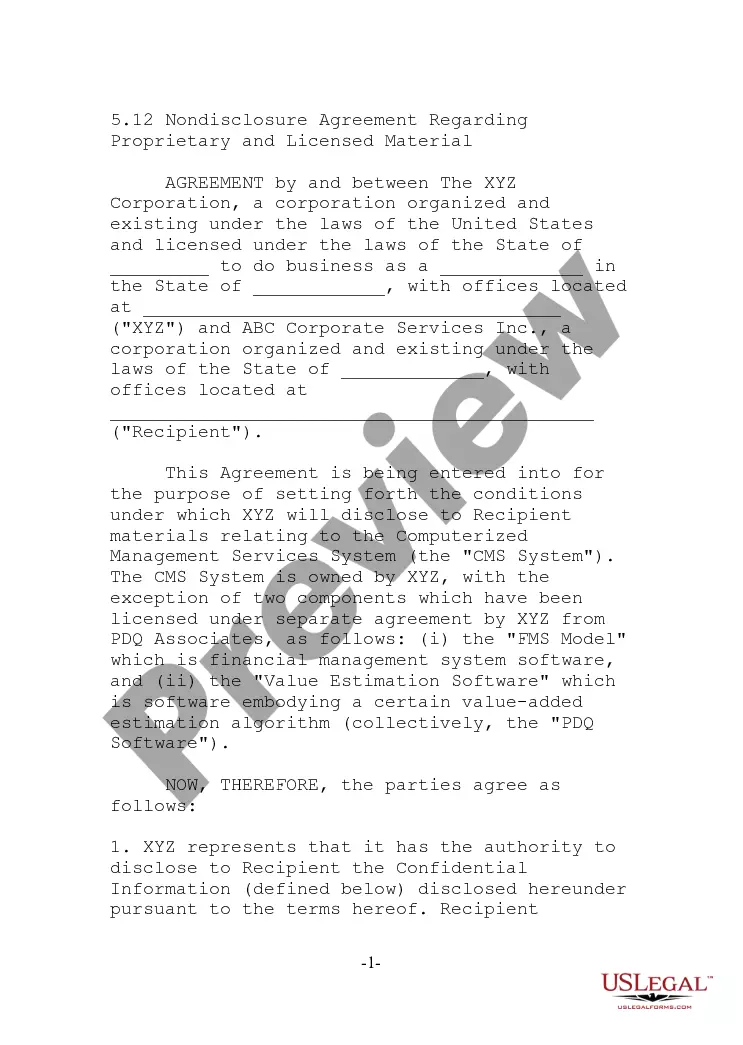

The Wisconsin Form of Note is a legally binding document used in real estate transactions in the state of Wisconsin. It outlines the terms and conditions of a loan agreement between a borrower and a lender. This comprehensive document includes all the essential details and provisions necessary for a smooth and secure lending process. Key elements of the Wisconsin Form of Note include the identification of the parties involved, namely the borrower and the lender. The complete legal names, addresses, and contact information of both parties are specified in the note. This ensures that the note is enforceable and allows for easy communication between the parties. The Wisconsin Form of Note also includes the loan amount, interest rate, and repayment terms. These details define the financial aspects of the loan agreement, including the principal amount borrowed, the interest rate charged, and the agreed-upon repayment schedule. The note may specify whether the interest is fixed or adjustable, providing transparency and clarity to both parties. Additionally, the form often includes provisions related to late fees, prepayment penalties, and default remedies. These provisions outline the consequences for failing to make payments on time and provide guidelines for resolving any disputes or issues that may arise during the loan term. It is important to note that there can be variations to the Wisconsin Form of Note based on the specific type of loan being issued. Different types of Wisconsin Form of Note may include: 1. Fixed-Rate Note: This note sets a predetermined interest rate that remains constant throughout the entire loan term, ensuring consistent monthly payments for the borrower. 2. Adjustable-Rate Note: This note allows the interest rate to fluctuate over time based on certain market indexes. The interest rate is usually subject to periodic adjustments, typically once a year. The borrower must be aware of the potential changes in the interest rate, consequently affecting the monthly payments. 3. Balloon Note: This note provides for smaller periodic payments over the loan term, with a large lump-sum payment due at the end. Balloon payments are commonly employed in situations where the borrower expects to have sufficient funds at the time of the final payment. 4. Installment Note: This type of note documents a loan agreement in which the borrower repays the loan in regular installments over an agreed period. Each installment includes a portion of both the principal and interest, ensuring gradual repayment of the loan. In conclusion, the Wisconsin Form of Note is a crucial legal document used in real estate transactions to define the terms and conditions of a loan agreement. By incorporating relevant keywords such as Wisconsin Form of Note, borrower, lender, loan amount, interest rate, repayment terms, late fees, prepayment penalties, default remedies, fixed-rate note, adjustable-rate note, balloon note, and installment note, this description provides a detailed and comprehensive understanding of this important document for real estate transactions in Wisconsin.

Wisconsin Form of Note

Description

How to fill out Wisconsin Form Of Note?

US Legal Forms - one of several greatest libraries of authorized varieties in the States - offers a variety of authorized file layouts it is possible to acquire or produce. Utilizing the web site, you can get thousands of varieties for enterprise and individual functions, sorted by classes, states, or search phrases.You can find the latest versions of varieties just like the Wisconsin Form of Note within minutes.

If you currently have a registration, log in and acquire Wisconsin Form of Note from the US Legal Forms catalogue. The Acquire option will appear on each form you look at. You gain access to all previously downloaded varieties from the My Forms tab of the bank account.

In order to use US Legal Forms the very first time, allow me to share straightforward instructions to get you began:

- Be sure to have selected the right form for your area/state. Go through the Preview option to check the form`s content. See the form outline to actually have chosen the proper form.

- If the form doesn`t suit your requirements, utilize the Lookup field on top of the screen to find the one which does.

- If you are content with the form, validate your choice by clicking on the Purchase now option. Then, opt for the prices program you like and provide your accreditations to register for an bank account.

- Approach the purchase. Utilize your charge card or PayPal bank account to accomplish the purchase.

- Choose the format and acquire the form on your own device.

- Make alterations. Fill up, change and produce and indication the downloaded Wisconsin Form of Note.

Each and every template you included with your bank account does not have an expiry particular date and is the one you have forever. So, if you wish to acquire or produce another duplicate, just visit the My Forms portion and click on around the form you will need.

Obtain access to the Wisconsin Form of Note with US Legal Forms, one of the most substantial catalogue of authorized file layouts. Use thousands of professional and express-particular layouts that fulfill your organization or individual requires and requirements.