A Wisconsin Investment Advisory Agreement is a legally binding document that outlines the terms and conditions of the relationship between First American Insurance Portfolios, Inc. (FAIR) and U.S. Bank National Association (US Bank) regarding investment advisory services provided in the state of Wisconsin. In this agreement, FAIR acts as the investment adviser, providing expert advice and guidance on investment strategies and portfolio management to US Bank. US Bank, on the other hand, acts as the client, entrusting FAIR with the responsibility of managing its investment assets. The Wisconsin Investment Advisory Agreement typically includes the following key components: 1. Parties involved: The agreement explicitly identifies FAIR and US Bank as the participating parties, clearly stating their roles and responsibilities. 2. Objective: The agreement outlines the primary purpose for entering into the advisory relationship, which is typically the management and growth of US Bank's investment portfolio. 3. Scope of services: FAIR specifies the range of investment advisory services it will provide to US Bank under this agreement. It may involve asset allocation, investment research, risk assessment, periodic reporting, and other related services. 4. Investment strategies: The agreement describes the investment approaches and strategies that FAIR will employ to achieve US Bank's investment objectives. These strategies may include diversification, sector allocation, risk management techniques, and adherence to specific investment philosophies. 5. Compensation: The agreement details the fees, compensation, and expense structure for FAIR's services, typically based on a percentage of the investment assets under management. 6. Duties and responsibilities: It outlines the specific duties and responsibilities of each party involved, ensuring transparency and clarity. This may include the requirement for FAIR to act in the best interests of US Bank and to conduct thorough due diligence on investment opportunities. 7. Term and termination: The agreement specifies the duration for which it remains in effect and the conditions under which either party may terminate the agreement. 8. Compliance and regulations: It highlights the need for FAIR to operate within the guidelines and regulations set forth by relevant regulatory bodies, ensuring compliance with legal and ethical standards. It is important to note that while there may be different variations or revisions of the Wisconsin Investment Advisory Agreement between FAIR and US Bank to accommodate specific circumstances, the fundamental components mentioned above will generally remain consistent. Disclaimer: The above information is purely for descriptive purposes and should not be considered as legal advice or an actual agreement. Specific details and terms may vary in actual agreements. It is recommended to consult legal professionals for accurate guidance and advice.

Wisconsin Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc.

Description

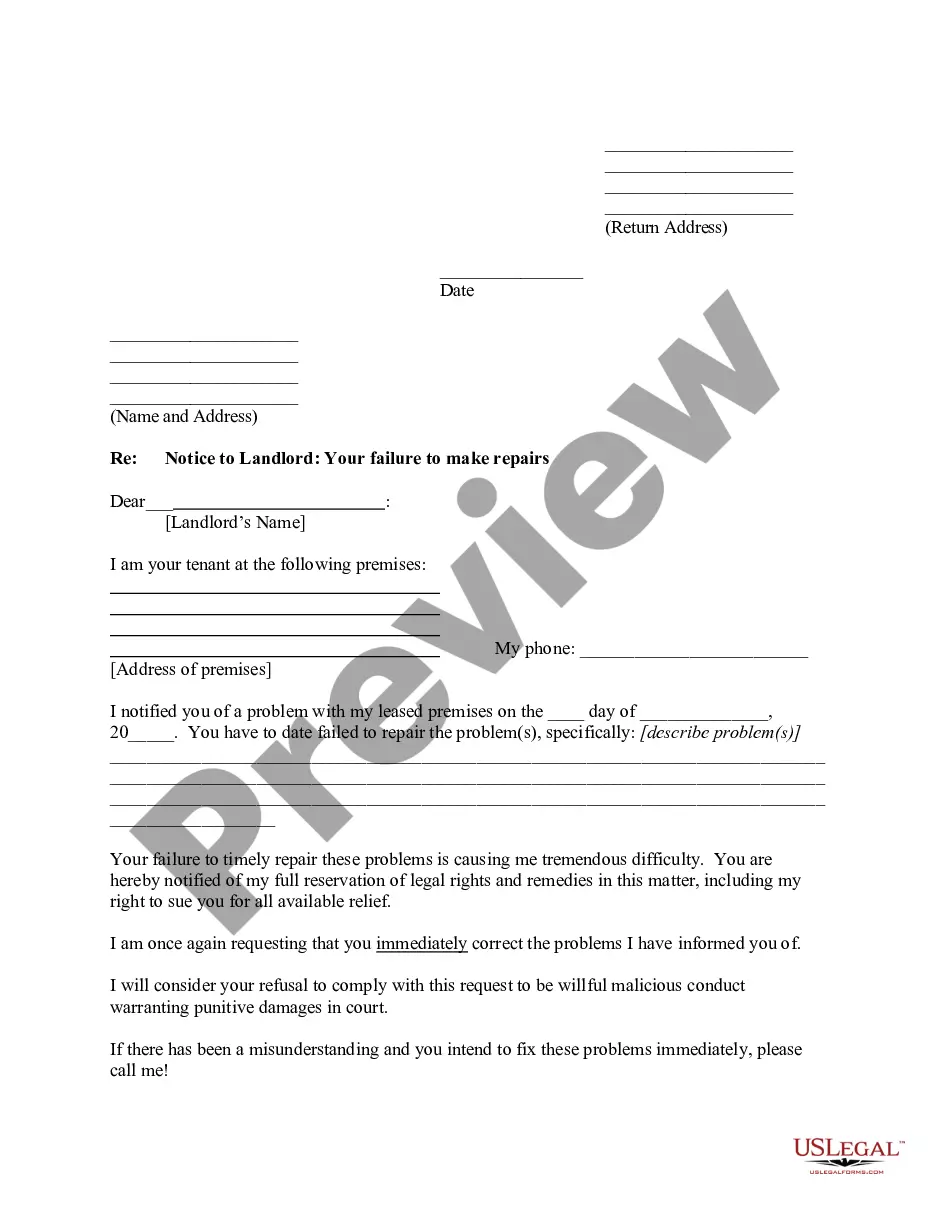

How to fill out Investment Advisory Agreement Between First American Insurance Portfolios, Inc. And U.S. Bank National Assoc.?

US Legal Forms - among the greatest libraries of authorized kinds in the USA - offers a variety of authorized papers themes you are able to acquire or produce. Making use of the internet site, you will get 1000s of kinds for business and person functions, sorted by classes, says, or key phrases.You will find the most up-to-date models of kinds just like the Wisconsin Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. in seconds.

If you have a membership, log in and acquire Wisconsin Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. in the US Legal Forms local library. The Obtain option will appear on every single kind you view. You gain access to all formerly downloaded kinds inside the My Forms tab of your profile.

In order to use US Legal Forms the very first time, listed below are basic instructions to get you started:

- Ensure you have picked the right kind for your metropolis/region. Go through the Preview option to check the form`s information. Look at the kind description to actually have selected the right kind.

- In case the kind doesn`t match your specifications, make use of the Look for industry near the top of the display to find the one who does.

- Should you be pleased with the form, confirm your selection by visiting the Acquire now option. Then, select the prices plan you prefer and supply your credentials to register to have an profile.

- Procedure the financial transaction. Utilize your credit card or PayPal profile to finish the financial transaction.

- Find the structure and acquire the form on your own product.

- Make alterations. Load, revise and produce and signal the downloaded Wisconsin Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc..

Every single template you added to your bank account does not have an expiration date and is your own eternally. So, if you want to acquire or produce one more version, just visit the My Forms segment and click in the kind you want.

Gain access to the Wisconsin Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. with US Legal Forms, probably the most considerable local library of authorized papers themes. Use 1000s of professional and state-certain themes that meet up with your organization or person demands and specifications.

Form popularity

FAQ

An advisor agreement is a legal document used between a company and an advisor they have hired. The legal agreements outlines the expectations and obligation between the two parties, including the role and responsibilities of the advisor, their compensation, confidentiality, and assignment of work.

This agreement is meant to be a blueprint of sorts for you as the client because it spells out both what the financial advisor will do you for you, such as provide general advice or recommend specific investment moves for your portfolio, as well as what your responsibilities are.

An advisory agreement should be used between a company and its advisor. The agreement sets forth the expectation of the relationship like work to be performed on behalf of the advisor and compensation. The agreement should also set forth certain key terms like confidentiality and assignment of work product.

This agreement is meant to be a blueprint of sorts for you as the client because it spells out both what the financial advisor will do you for you, such as provide general advice or recommend specific investment moves for your portfolio, as well as what your responsibilities are.

Investment advisory contracts are legal documents that outline the relationship between the client and the investment advisor. They provide clear guidelines of what is expected of each party in order for your needs to be met.

They provide clear guidelines of what is expected of each party in order for your needs to be met. Investment advisory agreements typically include terms related to the advisors fee structure, investment methodology, level of risk a client is willing to take, and more.