Wisconsin Credit Agreement between Southwest Royalties, Inc. and Bank One Texas

Description

How to fill out Credit Agreement Between Southwest Royalties, Inc. And Bank One Texas?

Are you currently in a place where you need paperwork for possibly business or person reasons just about every working day? There are plenty of authorized file templates available on the Internet, but discovering kinds you can depend on isn`t easy. US Legal Forms provides thousands of form templates, much like the Wisconsin Credit Agreement between Southwest Royalties, Inc. and Bank One Texas, which can be published to fulfill state and federal demands.

If you are currently acquainted with US Legal Forms internet site and possess a merchant account, basically log in. Afterward, you may down load the Wisconsin Credit Agreement between Southwest Royalties, Inc. and Bank One Texas design.

Unless you have an profile and need to begin to use US Legal Forms, abide by these steps:

- Discover the form you want and make sure it is for that proper area/county.

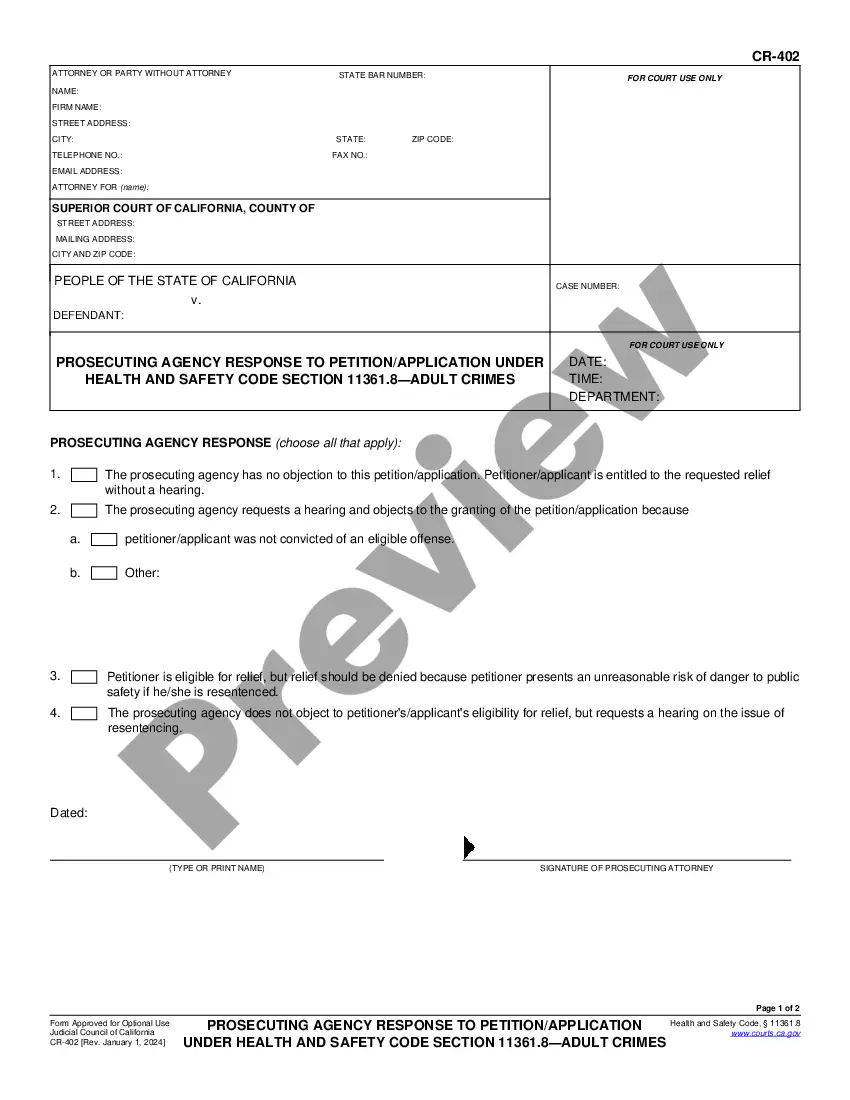

- Make use of the Preview option to check the shape.

- Read the outline to actually have selected the correct form.

- In case the form isn`t what you`re looking for, take advantage of the Lookup field to get the form that meets your requirements and demands.

- When you find the proper form, click Purchase now.

- Opt for the prices strategy you want, submit the required information and facts to produce your bank account, and buy your order utilizing your PayPal or Visa or Mastercard.

- Choose a hassle-free document structure and down load your duplicate.

Locate each of the file templates you may have purchased in the My Forms menu. You can get a additional duplicate of Wisconsin Credit Agreement between Southwest Royalties, Inc. and Bank One Texas anytime, if required. Just click the required form to down load or produce the file design.

Use US Legal Forms, the most considerable collection of authorized varieties, in order to save time as well as prevent mistakes. The support provides professionally created authorized file templates that you can use for a selection of reasons. Make a merchant account on US Legal Forms and commence generating your lifestyle a little easier.