Wisconsin Stock Option Plan of Star States Corporation is an employee benefit program designed to incentivize and retain talented individuals by offering them the opportunity to purchase company stocks at a discounted price. The plan is specifically tailored for employees of Star States Corporation who are employed in the state of Wisconsin. The primary objective of the Wisconsin Stock Option Plan is to reward employee loyalty and encourage long-term commitment to the company's growth and success. This plan serves as a powerful tool for attracting and retaining highly skilled professionals within the organization. The Wisconsin Stock Option Plan operates by granting eligible employees the right to purchase company stocks at a predetermined price known as the exercise price. The exercise price is generally set below the market value of the stock at the time of grant, making it an attractive benefit for employees. There are several types of Wisconsin Stock Option Plans available to employees of Star States Corporation: 1. Non-Qualified Stock Option (NO): This type of plan allows employees to purchase company stocks at a discounted price. However, the profits gained from the sale of these stocks are subject to standard tax treatment. 2. Incentive Stock Option (ISO): This plan enables employees to purchase company stocks at a discounted price while enjoying certain tax advantages. The profits from the sale of ISO stocks may be subject to long-term capital gains tax rates if certain conditions are met. 3. Restricted Stock Units (RSS): RSS are another form of equity compensation offered by the Wisconsin Stock Option Plan. Instead of granting the right to purchase stocks, RSS provide employees with the promise to receive a certain number of shares at a later date, typically upon meeting specific vesting requirements. Employees participating in the Wisconsin Stock Option Plan must carefully consider their personal financial goals and tax implications before exercising their options or selling the stocks acquired through the plan. Overall, the Wisconsin Stock Option Plan of Star States Corporation plays a significant role in motivating and retaining talented individuals while aligning their interests with the long-term success of the company.

Wisconsin Stock Option Plan of Star States Corporation

Description

How to fill out Wisconsin Stock Option Plan Of Star States Corporation?

Are you in a place the place you require paperwork for sometimes organization or personal reasons almost every working day? There are a variety of authorized document web templates available on the net, but discovering types you can rely on isn`t simple. US Legal Forms provides a large number of form web templates, just like the Wisconsin Stock Option Plan of Star States Corporation, which can be published to meet federal and state specifications.

When you are previously knowledgeable about US Legal Forms internet site and have a free account, just log in. Afterward, it is possible to acquire the Wisconsin Stock Option Plan of Star States Corporation web template.

Should you not come with an account and wish to begin to use US Legal Forms, adopt these measures:

- Get the form you want and make sure it is to the proper town/area.

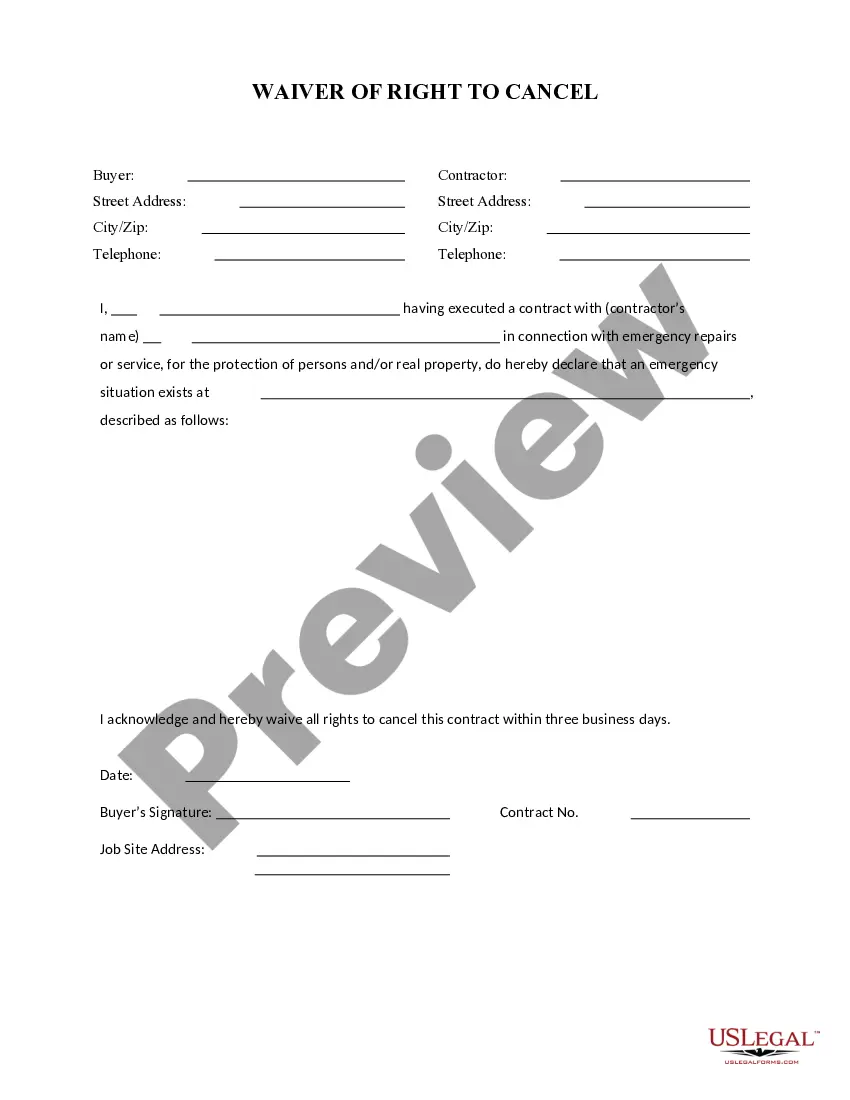

- Use the Review option to examine the form.

- Read the description to actually have selected the proper form.

- In the event the form isn`t what you`re looking for, use the Search field to discover the form that suits you and specifications.

- When you obtain the proper form, just click Get now.

- Choose the costs plan you need, fill in the specified information to create your account, and pay for an order making use of your PayPal or credit card.

- Pick a handy paper formatting and acquire your duplicate.

Discover each of the document web templates you possess bought in the My Forms food selection. You can get a further duplicate of Wisconsin Stock Option Plan of Star States Corporation at any time, if possible. Just click the necessary form to acquire or produce the document web template.

Use US Legal Forms, probably the most extensive selection of authorized kinds, in order to save time as well as prevent blunders. The support provides expertly produced authorized document web templates that can be used for a variety of reasons. Produce a free account on US Legal Forms and commence creating your way of life a little easier.

Form popularity

FAQ

corporation could have an equity incentive plan that issues only stock options (described below), but these are rarer.

ESOPs in S corps Taxes on earnings are computed based on applicable federal personal income tax rates. By law, an ESOP is a federally tax-exempt entity. As such, the pro-rata earnings of an S Corporation allocable to an ESOP (as a corporate shareholder) are exempt from federal income taxes.

A payment can be made by submitting Form Corp-ES with a check, or an electronic payment using ACH or My Tax Account. For additional information, see the instructions for Form Corp-ES or go to .revenue.wi.gov/pay.

Stock Options Corporations taxed as an s-corporation may have a Stock Option only plan. LLCs taxed as s-corporations may use contractual Option Agreements, which have similar characteristics to non-qualified stock options in a corporation.

S corporations can only have one class of stock. However, the tax regulations permit companies to issue voting and non-voting stock, even if the voting stock only represents 1% of the issued and outstanding shares.

Preferred stock not allowed: To be eligible for S corp status the corporation cannot have different classes of stock. Some investors want preferences to distributions or other privileges. An S corp cannot provide that.

S corporations cannot issue common and preferred stocks, which is allowed of C corporations. If an S corporation follows the single class of stock rules, however, they can issue stock options that function similarly to incentive stock options.

If the corporation incurs a loss, the loss is treated as the shareholders' loss. Under Wisconsin law, a tax-option (S) corporation is a corporation which is treated as an S corporation under Subchapter S of the IRC as adopted for Wisconsin purposes, and has not elected out of tax-option corporation status under sec.