Wisconsin Special Meeting Minutes of Directors

Description

How to fill out Special Meeting Minutes Of Directors?

You are able to spend several hours on the Internet attempting to find the legal papers web template that meets the federal and state demands you will need. US Legal Forms offers a large number of legal varieties that are evaluated by professionals. It is possible to down load or produce the Wisconsin Special Meeting Minutes of Directors from my service.

If you have a US Legal Forms accounts, you are able to log in and then click the Acquire switch. Following that, you are able to total, edit, produce, or sign the Wisconsin Special Meeting Minutes of Directors. Each legal papers web template you purchase is your own permanently. To have yet another backup associated with a acquired form, go to the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms internet site the first time, adhere to the easy directions under:

- Initially, make sure that you have chosen the proper papers web template for your state/metropolis of your choosing. See the form information to make sure you have picked the proper form. If available, make use of the Review switch to appear from the papers web template at the same time.

- If you wish to discover yet another model from the form, make use of the Search discipline to obtain the web template that meets your needs and demands.

- After you have discovered the web template you want, just click Acquire now to proceed.

- Pick the costs program you want, key in your credentials, and sign up for a free account on US Legal Forms.

- Complete the purchase. You may use your charge card or PayPal accounts to purchase the legal form.

- Pick the format from the papers and down load it in your product.

- Make alterations in your papers if required. You are able to total, edit and sign and produce Wisconsin Special Meeting Minutes of Directors.

Acquire and produce a large number of papers web templates while using US Legal Forms Internet site, which offers the most important selection of legal varieties. Use skilled and express-distinct web templates to deal with your small business or person demands.

Form popularity

FAQ

How to write meeting minutes reports Make an outline. Prior to the meeting, create an outline by picking or designing a template. ... Include factual information. ... Write down the purpose. ... Record decisions made. ... Add details for the next meeting. ... Be concise. ... Consider recording. ... Edit and proofread. How To Write Meeting Minutes (With Templates and Examples) - Indeed indeed.com ? career-development ? meeting... indeed.com ? career-development ? meeting...

Special meetings always require previous notice. Special meeting notices must include not only the date, time, place, and location, but they also must specify all the business to be included in the meeting. Nothing, repeat nothing, can be considered in a special meeting if it's not included in the notice.

Special meetings usually address issues that need immediate attention or that need more time and discussion than can be handled in routine Board or annual meetings from opening a new diner to a new pharmacy.

Notice of meeting letter template State the meeting information, such as its time, place and location. Also include the title and type of meeting, along with its participants. Make a brief statement about the topic of the meeting.]

Usually, the ?call to meeting? must be issued by a specific officer (often the president) and sometimes requires the approval of the board. Some organizations allow a set number of members to submit a written request that requires the president to call a special meeting. How to Have a Special Meeting - Civility civility.co ? uncategorized ? how-to-have-a-specia... civility.co ? uncategorized ? how-to-have-a-specia...

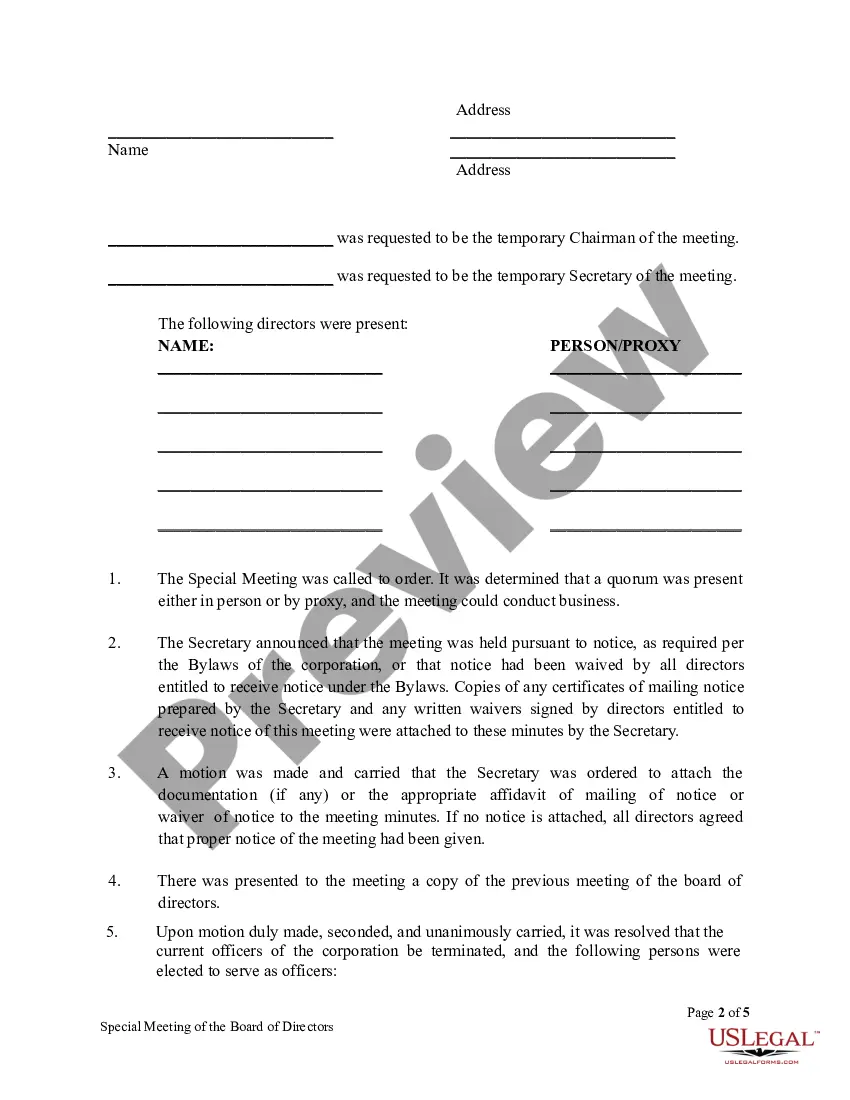

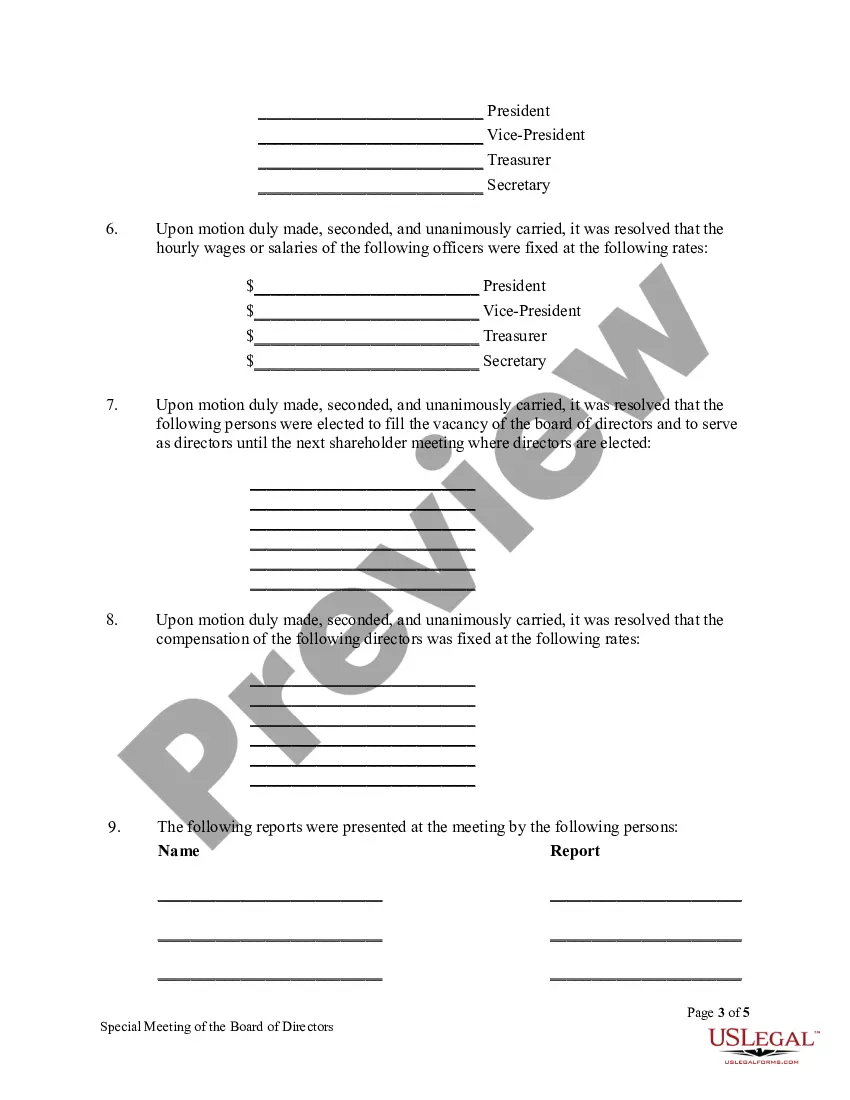

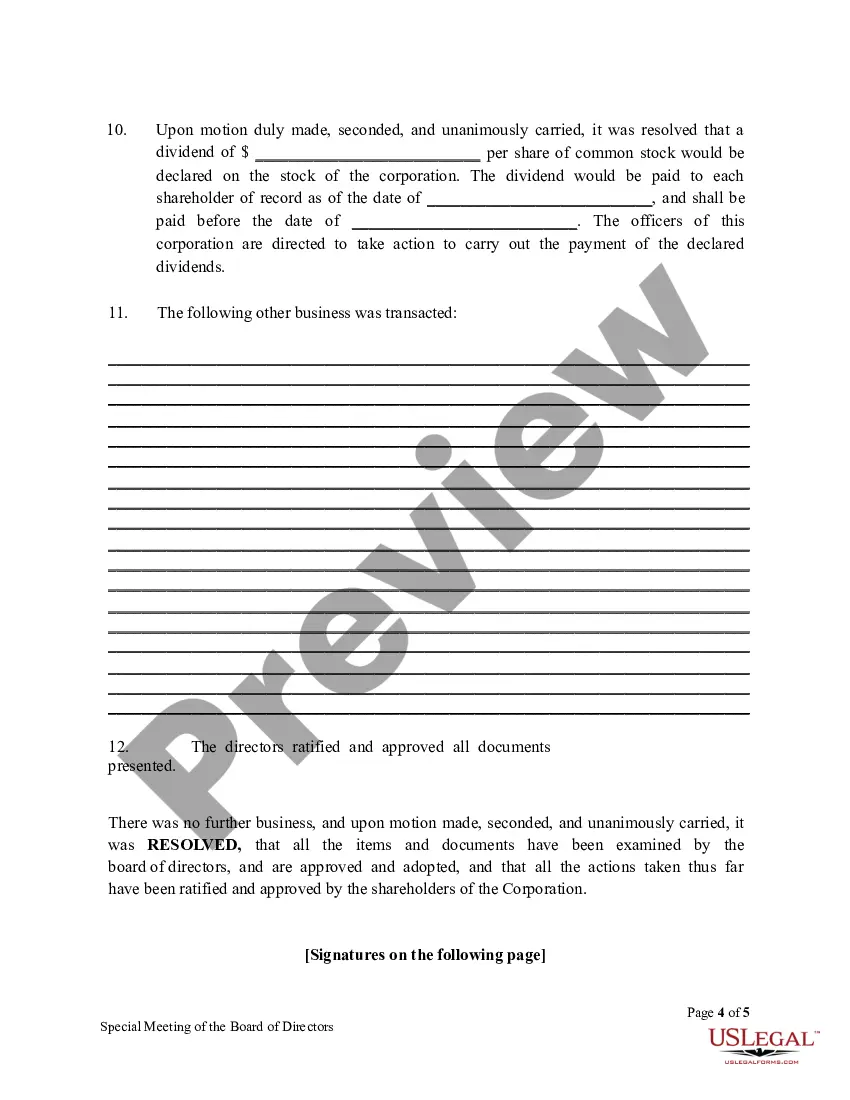

To take effective meeting minutes, the secretary should include: Date of the meeting. Time the meeting was called to order. Names of the meeting participants and absentees. Corrections and amendments to previous meeting minutes. Additions to the current agenda. Whether a quorum is present. Motions taken or rejected. Board Meeting Minutes 101: Free Template and Examples Included boardeffect.com ? blog ? board-meeting-mi... boardeffect.com ? blog ? board-meeting-mi...

The notice should state the time, date and place of the meeting and the general nature of the business to be conducted. The wording of any special resolution must also be included and the intention to propose it as a special resolution.

The notification must include the time, place of the special meeting and the business to be transacted. In the case of a special meeting, an agenda, or list of the business to be transacted, is required in advance of the meeting. Open Public Meetings, A Guide for School Board Members and ... - ERIC ed.gov ? fulltext ed.gov ? fulltext