The Wisconsin Management Agreement is a contractual agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC, pertaining to the management of investment funds in the state of Wisconsin. This agreement outlines the terms and conditions under which Prudential Investments Fund Management, LLC will act as the investment manager for the Prudential Tax-Managed Growth Fund in Wisconsin. Keywords: Wisconsin Management Agreement, Prudential Tax-Managed Growth Fund, Prudential Investments Fund Management, LLC, investment funds, contractual agreement, management, terms and conditions, investment manager. Different types of Wisconsin Management Agreements between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC may include: 1. General Management Agreement: This type of agreement covers the overall management of the Prudential Tax-Managed Growth Fund within the state of Wisconsin, including investment strategies, risk assessment, asset allocation, and compliance with applicable laws and regulations. 2. Fee Structure Agreement: This agreement focuses on the fee structure and compensation arrangement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC for their services rendered in managing the fund in Wisconsin. 3. Reporting and Disclosure Agreement: This type of agreement outlines the reporting requirements, frequency, and format of reports submitted by Prudential Investments Fund Management, LLC to Prudential Tax-Managed Growth Fund regarding the fund's performance, holdings, and other relevant information. 4. Termination Agreement: In the event that either party wishes to terminate the management arrangement, this agreement specifies the terms and conditions under which the agreement can be terminated, including notice period, termination fees, and any post-termination obligations. 5. Compliance Agreement: This agreement focuses on ensuring that Prudential Investments Fund Management, LLC adheres to all applicable laws, regulations, and guidelines set forth by regulatory bodies such as the Securities and Exchange Commission (SEC) and the Wisconsin Department of Financial Institutions. These are just some examples of potential types of Wisconsin Management Agreements between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC. The specific nature and contents of these agreements may vary depending on the circumstances and requirements of the parties involved.

Wisconsin Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC

Description

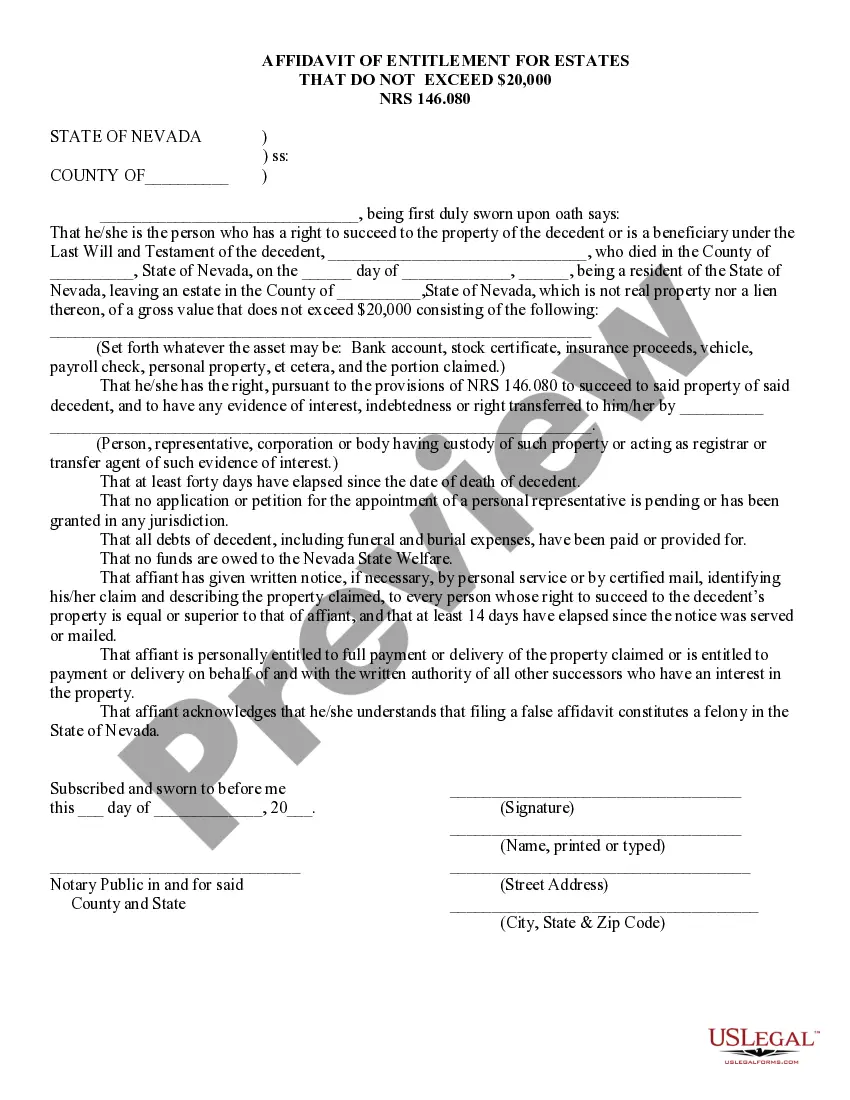

How to fill out Wisconsin Management Agreement Between Prudential Tax-Managed Growth Fund And Prudential Investments Fund Management, LLC?

Choosing the right authorized file design can be a struggle. Of course, there are a variety of themes available online, but how would you get the authorized develop you require? Use the US Legal Forms website. The service gives a large number of themes, for example the Wisconsin Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC, that you can use for business and private needs. Each of the kinds are checked by professionals and fulfill state and federal demands.

When you are already signed up, log in in your accounts and click the Down load key to find the Wisconsin Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC. Make use of accounts to search throughout the authorized kinds you might have purchased previously. Visit the My Forms tab of your respective accounts and get one more duplicate from the file you require.

When you are a whole new customer of US Legal Forms, here are straightforward directions for you to follow:

- Initial, be sure you have selected the appropriate develop for the town/state. You are able to check out the form making use of the Preview key and look at the form outline to ensure it will be the best for you.

- In the event the develop is not going to fulfill your needs, take advantage of the Seach field to find the right develop.

- When you are sure that the form is proper, go through the Acquire now key to find the develop.

- Choose the pricing prepare you want and enter in the required information and facts. Build your accounts and buy an order making use of your PayPal accounts or Visa or Mastercard.

- Choose the file formatting and acquire the authorized file design in your gadget.

- Complete, modify and produce and indicator the received Wisconsin Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC.

US Legal Forms may be the greatest local library of authorized kinds for which you can discover different file themes. Use the service to acquire expertly-created papers that follow state demands.