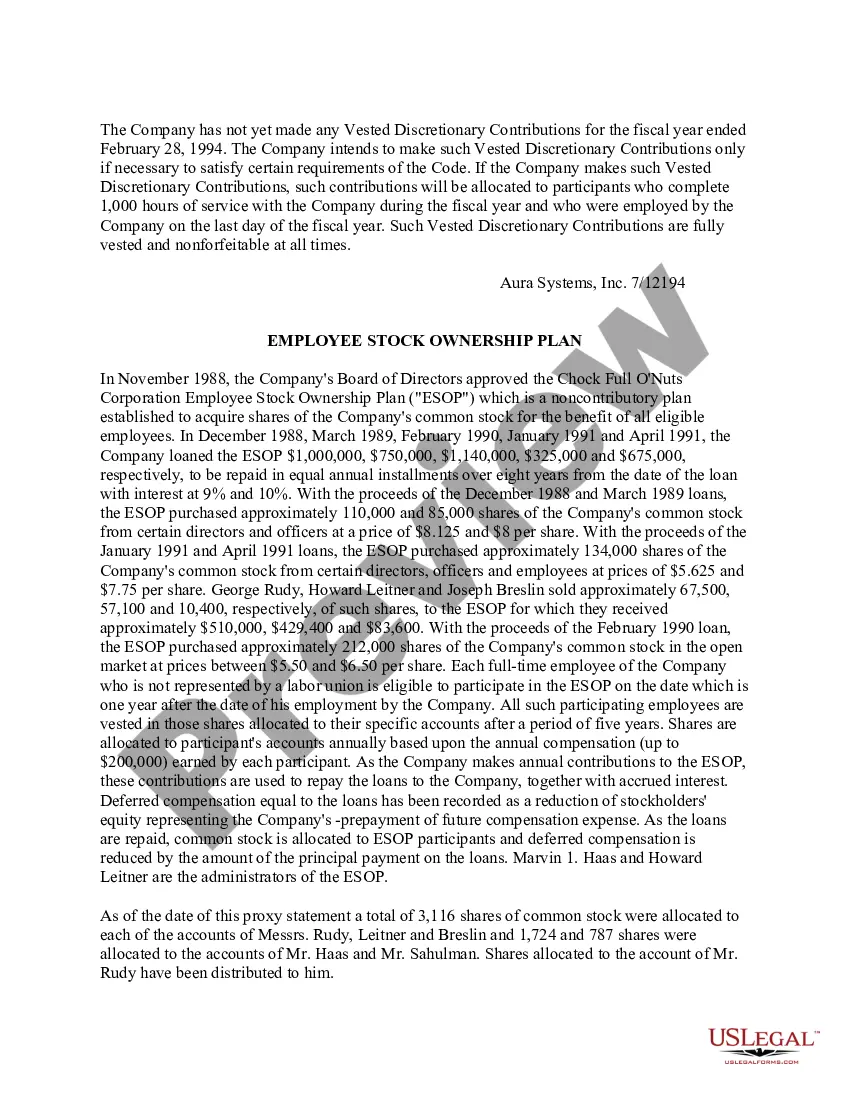

Wisconsin Employee Stock Ownership Plan of Aura Systems, Inc.

Description

How to fill out Employee Stock Ownership Plan Of Aura Systems, Inc.?

If you need to total, down load, or produce authorized papers templates, use US Legal Forms, the most important selection of authorized varieties, that can be found on-line. Take advantage of the site`s easy and convenient look for to get the paperwork you need. Various templates for enterprise and person uses are sorted by classes and states, or keywords. Use US Legal Forms to get the Wisconsin Employee Stock Ownership Plan of Aura Systems, Inc. with a couple of click throughs.

Should you be already a US Legal Forms client, log in for your accounts and click the Obtain switch to obtain the Wisconsin Employee Stock Ownership Plan of Aura Systems, Inc.. You may also access varieties you in the past acquired from the My Forms tab of the accounts.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for that correct city/country.

- Step 2. Use the Review solution to examine the form`s content. Do not forget to read through the information.

- Step 3. Should you be not satisfied with the develop, utilize the Search industry on top of the display screen to get other versions of the authorized develop web template.

- Step 4. Once you have located the shape you need, go through the Buy now switch. Choose the costs prepare you prefer and add your accreditations to sign up to have an accounts.

- Step 5. Approach the transaction. You may use your bank card or PayPal accounts to accomplish the transaction.

- Step 6. Select the structure of the authorized develop and down load it on your device.

- Step 7. Full, revise and produce or indication the Wisconsin Employee Stock Ownership Plan of Aura Systems, Inc..

Each authorized papers web template you get is your own permanently. You may have acces to each and every develop you acquired in your acccount. Click the My Forms portion and pick a develop to produce or down load once more.

Contend and down load, and produce the Wisconsin Employee Stock Ownership Plan of Aura Systems, Inc. with US Legal Forms. There are millions of professional and state-distinct varieties you can use to your enterprise or person needs.

Form popularity

FAQ

The ESOP is a tax-deferred retirement plan. Through your participation in the ESOP retirement plan, you have an ownership interest in shares of company stock that are credited to your ESOP account balance. These shares are provided each year at no cost to you.

The term employee stock option (ESO) refers to a type of equity compensation granted by companies to their employees and executives. Rather than granting shares of stock directly, the company gives derivative options on the stock instead.

In a leveraged ESOP structure, an inside loan is established between the company and the ESOP Trust. This inside loan is typically amortized over 15-30 years. Similar to other qualified retirement plans, the company makes cash contributions to the ESOP Trust (up to 25% of the qualified payroll).

Making ESO Offers Declare the type of stock options employees will receive (ISOs or NSOs). Explain the value in terms of the number of shares rather than the percentage of the company. State that the board must approve all stock option grant amounts before the offer letter becomes valid.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

Major Uses of ESOPs About two-thirds of ESOPs are used to provide a market for the shares of a departing owner of a profitable, closely held company. Most of the remainder are used either as a supplemental employee benefit plan or as a means to borrow money in a tax-favored manner.