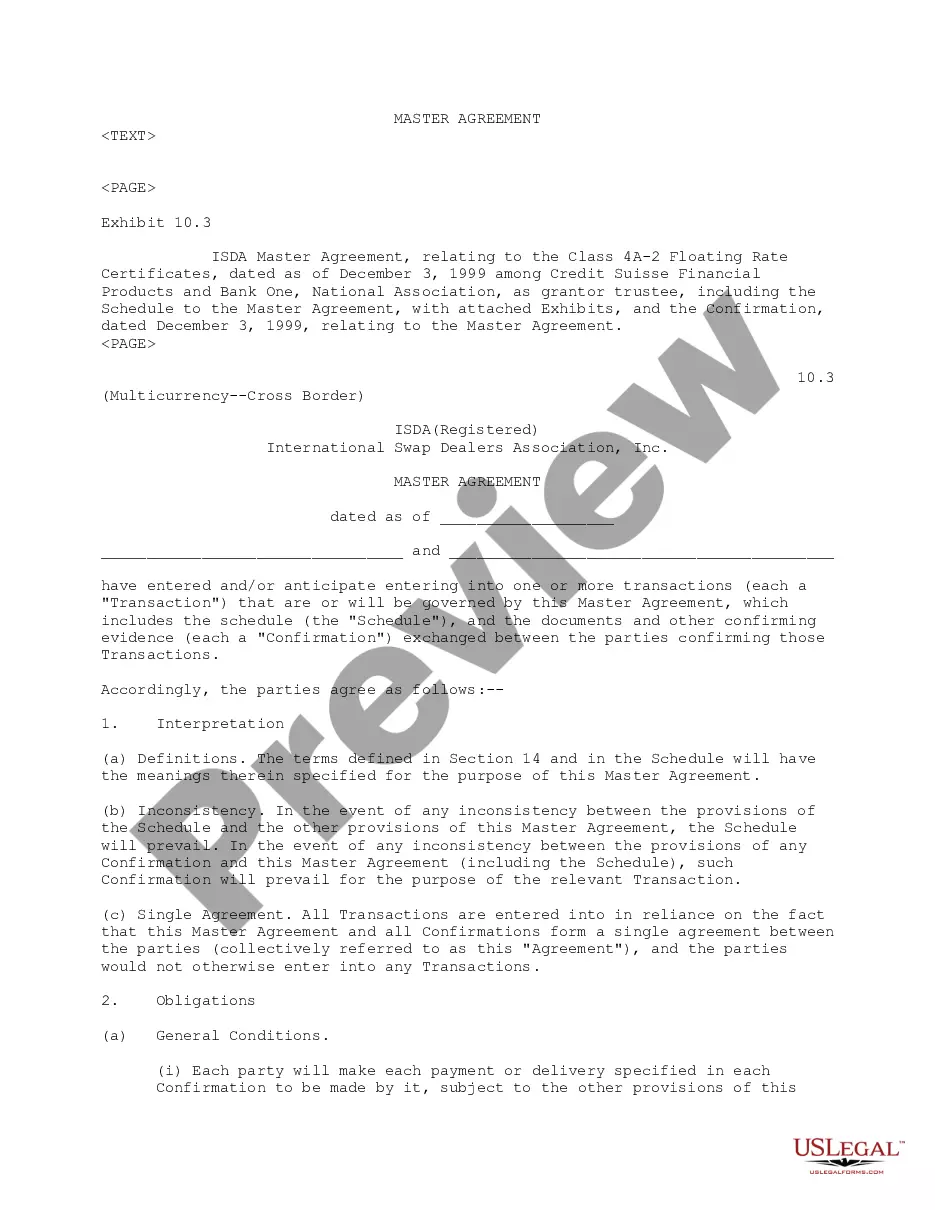

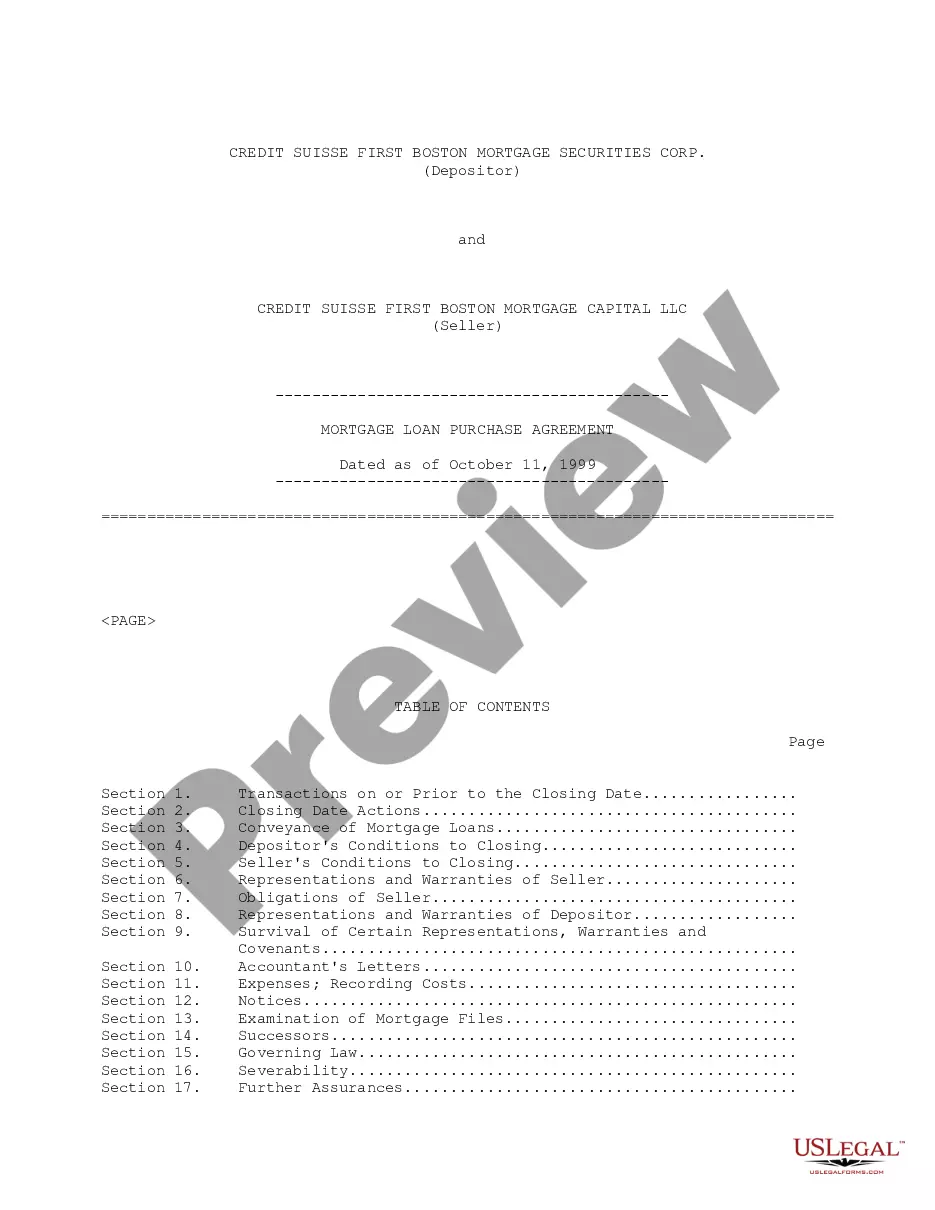

Wisconsin Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One

Description

How to fill out Pooling And Servicing Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. And Bank One?

Discovering the right lawful document web template might be a have difficulties. Needless to say, there are tons of templates available on the net, but how would you discover the lawful develop you require? Use the US Legal Forms web site. The support provides 1000s of templates, such as the Wisconsin Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One, which can be used for company and private requires. Every one of the forms are inspected by specialists and fulfill state and federal needs.

In case you are already signed up, log in to the profile and then click the Down load key to have the Wisconsin Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One. Make use of your profile to look from the lawful forms you may have acquired earlier. Proceed to the My Forms tab of your respective profile and obtain another duplicate of the document you require.

In case you are a whole new user of US Legal Forms, allow me to share basic directions that you can adhere to:

- Very first, make sure you have chosen the appropriate develop for your area/area. You are able to look over the form using the Review key and browse the form explanation to ensure this is the right one for you.

- When the develop will not fulfill your expectations, make use of the Seach field to discover the right develop.

- Once you are sure that the form is suitable, select the Acquire now key to have the develop.

- Choose the prices prepare you would like and enter the essential information and facts. Build your profile and buy your order with your PayPal profile or credit card.

- Choose the file formatting and down load the lawful document web template to the product.

- Complete, modify and printing and sign the received Wisconsin Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One.

US Legal Forms may be the biggest library of lawful forms in which you can find a variety of document templates. Use the service to down load appropriately-produced paperwork that adhere to condition needs.

Form popularity

FAQ

In 2005, Select Portfolio Servicing was purchased by Credit Suisse, a financial services company, headquartered in Zurich, Switzerland. Select Portfolio Servicing - Wikipedia wikipedia.org ? wiki ? Select_Portfolio_Servici... wikipedia.org ? wiki ? Select_Portfolio_Servici...

A mortgage pool is a group of mortgages held in trust as collateral for the issuance of a mortgage-backed security. Some mortgage-backed securities issued by Fannie Mae, Freddie Mac, and Ginnie Mae are known as "pools" themselves.

A collateralized mortgage obligation (CMO) is a fixed-income security with a pool of mortgage loans that are similar in a variety of ways, like credit score or loan amount, and are combined and resold as a single packaged investment to investors called a security.

When rates rise, there are fewer people who benefit from a new mortgage. Lenders and servicers adjust. Servicers looking to raise cash may make part or all of their portfolio available for sale to other servicers. Interested servicers may see this as an opportunity to grow their portfolio. Mortgage Servicing Transferred? Here's What You Should Know rocketmortgage.com ? learn ? mortgage-ser... rocketmortgage.com ? learn ? mortgage-ser...

A mortgage pool is a form of alternative investment that provides mortgages to those who may not be approved through usual methods. Essentially, a group of investors pool their money together and invest in projects that range from commercial to residential property.

Homeowners are often transferred to SPS once they become delinquent on their mortgage payments. Many lenders try to protect their brand when it comes to foreclosing on homeowners. stop select portfolio servicing foreclosure Keep Your Keys ? selectportfolioservicing Keep Your Keys ? selectportfolioservicing

Homeowners are often transferred to SPS once they become delinquent on their mortgage payments. Many lenders try to protect their brand when it comes to foreclosing on homeowners.

SPS is a mortgage servicer, which means we manage your account on behalf of the note holder. FrequentlyAskedQuestions - Select Portfolio Servicing Select Portfolio Servicing ? StaticDetails ? Help Select Portfolio Servicing ? StaticDetails ? Help

Securitization. Act of pooling mortgages and then selling them as mortgage-backed securities. - Mortgage loans purchased from the primary mortgage market are assembled into pools by a government/quasi-governmental entity or a private investor who operates in the secondary mortgage market.

NOTE: Another way to find a PSA is to go to the SEC EDGAR search index page: .