The Wisconsin Contribution Agreement is a legally binding document that outlines the terms and conditions under which Keystone Operating Partnership, L.P., Hudson Bay Partners II, LP, and Several Individual Contributors agree to contribute assets or resources to a specific project or venture within the state of Wisconsin. This agreement serves as a means of formalizing the contributions made by different parties involved, ensuring transparency and clarity in the agreement. Keywords: Wisconsin, Contribution Agreement, Keystone Operating Partnership, L.P., Hudson Bay Partners II, LP, Individual Contributors. Different Types of Wisconsin Contribution Agreement: 1. Wisconsin Real Estate Contribution Agreement: This type of agreement is specifically used when the contribution involves real estate assets in Wisconsin. It outlines the details of the property being contributed, its current value, and any specific conditions or restrictions associated with its transfer. 2. Wisconsin Financial Contribution Agreement: This variation of the agreement focuses on monetary contributions made by the entities involved. It highlights the amount being contributed, the payment terms, and any provisions related to interest, reimbursement, or dividends. 3. Wisconsin Intellectual Property Contribution Agreement: This agreement is utilized when the contributions involve intellectual property rights, such as patents, copyrights, or trademarks, within the state of Wisconsin. It covers the details of the intellectual property being contributed, any associated licensing terms, and any restrictions or obligations related to its usage. 4. Wisconsin Equipment or Asset Contribution Agreement: In cases where the contributions involve tangible assets or equipment, this type of agreement comes into play. It delineates the specific assets being contributed, their current condition, maintenance responsibilities, and any warranties or indemnification provisions. 5. Wisconsin Joint Venture Contribution Agreement: This type of agreement is used when the contributions are made towards a joint venture or partnership in Wisconsin. It outlines the respective contributions of each party, the ownership percentages, profit-sharing arrangements, and the decision-making processes within the venture. 6. Wisconsin Non-Profit Contribution Agreement: For non-profit organizations operating in Wisconsin, a distinct variation of the contribution agreement is utilized. It covers the contributions made towards charitable endeavors, volunteer services, or grant funding, outlining the purpose, specific deliverables, and any reporting requirements. By utilizing the appropriate variation of the Wisconsin Contribution Agreement, Keystone Operating Partnership, L.P., Hudson Bay Partners II, LP, and Several Individual Contributors can accurately record and formalize their contributions, ensuring a clear understanding of their respective rights, responsibilities, and obligations within the context of their Wisconsin-based endeavors.

Wisconsin Contribution Agreement between Keystone Operating Partnership, L.P., Hudson Bay Partners II, LP, and Several Individual Contributors

Description

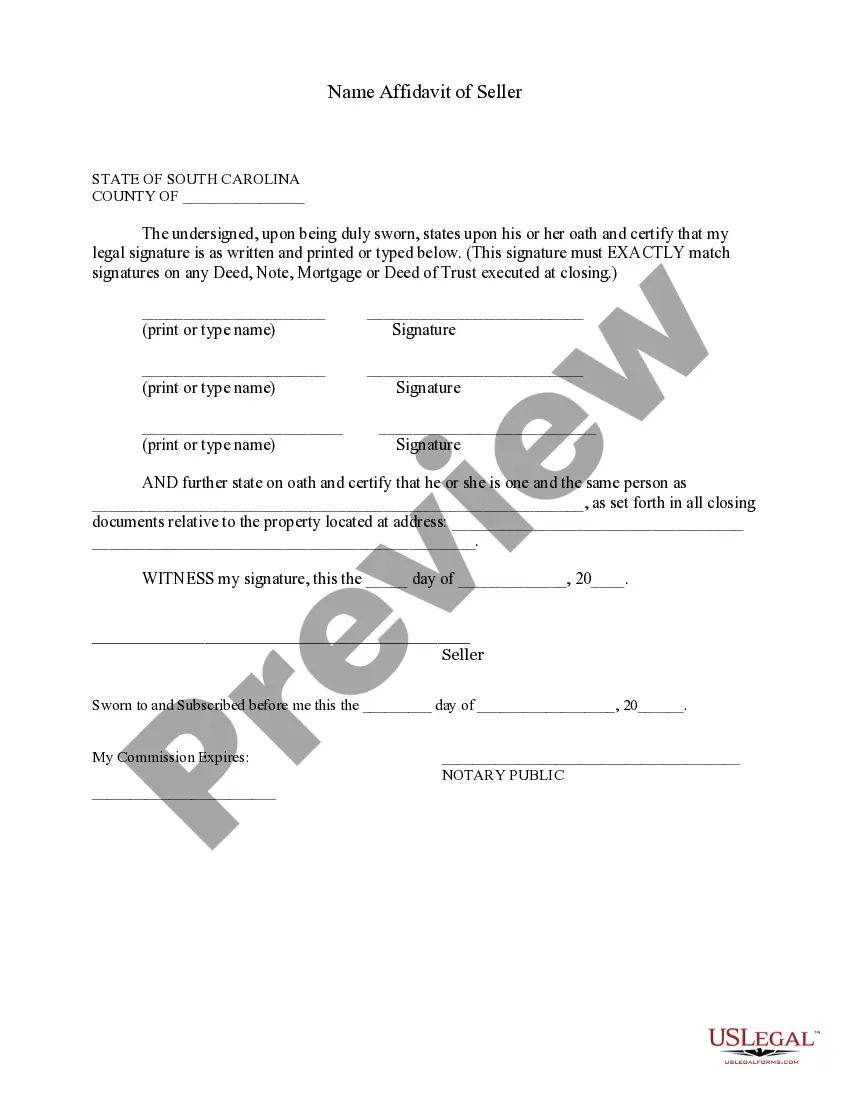

How to fill out Contribution Agreement Between Keystone Operating Partnership, L.P., Hudson Bay Partners II, LP, And Several Individual Contributors?

Choosing the right legitimate record format can be a have difficulties. Obviously, there are plenty of layouts available on the net, but how would you discover the legitimate form you require? Take advantage of the US Legal Forms site. The support provides 1000s of layouts, for example the Wisconsin Contribution Agreement between Keystone Operating Partnership, L.P., Hudson Bay Partners II, LP, and Several Individual Contributors, that you can use for enterprise and personal requires. All of the types are checked by pros and satisfy federal and state specifications.

Should you be already authorized, log in for your bank account and click the Down load switch to get the Wisconsin Contribution Agreement between Keystone Operating Partnership, L.P., Hudson Bay Partners II, LP, and Several Individual Contributors. Utilize your bank account to look through the legitimate types you have acquired in the past. Proceed to the My Forms tab of your own bank account and have an additional version of the record you require.

Should you be a whole new customer of US Legal Forms, here are straightforward guidelines so that you can stick to:

- Initially, make sure you have chosen the proper form for your town/area. You can look over the shape utilizing the Preview switch and read the shape information to make sure it is the right one for you.

- If the form fails to satisfy your expectations, utilize the Seach field to find the correct form.

- When you are certain that the shape is acceptable, click the Purchase now switch to get the form.

- Choose the costs strategy you desire and enter in the needed details. Build your bank account and pay for your order making use of your PayPal bank account or Visa or Mastercard.

- Choose the document format and obtain the legitimate record format for your system.

- Complete, edit and print and indicator the obtained Wisconsin Contribution Agreement between Keystone Operating Partnership, L.P., Hudson Bay Partners II, LP, and Several Individual Contributors.

US Legal Forms may be the greatest library of legitimate types in which you will find a variety of record layouts. Take advantage of the company to obtain expertly-produced papers that stick to condition specifications.