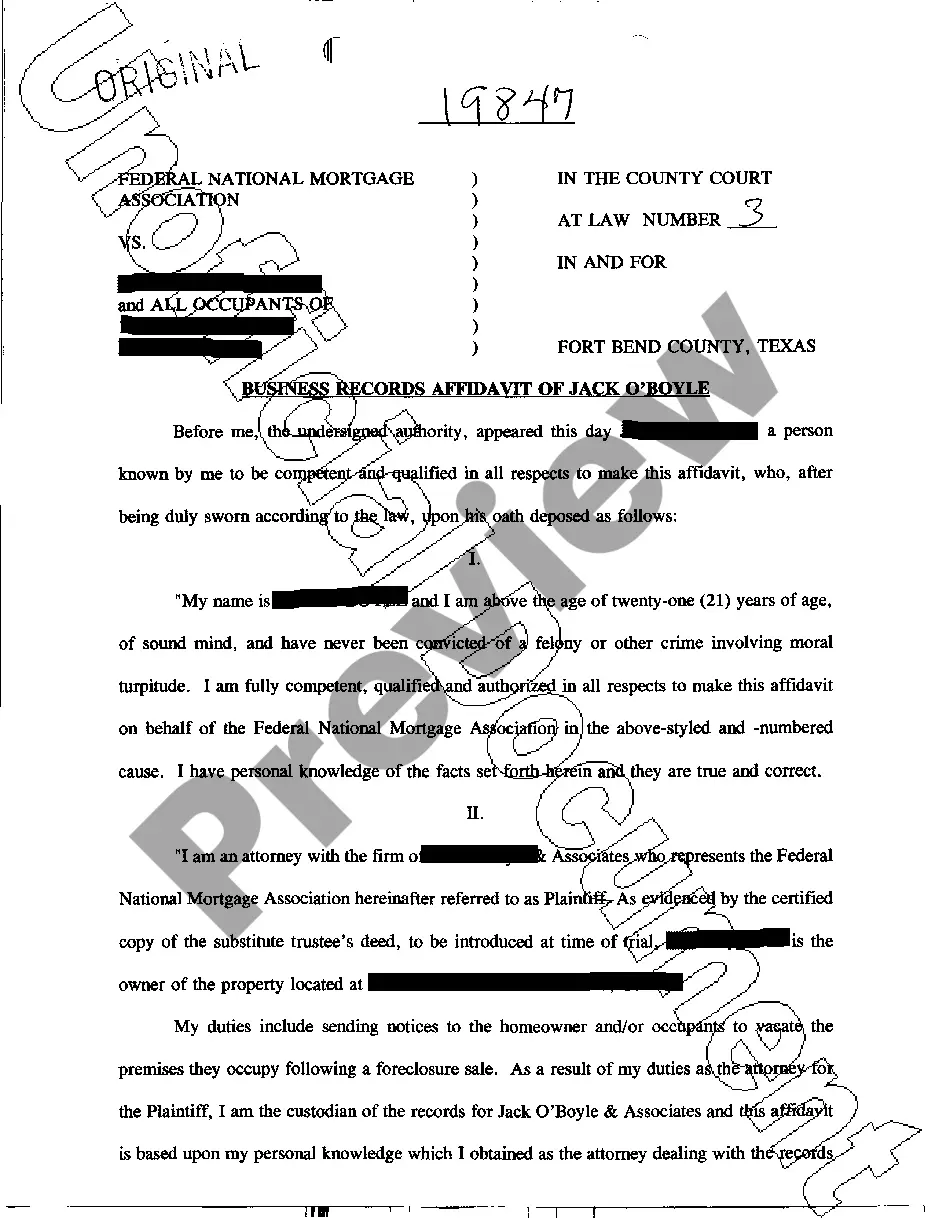

The Wisconsin Stockholders' Rights Plan of Data scope Corp is a legal document that outlines the rights and protections granted to the shareholders of Data scope Corp, a company based in Wisconsin. This plan is designed to safeguard the interests of the company's shareholders and prevent hostile takeovers and other actions that could potentially harm their investments. One type of Wisconsin Stockholders' Rights Plan of Data scope Corp is the "Poison Pill" provision. This provision allows existing shareholders to purchase additional shares at a discounted price in the event of a hostile takeover attempt. By increasing the number of shares outstanding, it makes the target company less attractive to the acquiring party, thereby deterring the takeover. Another type of plan included within the Wisconsin Stockholders' Rights Plan of Data scope Corp is the "Triggering Events" provision. This provision specifies the circumstances under which the rights plan is activated. Common triggering events could include a significant acquisition of shares by an individual or group, an attempt to gain control of a certain percentage of the company's outstanding shares, or other similar actions that may signal a potential threat to shareholder interests. Furthermore, the Wisconsin Stockholders' Rights Plan of Data scope Corp may feature a "Board Discretion" provision, which grants the board of directors the authority to waive or modify the terms of the plan under certain circumstances. This provision allows the board to consider alternative strategies or negotiate with potential acquirers in the best interest of the company and its shareholders. Additionally, the plan may include provisions related to voting rights, stock dilution, and restrictions on transferability of shares. These provisions aim to protect shareholders' voting power and ensure the stability and integrity of the company's stock ownership structure. It's worth noting that the specifics of the Wisconsin Stockholders' Rights Plan of Data scope Corp may vary depending on the company's unique circumstances, its industry, and evolving legal requirements. Shareholders are strongly encouraged to review the plan carefully to fully understand their rights, responsibilities, and potential remedies under different scenarios. Consulting with legal and financial advisors is advisable when dealing with matters related to corporate governance and stockholder rights.

Wisconsin Stockholders' Rights Plan of Datascope Corp.

Description

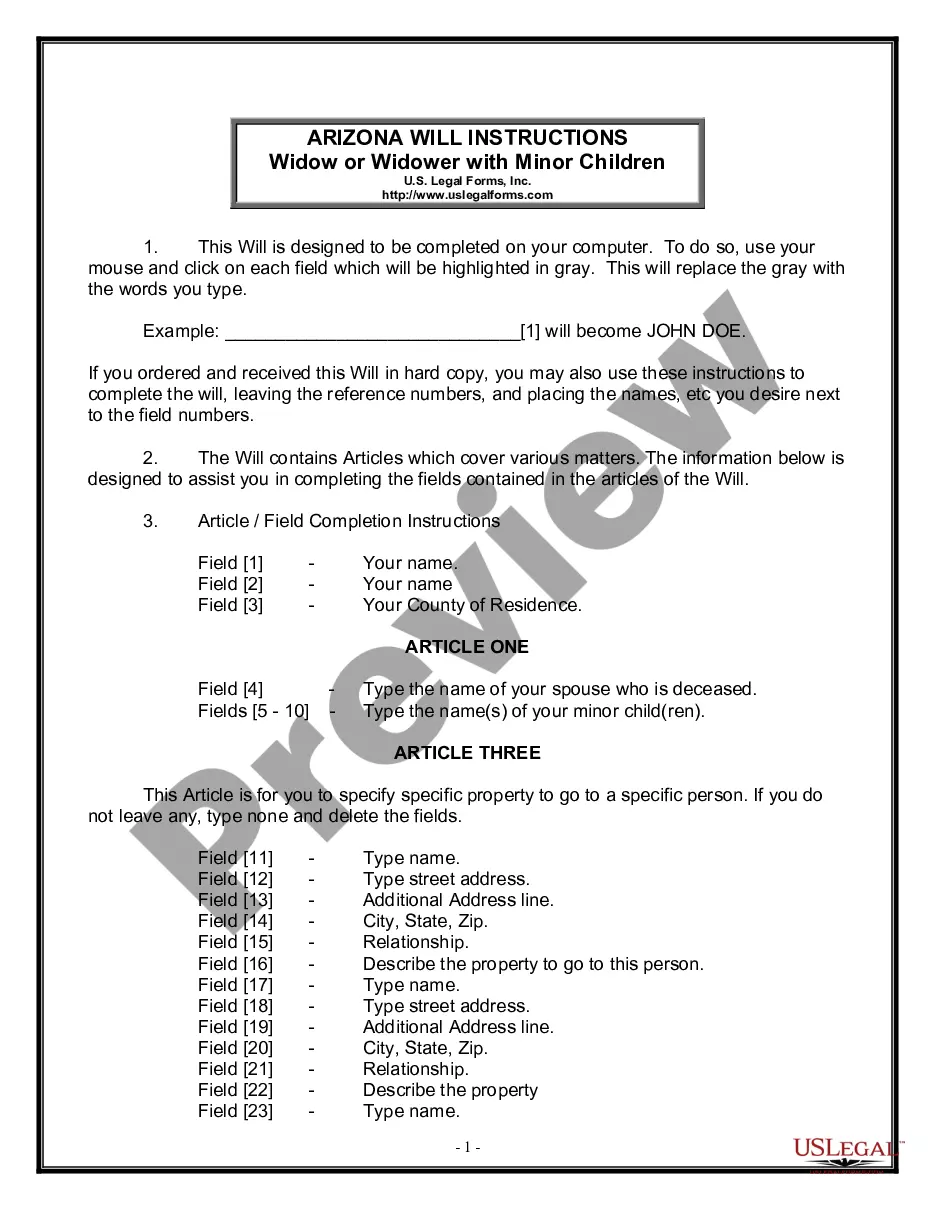

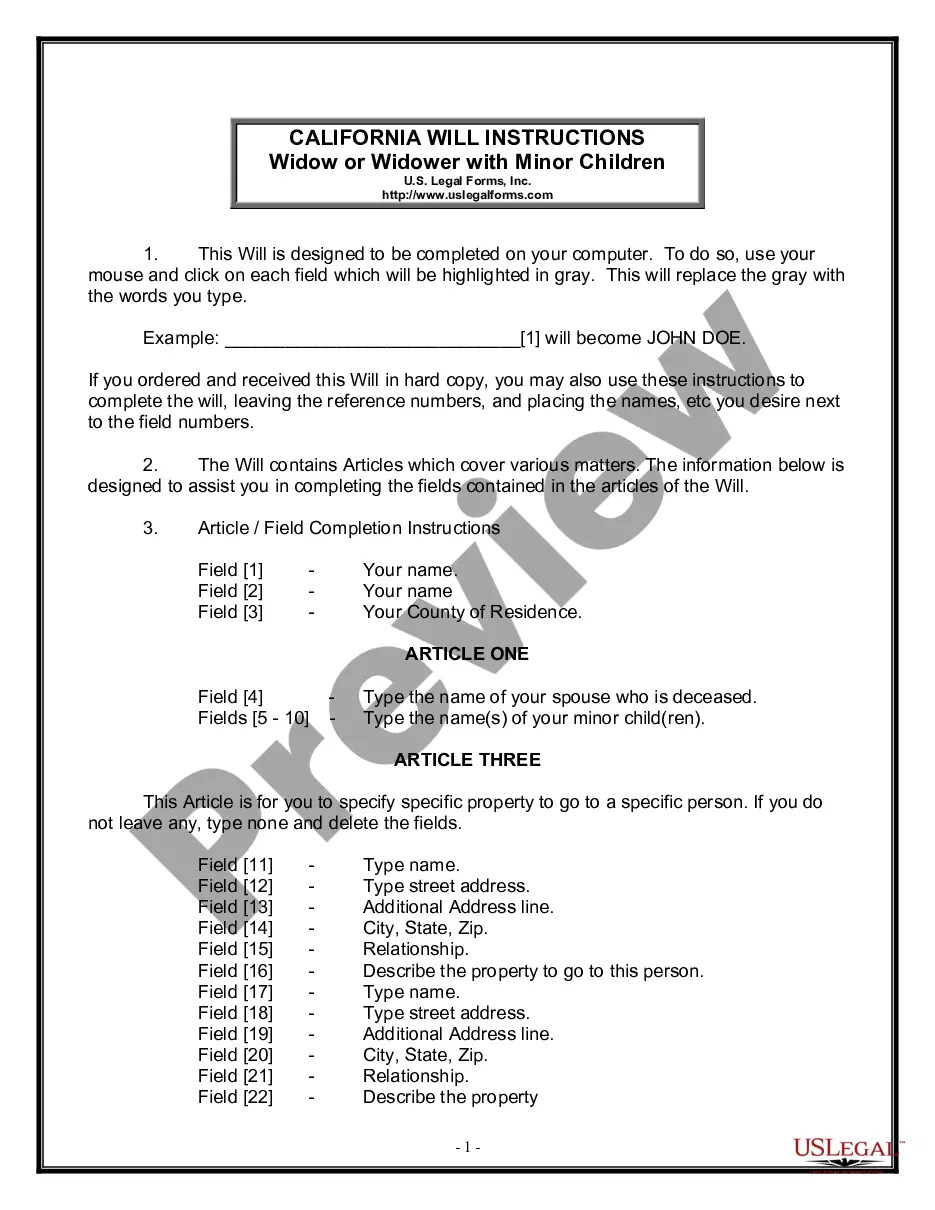

How to fill out Wisconsin Stockholders' Rights Plan Of Datascope Corp.?

US Legal Forms - among the biggest libraries of authorized types in America - delivers a wide array of authorized record templates you can obtain or print. While using site, you will get a huge number of types for enterprise and specific purposes, sorted by groups, claims, or key phrases.You will discover the latest types of types just like the Wisconsin Stockholders' Rights Plan of Datascope Corp. within minutes.

If you already possess a registration, log in and obtain Wisconsin Stockholders' Rights Plan of Datascope Corp. through the US Legal Forms library. The Acquire switch will appear on every type you look at. You have accessibility to all in the past downloaded types within the My Forms tab of your respective bank account.

In order to use US Legal Forms the very first time, listed below are easy guidelines to help you started:

- Ensure you have picked the proper type for the city/area. Click the Review switch to examine the form`s articles. See the type information to ensure that you have chosen the proper type.

- In case the type doesn`t suit your specifications, utilize the Look for industry on top of the screen to get the the one that does.

- In case you are satisfied with the shape, confirm your decision by simply clicking the Purchase now switch. Then, pick the costs plan you favor and provide your references to sign up on an bank account.

- Procedure the deal. Utilize your Visa or Mastercard or PayPal bank account to finish the deal.

- Choose the structure and obtain the shape in your system.

- Make modifications. Fill up, modify and print and sign the downloaded Wisconsin Stockholders' Rights Plan of Datascope Corp..

Every design you included in your account does not have an expiry time and is also yours forever. So, if you would like obtain or print another duplicate, just check out the My Forms segment and click in the type you need.

Get access to the Wisconsin Stockholders' Rights Plan of Datascope Corp. with US Legal Forms, probably the most substantial library of authorized record templates. Use a huge number of expert and status-distinct templates that fulfill your business or specific requires and specifications.

Form popularity

FAQ

Often called a shareholder rights plan, it is meant to frustrate creeping acquisitions of control, in which the acquirer seeks to accumulate a controlling or dominant stake piecemeal without negotiating with the board or offering the same deal to every shareholder.

A poison pill is designed to discourage a major acquisition of shares and a company's hostile takeover by an individual or entity. Once activated, the strategy allows shareholders, with the exception of the acquiring party, to buy additional shares of company stock at a highly discounted price.

"The rights of a shareholder include the right to attend shareholders' meetings and vote in proxy elections. A shareholder can also see corporate records, inspect the corporation's premises, receive notice of stockholder meetings, and be paid dividends."

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, a claim to dividends, the right to inspect corporate documents, and the right to sue for wrongful acts. Investors should thoroughly research the corporate governance policies of the companies they invest in.

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, a claim to dividends, the right to inspect corporate documents, and the right to sue for wrongful acts. Investors should thoroughly research the corporate governance policies of the companies they invest in.

The three basic shareholder rights are: the right to vote, the right to receive dividends, and the right to the corporation's remaining assets upon dissolution or winding-up. Where a corporation only has one class of shares, the three basic rights must attach to that class.

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, a claim to dividends, the right to inspect corporate documents, and the right to sue for wrongful acts. Investors should thoroughly research the corporate governance policies of the companies they invest in.

Other Examples of Poison Pills Upon learning that Icahn had acquired a 10% stake in the company, Netflix immediately went on the defensive. Any attempt to buy a large equity position in Netflix without board approval would result in flooding the market with new shares, making any stake attempt very expensive.

For example, if a company had nine directors, then three directors would be up for re-election each year, with a three-year term. This would present a potential acquirer with the position of having a hostile board for at least a year after the first election.

Among the rights of the company's shareholders are: (1) to receive notices of and to attend shareholders' meetings; (2) to participate and vote on the basis of the one-share, one-vote policy; (3) nominate, elect, remove, and replace Board members (including via cumulative voting); (4) call for a special board meeting ...