Wisconsin Angel Fund Promissory Note Term Sheet

Description

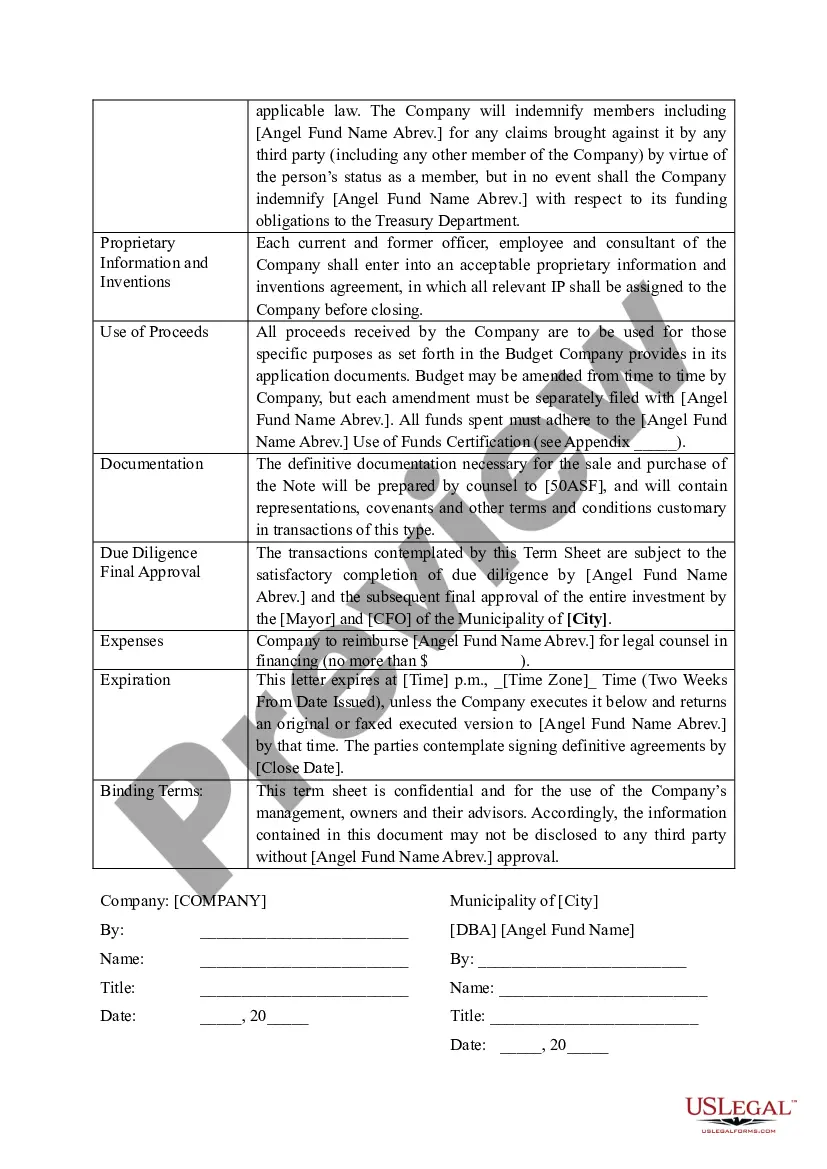

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made.

How to fill out Angel Fund Promissory Note Term Sheet?

You are able to spend hrs on the web trying to find the authorized file design that suits the federal and state demands you need. US Legal Forms supplies thousands of authorized varieties that happen to be examined by pros. You can easily acquire or print the Wisconsin Angel Fund Promissory Note Term Sheet from your services.

If you already have a US Legal Forms account, you can log in and click the Obtain key. Following that, you can full, modify, print, or sign the Wisconsin Angel Fund Promissory Note Term Sheet. Each and every authorized file design you acquire is your own permanently. To acquire yet another backup of the purchased kind, visit the My Forms tab and click the related key.

If you use the US Legal Forms web site initially, adhere to the straightforward guidelines beneath:

- Initially, make certain you have selected the correct file design to the area/metropolis of your choice. Look at the kind outline to ensure you have picked the right kind. If available, utilize the Review key to search from the file design at the same time.

- If you would like find yet another version of the kind, utilize the Look for industry to obtain the design that meets your needs and demands.

- Upon having identified the design you desire, simply click Acquire now to proceed.

- Select the pricing plan you desire, enter your credentials, and sign up for a free account on US Legal Forms.

- Total the deal. You can utilize your bank card or PayPal account to fund the authorized kind.

- Select the file format of the file and acquire it to your gadget.

- Make adjustments to your file if necessary. You are able to full, modify and sign and print Wisconsin Angel Fund Promissory Note Term Sheet.

Obtain and print thousands of file templates while using US Legal Forms web site, which offers the greatest collection of authorized varieties. Use skilled and express-certain templates to take on your company or personal requirements.

Form popularity

FAQ

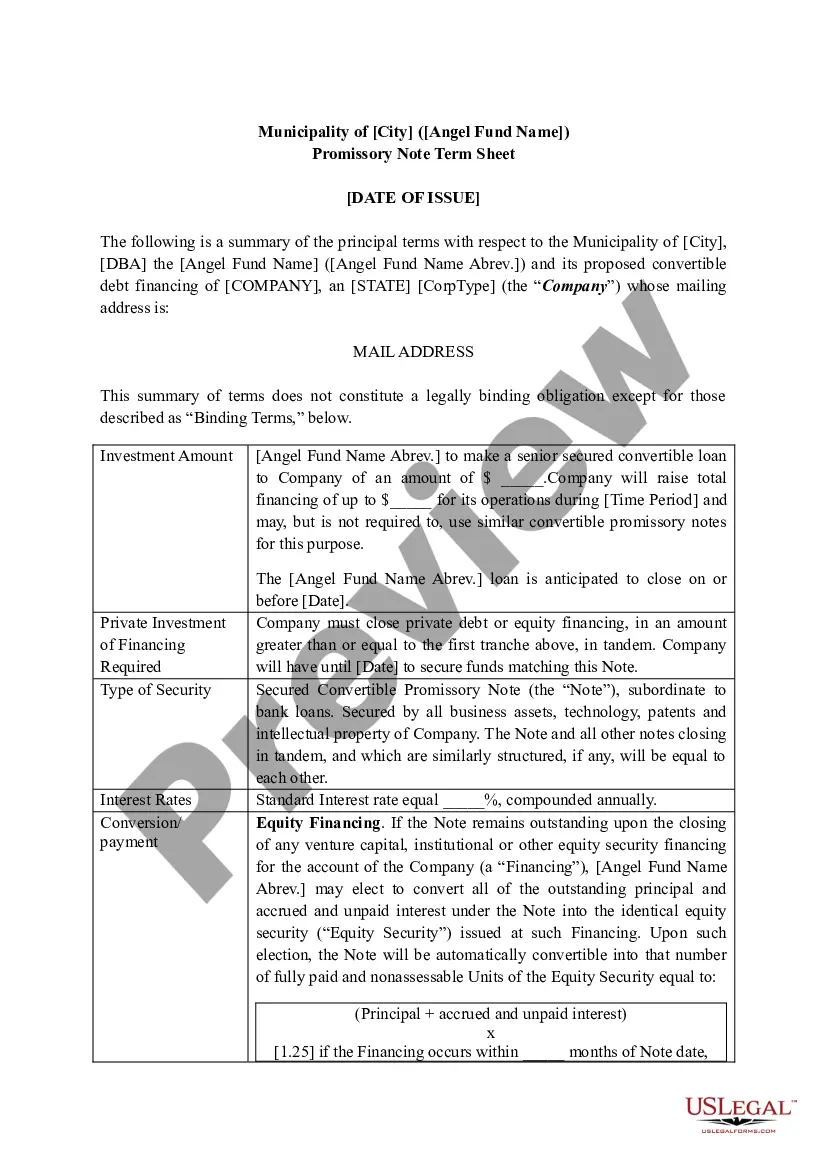

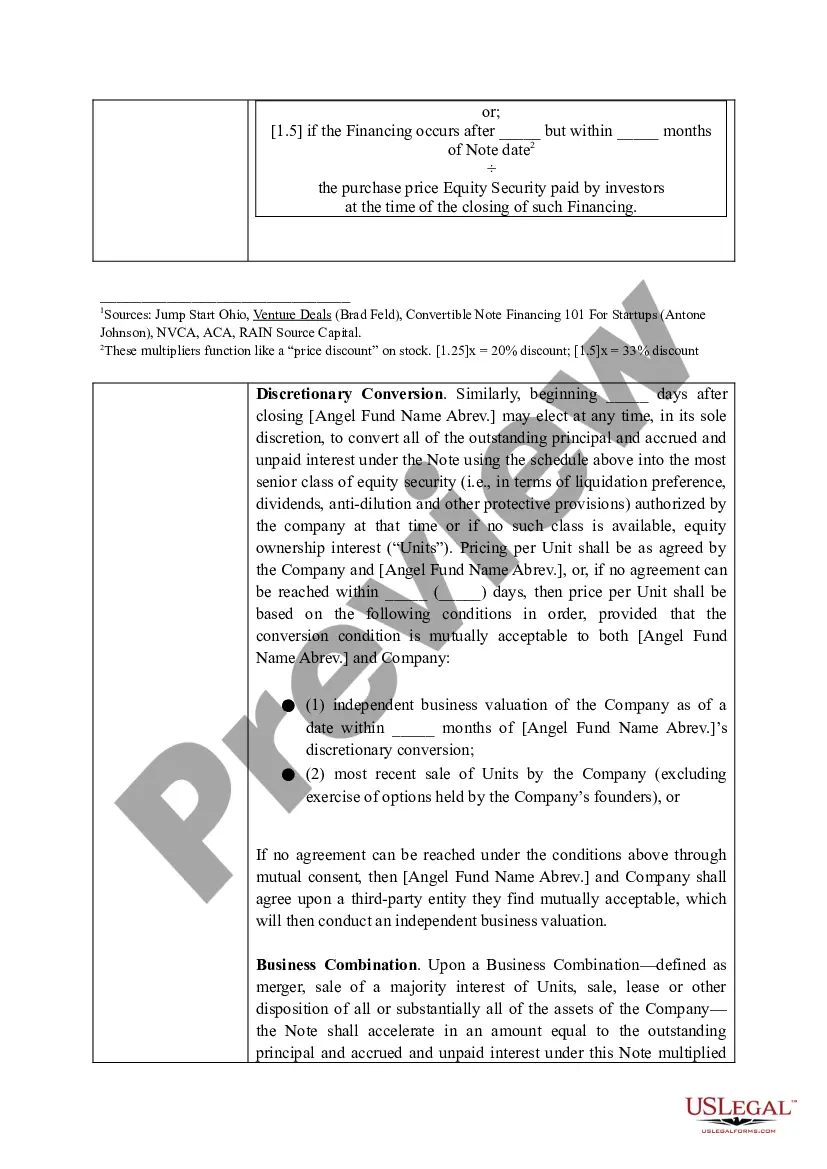

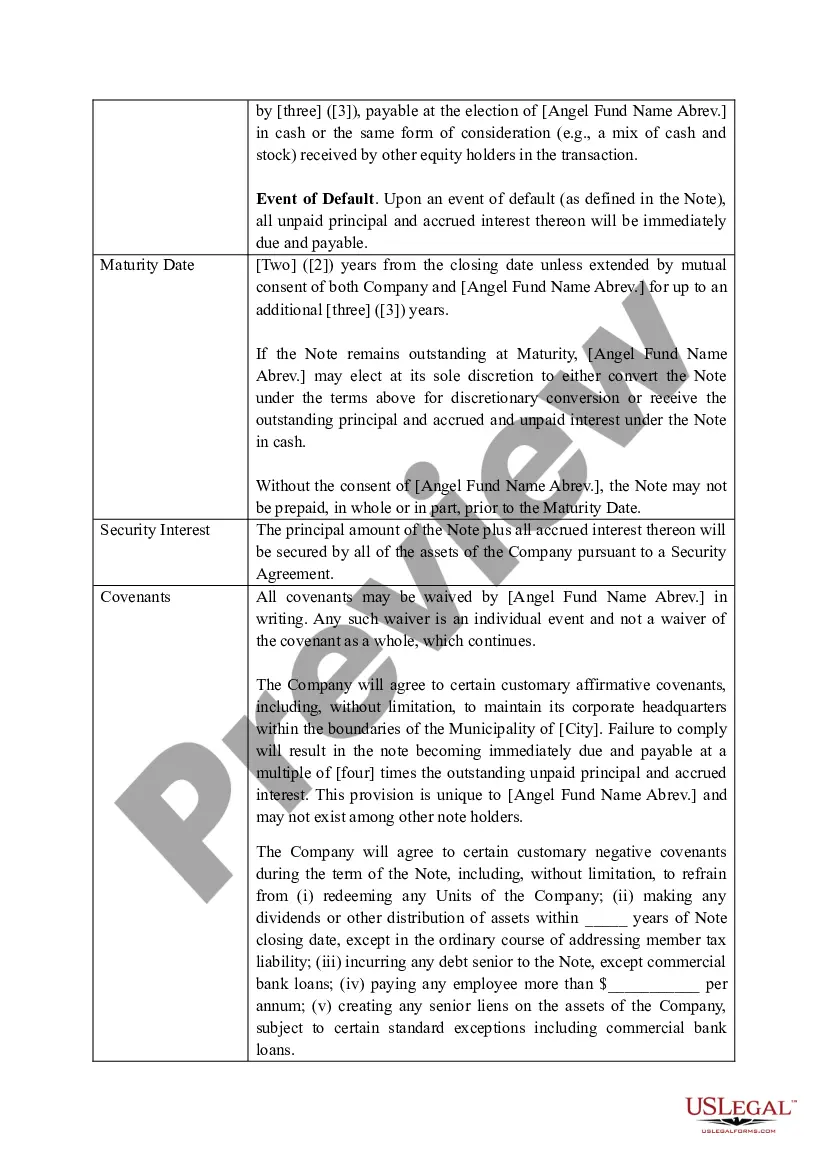

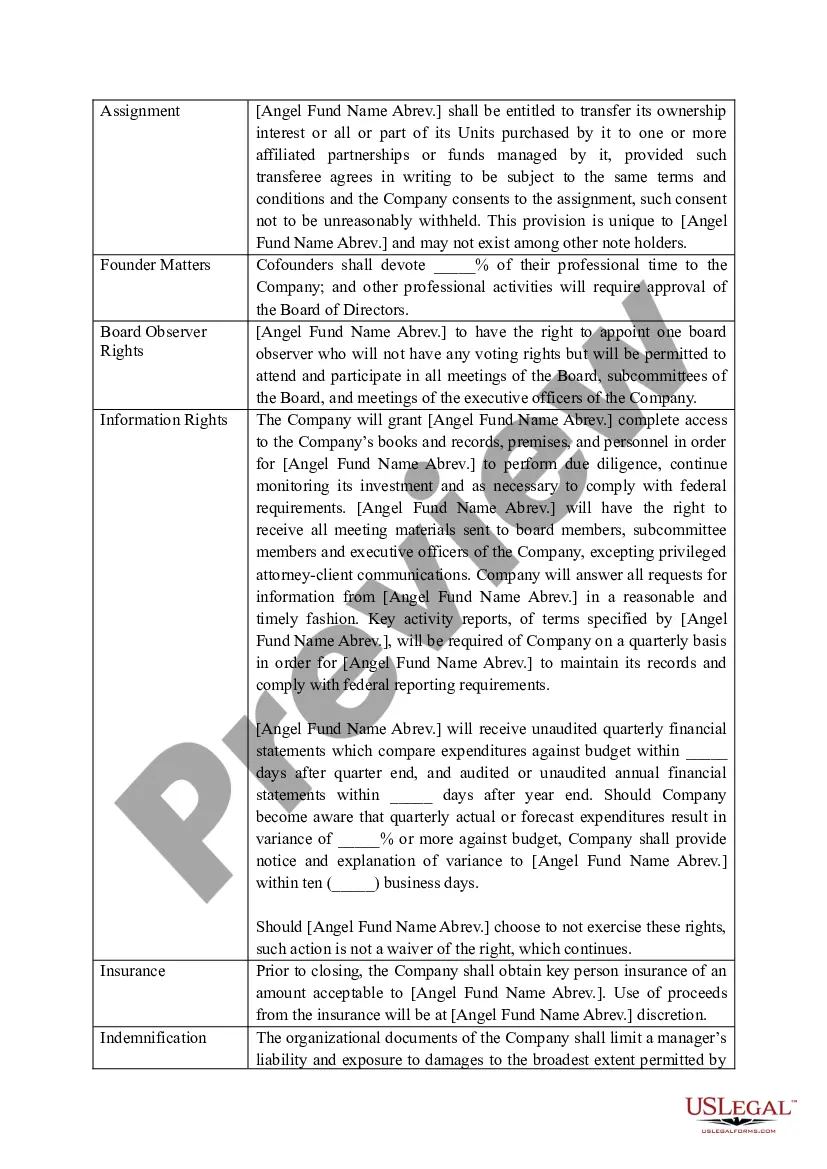

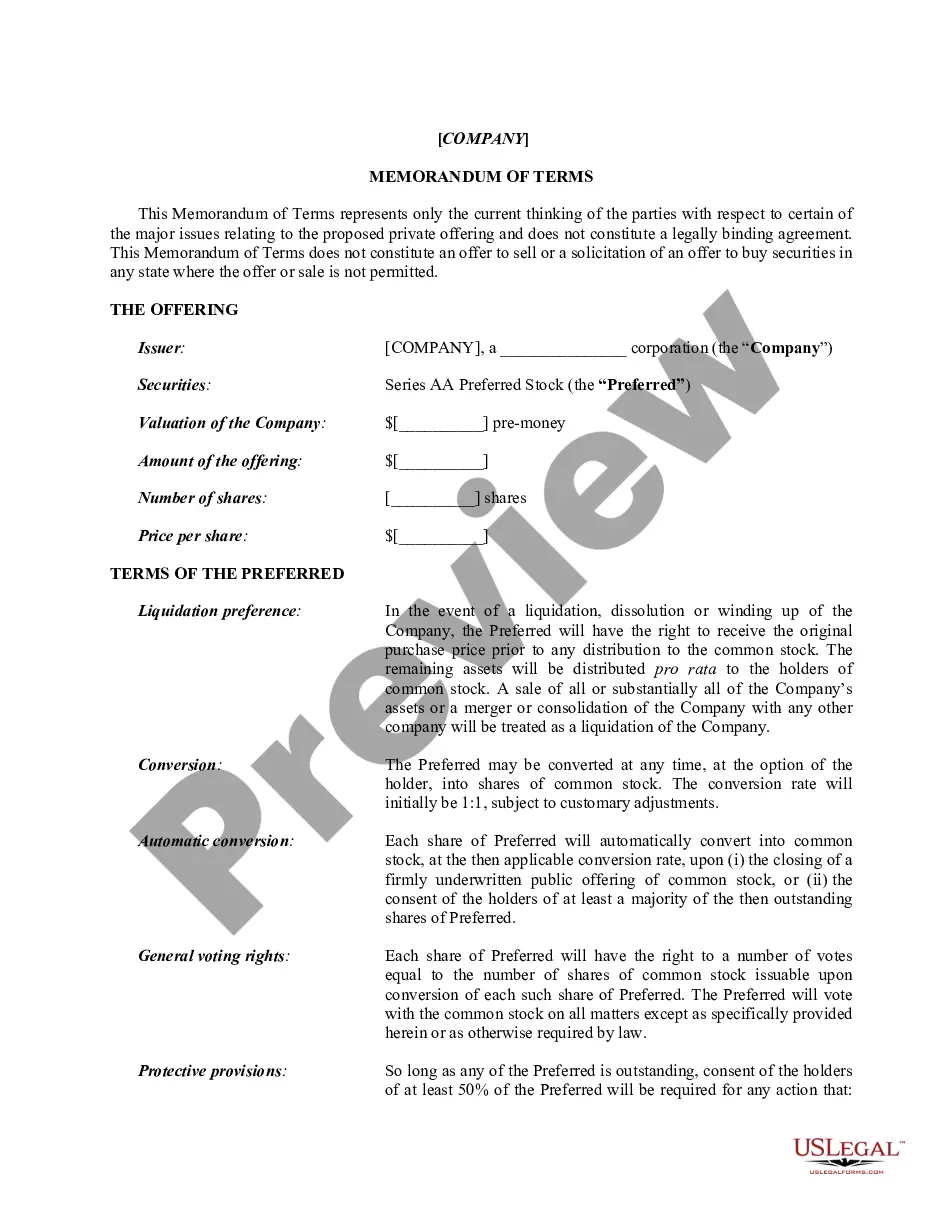

VC term sheets typically include the amount of money being raised, the types of securities involved, the company's valuation before and after the investment, the investor's liquidation preferences, voting rights, board representation, and so much more.

Preamble: It states the major points in a typical term sheet such as the non-binding statement of intent and that it cannot be construed as an offer but an expression of interest. Party Details: States the parties involved, generally the investor, the startup and the founders.

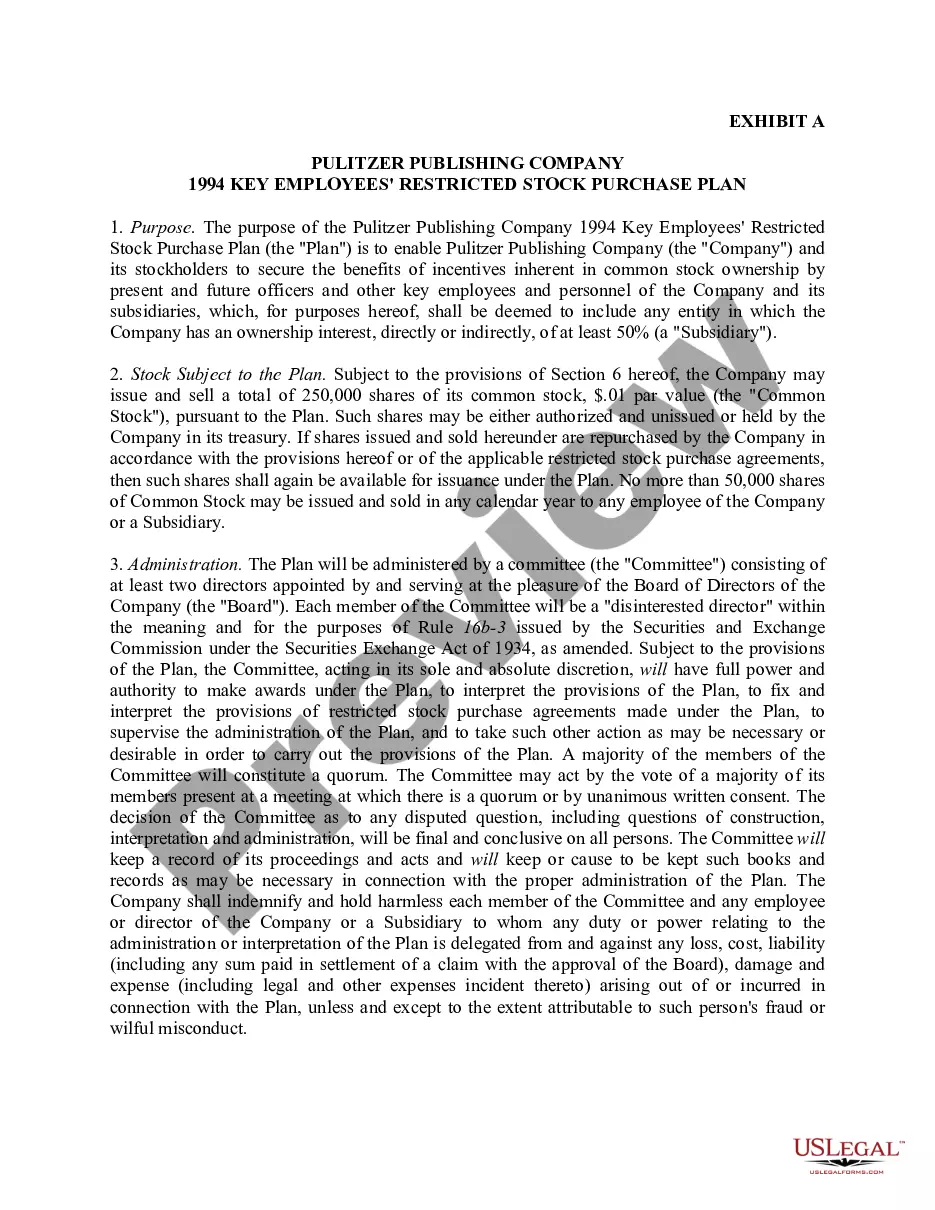

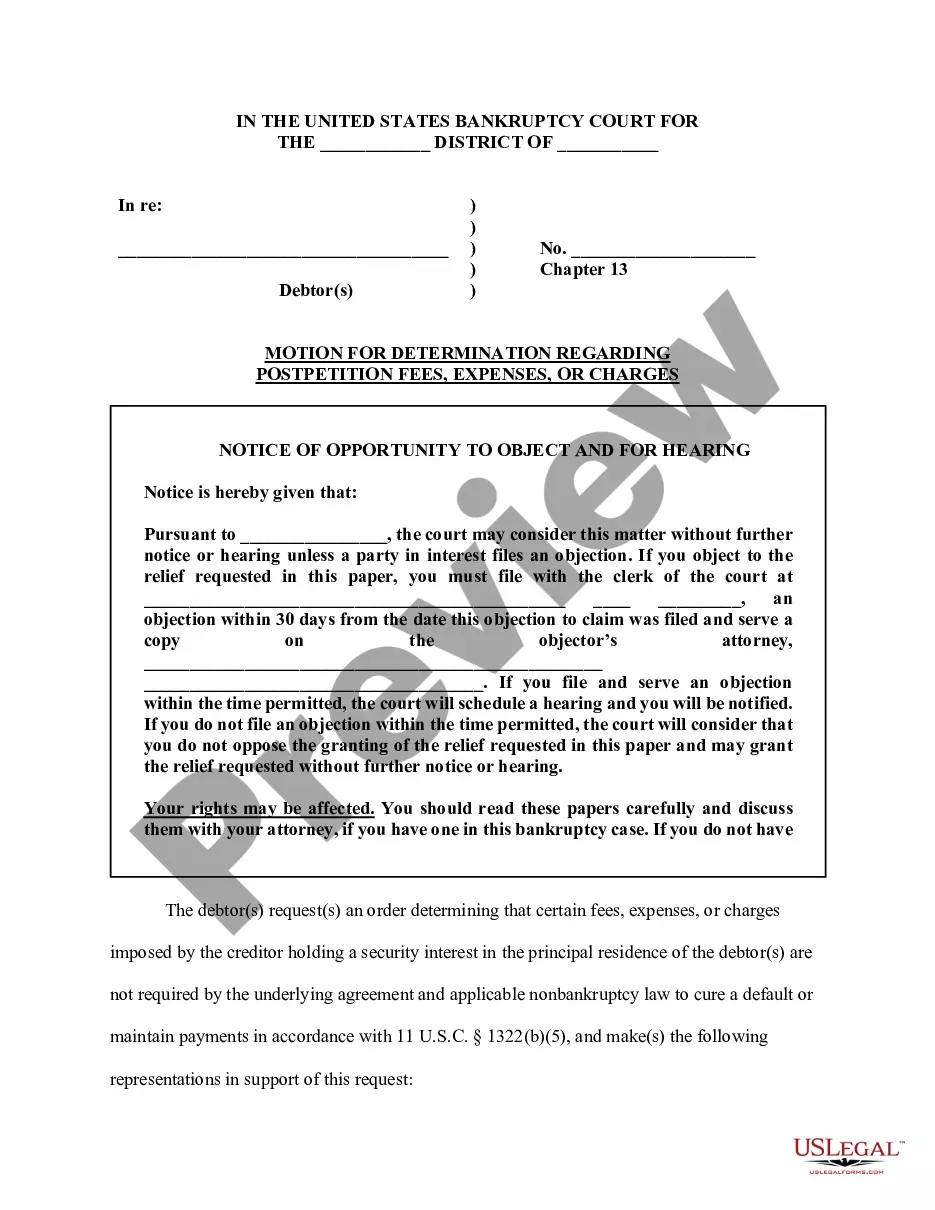

Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process. Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

Key Takeaways The company valuation, investment amount, percentage stake, voting rights, liquidation preference, anti-dilutive provisions, and investor commitment are some items that should be spelled out in the term sheet.

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.

The main point of difference is that, generally, a Term Sheet is not intended to be legally binding while Shareholders Agreements are legally binding. You often use a Term Sheet to quickly agree on the key commercial terms and then use that as a basis to draft up a more formal Shareholders Agreement.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

VC term sheets typically include the amount of money being raised, the types of securities involved, the company's valuation before and after the investment, the investor's liquidation preferences, voting rights, board representation, and so much more.

All term sheets contain information on the assets, initial purchase price including any contingencies that may affect the price, a timeframe for a response, and other salient information. Term sheets are most often associated with startups.