Wisconsin Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company

Description

How to fill out Pooling And Servicing Agreement Contemplating The Sale Of Mortgage Loans To Trustee For Inclusion In The Trust Fund By The Company?

If you need to total, obtain, or printing lawful papers templates, use US Legal Forms, the biggest selection of lawful types, which can be found online. Utilize the site`s basic and hassle-free research to find the paperwork you will need. Numerous templates for business and individual uses are categorized by classes and states, or search phrases. Use US Legal Forms to find the Wisconsin Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company in just a handful of clicks.

In case you are presently a US Legal Forms consumer, log in to the accounts and click the Obtain switch to get the Wisconsin Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company. You can also access types you previously delivered electronically from the My Forms tab of your accounts.

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape to the correct town/region.

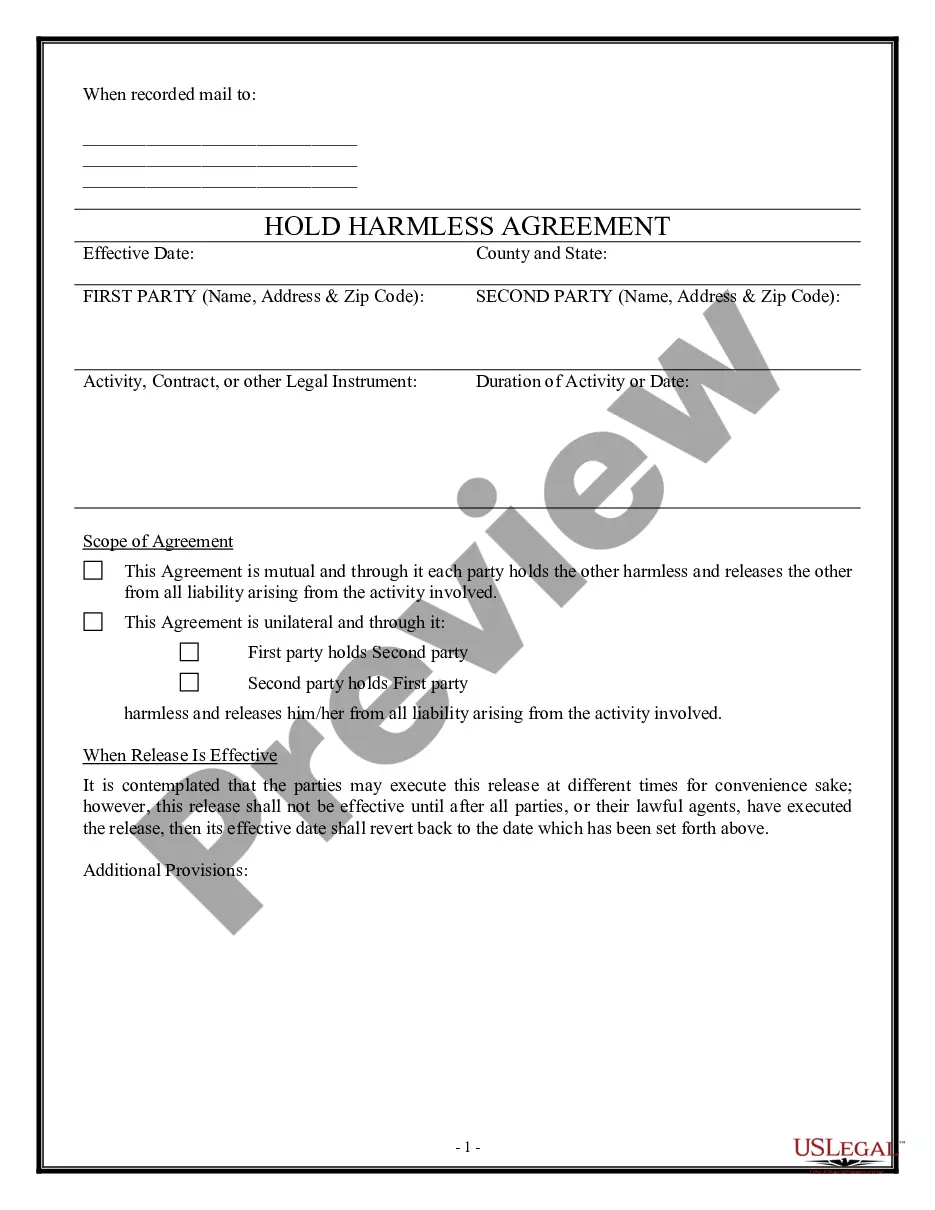

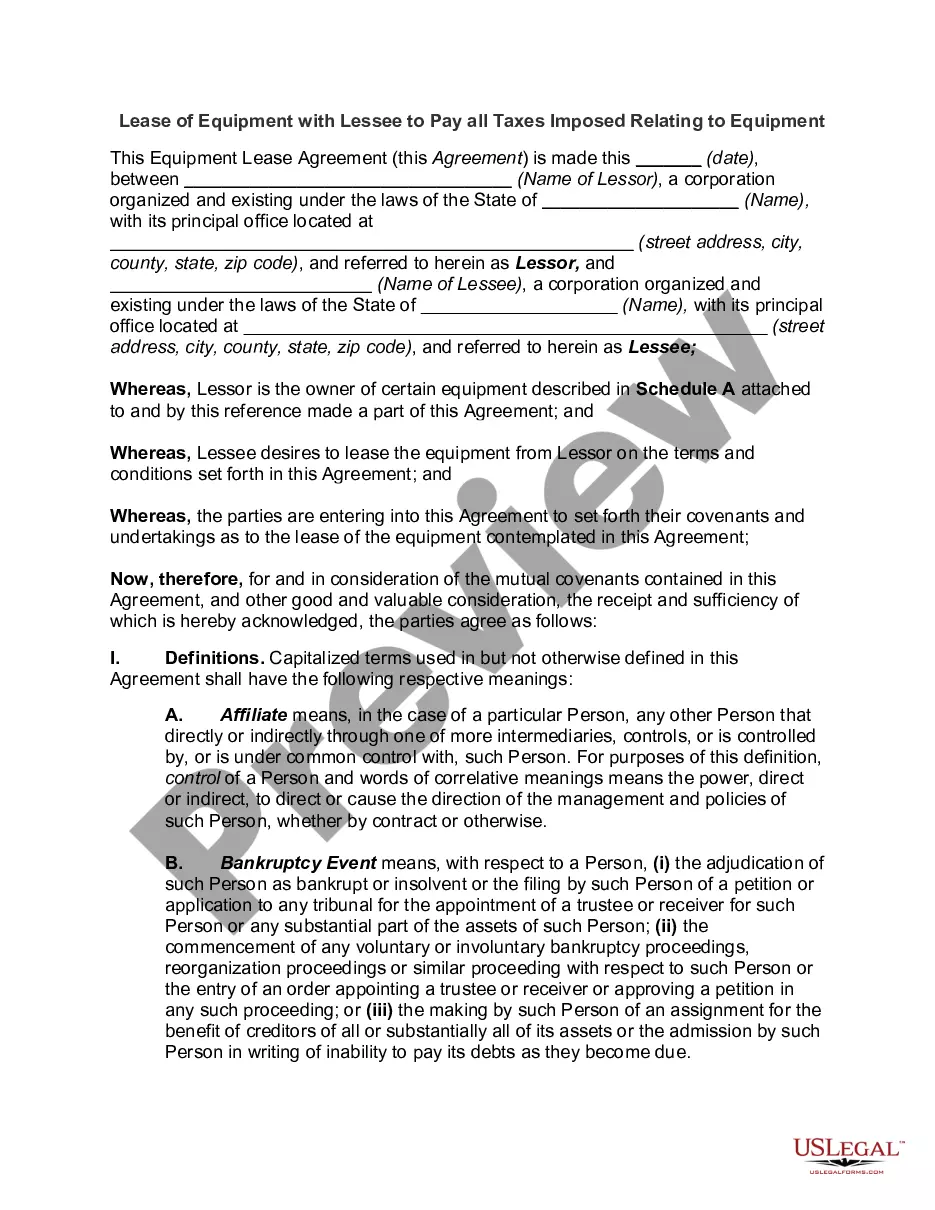

- Step 2. Utilize the Review solution to look through the form`s articles. Do not forget to see the outline.

- Step 3. In case you are unsatisfied with the form, make use of the Research field on top of the display to find other models in the lawful form web template.

- Step 4. Once you have discovered the shape you will need, go through the Get now switch. Pick the rates prepare you like and include your accreditations to register for an accounts.

- Step 5. Approach the financial transaction. You should use your Мisa or Ьastercard or PayPal accounts to complete the financial transaction.

- Step 6. Choose the structure in the lawful form and obtain it in your device.

- Step 7. Full, edit and printing or sign the Wisconsin Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company.

Every single lawful papers web template you acquire is the one you have forever. You possess acces to every form you delivered electronically in your acccount. Select the My Forms section and select a form to printing or obtain again.

Compete and obtain, and printing the Wisconsin Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company with US Legal Forms. There are thousands of skilled and state-distinct types you may use for the business or individual demands.

Form popularity

FAQ

Mortgage servicing rights (MSR) refer to a contractual agreement in which the right to service an existing mortgage is sold by the original mortgage lender to another party that specializes in the various functions involved with servicing mortgages. Mortgage Servicing Rights (MSR) Meaning, Example, and History investopedia.com ? terms ? msr investopedia.com ? terms ? msr

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans. Finding Pooling And Servicing Agreements (PSA's) For Securitized ... ohio.gov ? foreclosure ? PSA ohio.gov ? foreclosure ? PSA

Mortgage servicers collect homeowners' mortgage payments and pass on those payments to investors, tax authorities, and insurers, often through escrow accounts. Servicers also work to protect investors' interests in mortgaged properties, for example, by ensuring homeowners maintain proper insurance coverage.

A Servicing Agreement (or Loan Servicing Agreement) is a document entered into in connection with a facility established for the securitization of various types of assets, most often loans, receivables or leases. Finance, Document Description - Servicing Agreements bloomberglaw.com ? external ? finance-doc... bloomberglaw.com ? external ? finance-doc...

Servicers, except small servicers, must establish and maintain policies and procedures to achieve the following: Provide accurate and timely information to borrowers, investors, courts. Confirm a person's status as a successor in interest. Properly evaluate loss mitigation applications per investor guidelines.

A servicing agreement is a contract between a servicer and a special purpose vehicle (SPV) or an assignee under which the servicer is responsible for administering a lease and acting as a conduit for all payments over the lease term in return for a periodic servicing fee .

Mortgage servicing rights (MSR) allow a third party to perform the day-to-day mortgage servicing duties in exchange for a flat fee, paid by the loan originator. This can and often does happen while borrowers are in the process of repaying their mortgages. However, borrowers may not notice much of a change.