Wisconsin Approval of savings plan for employees

Description

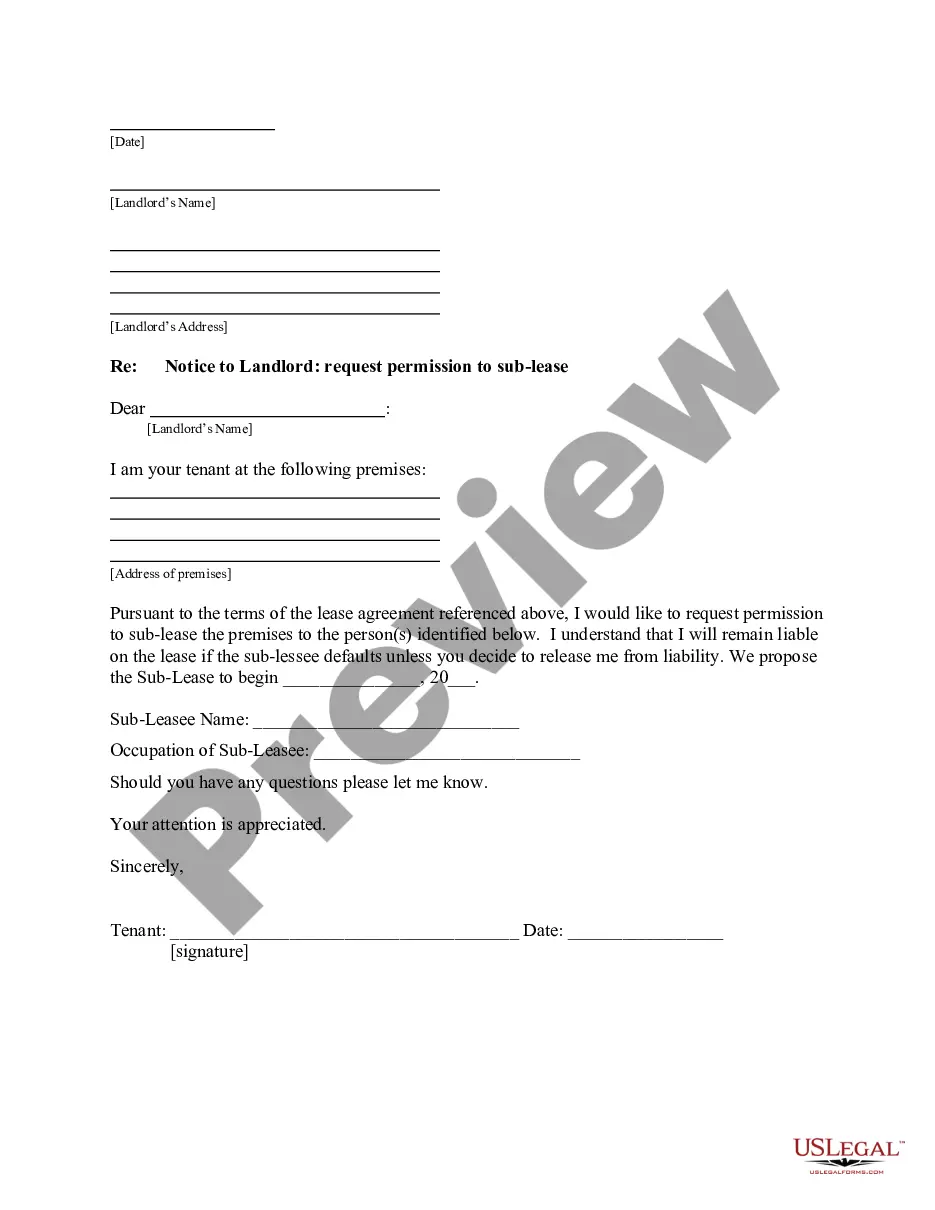

How to fill out Approval Of Savings Plan For Employees?

US Legal Forms - among the most significant libraries of legal forms in the States - offers a wide range of legal papers layouts you can download or produce. Making use of the website, you can get a large number of forms for enterprise and personal functions, categorized by groups, states, or keywords.You can find the latest variations of forms much like the Wisconsin Approval of savings plan for employees within minutes.

If you currently have a membership, log in and download Wisconsin Approval of savings plan for employees from your US Legal Forms local library. The Acquire option will show up on every form you see. You have accessibility to all in the past acquired forms from the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, here are basic directions to help you started:

- Be sure you have chosen the right form to your town/region. Click on the Review option to examine the form`s articles. Read the form outline to ensure that you have chosen the right form.

- When the form doesn`t suit your specifications, make use of the Lookup field near the top of the display to obtain the the one that does.

- Should you be content with the form, validate your option by clicking on the Purchase now option. Then, opt for the costs prepare you like and provide your references to sign up on an bank account.

- Approach the transaction. Make use of your credit card or PayPal bank account to accomplish the transaction.

- Pick the formatting and download the form in your gadget.

- Make modifications. Fill out, modify and produce and indicator the acquired Wisconsin Approval of savings plan for employees.

Each and every template you added to your money does not have an expiry time and is also your own property permanently. So, in order to download or produce yet another copy, just visit the My Forms section and click around the form you will need.

Obtain access to the Wisconsin Approval of savings plan for employees with US Legal Forms, one of the most comprehensive local library of legal papers layouts. Use a large number of skilled and express-particular layouts that meet up with your company or personal needs and specifications.

Form popularity

FAQ

To be eligible for a WRS retirement benefit: You must be vested and be at least age 55 (or age 50 if you have protective category service). You must terminate all WRS-covered employment. You must not be on a leave of absence or in layoff status. You must turn in a complete and valid retirement application to ETF.

For most people, the maximum amount that can be saved in a WDC account in 2023 is $22,500. However: If you are age 50 or older you can make annual catch-up contributions.

Members who are not vested may only receive a separation benefit. You may have to meet 1 of 2 vesting laws depending on when you first began WRS employment: If you first began WRS employment after 1989 and terminated employment before April 24, 1998, then you must have some WRS creditable service in 5 calendar years.

The 2023-25 proposal to adjust compensation of UW System employees constitutes increases of 4% and 2% to the budgeted salary base in July of each fiscal year, in ance with what was budgeted under 2023 Act 19 (the 2023-25 biennial budget) in compensation reserves.

The elective deferral limit ($22,500 in 2023; $20,500 in 2022; $19,500 in 2020 and in 2021). the basic annual limit plus the amount of the basic limit not used in prior years (only allowed if not using age 50 or over catch-up contributions)

Unlike a 401(k), which has contribution limitations, deferred comp plans have no limits, though employers may specify limits.

For most people, the maximum amount you can save in your WDC account in 2023 is $22,500. However: People age 50 or older can make annual catch-up contributions.

The amount you can defer (including pre-tax and Roth contributions) to all your plans (not including 457(b) plans) is $22,500 in 2023 ($20,500 in 2022; $19,500 in 2020 and 2021; $19,000 in 2021).