Wisconsin Proposal to Amend Certificate of Incorporation to Authorize Preferred Stock In Wisconsin, a proposal to amend the certificate of incorporation to authorize preferred stock is a significant step for a corporation seeking to provide investment opportunities to potential investors while also maintaining control of the company. By amending the certificate of incorporation, corporations can create various types of preferred stock that offer different benefits and rights to shareholders. Let's delve into the details of this topic, exploring the different types of preferred stock that might be authorized in Wisconsin. Preferred stock is a unique class of shares that offers certain advantages to shareholders compared to common stockholders. Unlike common stock, preferred stockholders typically have a higher claim on the company's assets and earnings, providing them with a priority in receiving dividends and liquidation proceeds. Here are a few types of preferred stock that may be authorized under a Wisconsin proposal to amend the certificate of incorporation: 1. Cumulative Preferred Stock: This type of preferred stock ensures that if the company fails to pay dividends in any year, those unpaid dividends will accumulate and become payable in the future. Cumulative preferred stockholders have a higher level of income security compared to other types of preferred stock. 2. Non-Cumulative Preferred Stock: In contrast to cumulative preferred stock, non-cumulative preferred stock does not accumulate unpaid dividends. If the company fails to pay dividends in a particular year, the preferred stockholders will not be entitled to receive those missed dividends in the future. 3. Convertible Preferred Stock: Convertible preferred stock provides shareholders with the option to convert their preferred shares into a fixed number of common shares. This feature allows investors to benefit from price appreciation and participate in the company's growth potential if they choose to convert their preferred stock into common stock. 4. Callable Preferred Stock: Callable preferred stock enables the corporation to redeem the shares at a specified price after a predetermined date. This gives the company the flexibility to repurchase the preferred stock if needed, often at a premium price, allowing better control over its capital structure. 5. Adjustable-Rate Preferred Stock: This type of preferred stock has a dividend rate that adjusts periodically based on changes in a specified benchmark interest rate, such as the prime rate or Treasury bill rate. The dividend payments to shareholders will vary accordingly, making it an enticing option for investors seeking flexibility in their income streams. 6. Participating Preferred Stock: Participating preferred stockholders have the opportunity to receive additional dividends beyond their fixed dividend rate if the company surpasses the predetermined thresholds for dividend payments to common stockholders. This participation grants preferred stockholders the potential to enjoy higher returns alongside common stockholders. It's important to note that the exact types of preferred stock authorized under a Wisconsin proposal to amend the certificate of incorporation may vary depending on the specific requirements and preferences of the corporation. Corporations should consult legal professionals and consider the best structure for their business before finalizing any changes to their certificate of incorporation. In summary, a Wisconsin proposal to amend the certificate of incorporation to authorize preferred stock offers corporations the ability to create different classes of shares with varying rights and benefits. By allowing for the issuance of preferred stock, corporations can attract different types of investors while maintaining control over the company's affairs. However, it's crucial for corporations to determine which types of preferred stock align with their goals and seek legal guidance to ensure compliance with the laws and regulations governing corporate governance in Wisconsin.

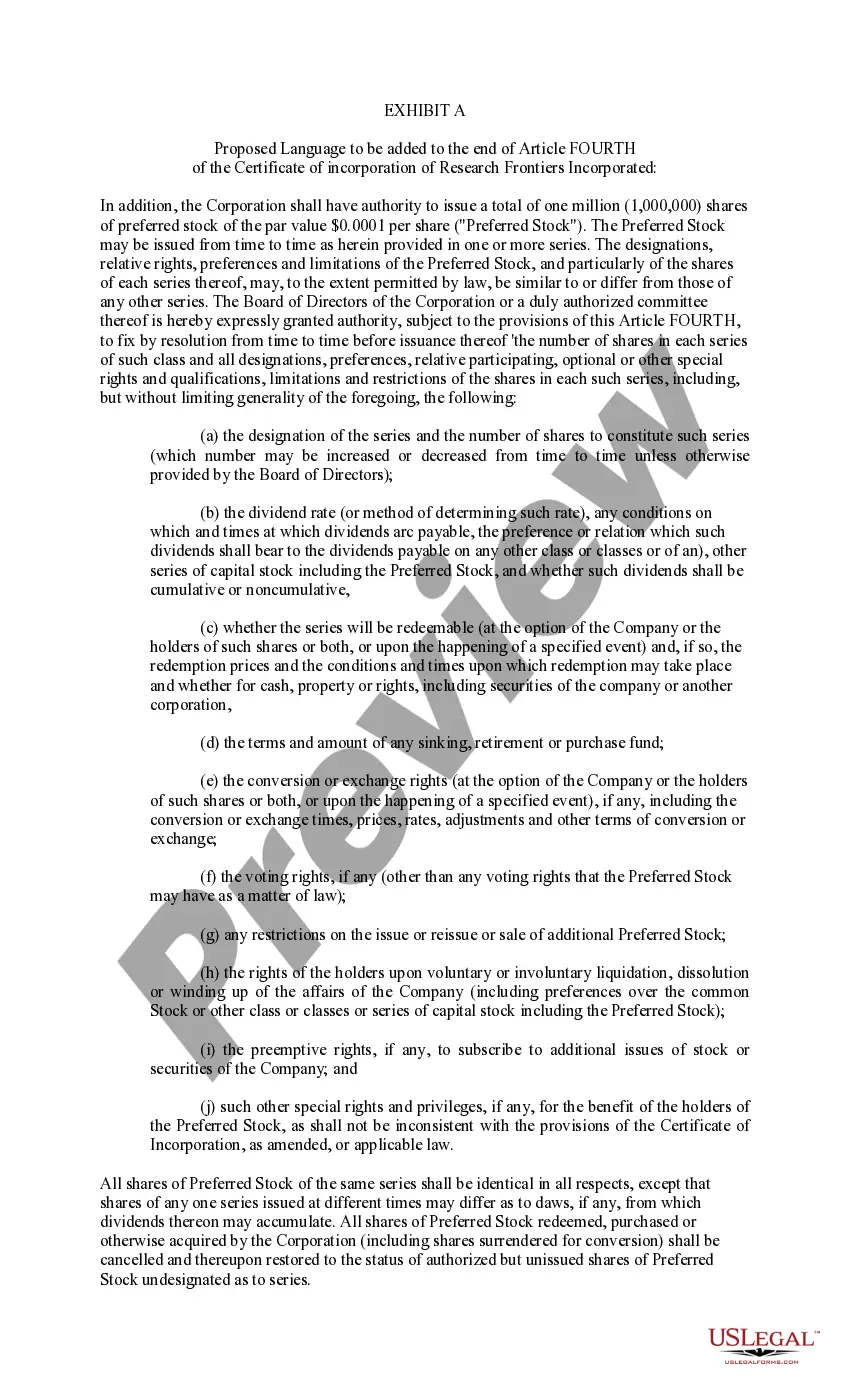

Wisconsin Proposal to amend certificate of incorporation to authorize a preferred stock

Description

How to fill out Wisconsin Proposal To Amend Certificate Of Incorporation To Authorize A Preferred Stock?

If you want to total, acquire, or printing lawful papers layouts, use US Legal Forms, the greatest collection of lawful kinds, which can be found online. Use the site`s simple and convenient search to find the files you will need. Numerous layouts for enterprise and individual functions are categorized by categories and claims, or key phrases. Use US Legal Forms to find the Wisconsin Proposal to amend certificate of incorporation to authorize a preferred stock in just a number of click throughs.

If you are already a US Legal Forms client, log in in your bank account and click the Acquire option to find the Wisconsin Proposal to amend certificate of incorporation to authorize a preferred stock. Also you can access kinds you previously delivered electronically inside the My Forms tab of the bank account.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have chosen the form for your right area/country.

- Step 2. Make use of the Review choice to check out the form`s information. Do not overlook to see the outline.

- Step 3. If you are unsatisfied with the type, utilize the Research field towards the top of the display screen to find other models in the lawful type web template.

- Step 4. After you have discovered the form you will need, click the Get now option. Choose the pricing strategy you choose and include your references to register for an bank account.

- Step 5. Method the transaction. You may use your charge card or PayPal bank account to perform the transaction.

- Step 6. Find the file format in the lawful type and acquire it on the gadget.

- Step 7. Full, change and printing or indication the Wisconsin Proposal to amend certificate of incorporation to authorize a preferred stock.

Every single lawful papers web template you get is your own property forever. You possess acces to every type you delivered electronically within your acccount. Go through the My Forms segment and pick a type to printing or acquire yet again.

Be competitive and acquire, and printing the Wisconsin Proposal to amend certificate of incorporation to authorize a preferred stock with US Legal Forms. There are many skilled and state-distinct kinds you may use for your enterprise or individual requires.