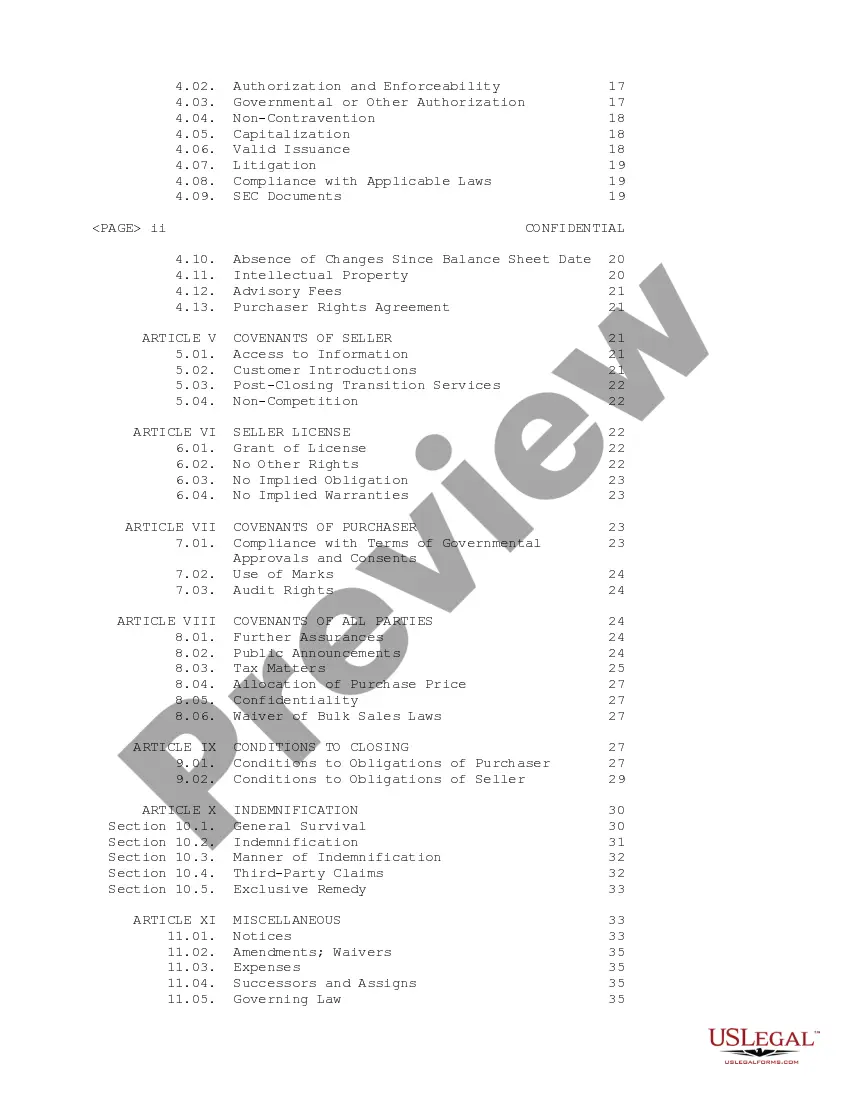

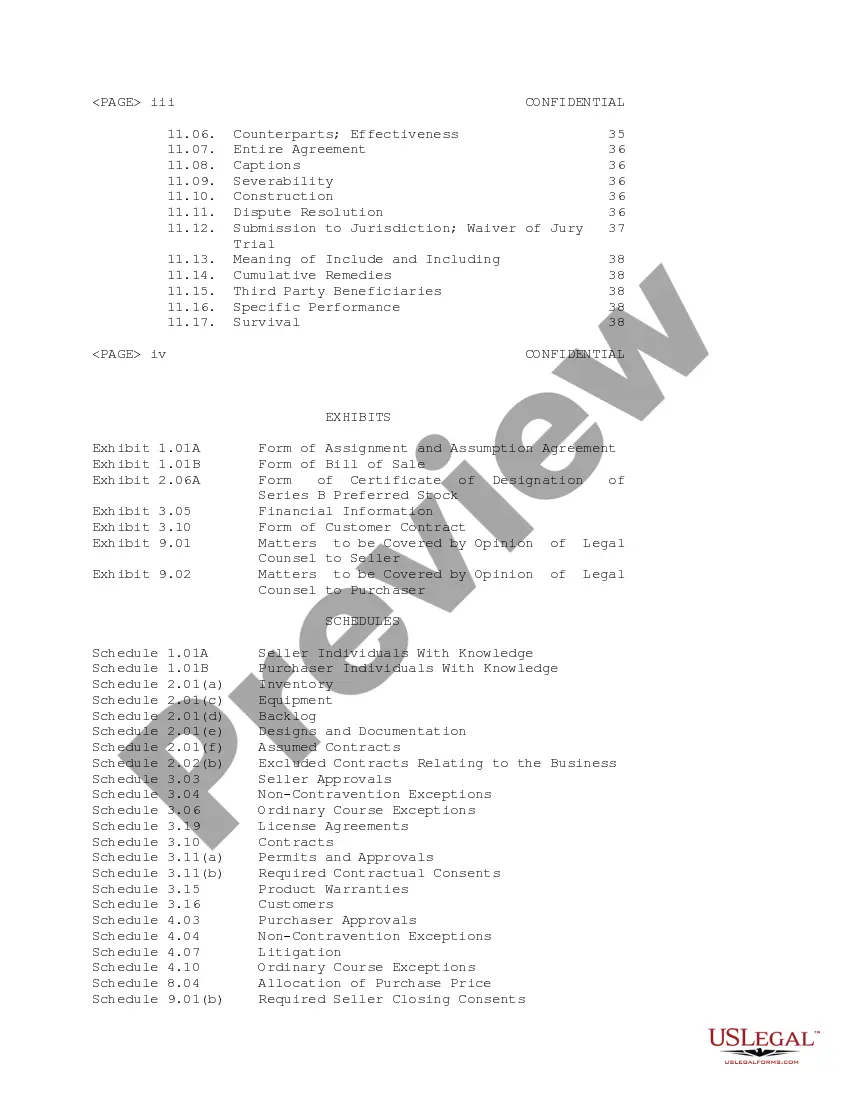

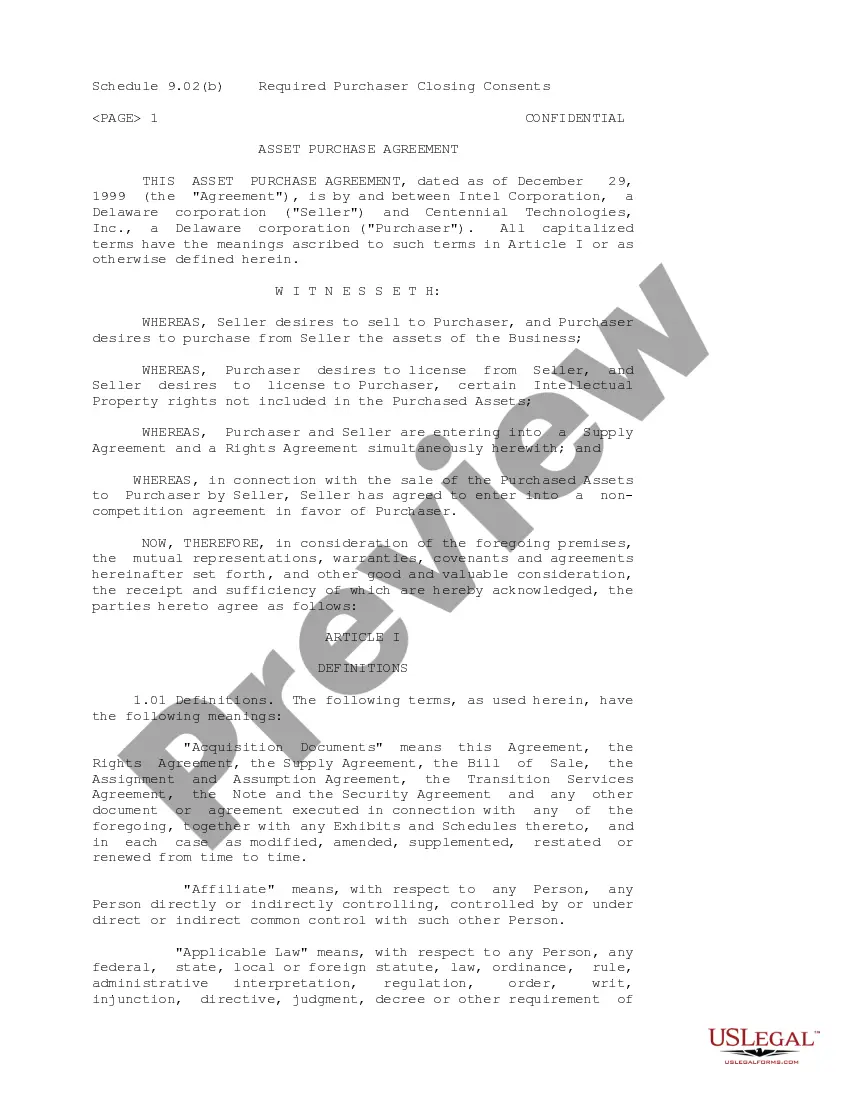

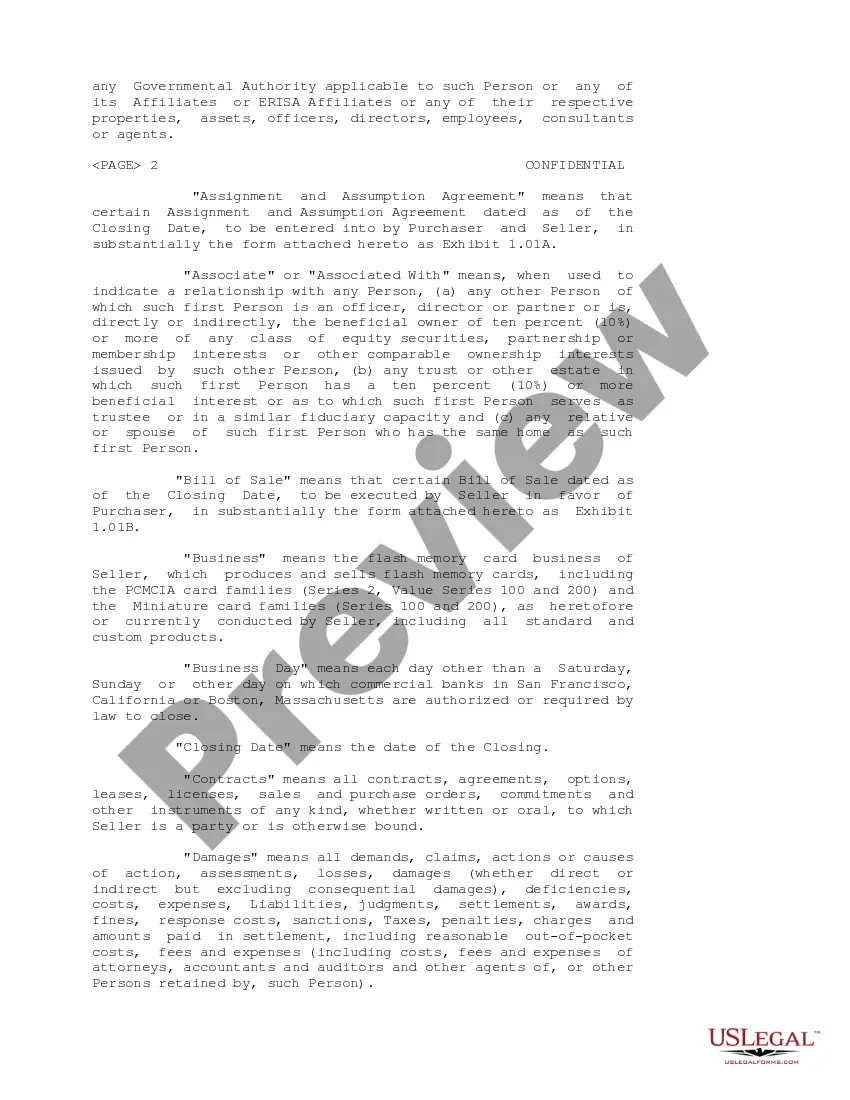

Wisconsin Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation — Sample is a legally binding document that outlines the terms and conditions for the acquisition of assets by Intel Corporation from Centennial Technologies, Inc. This agreement relates to a specific transaction and is tailored to meet the requirements of businesses operating in Wisconsin. The agreement encompasses various elements such as: 1. Parties: Clearly outlines the names and legal details of the parties involved, i.e., Centennial Technologies, Inc. as the seller and Intel Corporation as the buyer. 2. Definitions: Provides a comprehensive list of defined terms used throughout the agreement, ensuring clarity and mutual understanding. 3. Assets: Identifies the specific assets being sold, including tangible property, intellectual property rights, customer contracts, and other relevant assets. The agreement may outline any excluded assets that are explicitly not part of the transaction. 4. Purchase Price: Details the agreed-upon consideration for the assets being transferred. This may include the total purchase price, payment terms, and any adjustments or conditions for payment. 5. Representations and Warranties: Outlines the assurances made by each party regarding their respective legal authority, ownership of assets, absence of liens or encumbrances, and compliance with laws and regulations, among other matters. This section helps mitigate risk and provides a basis for legal recourse if any misrepresentation occurs. 6. Covenants and Obligations: Specifies the ongoing obligations of the parties both during and after the asset transfer. This may include non-compete clauses, confidentiality agreements, transition assistance, and other mutually agreed-upon obligations. 7. Indemnification: Establishes the rights and responsibilities of each party for reimbursing any losses, damages, or liabilities arising from breaches of the agreement, misrepresentation, or violation of applicable laws. 8. Governing Law and Jurisdiction: Indicates the jurisdiction whose laws govern the interpretation and enforcement of the agreement. In this case, it would be Wisconsin. Different types of Wisconsin Sample Asset Purchase Agreement might include variations specific to unique circumstances, industries, or assets involved. Some possible examples could include: — Wisconsin Sample Asset Purchase Agreement for the acquisition of technology or software-related assets — Wisconsin Sample Asset Purchase Agreement for the purchase of real estate assets — Wisconsin Sample Asset Purchase Agreement for the transfer of manufacturing equipment or machinery Ultimately, the specific type of agreement will depend on the nature of the assets being acquired and the specific requirements of the parties involved.

Wisconsin Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample

Description

How to fill out Wisconsin Sample Asset Purchase Agreement Between Centennial Technologies, Inc. And Intel Corporation - Sample?

US Legal Forms - one of many most significant libraries of lawful varieties in the USA - offers a variety of lawful file web templates you may acquire or print out. Utilizing the web site, you may get thousands of varieties for business and specific uses, categorized by classes, suggests, or search phrases.You can find the newest models of varieties like the Wisconsin Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample in seconds.

If you already possess a registration, log in and acquire Wisconsin Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample from your US Legal Forms catalogue. The Down load key will appear on every form you look at. You get access to all previously delivered electronically varieties within the My Forms tab of your own profile.

If you want to use US Legal Forms for the first time, allow me to share simple directions to get you started out:

- Ensure you have selected the best form for your personal city/area. Click the Preview key to check the form`s articles. Look at the form information to ensure that you have chosen the right form.

- In the event the form doesn`t suit your demands, make use of the Search discipline near the top of the screen to get the one that does.

- If you are content with the shape, verify your selection by visiting the Buy now key. Then, choose the prices strategy you like and offer your accreditations to sign up to have an profile.

- Procedure the transaction. Utilize your charge card or PayPal profile to perform the transaction.

- Find the format and acquire the shape on your own device.

- Make modifications. Load, modify and print out and indicator the delivered electronically Wisconsin Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample.

Each and every format you added to your money does not have an expiration particular date and it is the one you have forever. So, if you would like acquire or print out one more backup, just go to the My Forms segment and click in the form you will need.

Gain access to the Wisconsin Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample with US Legal Forms, the most extensive catalogue of lawful file web templates. Use thousands of specialist and express-distinct web templates that meet up with your company or specific requires and demands.