Wisconsin Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York

Description

How to fill out Investment Advisory Agreement Between Hamilton Small Cap Growth CRT Fund And The Bank Of New York?

Are you currently within a placement the place you require documents for sometimes company or person reasons nearly every working day? There are a variety of lawful papers layouts accessible on the Internet, but locating versions you can trust isn`t straightforward. US Legal Forms delivers thousands of form layouts, just like the Wisconsin Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York, that happen to be written to meet federal and state requirements.

When you are presently informed about US Legal Forms internet site and possess a free account, merely log in. After that, you are able to obtain the Wisconsin Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York template.

Should you not provide an accounts and need to begin to use US Legal Forms, abide by these steps:

- Discover the form you need and ensure it is for your appropriate area/county.

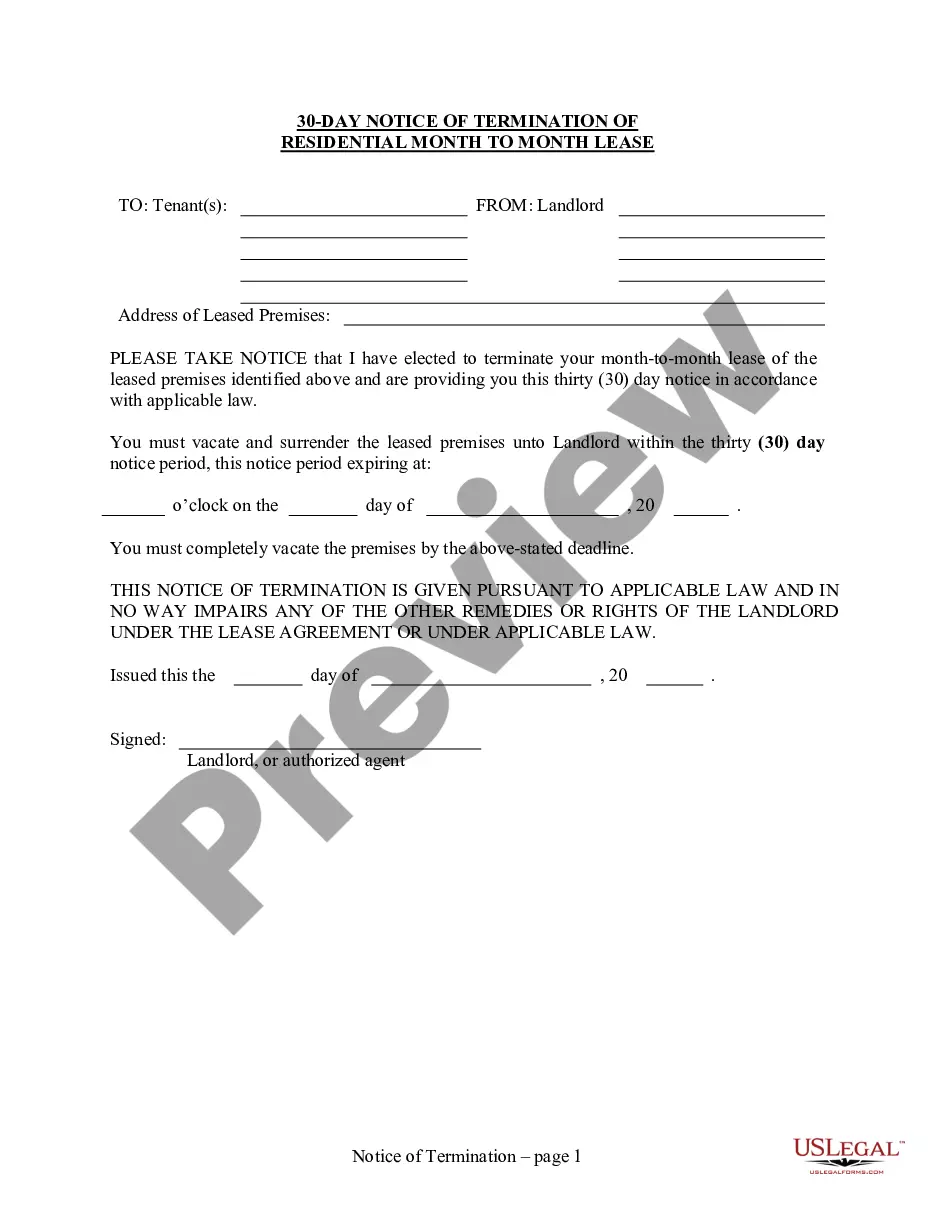

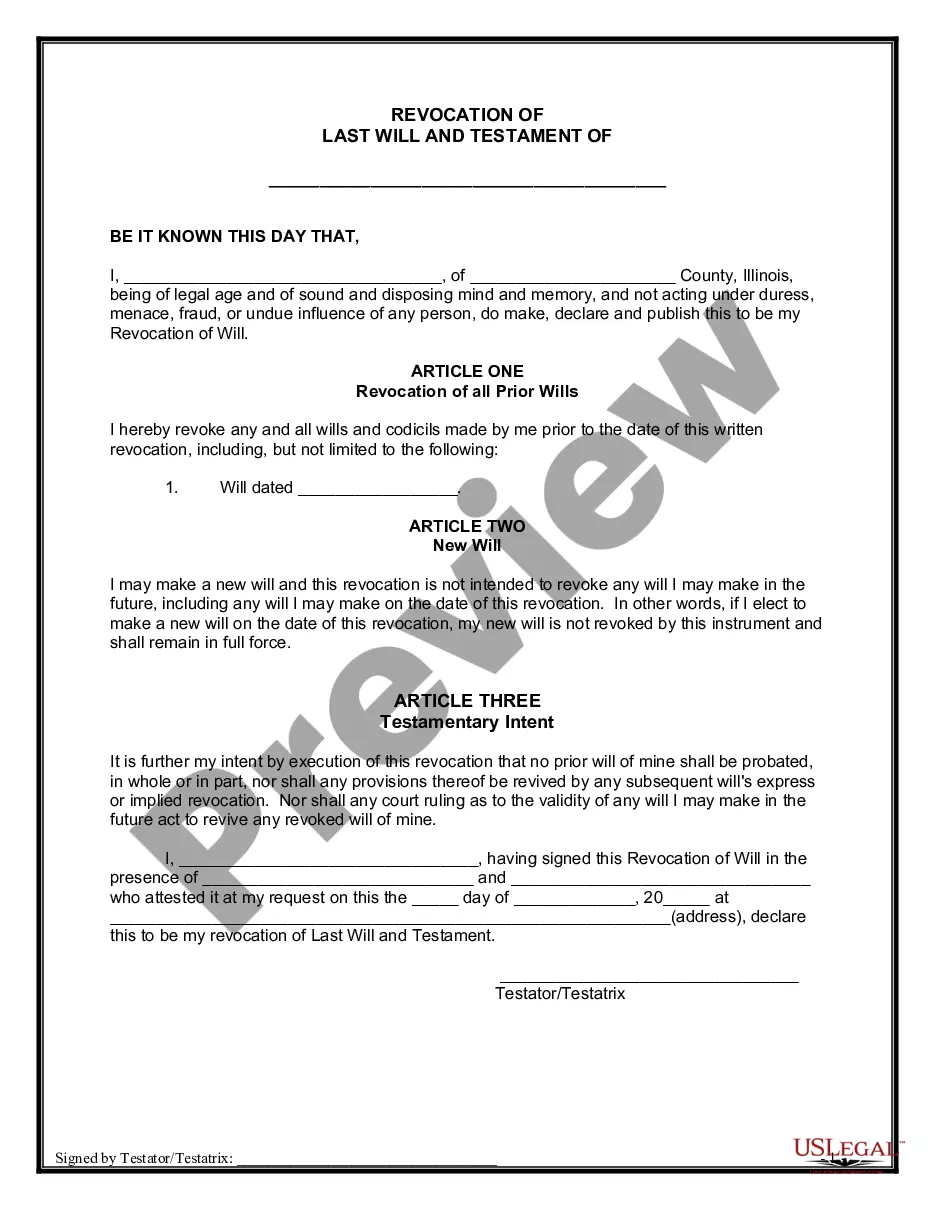

- Make use of the Preview button to examine the form.

- See the description to actually have chosen the right form.

- In the event the form isn`t what you`re searching for, use the Search industry to get the form that suits you and requirements.

- Whenever you find the appropriate form, simply click Get now.

- Choose the pricing program you desire, fill in the desired details to produce your account, and buy an order utilizing your PayPal or Visa or Mastercard.

- Choose a practical document structure and obtain your duplicate.

Locate all of the papers layouts you might have bought in the My Forms menu. You can obtain a more duplicate of Wisconsin Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York anytime, if necessary. Just click on the needed form to obtain or produce the papers template.

Use US Legal Forms, by far the most substantial collection of lawful types, to conserve time as well as prevent errors. The assistance delivers skillfully made lawful papers layouts which you can use for a range of reasons. Create a free account on US Legal Forms and commence generating your life a little easier.

Form popularity

FAQ

The SEBI (Investment Advisers) Regulations, 2013 (?IA Regulations?) have been notified on January 21, 2013. The IA Regulations came into effect from April 21, 2013.

Ing to the U.S. Investment Advisers Act of 1940, an investment advisor is a person or firm that provides advice to others or issues securities reports or analyses for compensation. U.S. Securities and Exchange Commission.

Advisers to business development companies, when the adviser has at least $25 million of RAUM, must register with the SEC. Certain internet advisers who provide advice through an interactive website may register with the SEC.

This agreement is meant to be a blueprint of sorts for you as the client because it spells out both what the financial advisor will do you for you, such as provide general advice or recommend specific investment moves for your portfolio, as well as what your responsibilities are.

An advisory agreement is a business contract signed between a company and an advisor. The latter offers their services as an external third party and does so for any chosen term. The agreement is either signed at the beginning of the project or for the specific duration which the advisor offers their service.

Canadian Investment advisors have earned a college degree in business, finance, economics, or a related field such as accounting. Post secondary education is a vital component to success in this industry, as even being considered for employment requires a strong educational background.

To become a Registered Investment Advisor you must at a minimum pass the Series 65 exam administered by the Financial Industry Regulatory Authority (FINRA). Once you've passed the series 65 you must register with the Securities and Exchange Commission (SEC) or with state regulatory agencies.

They provide clear guidelines of what is expected of each party in order for your needs to be met. Investment advisory agreements typically include terms related to the advisors fee structure, investment methodology, level of risk a client is willing to take, and more.