Wisconsin Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

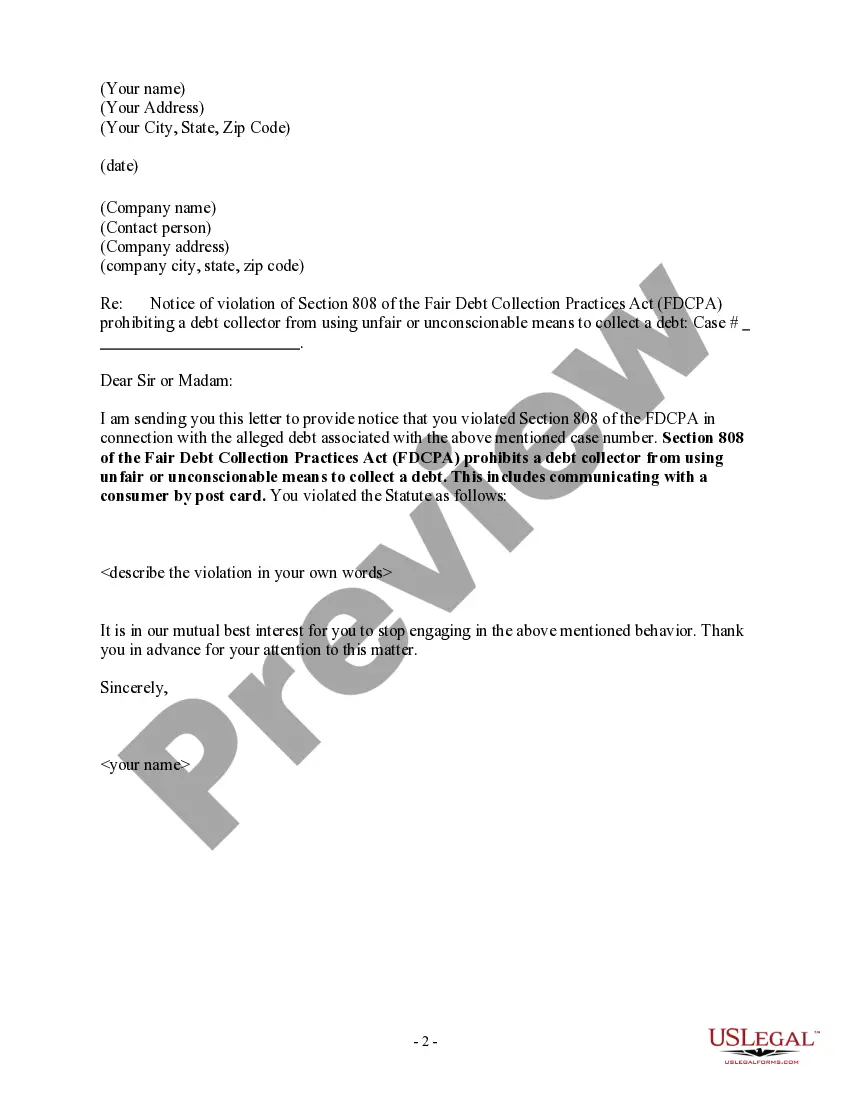

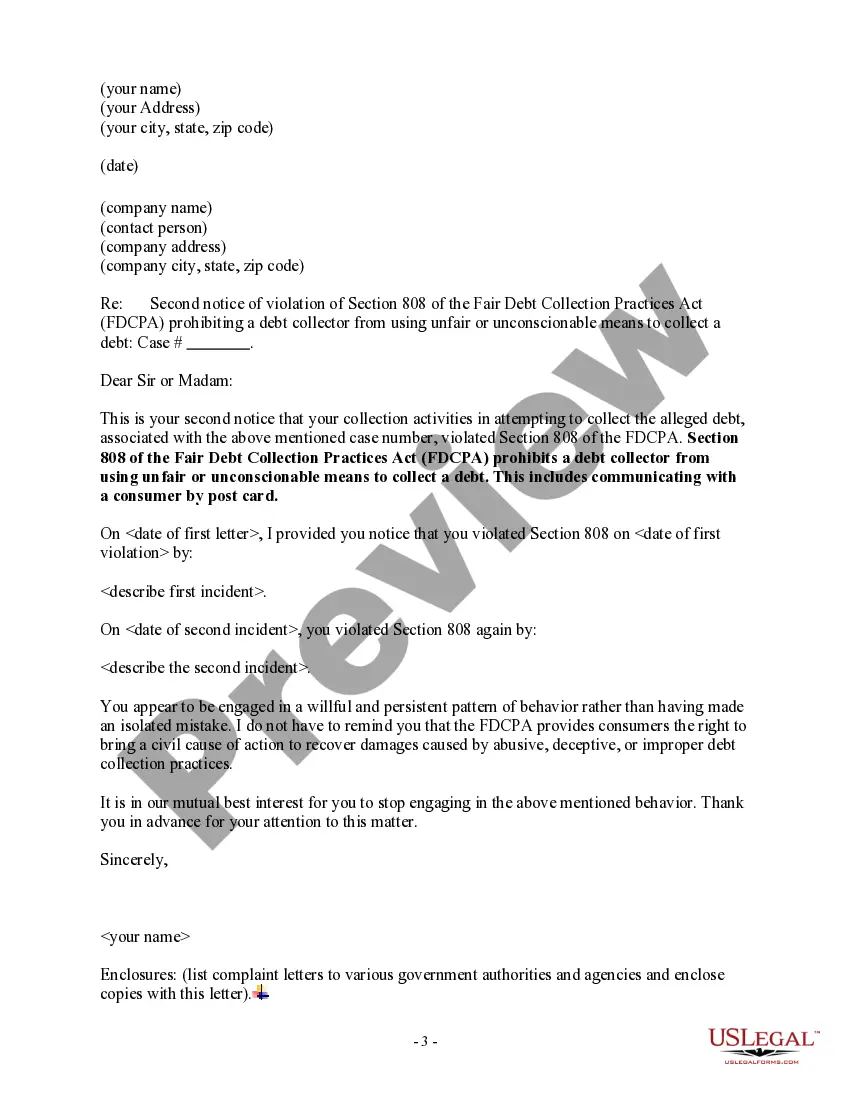

How to fill out Wisconsin Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

You are able to devote time on the web searching for the legitimate file template that suits the state and federal needs you will need. US Legal Forms supplies 1000s of legitimate varieties that are analyzed by specialists. You can easily acquire or print the Wisconsin Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard from our support.

If you have a US Legal Forms bank account, you are able to log in and click on the Download button. Following that, you are able to complete, edit, print, or sign the Wisconsin Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard. Every legitimate file template you acquire is yours eternally. To obtain yet another version associated with a obtained develop, visit the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms site the very first time, follow the straightforward directions below:

- Initially, make certain you have selected the right file template for your state/metropolis of your choosing. Look at the develop explanation to make sure you have picked the proper develop. If offered, use the Review button to search from the file template as well.

- If you wish to locate yet another edition from the develop, use the Search field to find the template that meets your needs and needs.

- Once you have discovered the template you would like, click on Buy now to move forward.

- Choose the pricing prepare you would like, key in your references, and sign up for an account on US Legal Forms.

- Complete the purchase. You can utilize your credit card or PayPal bank account to cover the legitimate develop.

- Choose the formatting from the file and acquire it to the product.

- Make changes to the file if needed. You are able to complete, edit and sign and print Wisconsin Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard.

Download and print 1000s of file layouts making use of the US Legal Forms website, which offers the greatest assortment of legitimate varieties. Use specialist and express-particular layouts to take on your organization or person requirements.

Form popularity

FAQ

As of Nov. 30, 2021, debt collectors have new options for how they may communicate with you about debts they're trying to collect. Now they can text you. Text messages, along with emailing and direct messages on social media, are allowed as part of an update to the Fair Debt Collection Practices Act (FDCPA).

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Problems Faced by Debt Collection Agents and How to Solve Them!Oral Contracts:Faulty Written Agreements:Money Recovery Issues:Collection Methods Are Not Real-Time:Mobile Borrowers:Too Many Calls:Contacting Wrong People:Customer Bankruptcy:More items...?30-Nov-2019

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.