Title: Exploring Wisconsin Summary of Terms for Proposed Private Placement Offering Introduction: Wisconsin Summary of Terms for Proposed Private Placement Offering serves as a crucial legal document that outlines the essential details of a private placement investment opportunity. This comprehensive summary provides potential investors with clarity regarding the terms, conditions, and potential risks associated with investing in a private placement offering in the state of Wisconsin. Keywords: Wisconsin Summary of Terms, Proposed Private Placement Offering, private placement investment, terms and conditions, potential risks, Wisconsin private placement offering. 1. Key Components of Wisconsin Summary of Terms of Proposed Private Placement Offering: The Wisconsin Summary of Terms for Proposed Private Placement Offering covers important elements that investors need to understand before engaging in the investment. Some significant components include: a. Securities Offered: The document specifies the type of securities being offered for the private placement investment, such as stocks, bonds, or other debt instruments. b. Price and Valuation: It outlines the offering price per security and how the securities are valued, providing investors with clarity on pricing and potential returns. c. Minimum Investment Requirements: The summary specifies the minimum investment amount or unit requirement, ensuring investors are aware of the financial commitment. d. Use of Proceeds: The document details how the funds raised through the private placement will be utilized by the issuing company, such as for research and development, marketing, or acquisitions. e. Investor Eligibility: It highlights any eligibility criteria, such as required accreditation or limitation on the number of investors, ensuring compliance with regulatory requirements. f. Risk Factors: The summary provides an overview of the potential risks associated with the investment, including market risks, operational risks, and regulatory risks, enabling investors to make informed decisions. g. Offering Period: It outlines the timeframe during which the private placement is open for investment, indicating the start and end dates. 2. Different Types of Wisconsin Summary of Terms for Proposed Private Placement Offering: While the core components of a Wisconsin Summary of Terms for Proposed Private Placement Offering remain relatively consistent, they may vary based on the nature and structure of the investment opportunity. Here are a few types of offerings that might have distinct summaries: a. Equity Private Placement Offering: This type of private placement involves the sale of shares or stock in a company, providing investors with an ownership stake. b. Debt Private Placement Offering: In this scenario, investors purchase fixed-income securities, such as bonds or debentures, representing loans made to the issuing company. c. Convertible Private Placement Offering: These offerings include securities that can be converted into another form, such as convertible bonds that can be converted into company shares. d. Preferred Shares Private Placement Offering: Investors acquire preferred shares in the company, entitling them to certain preferential treatment, such as priority dividends or liquidation preference. Final Thoughts: The Wisconsin Summary of Terms for Proposed Private Placement Offering serves as a critical tool for prospective investors to evaluate and understand the terms, risks, and investment potential associated with participating in a private placement offering in the state. Investors are encouraged to review the summary thoroughly and seek professional advice before making any investment decisions. Keywords: Wisconsin Summary of Terms, Proposed Private Placement Offering, private placement investment, terms and conditions, risk factors, investor eligibility, equity private placement, debt private placement, convertible private placement, preferred shares private placement.

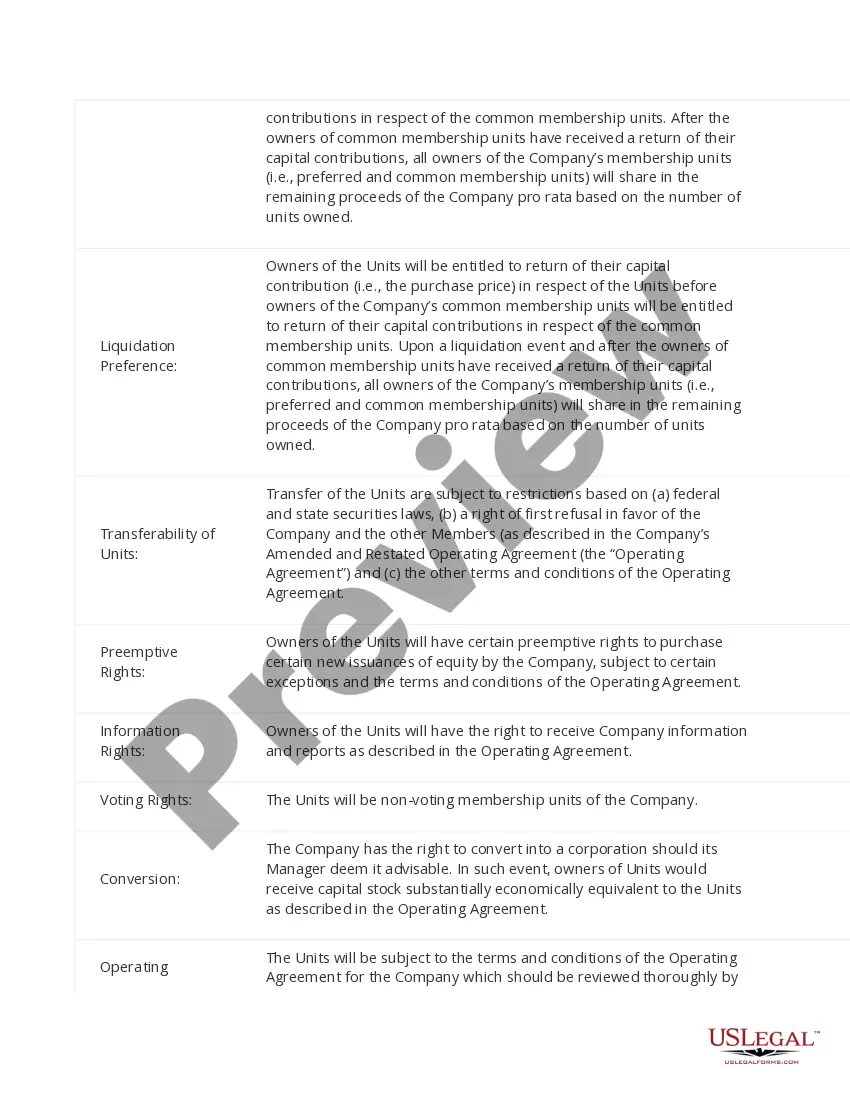

Wisconsin Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Wisconsin Summary Of Terms Of Proposed Private Placement Offering?

If you have to full, download, or print legitimate file templates, use US Legal Forms, the biggest collection of legitimate varieties, which can be found on the web. Utilize the site`s simple and easy practical research to discover the files you will need. A variety of templates for enterprise and personal reasons are categorized by categories and states, or keywords. Use US Legal Forms to discover the Wisconsin Summary of Terms of Proposed Private Placement Offering in a handful of mouse clicks.

When you are previously a US Legal Forms client, log in to the account and click the Acquire key to get the Wisconsin Summary of Terms of Proposed Private Placement Offering. Also you can access varieties you in the past saved inside the My Forms tab of your account.

Should you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the form for that right city/land.

- Step 2. Take advantage of the Preview option to look over the form`s content material. Never overlook to read the explanation.

- Step 3. When you are not satisfied with the type, take advantage of the Lookup field on top of the display screen to find other models of your legitimate type format.

- Step 4. Once you have identified the form you will need, click on the Purchase now key. Select the prices prepare you choose and add your qualifications to sign up on an account.

- Step 5. Method the transaction. You should use your bank card or PayPal account to finish the transaction.

- Step 6. Select the formatting of your legitimate type and download it in your product.

- Step 7. Total, modify and print or indicator the Wisconsin Summary of Terms of Proposed Private Placement Offering.

Each legitimate file format you buy is yours eternally. You might have acces to every type you saved in your acccount. Click the My Forms segment and select a type to print or download once again.

Contend and download, and print the Wisconsin Summary of Terms of Proposed Private Placement Offering with US Legal Forms. There are millions of professional and condition-specific varieties you can utilize for your enterprise or personal needs.