Wisconsin First Meeting Minutes of Sole Director is a legal document that outlines the proceedings and decisions made during the initial meeting of a sole director in Wisconsin. These minutes serve as official records and provide a detailed account of the actions taken by the director. Wisconsin's law mandates the recording of such minutes to ensure transparency and compliance with corporate governance requirements. The key components typically included in the minutes of a First Meeting of Sole Director in Wisconsin are as follows: 1. Meeting details: Begin by stating the date, time, and location of the meeting. This information helps identify the meeting accurately and establishes its legality. 2. Verification of quorum: State whether the sole director constitutes a quorum as required by the Wisconsin law. A quorum refers to the minimum number of individuals required to hold a valid meeting and make binding decisions. 3. Appointment of Chairperson: Specify the appointment of a chairperson to preside over the meeting. This person is responsible for moderating the discussion, maintaining order, and facilitating the decision-making process. 4. Review and adoption of bylaws: Outline the process of reviewing and adopting the company's bylaws, which govern its internal operations and decision-making procedures. Mention any amendments or revisions proposed and the decision taken by the sole director. 5. Election of corporate officers: If applicable, state the election of corporate officers such as the Chief Executive Officer (CEO), Chief Financial Officer (CFO), or Secretary. Provide details of the individuals appointed, and their respective roles and responsibilities. 6. Appointment of registered agent: Highlight the appointment of a registered agent—a person or entity responsible for receiving legal and official documents on behalf of the company. Include the registered agent's name, address, and contact information. 7. Discussion and approval of business activities: Summarize the sole director's discussion regarding the company's proposed business activities, potential contracts, investments, or any other important matters requiring decisions. Record the resolutions passed, decisions made, and actions approved. 8. Approval of financial matters: Note the discussions related to the company's financial matters, including budget allocation, investment strategies, expenditure approvals, and any financial policies or procedures. Record the resolutions and approvals made in this regard. 9. Miscellaneous matters: Include any other relevant discussions, presentations, or reports that were brought up during the meeting. This may involve considerations of legal compliance, tax obligations, or any other significant matters related to the business. Different types of Wisconsin First Meeting Minutes of Sole Director may vary depending on the specific circumstances and requirements of each company. However, the fundamental purpose—recording and documenting the decisions and discussions of a sole director's first meeting—remains the same. It is crucial to consult with legal professionals or refer to Wisconsin statutory laws while drafting the minutes to ensure compliance and accuracy.

Wisconsin First Meeting Minutes of Sole Director

Description

How to fill out Wisconsin First Meeting Minutes Of Sole Director?

If you need to total, download, or print out legitimate record web templates, use US Legal Forms, the largest variety of legitimate types, that can be found on the Internet. Make use of the site`s easy and practical look for to discover the paperwork you need. A variety of web templates for organization and personal purposes are categorized by classes and states, or key phrases. Use US Legal Forms to discover the Wisconsin First Meeting Minutes of Sole Director in just a few mouse clicks.

In case you are previously a US Legal Forms client, log in in your accounts and click the Acquire button to find the Wisconsin First Meeting Minutes of Sole Director. Also you can entry types you formerly saved from the My Forms tab of your accounts.

If you work with US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have selected the form for your correct metropolis/land.

- Step 2. Utilize the Preview choice to look over the form`s articles. Don`t neglect to read the information.

- Step 3. In case you are not satisfied together with the type, take advantage of the Lookup discipline near the top of the screen to discover other models from the legitimate type design.

- Step 4. After you have located the form you need, select the Buy now button. Pick the rates plan you prefer and add your accreditations to register for an accounts.

- Step 5. Process the transaction. You can utilize your bank card or PayPal accounts to accomplish the transaction.

- Step 6. Choose the file format from the legitimate type and download it in your product.

- Step 7. Full, edit and print out or indication the Wisconsin First Meeting Minutes of Sole Director.

Every legitimate record design you purchase is your own property permanently. You have acces to each and every type you saved in your acccount. Click on the My Forms area and pick a type to print out or download once more.

Contend and download, and print out the Wisconsin First Meeting Minutes of Sole Director with US Legal Forms. There are thousands of specialist and condition-particular types you can use for your personal organization or personal requirements.

Form popularity

FAQ

For the sake of practicality, it has been generally understood that Article 7(2) 'overrides' Article 11(2) ? and as such, sole directors are free to hold board meetings and make decisions.

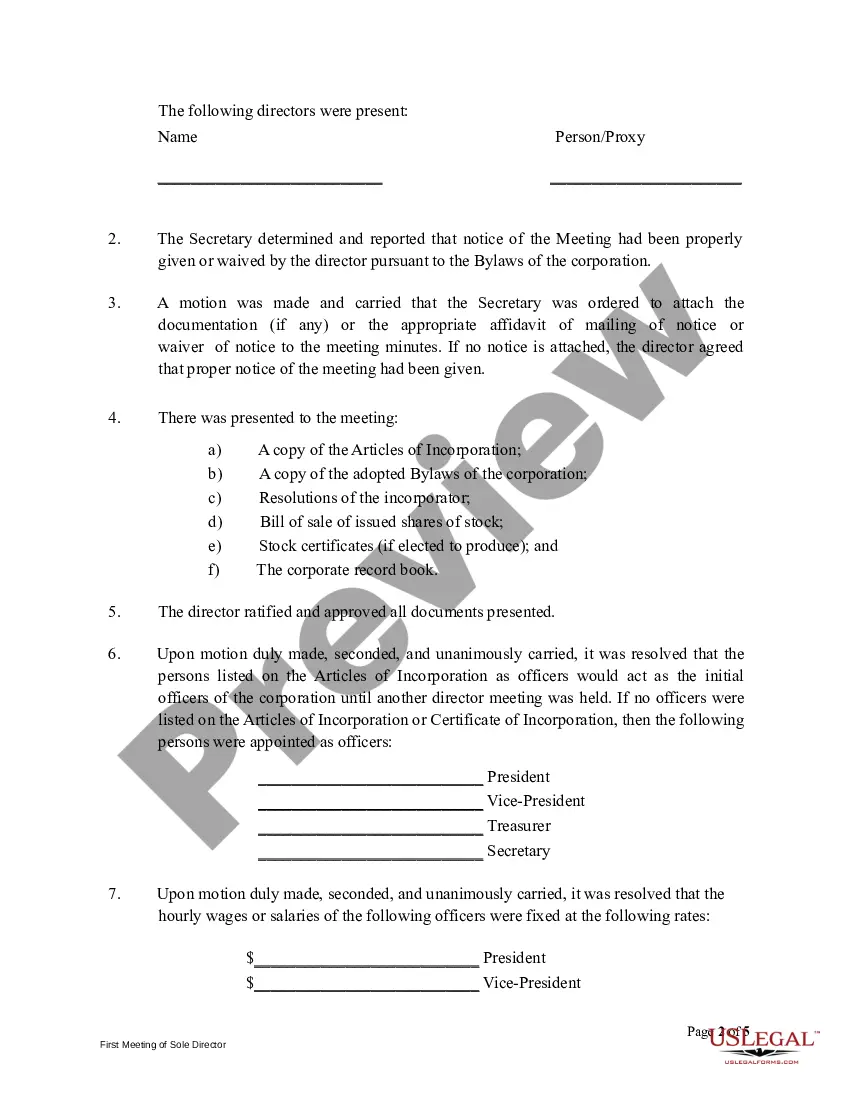

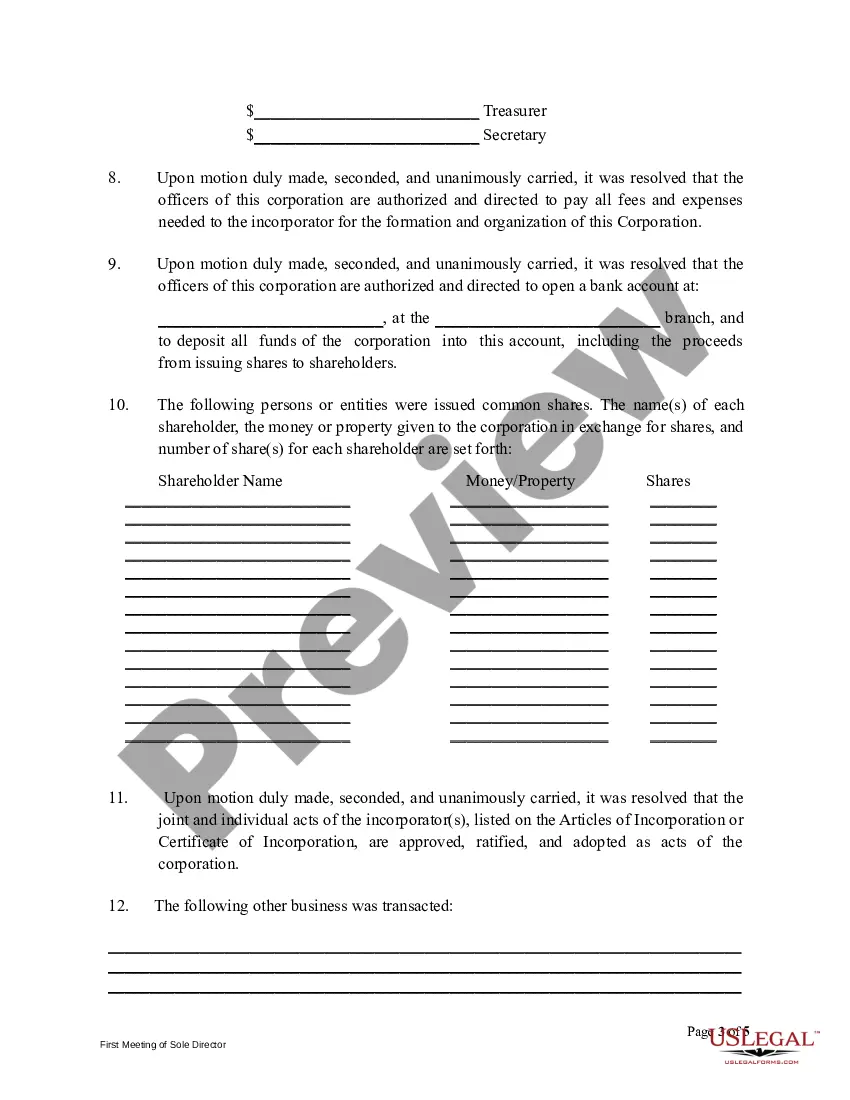

The first meeting of the sole director ratifies the actions of the incorporator, appoints the officers, gives authority to open a bank account, and allows for any other initial director tasks needed. Meeting minutes ensure that all these actions are documented in the corporate record.

What should board of directors first meeting minutes include? Your corporation's first directors meeting typically focuses on initial organizational tasks, including electing officers, setting their salaries, resolving to open a bank account, and ratifying bylaws and actions of the incorporators.

Directors are responsible for calling directors' meetings. They can decide together but it is also possible for one director to call a directors' meeting by giving reasonable notice to each of the other directors.

Decision-making by directors Decisions are usually taken either by passing resolutions at a board meeting or by passing a written resolution. Although a sole director may be able to hold a board meeting, in practice, a sole director would usually make decisions by passing written resolutions.

Directors can generally call a general meeting at any time. If the directors of a private company call an AGM, they must give at least 14 days' notice. For directors of a public company, at least 21 days' notice is required.

The sole director and member of a company is responsible for managing the company's business and may exercise all of the company's powers.

How to write meeting minutes reports Make an outline. Prior to the meeting, create an outline by picking or designing a template. ... Include factual information. ... Write down the purpose. ... Record decisions made. ... Add details for the next meeting. ... Be concise. ... Consider recording. ... Edit and proofread.