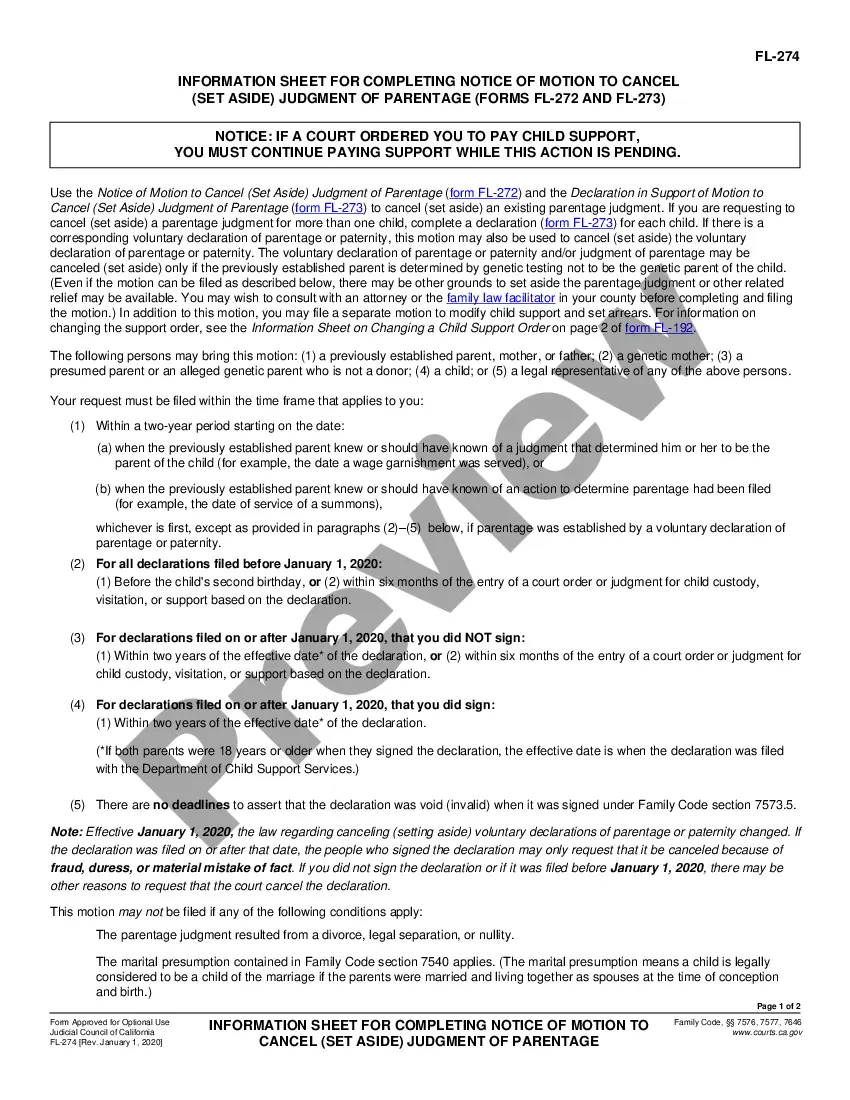

A Wisconsin Subsequent Pledge Agreement is a legal contract between ABCs Mortgage Loan Trust and The Bank of New York, specifically pertaining to the pledging of assets by the trust to the bank. This agreement establishes the terms and conditions under which the trust pledges certain assets as collateral to secure any obligations or debts owed to the bank. The purpose of a Wisconsin Subsequent Pledge Agreement is to provide the bank with additional security in case of default by the trust or to fulfill certain regulatory requirements. The agreement typically outlines the specific assets being pledged, including but not limited to mortgage loan portfolios, securities, or other types of financial assets. By entering into a Wisconsin Subsequent Pledge Agreement, ABCs Mortgage Loan Trust acknowledges its commitment to provide the bank with the pledged assets if it fails to meet its obligations. The Bank of New York, on the other hand, agrees to accept these assets as collateral and holds the right to take ownership or control over them in the event of default. While the basic structure and purpose of the Wisconsin Subsequent Pledge Agreement remain the same, there may be different types or variations of this agreement. Some potential variations may include: 1. Fixed Pledge Agreement: This type of agreement establishes a fixed term during which the pledged assets will remain with the bank unless released or substituted by mutual agreement. 2. Floating Pledge Agreement: In this variation, the pledged assets can be periodically adjusted or replaced, based on the changing needs of the trust or as agreed upon between the parties. 3. Revolving Pledge Agreement: Under this form of agreement, the trust has the ability to add or remove assets from the pledged pool, within certain predetermined limits, without requiring the bank's consent each time. 4. Cross-Collateralization Pledge Agreement: This type of agreement allows the bank to utilize the pledged assets to secure multiple loans or obligations held by the trust simultaneously. It is important for both parties to the Wisconsin Subsequent Pledge Agreement to clearly define their rights, responsibilities, and obligations to ensure a fair and transparent transaction. Before entering into such an agreement, legal advice should be sought to fully understand the implications and potential consequences for both ABCs Mortgage Loan Trust and The Bank of New York.

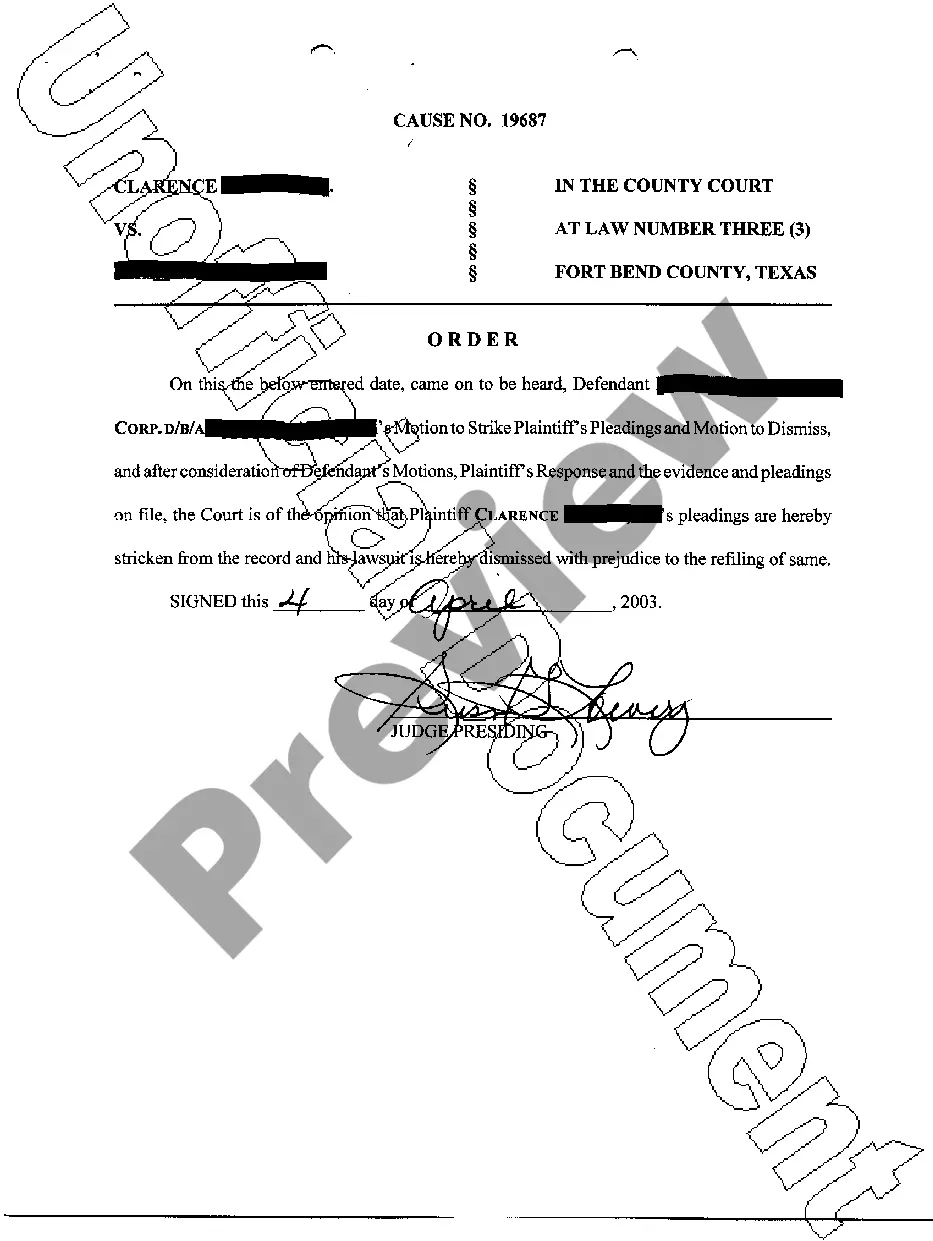

Wisconsin Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York

Description

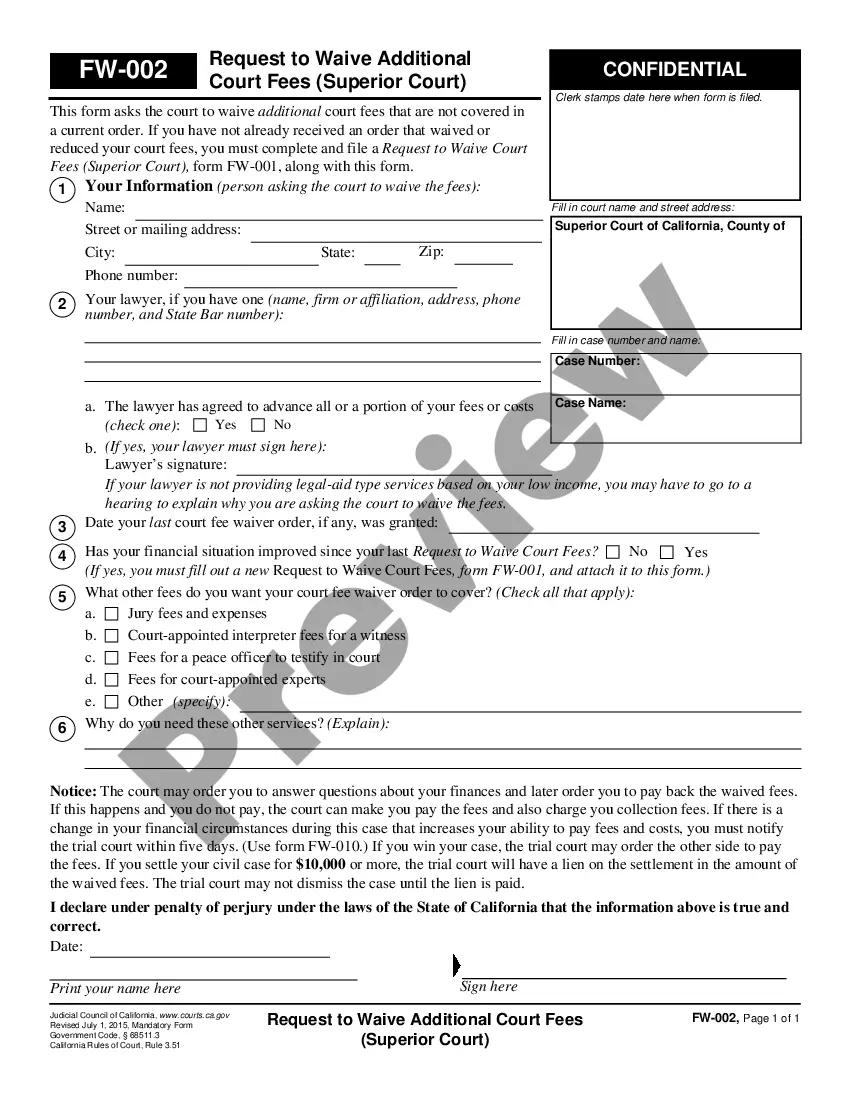

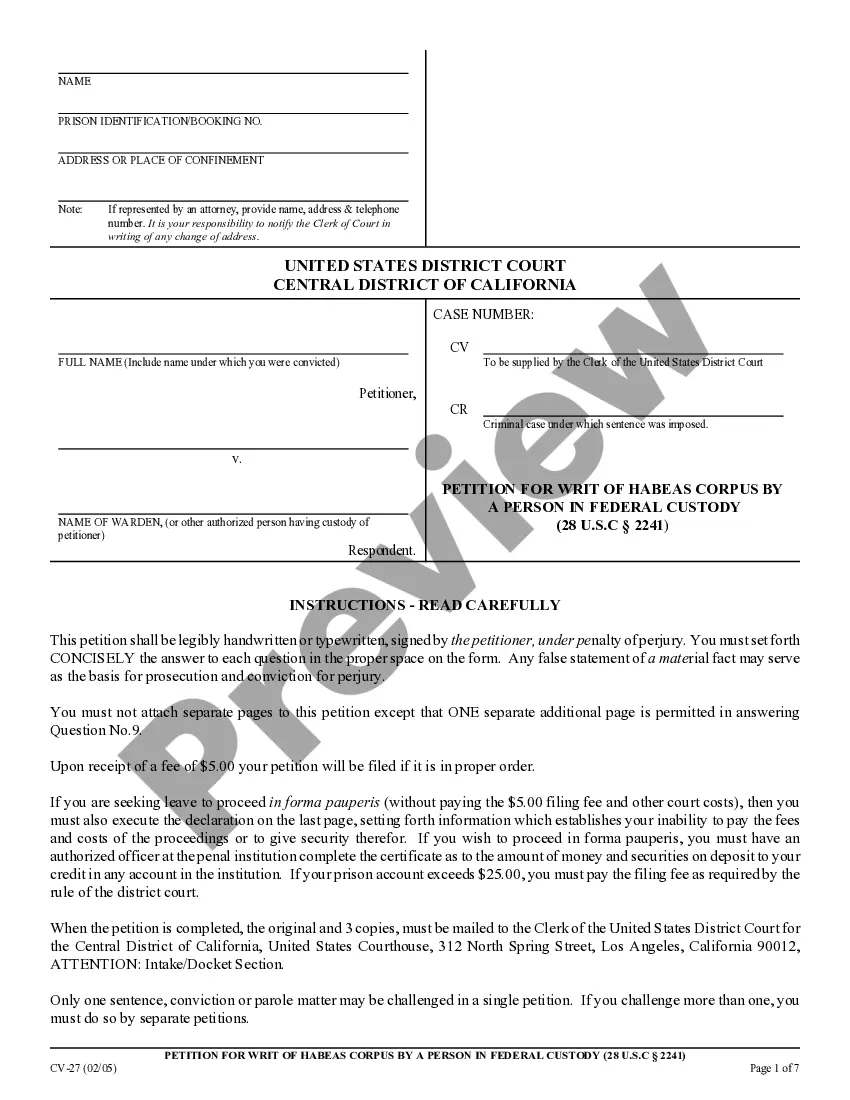

How to fill out Wisconsin Subsequent Pledge Agreement Between ABFS Mortgage Loan Trust And The Bank Of New York?

If you need to full, acquire, or print out legitimate record web templates, use US Legal Forms, the most important collection of legitimate forms, which can be found online. Make use of the site`s basic and practical search to find the papers you will need. A variety of web templates for organization and personal purposes are sorted by groups and states, or search phrases. Use US Legal Forms to find the Wisconsin Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York with a number of mouse clicks.

If you are presently a US Legal Forms consumer, log in for your account and click on the Acquire switch to get the Wisconsin Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York. You can even gain access to forms you earlier acquired inside the My Forms tab of the account.

If you work with US Legal Forms the first time, follow the instructions beneath:

- Step 1. Ensure you have chosen the shape for that proper city/nation.

- Step 2. Take advantage of the Review method to look through the form`s information. Never forget about to read through the description.

- Step 3. If you are not happy with the develop, utilize the Lookup field on top of the monitor to find other models from the legitimate develop design.

- Step 4. Once you have located the shape you will need, click on the Acquire now switch. Choose the rates strategy you favor and include your qualifications to sign up on an account.

- Step 5. Approach the deal. You can use your Мisa or Ьastercard or PayPal account to complete the deal.

- Step 6. Choose the file format from the legitimate develop and acquire it in your gadget.

- Step 7. Comprehensive, edit and print out or indicator the Wisconsin Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York.

Each and every legitimate record design you purchase is your own eternally. You might have acces to every single develop you acquired with your acccount. Click the My Forms area and choose a develop to print out or acquire once more.

Be competitive and acquire, and print out the Wisconsin Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York with US Legal Forms. There are thousands of specialist and status-particular forms you can utilize for the organization or personal demands.

Form popularity

FAQ

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own.

Pledged Collateral Definition The borrower pledges assets or property to the lender to guarantee or secure the loan. Pledging assets, also referred to as hypothecation, does not transfer ownership of the property to the creditor, but gives the creditor a non-possessory interest in the property.

Bank Account Pledge Agreement means the pledge agreement entered into between the Issuer and the Trustee on or about the First Issue Date in respect of a first priority pledge over the Bank Account and all funds held on the Bank Account from time to time, granted in favour of the Trustee and the Bondholders ( ...

In simple terms, a home loan is a loan taken to buy or construct a new home ? i.e. the property is not owned by the loan applicant. A mortgage loan, also known as a loan against property, is a loan secured by a property that the loan applicant already owns.

Benefits of having a mortgage Although your credit might take a temporary hit when you get your mortgage, over time, paying down the balance can help improve or maintain your credit score. A higher credit score translates to everything from better interest rates to more loan options.

A mortgage is a type of loan that's used to finance property. Mortgages are ?secured? loans. With a secured loan, the borrower promises collateral to the lender in the event that they stop making payments. In the case of a mortgage, the collateral is the home.

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own. Seven things to look for in a mortgage.