Wisconsin Management Stock Purchase Plan

Description

How to fill out Management Stock Purchase Plan?

If you want to full, down load, or print out legal document templates, use US Legal Forms, the biggest collection of legal forms, that can be found on-line. Take advantage of the site`s easy and handy look for to find the papers you need. Different templates for company and personal reasons are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to find the Wisconsin Management Stock Purchase Plan in just a number of clicks.

In case you are presently a US Legal Forms client, log in for your bank account and then click the Obtain key to get the Wisconsin Management Stock Purchase Plan. You can also access forms you earlier downloaded inside the My Forms tab of your bank account.

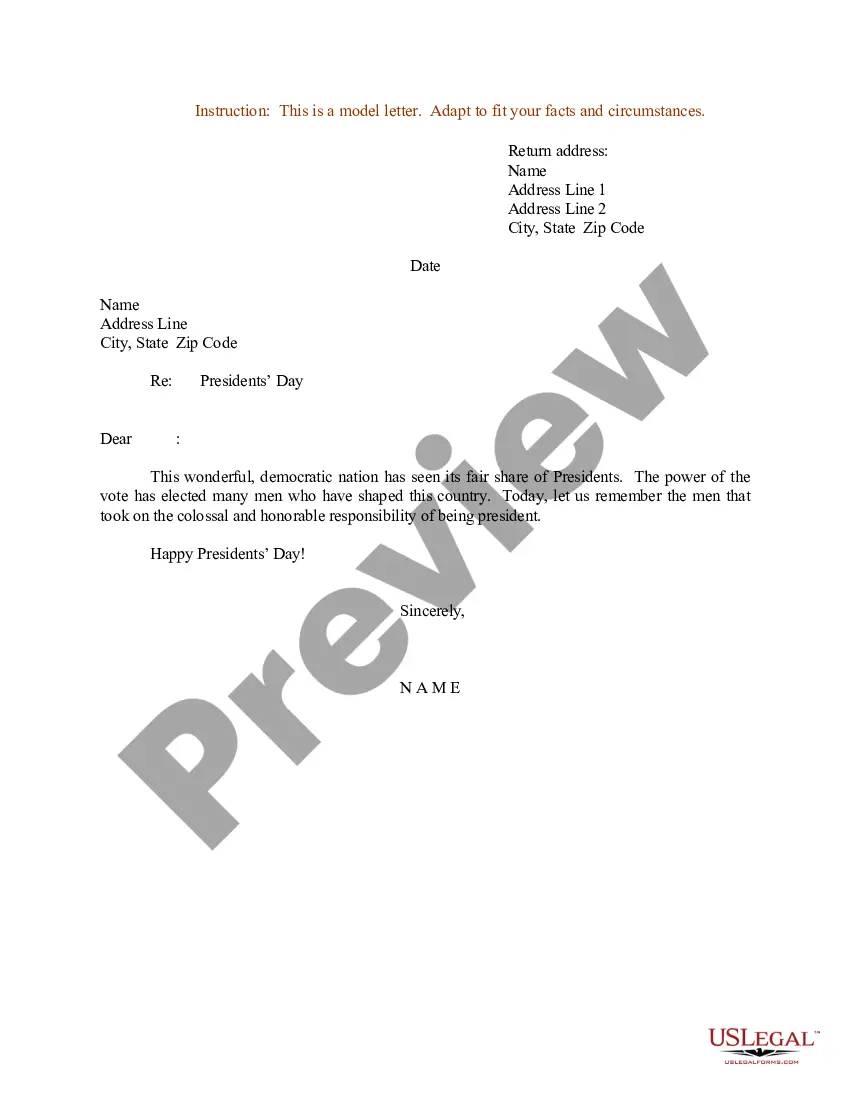

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for that proper area/land.

- Step 2. Take advantage of the Preview option to examine the form`s information. Never overlook to read the outline.

- Step 3. In case you are not happy with all the develop, take advantage of the Research area on top of the screen to locate other versions from the legal develop web template.

- Step 4. Upon having identified the form you need, click on the Get now key. Pick the prices program you like and add your references to register to have an bank account.

- Step 5. Process the financial transaction. You should use your credit card or PayPal bank account to complete the financial transaction.

- Step 6. Pick the file format from the legal develop and down load it on your device.

- Step 7. Comprehensive, modify and print out or sign the Wisconsin Management Stock Purchase Plan.

Each legal document web template you buy is your own eternally. You have acces to every develop you downloaded with your acccount. Click the My Forms segment and choose a develop to print out or down load once more.

Remain competitive and down load, and print out the Wisconsin Management Stock Purchase Plan with US Legal Forms. There are millions of professional and status-particular forms you can utilize for your personal company or personal requires.

Form popularity

FAQ

A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. The warrant is filed with the Clerk of Court and is a public record of the amount you owe. It could affect your ability to obtain credit or sell real estate. There are fees associated with filing a warrant.

You are required to file a Wisconsin income tax return if your Wisconsin gross income is $2,000 or more. Gross income means income before deducting expenses. While net income reported to you may be less than $2,000, gross income may be over that amount, requiring that a Wisconsin income tax return be filed.

The State of Wisconsin charges a flat $20 late filing fee and an additional 5% penalty on the total sales and use tax due at the time listed above. This penalty is accrued monthly up to a maximum penalty of 25%. There are additional fines for repeat offenses, fraud, or other failures to file properly.

How to Fill Out Form A-771 (Request a Payment Plan) This form request basic information about you, your spouse, and your taxes owed. It also asks you to specify a payment amount, whether you want to pay monthly, bi-weekly, or weekly, and the date of your first payment.

An employee who is a resident of another state and who telecommutes for a Wisconsin employer is subject to Wisconsin state income tax on the amount earned for the days the employee is present in the state.

Schedule M is used to report differences between federal and Wisconsin income. These differences are called modifications and may affect the amount you report on lines 15 and 28 of Form 1NPR.

Payment Plans?: For individuals and businesses registered for My Tax Account, log in to My Tax Account, select Manage My Collection and select Request New Plan under Payment Plan. Individuals and businesses not registered for My Tax Account can find the forms on our website to request a payment plan:

= $ Single TaxpayerMarried Filing JointlyCapital Gain Tax Rate$0 ? $44,625$0 ? $89,2500%$44,626 ? $200,000$89,251 ? $250,00015%$200,001 ? $492,300$250,001 ? $553,85015%$492,301+$553,851+20%