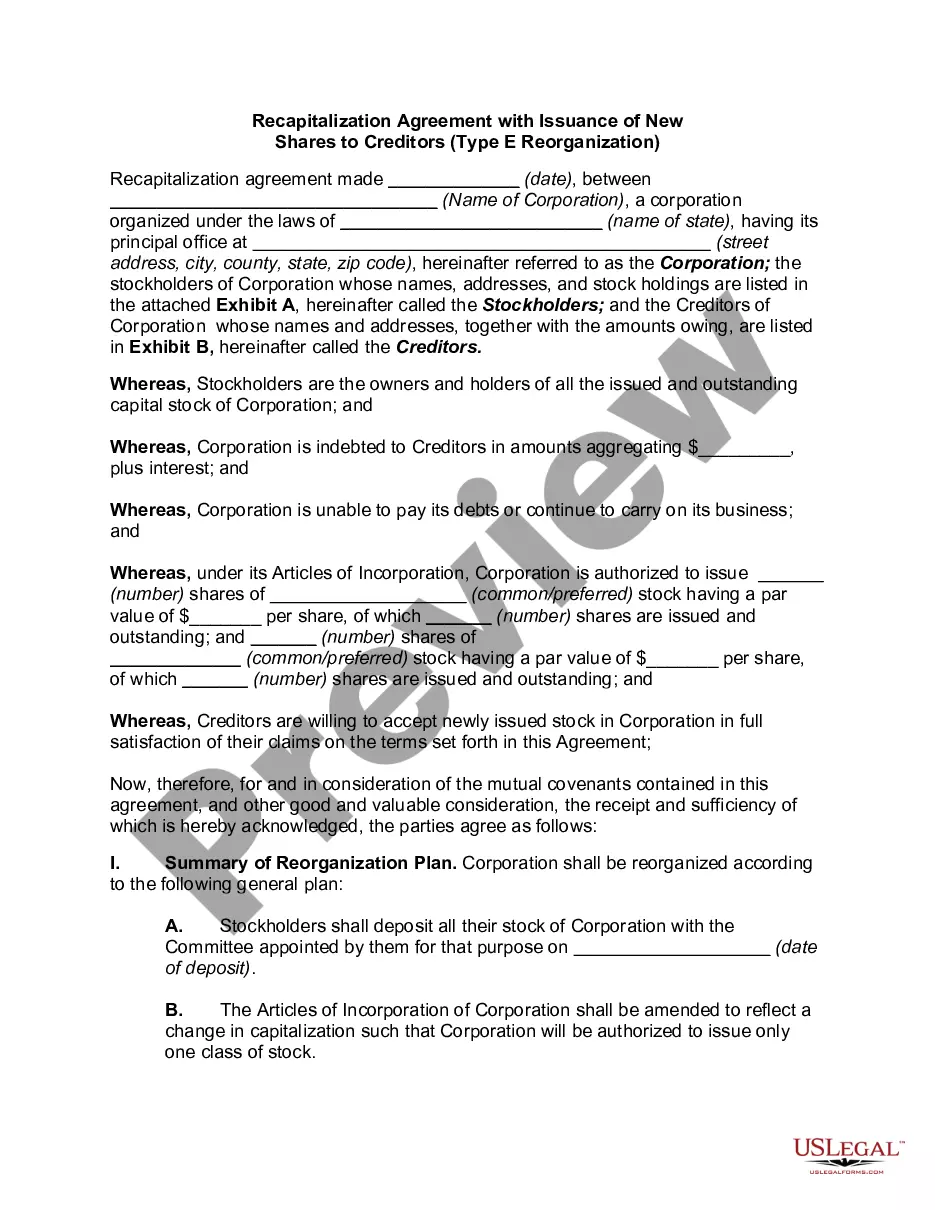

Wisconsin Recapitalization Agreement

Description

How to fill out Recapitalization Agreement?

Are you presently within a position the place you require files for possibly enterprise or personal functions just about every day? There are tons of legal record web templates accessible on the Internet, but discovering types you can trust is not effortless. US Legal Forms delivers a large number of form web templates, much like the Wisconsin Recapitalization Agreement, that are composed to fulfill federal and state needs.

If you are currently acquainted with US Legal Forms internet site and have a free account, basically log in. Next, you are able to download the Wisconsin Recapitalization Agreement web template.

Should you not have an account and wish to begin using US Legal Forms, abide by these steps:

- Discover the form you need and ensure it is to the appropriate area/area.

- Make use of the Preview key to check the shape.

- Look at the outline to actually have chosen the proper form.

- If the form is not what you are trying to find, take advantage of the Look for area to obtain the form that suits you and needs.

- Once you find the appropriate form, just click Purchase now.

- Choose the costs plan you would like, submit the specified details to generate your money, and purchase your order utilizing your PayPal or bank card.

- Pick a practical data file formatting and download your version.

Get all of the record web templates you may have bought in the My Forms menus. You can aquire a more version of Wisconsin Recapitalization Agreement at any time, if needed. Just click on the essential form to download or produce the record web template.

Use US Legal Forms, probably the most extensive variety of legal kinds, to conserve time as well as steer clear of blunders. The services delivers expertly produced legal record web templates which you can use for a selection of functions. Produce a free account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

Cons of Majority Recapitalization Here are a few potential drawbacks to keep in mind: Dilution of Ownership: By selling a majority stake, existing shareholders dilute their share of the company's equity into a minority position (or sell entirely), weakening their influence over decision-making.

Equity Recapitalization The move can benefit companies that have a high debt-to-equity ratio. A high debt-to-equity ratio puts an additional burden on a company, as it must pay interest on its debt securities. Higher debt levels also increase a company's risk level, making it less attractive to investors.

Leveraged recapitalizations have a similar structure to that employed in leveraged buyouts (LBO), to the extent that they significantly increase financial leverage. But unlike LBOs, they may remain publicly traded.

Leveraged recapitalization, leveraged buyouts, nationalization, and equity recapitalization are various types of recapitalization. One may also use this process as an opening route in private equity.

Recapitalization is the restructuring of a company's debt and equity ratio. The purpose of recapitalization is to stabilize a company's capital structure. Some of the reasons a company may consider recapitalization include a drop in its share price, to defend against a hostile takeover, or bankruptcy.