The Wisconsin Proposal to consider and approve an offer to exchange outstanding shares and amend the certificate of designations, preferences, and rights with a Fairness Opinion Report is an important decision that requires a detailed description. This process involves several steps and considerations to ensure fairness for all parties involved. The purpose of the Wisconsin Proposal is to present shareholders with an offer to exchange their currently held outstanding shares with a new offer. This exchange may involve a change in the certificate of designations, preferences, and rights, which outlines the specific terms and conditions associated with the shares. By amending the certificate, the company aims to modify existing provisions or introduce new ones to better align with its goals and objectives. In order to ensure transparency and impartiality, a Fairness Opinion Report is prepared and provided to shareholders. This report is prepared by an independent third-party financial advisor or valuation expert who examines the terms of the offer in relation to the company's current and future prospects. The Fairness Opinion Report serves as a professional assessment of whether the exchange offer is fair from a financial standpoint, taking into account a variety of factors such as the company's valuation, market conditions, and potential benefits or risks associated with the proposed amendments. It's important to note that there may be different types of Wisconsin Proposals to consider and approve an offer to exchange outstanding shares and amend the certificate of designations, preferences, and rights. These can vary depending on the specific circumstances and objectives of the company. Some potential variations could include: 1. Exchange Offer for Enhanced Voting Rights: This type of proposal may aim to offer shareholders the opportunity to exchange their existing shares for a new class of shares with enhanced voting rights. The company may seek to consolidate voting power or restructure its governance structure through this exchange. 2. Exchange Offer for Preferred Shares: In some cases, the company may offer shareholders the option to exchange their outstanding common shares for preferred shares. Preferred shares often come with additional benefits such as preferential dividend payments or priority in liquidation scenarios. 3. Exchange Offer for Debt Conversion: This type of proposal may involve the opportunity for shareholders to exchange their outstanding shares for debt instruments such as bonds or promissory notes. The company may seek to improve its balance sheet by converting outstanding equity into debt, potentially reducing its overall interest expense. 4. Exchange Offer for Cash Consideration: Instead of offering new shares, the company may propose an exchange offer where shareholders have the option to exchange their existing shares for cash. This type of proposal may be attractive to shareholders seeking liquidity or a clear exit strategy. Each of these potential variations of the Wisconsin Proposal would require careful consideration and evaluation, with the Fairness Opinion Report playing a critical role in determining whether the offer is fair for the shareholders involved. Ultimately, the decision to approve the proposal and proceed with the exchange rests in the hands of the shareholders based on the information provided to them.

Wisconsin Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report

Description

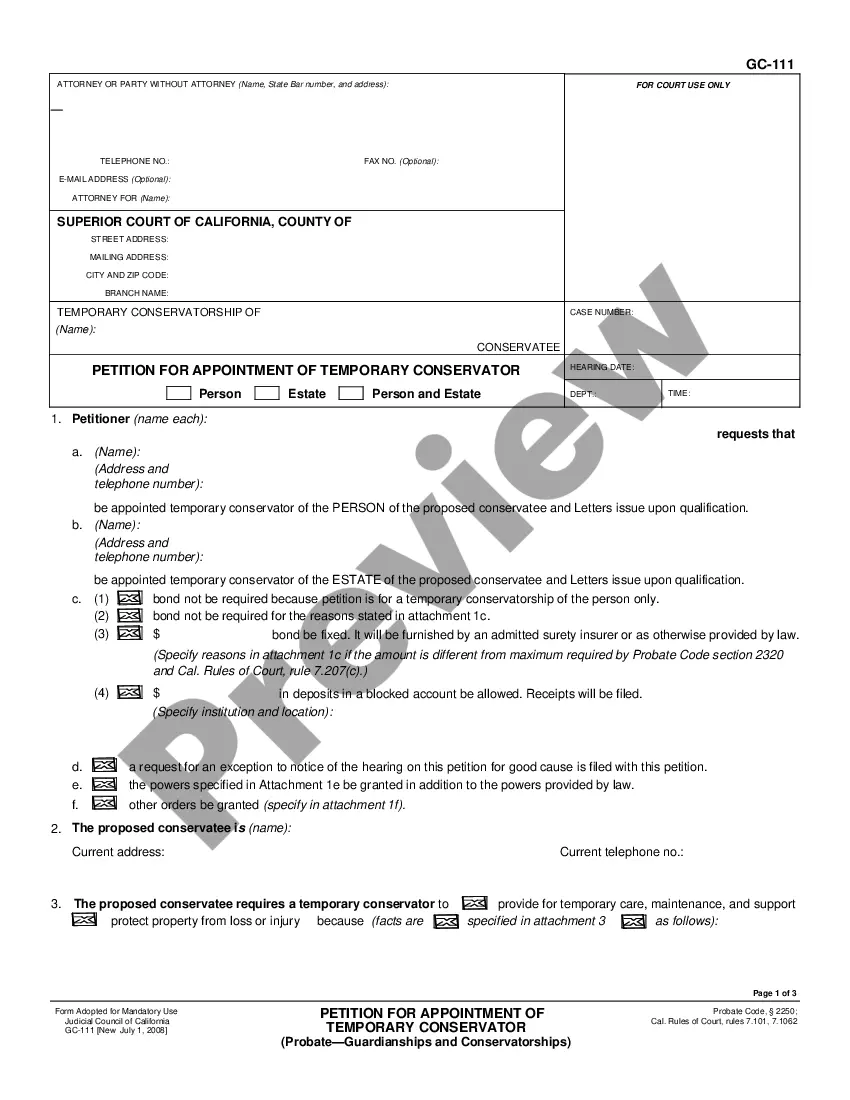

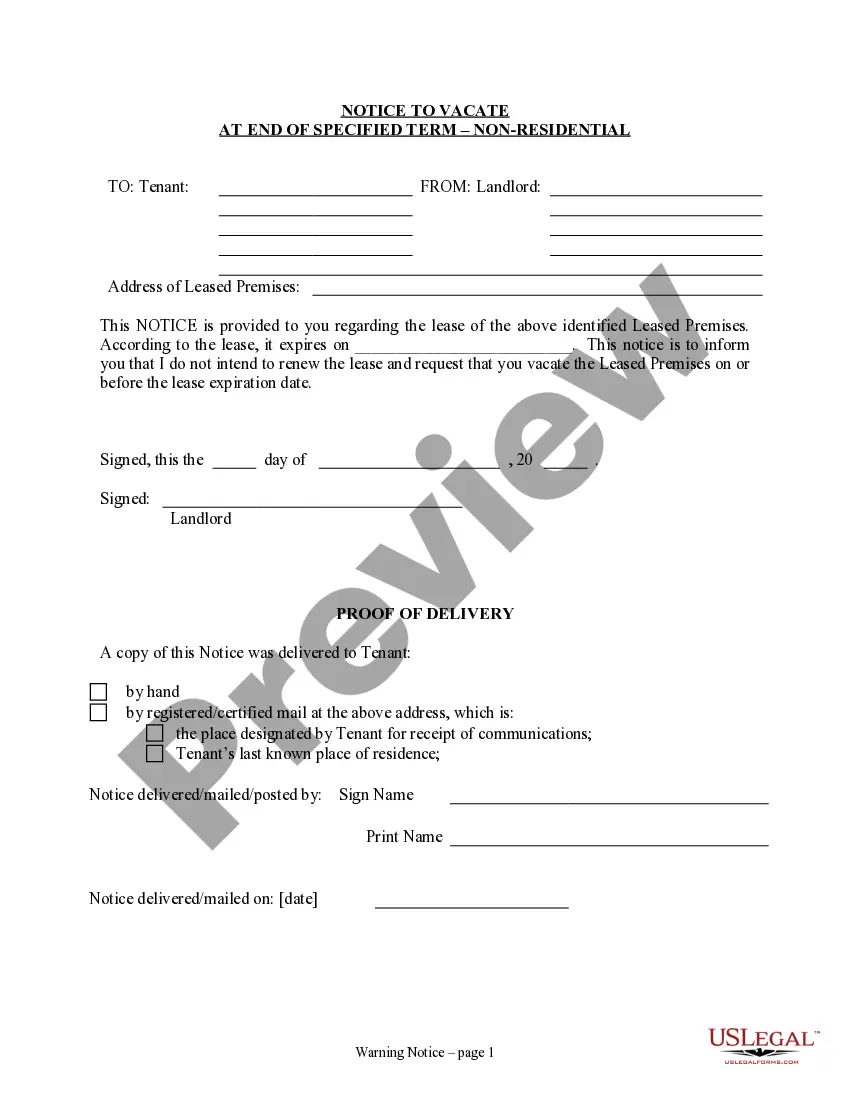

How to fill out Wisconsin Proposal To Consider And Approve Offer To Exchange Outstanding Shares And Amend Certificate Of Designations, Preferences And Rights With Fairness Opinion Report?

Choosing the best legitimate record template might be a battle. Of course, there are a variety of layouts available online, but how do you get the legitimate kind you will need? Use the US Legal Forms web site. The service provides a large number of layouts, like the Wisconsin Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report, that you can use for enterprise and personal requires. Every one of the forms are inspected by experts and satisfy federal and state requirements.

When you are previously listed, log in to the accounts and click on the Obtain option to obtain the Wisconsin Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report. Utilize your accounts to appear from the legitimate forms you might have bought previously. Visit the My Forms tab of your respective accounts and have one more copy in the record you will need.

When you are a fresh end user of US Legal Forms, here are simple recommendations so that you can follow:

- Initially, ensure you have chosen the right kind for your metropolis/area. You can check out the form making use of the Review option and read the form information to guarantee it will be the best for you.

- In case the kind will not satisfy your requirements, utilize the Seach industry to get the correct kind.

- When you are sure that the form is suitable, click the Buy now option to obtain the kind.

- Choose the rates strategy you need and type in the essential details. Build your accounts and pay for your order using your PayPal accounts or charge card.

- Select the document formatting and acquire the legitimate record template to the product.

- Total, modify and print out and signal the attained Wisconsin Proposal to consider and approve offer to exchange outstanding shares and amend certificate of designations, preferences and rights with Fairness Opinion Report.

US Legal Forms will be the most significant library of legitimate forms that you can see a variety of record layouts. Use the company to acquire appropriately-manufactured files that follow express requirements.

Form popularity

FAQ

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

To start a corporation in Wisconsin, you must file Articles of Incorporation with the Wisconsin Department of Financial Institutions. You can file the document online or by mail. The Articles of Incorporation cost $100 to file. Once filed with the state, this document formally creates your Wisconsin corporation.

You can file the Articles of Organization online and pay the filing fee by credit card. You may also file them by mail and include the requisite fee. If you use mail to file, your WI LLC Articles of Organization must contain an original signature. Expedited service is also available.

A party may amend the party's pleading once as a matter of course at any time within 6 months after the summons and complaint are filed or within the time set in a scheduling order under s. 802.10.

?????Note: A corporation, limited liability company filing as a corporation or partnership, or limited partnership that is required to register with the Wisconsin Department of Financial Institutions (DFI) may change its name by writing to the Wisconsin Department of Financial Institutions, PO Box 7846, Madison, WI ...

To make amendments to your Wisconsin articles of incorporation, you can file Wisconsin Form 4, Articles of Amendment ? Stock, for-Profit Corporation to the Wisconsin Department of Financial Institutions (DFI). The form is optional; you may draft your own Articles of Amendment.