Wisconsin A Summary of Your Rights Under the Fair Credit Reporting Act provides individuals with important information about their rights when it comes to their credit reports. This act, also referred to as the FCRA, is a federal law that regulates how consumer credit information is collected, used, and shared. When it comes to Wisconsin's version of the act, there are no specific types mentioned, but it is important to understand the overall rights that individuals possess under this law. Here is a detailed description of what Wisconsin A Summary of Your Rights Under the Fair Credit Reporting Act entails, including relevant keywords: 1. Access to Your Credit Report: Under the FCRA, you have the right to obtain a free credit report from each of the three major credit bureaus — Equifax, Experian, and TransUnion – once every 12 months. This allows you to review the information being reported about you in order to ensure its accuracy. 2. Dispute Process: If you believe there is inaccurate or incomplete information on your credit report, you have the right to dispute it. Contacting both the credit bureau and the information provider, preferably in writing, is crucial in order to initiate the investigation process. 3. Investigation Timeline: The credit reporting agencies must usually investigate a dispute within 30 days of receiving your request. During this investigation period, they are required to verify the accuracy of the information with the information provider and make the necessary corrections if any inaccuracies are found. 4. Adverse Action Notifications: If you are denied credit, insurance, or employment based on information in your credit report, the company or organization must provide you with a notice called an "adverse action" notice. This notice will include the reasons behind their decision, the credit report source used, and your rights to obtain a free copy of your credit report within 60 days. 5. Consent for Credit Report Access: In most cases, entities that want to access your credit report must obtain your consent. However, certain exceptions exist for situations involving employment, court orders, and permissible purposes under the law. 6. Identity Theft: The FCRA provides measures to help protect against identity theft by allowing consumers to place fraud alerts and active duty alerts on their credit reports, preventing unauthorized access or activity. It is important to understand that this description of Wisconsin A Summary of Your Rights Under the Fair Credit Reporting Act is not exhaustive and may vary in specific legal language or additional state-specific provisions.

Wisconsin Fair Credit Reporting Act Lawsuits

Description

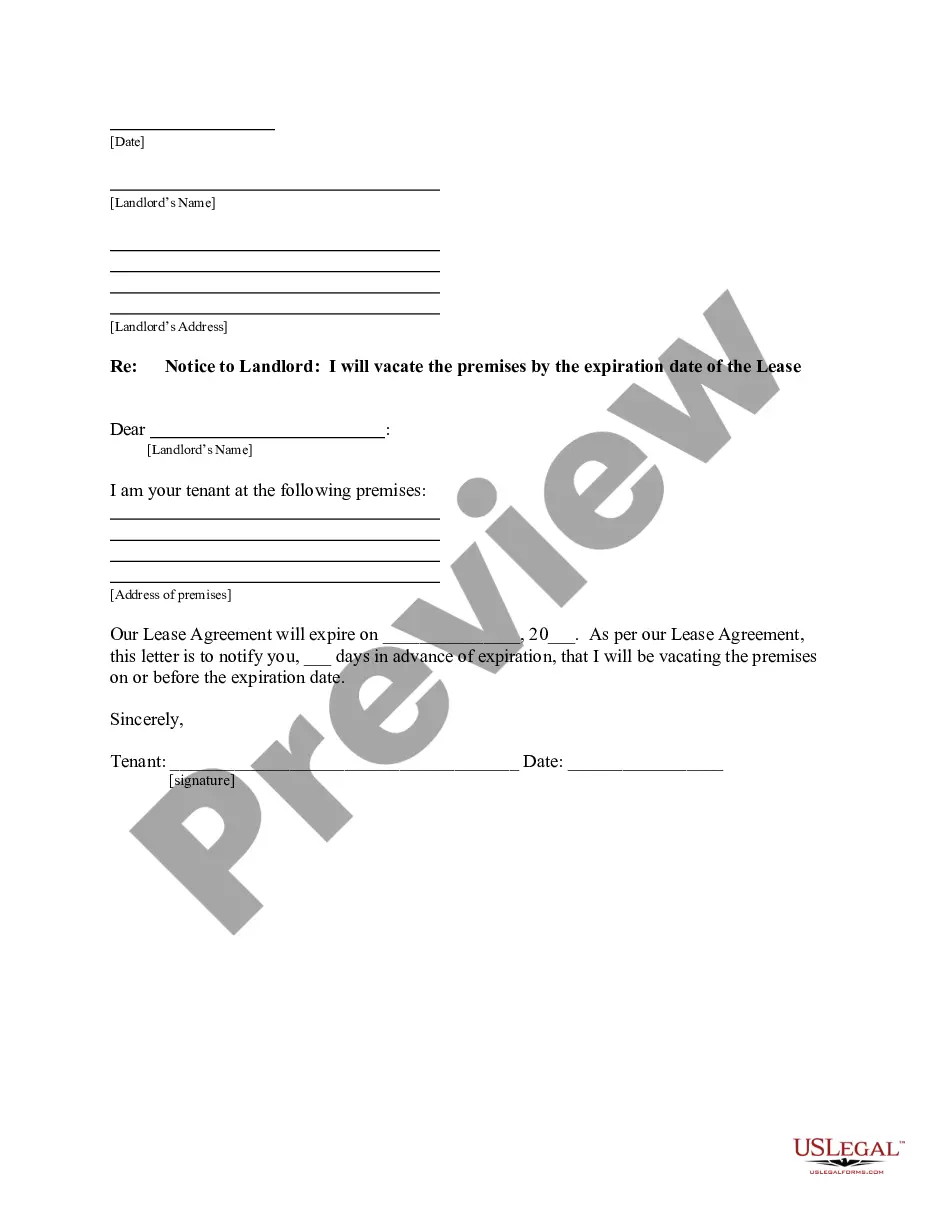

How to fill out Wisconsin A Summary Of Your Rights Under The Fair Credit Reporting Act?

Are you currently within a place that you need to have papers for possibly organization or specific functions almost every time? There are tons of authorized record web templates available on the net, but locating kinds you can depend on isn`t straightforward. US Legal Forms provides 1000s of develop web templates, just like the Wisconsin A Summary of Your Rights Under the Fair Credit Reporting Act, that happen to be composed to satisfy federal and state specifications.

In case you are currently acquainted with US Legal Forms internet site and possess a free account, merely log in. Next, you can obtain the Wisconsin A Summary of Your Rights Under the Fair Credit Reporting Act template.

If you do not have an account and need to start using US Legal Forms, abide by these steps:

- Discover the develop you require and make sure it is to the correct metropolis/county.

- Use the Preview switch to analyze the shape.

- Look at the information to actually have chosen the right develop.

- When the develop isn`t what you are seeking, utilize the Lookup area to find the develop that fits your needs and specifications.

- Once you obtain the correct develop, simply click Get now.

- Select the pricing prepare you need, fill in the necessary details to make your bank account, and pay money for the order using your PayPal or credit card.

- Select a practical paper format and obtain your backup.

Discover every one of the record web templates you have purchased in the My Forms menu. You may get a more backup of Wisconsin A Summary of Your Rights Under the Fair Credit Reporting Act at any time, if necessary. Just select the necessary develop to obtain or printing the record template.

Use US Legal Forms, one of the most extensive selection of authorized forms, to save lots of efforts and steer clear of faults. The support provides skillfully made authorized record web templates which can be used for an array of functions. Make a free account on US Legal Forms and initiate generating your way of life a little easier.

Form popularity

FAQ

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs). Fair Credit Reporting Act - Bureau of Justice Assistance ojp.gov ? program ? authorities ? statutes ojp.gov ? program ? authorities ? statutes

? You have the right to know what is in your file. In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See .consumerfinance.gov/learnmore for additional information. A Summary of Your Rights Under the Fair Credit Reporting Act Consumer Financial Protection Bureau (.gov) ? 201504_cfp... Consumer Financial Protection Bureau (.gov) ? 201504_cfp... PDF

Four Basic Steps to FCRA Compliance Step 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must: ... Step 2: Certification To The Consumer Reporting Agency. ... Step 3: Provide Applicant With Pre-Adverse Action Documents. ... Step 4: Notify Applicant Of Adverse Action. Four Basic Steps to FCRA Compliance mcdowellagency.com ? resources ? four-basic-ste... mcdowellagency.com ? resources ? four-basic-ste...

I am writing to dispute a charge of [$______] to my [credit or debit card] account on [date of the charge]. The charge is in error because [explain the problem briefly. For example, the items weren't delivered, I was overcharged, I returned the items, I did not buy the items, etc.].

Written by Natasha Wiebusch, J.D.. A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices.

Fix Errors on Your Credit Report: 8 Tips for Writing an Effective Complaint Letter to the Credit Reporting Agency Provide identification information. ... Clearly identify the mistake. ... Be brief and to the point. ... Type the letter. ... Don't quote Fair Credit Reporting Act laws. ... Include proof, if you have it. ... Proofread! How to Write a Complaint Letter to a Credit Reporting Agency theconsumerlawgroup.com ? library ? how-t... theconsumerlawgroup.com ? library ? how-t...

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Yes, 609 dispute letters can work. The FCRA provides a consumer the legal right to challenge any inaccurate information found in their credit report.