Wisconsin Underwriting Agreement of Ameriquest Mortgage Securities, Inc.

Description

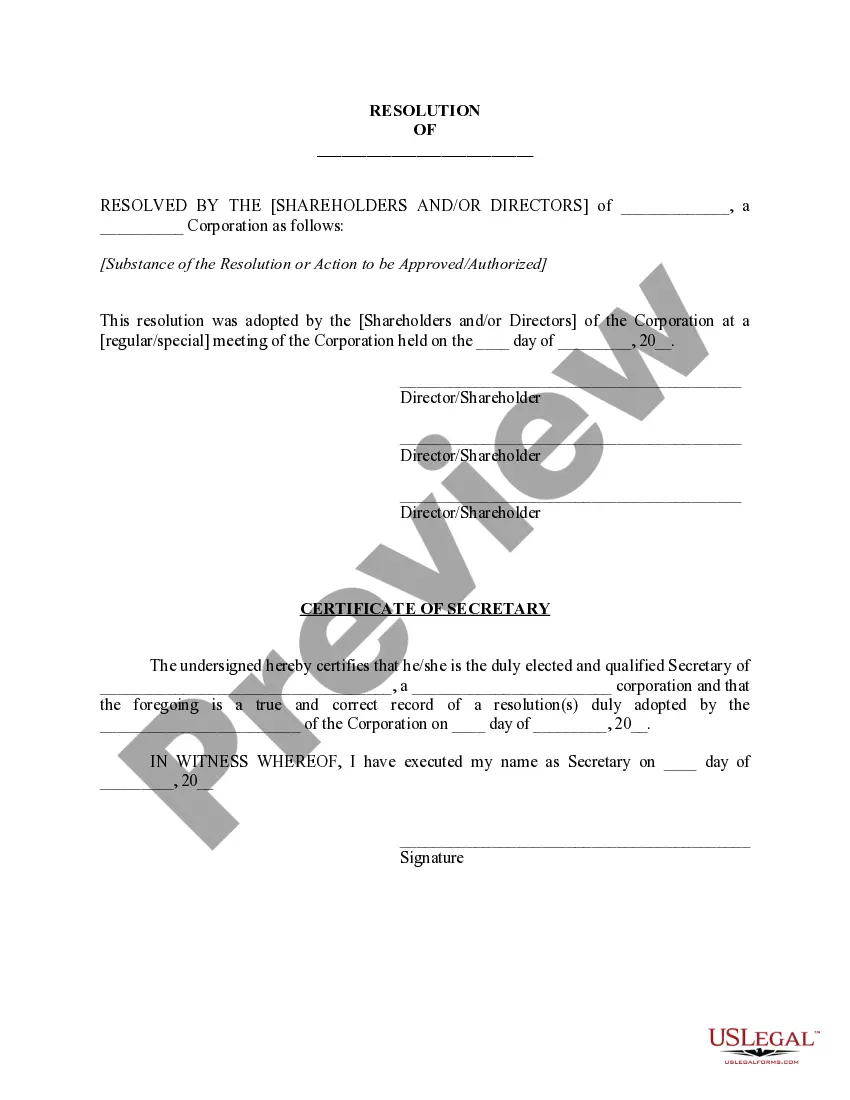

How to fill out Underwriting Agreement Of Ameriquest Mortgage Securities, Inc.?

Finding the right authorized record template could be a battle. Of course, there are a variety of themes available online, but how can you find the authorized form you will need? Use the US Legal Forms site. The services offers a huge number of themes, including the Wisconsin Underwriting Agreement of Ameriquest Mortgage Securities, Inc., which you can use for business and private requirements. All of the types are checked out by professionals and meet up with federal and state requirements.

If you are presently registered, log in to the bank account and click on the Download option to have the Wisconsin Underwriting Agreement of Ameriquest Mortgage Securities, Inc.. Use your bank account to appear with the authorized types you possess bought earlier. Visit the My Forms tab of your bank account and obtain an additional backup of your record you will need.

If you are a whole new customer of US Legal Forms, allow me to share simple instructions for you to adhere to:

- Initial, ensure you have selected the appropriate form for your metropolis/state. It is possible to examine the form utilizing the Review option and read the form explanation to ensure it will be the best for you.

- In the event the form does not meet up with your requirements, make use of the Seach industry to find the correct form.

- Once you are certain that the form is suitable, go through the Purchase now option to have the form.

- Opt for the rates plan you need and enter in the necessary details. Make your bank account and pay money for an order utilizing your PayPal bank account or charge card.

- Select the data file formatting and obtain the authorized record template to the gadget.

- Full, edit and print and indication the acquired Wisconsin Underwriting Agreement of Ameriquest Mortgage Securities, Inc..

US Legal Forms will be the biggest collection of authorized types in which you will find numerous record themes. Use the service to obtain professionally-manufactured paperwork that adhere to condition requirements.

Form popularity

FAQ

The "lender" is the financial institution that loaned you the money. The lender owns the loan and is also called the "note holder" or "holder." Sometime later, the lender might sell the mortgage debt to another entity, which then becomes the new loan owner (holder).

Status: CLOSED. Long Beach was closed by Washington Mutual in 2007. History: Originally a California-based savings and loan, founded in 1979, Long Beach Bank became a federally chartered thrift institution in 1990. In October 1994, it became Long Beach Mortgage Co.

On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage.

Employer Identification No.) 1100 TOWN & COUNTRY ROAD, SUITE 1100 ORANGE, CALIFORNIA 92868 (Address of principal executive offices) (Zip Code) Registrant's Telephone Number, Including Area Code: (714) 541-9960 Item 5.

?The mortgage will be transferred to another bank if the first bank experiences problems and fails, and you will need to start making payments to the new lender. You might need to refinance your mortgage with the new bank, depending on the details of the transfer.?