format.

- Step 4. After you have located the form you need, go through the Get now switch. Select the rates prepare you prefer and include your qualifications to sign up to have an profile.

- Step 5. Approach the purchase. You can utilize your bank card or PayPal profile to accomplish the purchase.

- Step 6. Find the structure of your legitimate kind and acquire it on the gadget.

- Step 7. Complete, change and printing or sign the Wisconsin Prospectus of Scudder growth and income fund.

Every legitimate document format you purchase is yours eternally. You might have acces to every single kind you delivered electronically with your acccount. Select the My Forms section and decide on a kind to printing or acquire yet again.

Compete and acquire, and printing the Wisconsin Prospectus of Scudder growth and income fund with US Legal Forms. There are millions of specialist and express-distinct varieties you can utilize for the enterprise or personal demands.

Form popularity

FAQ

Deutsche Bank buys Scudder Investments.

DWS Scudder changed its name to DWS Investments, completing a rebranding started two years ago to align with Deutsche Bank Asset Management (DeAM).

Effective February 6, 2006, Scudder Investments will change its name to DWS Scudder and the Scudder funds will be renamed DWS funds. The Trusts/Corporations that the funds are organized under will also be renamed DWS.