Wisconsin Subscription Agreement

Description

How to fill out Subscription Agreement?

Choosing the best lawful record template could be a have difficulties. Naturally, there are a variety of templates available on the net, but how do you discover the lawful form you need? Use the US Legal Forms internet site. The services offers thousands of templates, for example the Wisconsin Subscription Agreement, which can be used for organization and private demands. Each of the forms are inspected by professionals and satisfy federal and state needs.

When you are presently signed up, log in to your account and click the Obtain option to have the Wisconsin Subscription Agreement. Use your account to appear through the lawful forms you have bought previously. Proceed to the My Forms tab of your own account and obtain one more backup of the record you need.

When you are a whole new customer of US Legal Forms, listed below are easy directions for you to adhere to:

- Initially, be sure you have selected the correct form to your area/region. You may examine the form using the Review option and study the form information to guarantee this is basically the right one for you.

- In the event the form does not satisfy your needs, use the Seach field to get the proper form.

- Once you are certain that the form is proper, go through the Buy now option to have the form.

- Choose the pricing program you would like and enter in the required information. Make your account and buy an order using your PayPal account or credit card.

- Pick the submit formatting and obtain the lawful record template to your device.

- Full, change and printing and indicator the acquired Wisconsin Subscription Agreement.

US Legal Forms will be the biggest local library of lawful forms where you will find numerous record templates. Use the company to obtain expertly-made paperwork that adhere to condition needs.

Form popularity

FAQ

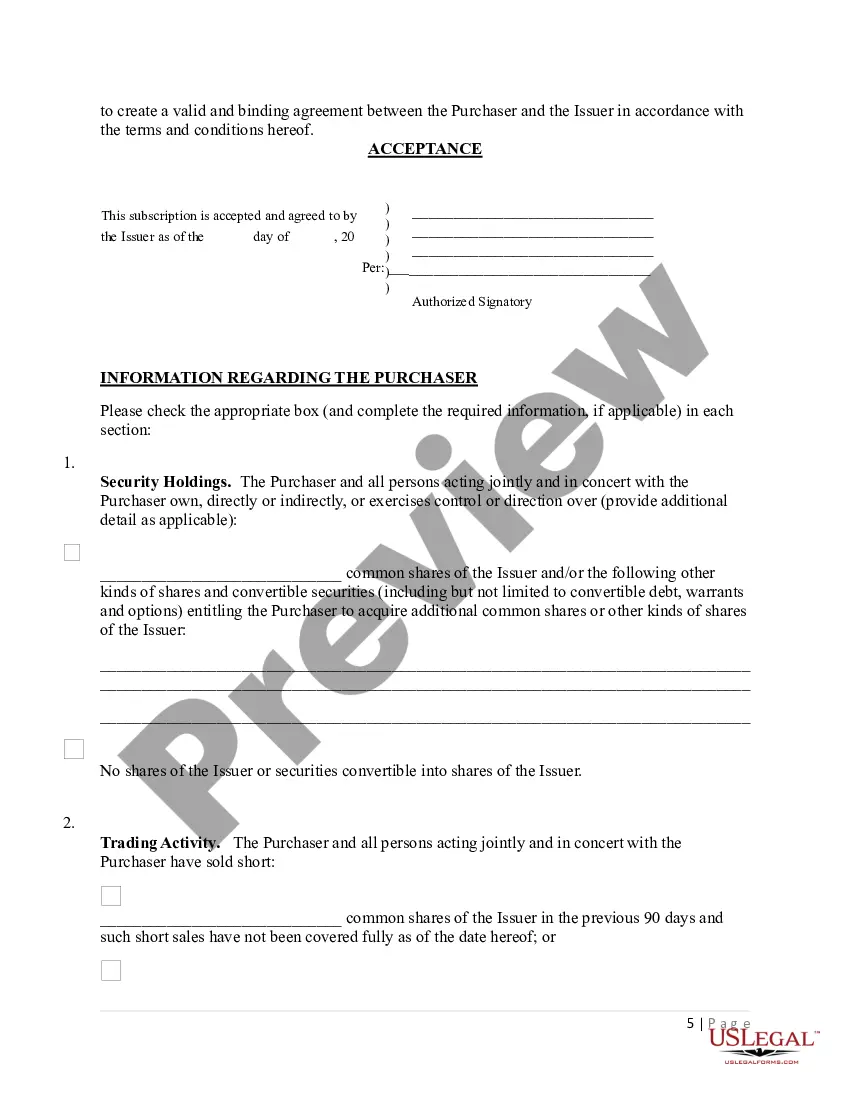

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

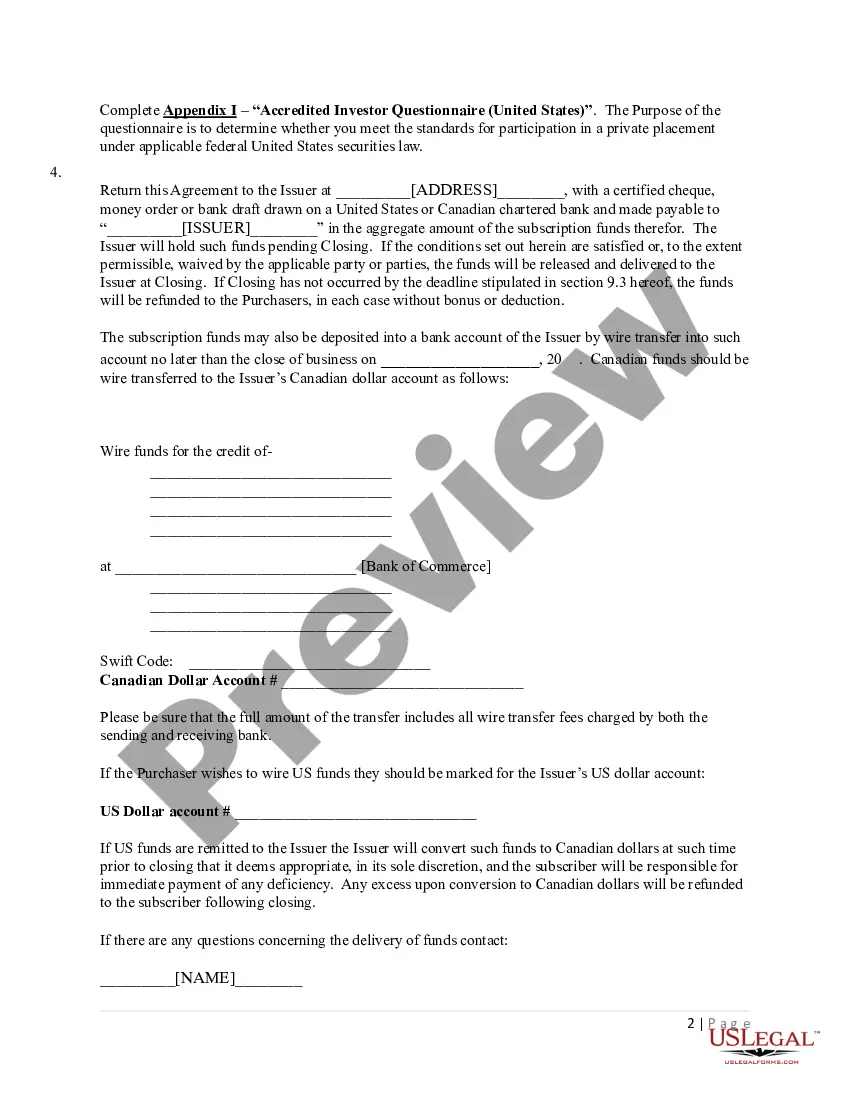

Also known as a purchase agreement. The subscription agreement is the principal agreement between the issuer and the investor or substitute purchasers in a private placement of debt obligations or equity securities.

Contracts have traditionally been the backbone of B2B relationships, providing a rigid structure for the delivery of goods and services. In contrast, subscriptions offer a more flexible and customer-centric approach, enabling businesses to tailor their offerings to better meet client needs.

By including these five key elements in your Share Subscription Agreement ? subscription price, payment terms, representations and warranties, closing conditions, and indemnification ? you can help safeguard against any potential issues or disputes that may arise down the road.

Summary. This template is a Subscription Agreement for Limited Liability Company Interests between a limited liability company (LLC) and an investor that wants to purchase an interest in the LLC. This template includes practical guidance and drafting notes. This template may be tailored to suit each transaction.

The subscription agreement is the principal agreement between the issuer and the investor or substitute purchasers in a private placement of debt obligations or equity securities.

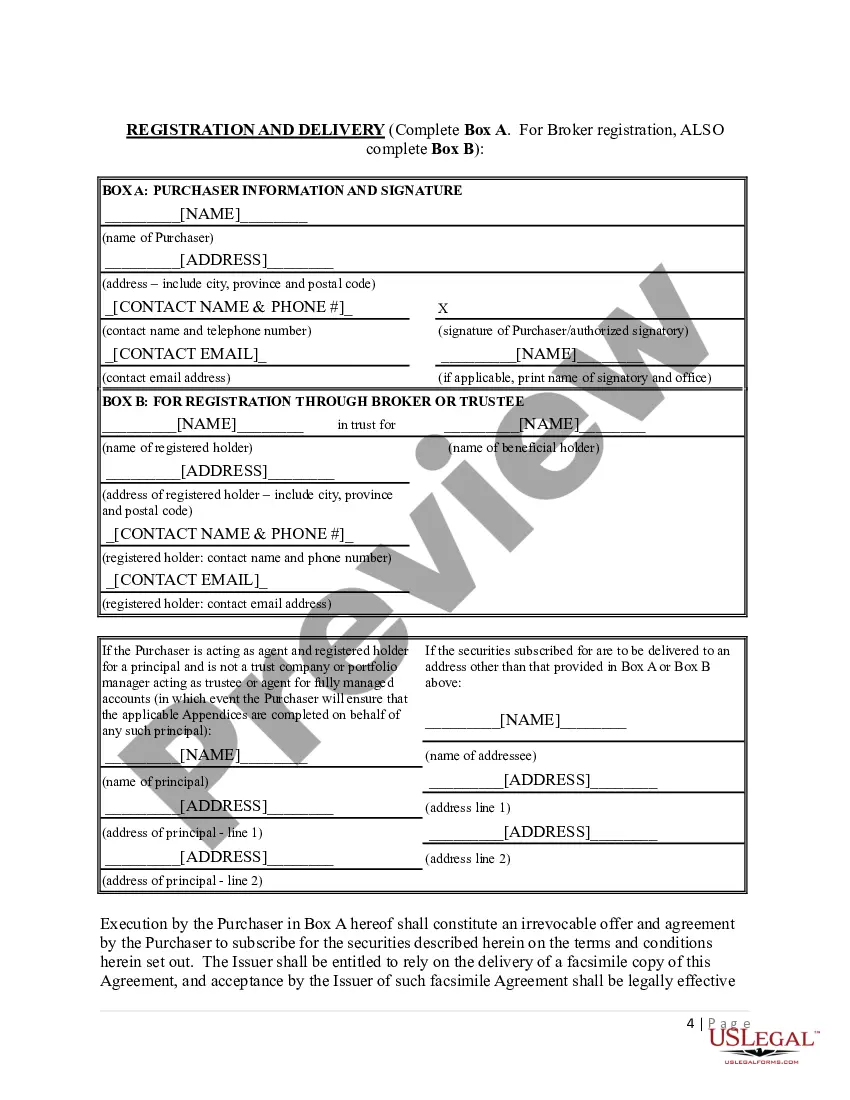

A Share Subscription Agreement is a legally binding contract between a company and an investor or subscriber. It outlines the terms and conditions under which the investor agrees to purchase newly issued company shares.

What information is typically included in a subscription agreement? Company information. Expectations of both parties. Agreement to subscribe (this includes the number of shares and price) Rights attached to the subscription. ... Terms for termination before completion. Nomination onto board. Confidentiality provisions.