Wisconsin Directors and Officers Indemnity Trust, also known as WI DOT, is a specialized insurance program designed to protect directors and officers of organizations operating in Wisconsin. This program provides indemnity coverage to these individuals, safeguarding them from legal expenses and financial liabilities arising from their decisions and actions while serving in their official capacity. The Wisconsin Directors and Officers Indemnity Trust is vital for various entities such as corporations, non-profit organizations, educational institutions, and government agencies. It ensures that directors and officers can fulfill their duties without the fear of personal financial loss due to litigation or claims. Key Features and Benefits: 1. Comprehensive Protection: WI DOT offers comprehensive protection to directors and officers against lawsuits, claims, and legal expenses resulting from their management decisions, wrongful acts, errors, or omissions committed during their term of service. 2. Legal Defense Coverage: The trust provides coverage for legal defense costs, including attorney fees, court expenses, and settlements or judgments resulting from covered claims. 3. Personal Asset Protection: By having the Directors and Officers Indemnity Trust, the personal assets of directors and officers are shielded from being seized to satisfy legal judgments or settlements related to covered claims. 4. Reputation Preservation: WI DOT helps protect the reputation of directors and officers by providing coverage for defamation, libel, or slander claims, ensuring that their personal and professional standing remains intact. 5. Financial Stability: The trust's coverage ensures that directors and officers can confidently fulfill their responsibilities, knowing that they have the necessary financial support to navigate potential legal challenges. Types of Wisconsin Directors and Officers Indemnity Trust: 1. Corporate Directors and Officers (CDO) Indemnity: This type of coverage is tailored for directors and officers serving in for-profit corporations. It provides protection against shareholder derivative actions, breach of fiduciary duty allegations, securities claims, and other legal actions arising from their corporate responsibilities. 2. Non-Profit Directors and Officers (NO) Indemnity: NO Indemnity is specifically designed for directors and officers of non-profit organizations. It offers coverage against claims related to mismanagement, financial misrepresentation, employment practices, and regulatory or compliance issues. 3. Educational Institution Directors and Officers (DO) Indemnity: DO Indemnity focuses on the unique needs of directors and officers in educational institutions. It offers protection against claims pertaining to educational policies, employment practices, admissions, accreditation, and governance matters. 4. Government Directors and Officers (GO) Indemnity: GO Indemnity caters to directors and officers serving in government agencies. It provides coverage against claims arising from decisions related to policy-making, public service, enforcement actions, and constitutional rights violations. By securing Wisconsin Directors and Officers Indemnity Trust, directors and officers can perform their duties confidently, knowing they have the necessary protection and support in the face of legal challenges. It is essential to consult with insurance professionals to understand the specific coverage terms, limits, and exclusions associated with each type of indemnity trust.

Wisconsin Directors and Officers Indemnity Trust

Description

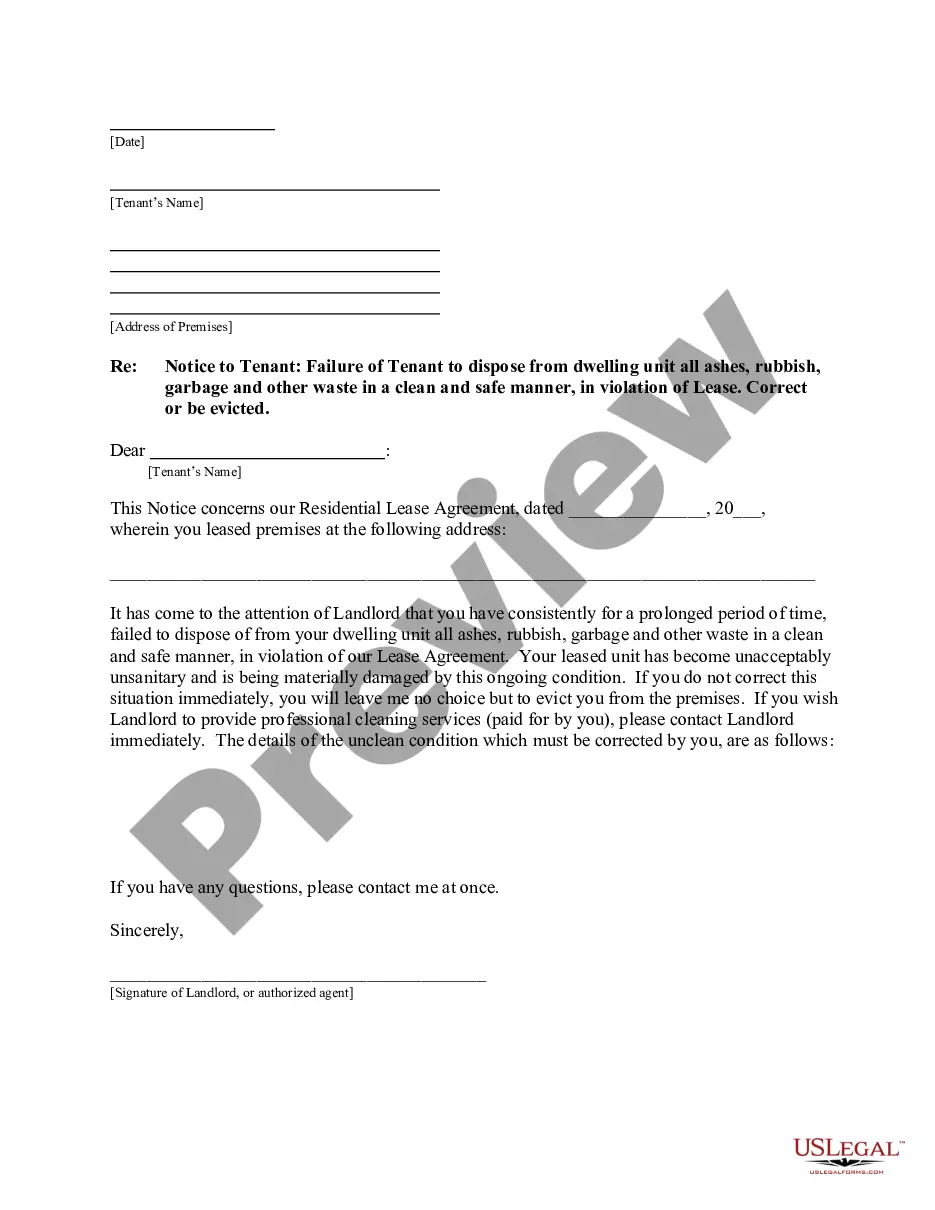

How to fill out Directors And Officers Indemnity Trust?

Choosing the best authorized record web template might be a have difficulties. Naturally, there are plenty of web templates accessible on the Internet, but how do you get the authorized form you want? Use the US Legal Forms website. The assistance gives a huge number of web templates, for example the Wisconsin Directors and Officers Indemnity Trust, that you can use for organization and personal requirements. All of the kinds are inspected by experts and meet state and federal requirements.

If you are currently listed, log in to your accounts and click on the Down load switch to obtain the Wisconsin Directors and Officers Indemnity Trust. Make use of accounts to check through the authorized kinds you possess purchased earlier. Visit the My Forms tab of your respective accounts and get one more copy in the record you want.

If you are a new user of US Legal Forms, listed below are simple directions that you can follow:

- Initial, be sure you have selected the right form for your area/region. You can look through the form utilizing the Preview switch and read the form outline to make sure this is the best for you.

- In case the form fails to meet your needs, use the Seach field to get the right form.

- When you are certain that the form would work, go through the Purchase now switch to obtain the form.

- Opt for the prices plan you need and enter in the needed info. Create your accounts and buy the transaction with your PayPal accounts or bank card.

- Choose the data file structure and down load the authorized record web template to your system.

- Comprehensive, modify and produce and signal the received Wisconsin Directors and Officers Indemnity Trust.

US Legal Forms is the most significant catalogue of authorized kinds in which you will find a variety of record web templates. Use the service to down load professionally-created papers that follow state requirements.

Form popularity

FAQ

Insurance ? The indemnification agreement typically will require that the company provide D&O liability insurance that protects the indemnitee to the same extent as the most favorably insured of the company's and its affiliates' current directors and officers.

Indemnity is implicated when a person discharges another's duty: A person who, in whole or in part, has discharged a duty which is owed by him but which as between himself and another should have been discharged by the other, is entitled to indemnity from the other, unless the payor is barred by the wrongful nature of ...

Section 145(c)(1) provides that to the extent a director has been successful on the merits or otherwise in defense of any action, suit, or proceeding referenced in Section 145(a) or Section 145(b), the director shall be indemnified against expenses actually and reasonably incurred by the director in connection ...

In legal terms, an Act of Indemnity is a statute passed to protect people who have committed some illegal act which would otherwise cause them to be subjected to legal penalties.

(1), a corporation may indemnify and allow reasonable expenses of an employee or agent who is not a director or officer of the corporation to the extent provided by the articles of incorporation or bylaws, by general or specific action of the board of directors or by contract.

701.0708 Compensation of trustee. (1) If the terms of a trust do not specify the trustee's compensation, a trustee is entitled to compensation that is reasonable under the circumstances.

(1), a corporation may indemnify and allow reasonable expenses of an employee or agent who is not a director or officer of the corporation to the extent provided by the articles of incorporation or bylaws, by general or specific action of the board of directors or by contract.

In the indemnity clause, one party commits to compensate another party for any prospective loss or damage. More common is in insurance contracts, in exchange for premiums paid by the insured to the insurer, the insurer offers to compensate the insured for any potential damages or losses.