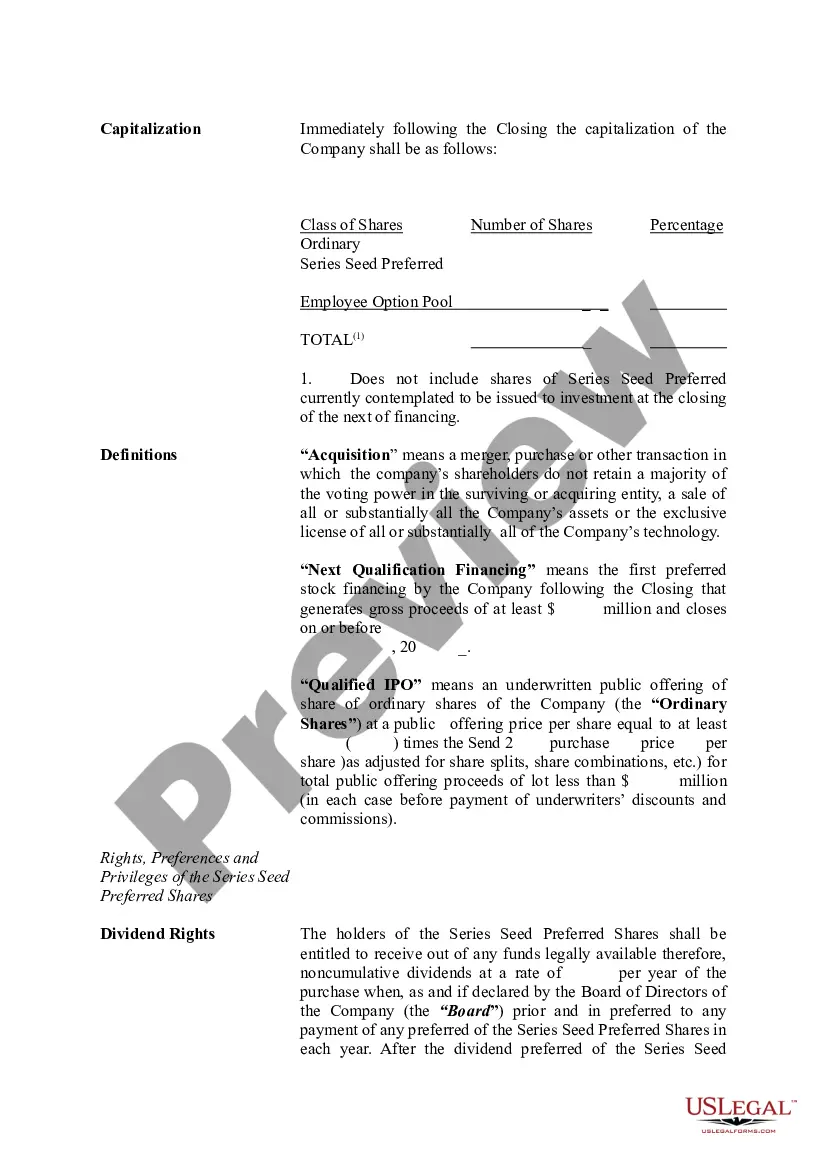

Wisconsin Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Term Sheet - Series Seed Preferred Share For Company?

Have you been in the position that you will need documents for both enterprise or individual purposes almost every time? There are tons of legitimate document layouts available on the Internet, but finding kinds you can rely isn`t straightforward. US Legal Forms gives 1000s of type layouts, like the Wisconsin Term Sheet - Series Seed Preferred Share for Company, which can be created to satisfy state and federal demands.

In case you are currently acquainted with US Legal Forms internet site and have a merchant account, just log in. Following that, you are able to acquire the Wisconsin Term Sheet - Series Seed Preferred Share for Company design.

Unless you come with an account and need to begin using US Legal Forms, abide by these steps:

- Get the type you require and make sure it is to the right area/area.

- Take advantage of the Review switch to examine the shape.

- Browse the description to actually have chosen the correct type.

- In the event the type isn`t what you are searching for, utilize the Lookup field to find the type that suits you and demands.

- Whenever you get the right type, just click Purchase now.

- Select the costs strategy you would like, fill out the desired details to produce your account, and purchase the transaction using your PayPal or charge card.

- Pick a handy paper file format and acquire your copy.

Get every one of the document layouts you might have bought in the My Forms menus. You can obtain a extra copy of Wisconsin Term Sheet - Series Seed Preferred Share for Company any time, if possible. Just click on the required type to acquire or print out the document design.

Use US Legal Forms, one of the most extensive assortment of legitimate types, in order to save time as well as steer clear of faults. The support gives appropriately manufactured legitimate document layouts which can be used for an array of purposes. Make a merchant account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

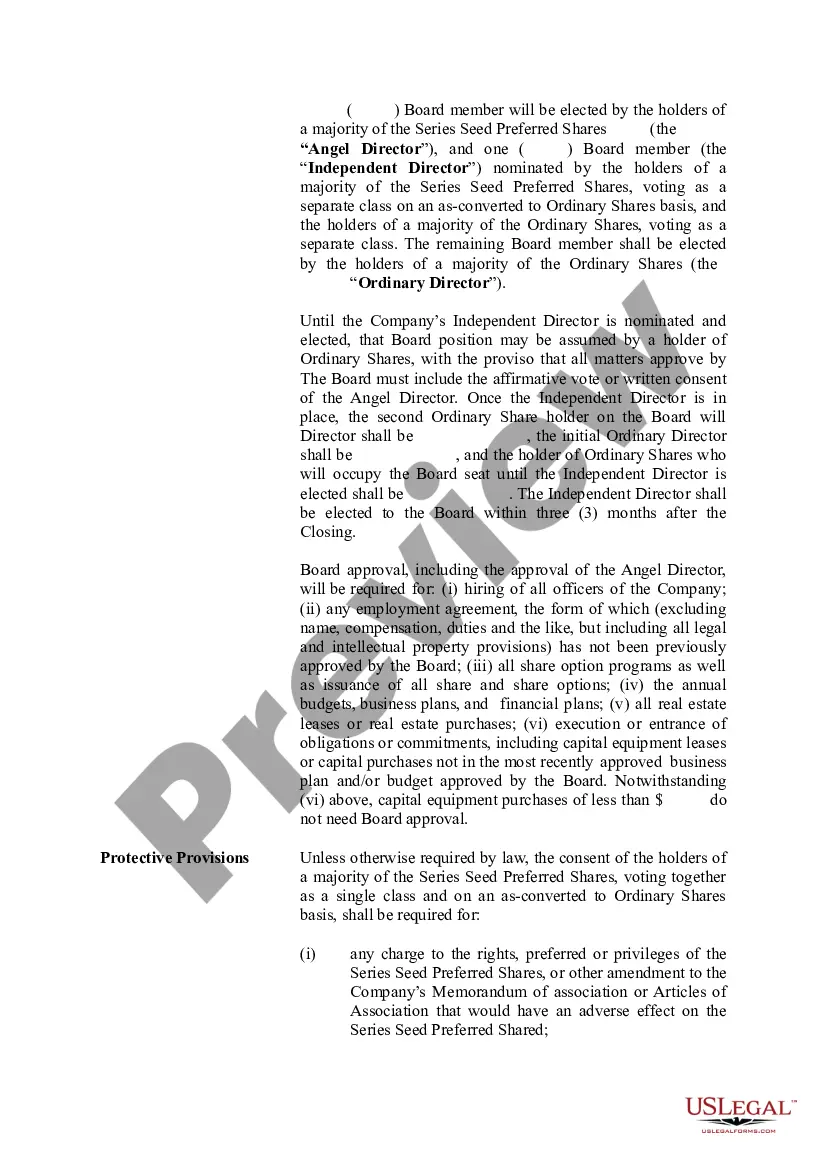

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

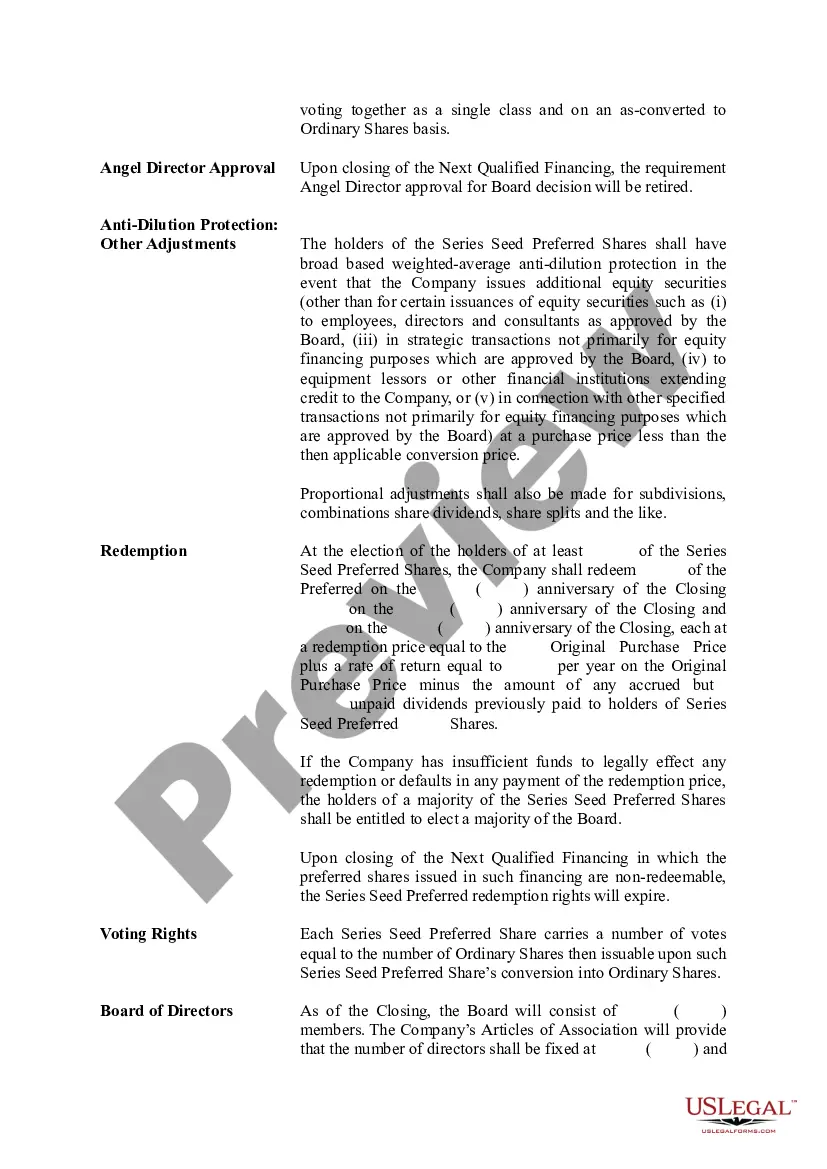

Series A Preferred Stock is the class of stock that is issued to investors in a Series A round. The stock is preferred because it contains certain rights superior to the company's common stock, commonly liquidation preference, anti-dilution protection, and control rights.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

Series A funding is different from seed funding in a few key ways. First, seed funding is typically used to finance a startups initial costs, such as product development and market research. Series A funding, on the other hand, is used to finance a company's early-stage growth.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

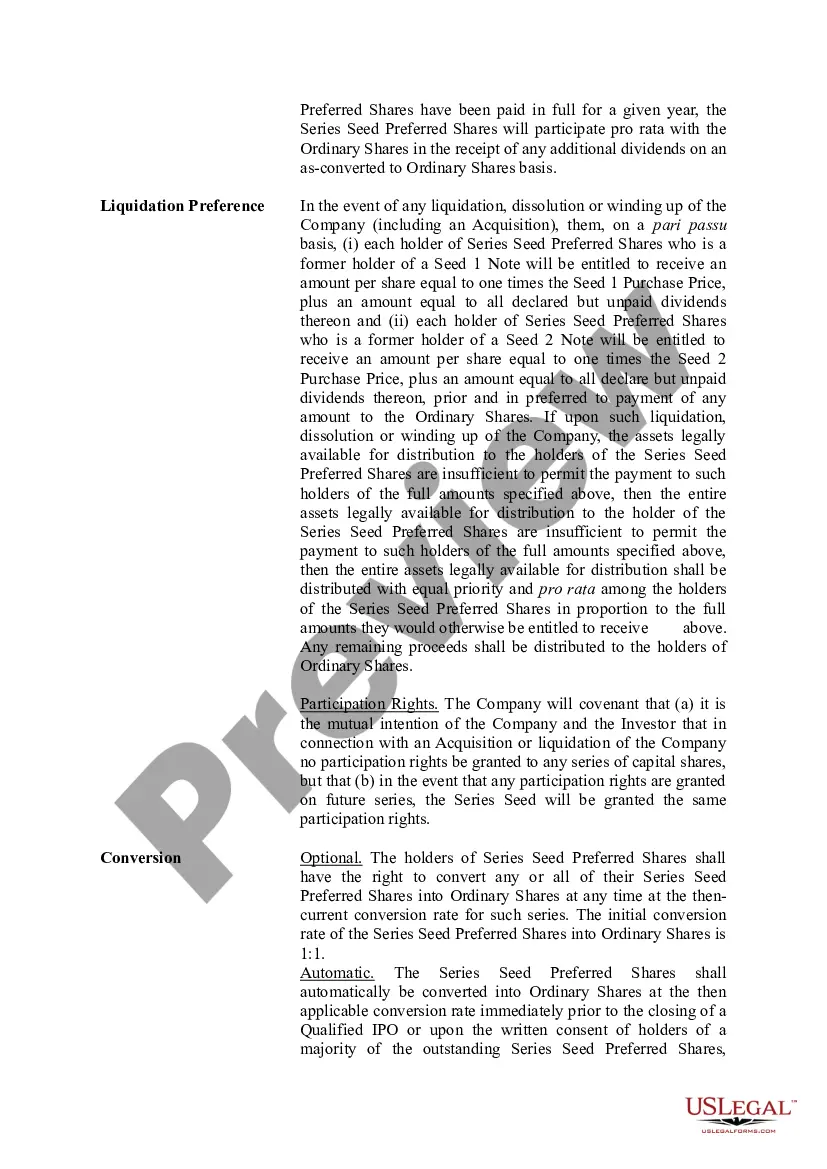

Common Series Seed terms include: Preferred Stock. Preferred stock is a class of stock with certain preferences and rights that are superior to the rights of the common stock that is issued to the founders. Series Seed will generally be issued as preferred stock. Liquidation Preference.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).

Series Seed will generally be issued as preferred stock. This is the order of payments made to various classes of stockholders in the event that the business is liquidated and there is cash available for distribution to the stockholders.