Wisconsin Registration Rights Agreement (ERA) is a legal document that provides certain rights and protections to investors who purchase convertible subordinated debentures issued by a company based in Wisconsin. This agreement ensures that investors have the ability to register their securities with the appropriate regulatory authorities, such as the Securities and Exchange Commission (SEC), to facilitate their resale in the public market. Under the Wisconsin ERA, investors are granted specific registration rights, which typically include the following: 1. Demand Registration Rights: This allows investors to request the company to register their convertible subordinated debentures for resale at any time. The company is obligated to comply with this demand, within certain limitations and under specified conditions. 2. Piggyback Registration Rights: Investors may have the right to include their debentures in any registration statement filed by the company for other securities. This allows them to "piggyback" on the company's registration process, enabling resale of their debentures alongside the company's offerings. 3. Form S-3 Registration Rights: If the company becomes eligible to use Form S-3, a simplified registration statement, investors may have the right to utilize this form to register their debentures for resale. Form S-3 registration is generally more expeditious and cost-effective for investors. 4. Shelf Registration Rights: This provision allows investors to request the company to register their debentures on a "shelf" registration statement, which permits the debentures to be offered continuously or intermittently over a specified period. It's important to note that while these general types of registration rights are often found in Wisconsin Eras, each agreement may have unique provisions and negotiate specific terms and conditions, including limitations on the number of shares or debentures eligible for registration and the timing or frequency of registration requests. The Wisconsin ERA is designed to ensure transparency, liquidity, and flexibility for investors when dealing with convertible subordinated debentures issued by Wisconsin-based companies. By providing these registration rights, it encourages investment in such debentures and fosters a more vibrant and efficient market for these securities.

Wisconsin Registration Rights Agreement regarding the purchase of convertible subordinated debentures

Description

How to fill out Wisconsin Registration Rights Agreement Regarding The Purchase Of Convertible Subordinated Debentures?

Discovering the right legitimate file template can be quite a have difficulties. Obviously, there are a lot of themes available on the Internet, but how would you discover the legitimate form you need? Utilize the US Legal Forms site. The service offers a large number of themes, such as the Wisconsin Registration Rights Agreement regarding the purchase of convertible subordinated debentures, that can be used for organization and private requires. All the varieties are inspected by specialists and fulfill state and federal requirements.

Should you be presently listed, log in to your account and then click the Down load switch to get the Wisconsin Registration Rights Agreement regarding the purchase of convertible subordinated debentures. Make use of your account to look from the legitimate varieties you have purchased earlier. Visit the My Forms tab of your own account and get another backup of the file you need.

Should you be a fresh end user of US Legal Forms, listed below are straightforward guidelines so that you can adhere to:

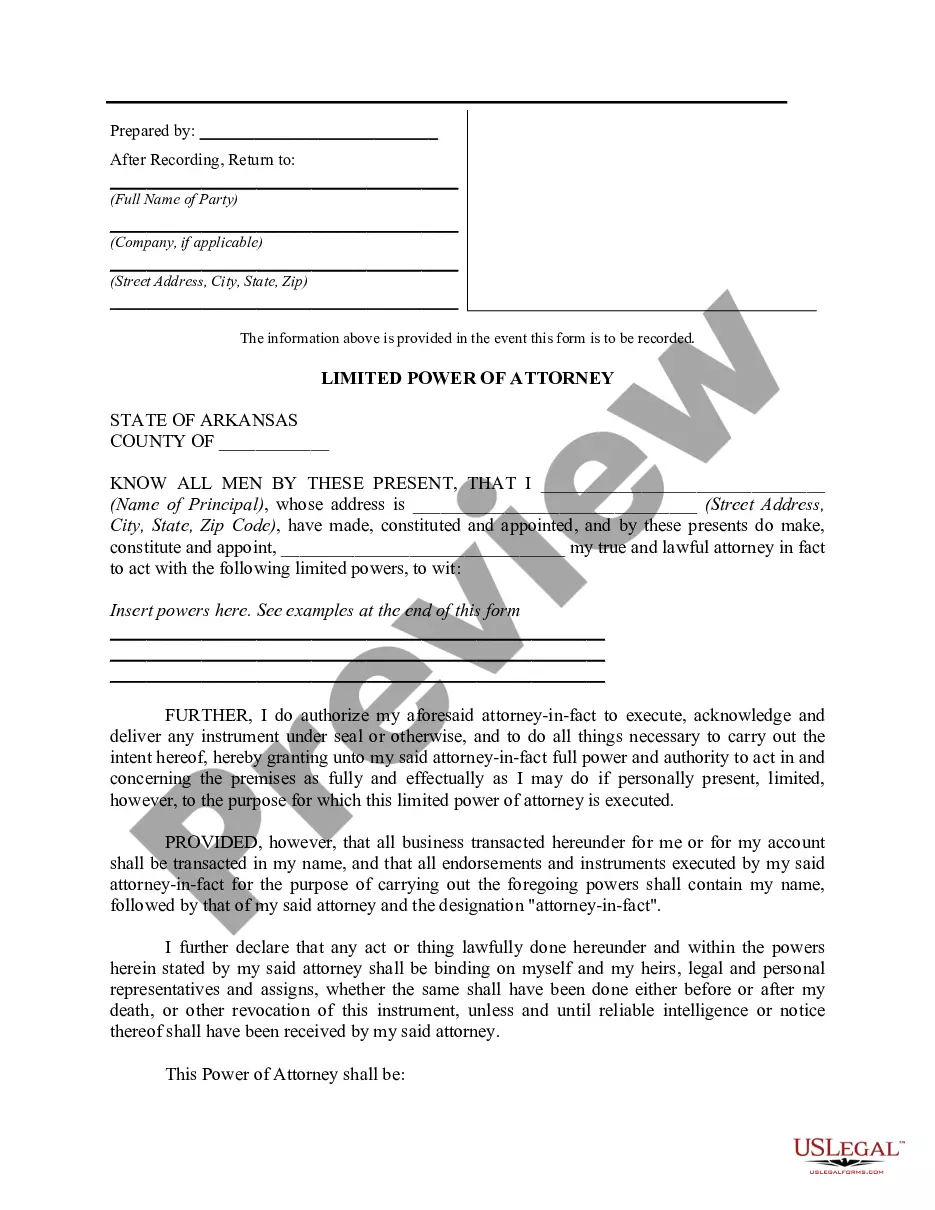

- Initially, ensure you have selected the proper form for the area/state. You may look through the shape while using Preview switch and browse the shape outline to ensure it is the best for you.

- In the event the form will not fulfill your preferences, make use of the Seach area to discover the proper form.

- When you are certain that the shape is suitable, click on the Buy now switch to get the form.

- Select the costs plan you desire and enter the needed details. Create your account and pay for an order utilizing your PayPal account or Visa or Mastercard.

- Pick the file structure and obtain the legitimate file template to your system.

- Comprehensive, change and produce and sign the received Wisconsin Registration Rights Agreement regarding the purchase of convertible subordinated debentures.

US Legal Forms will be the largest catalogue of legitimate varieties that you can find different file themes. Utilize the service to obtain skillfully-produced documents that adhere to state requirements.