Wisconsin Appliance Refinish Services Contract - Self-Employed

Description

How to fill out Wisconsin Appliance Refinish Services Contract - Self-Employed?

Are you in a situation the place you need paperwork for both enterprise or individual uses nearly every day? There are a lot of authorized record web templates available online, but getting kinds you can trust is not effortless. US Legal Forms gives a huge number of form web templates, like the Wisconsin Appliance Refinish Services Contract - Self-Employed, which can be published in order to meet federal and state requirements.

If you are currently informed about US Legal Forms site and also have a free account, just log in. Next, you can download the Wisconsin Appliance Refinish Services Contract - Self-Employed format.

If you do not come with an profile and want to begin using US Legal Forms, follow these steps:

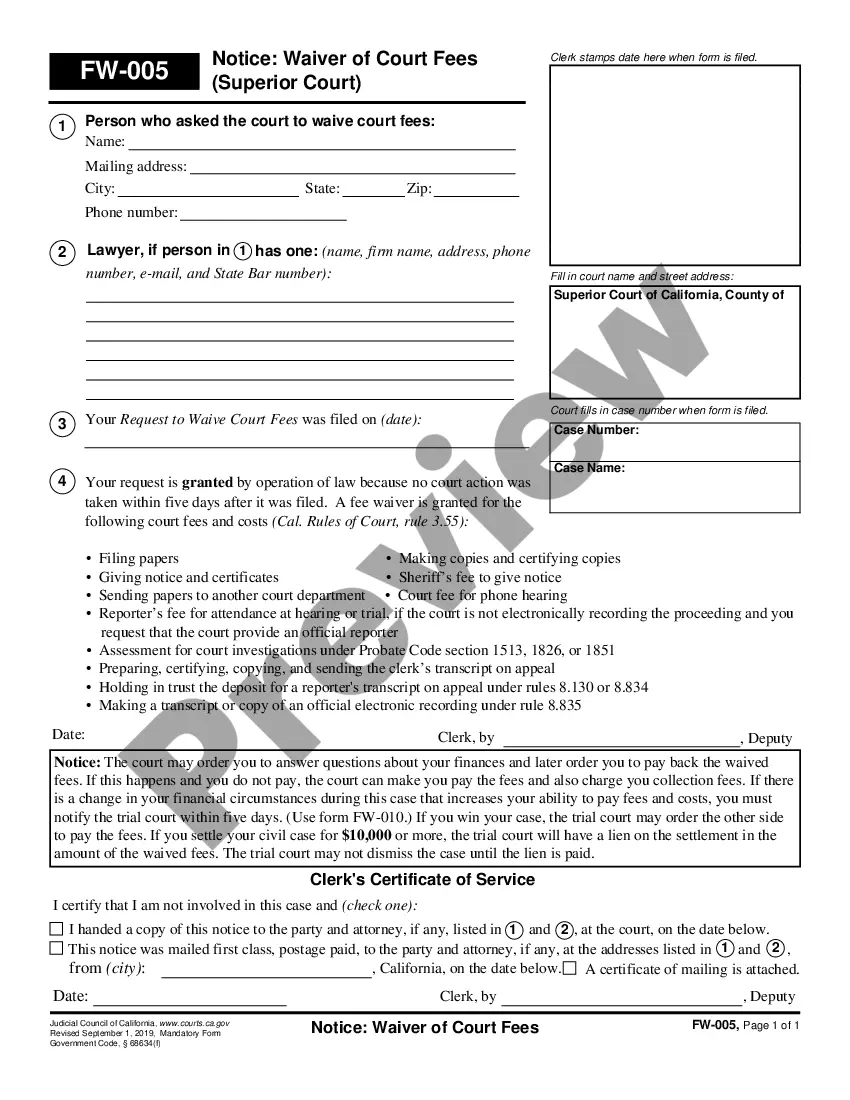

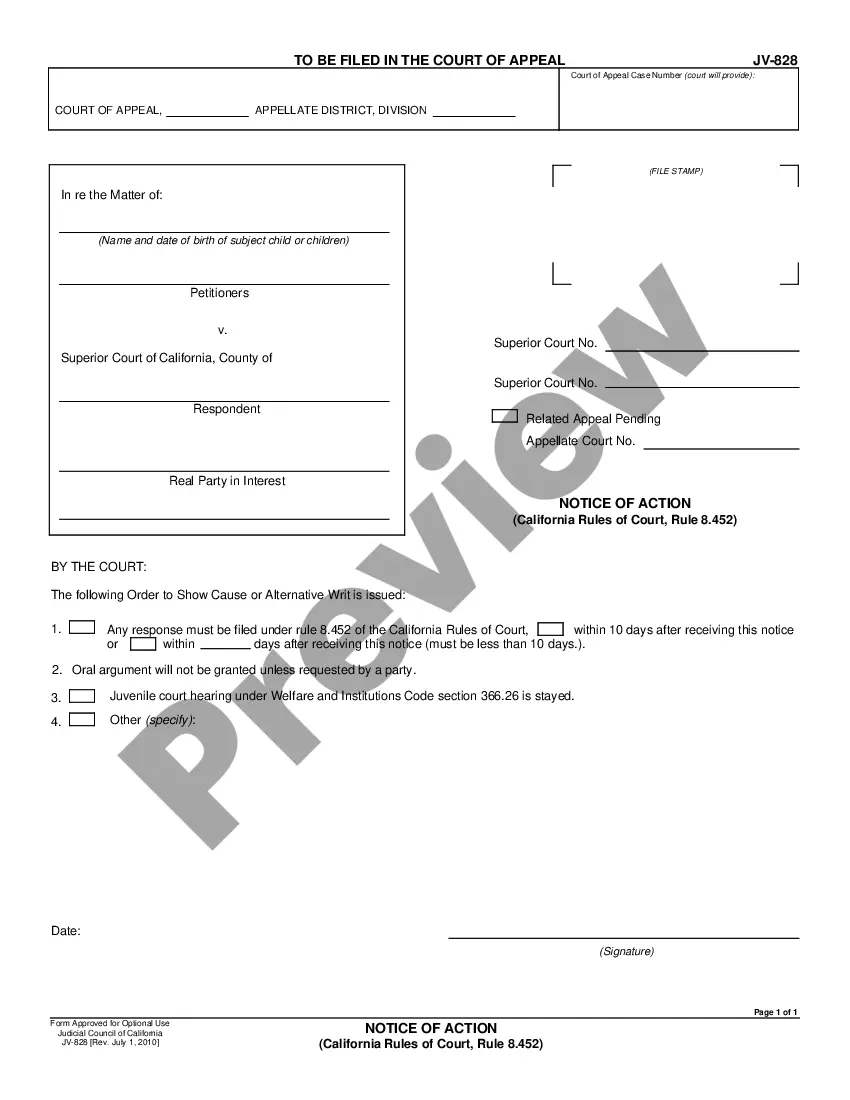

- Obtain the form you require and make sure it is to the correct area/state.

- Utilize the Preview button to check the shape.

- Read the explanation to ensure that you have selected the right form.

- If the form is not what you`re searching for, use the Lookup industry to get the form that meets your requirements and requirements.

- Whenever you find the correct form, just click Purchase now.

- Opt for the prices plan you need, complete the required information and facts to produce your money, and buy an order using your PayPal or Visa or Mastercard.

- Decide on a handy paper file format and download your duplicate.

Discover all the record web templates you have purchased in the My Forms menu. You can get a further duplicate of Wisconsin Appliance Refinish Services Contract - Self-Employed whenever, if necessary. Just click on the necessary form to download or produce the record format.

Use US Legal Forms, the most comprehensive assortment of authorized forms, in order to save efforts and prevent errors. The support gives expertly manufactured authorized record web templates which can be used for a range of uses. Make a free account on US Legal Forms and begin creating your daily life easier.

Form popularity

FAQ

Only certain services sold, performed, or furnished in Wisconsin are subject to Wisconsin sales or use tax. Taxable services include: Admission and access privileges to amusement, athletic, entertainment, or recreational places or events. Access or use of amusement devices.

Per Wisconsin law, if a contractor purchases construction materials for use in a real property construction project or repair, the contractor is considered the end user of those materials. That means the contractor must pay sales or use tax on those purchases, and the contractor's sale to their customer is not taxable.

Generally speaking, most professional services in Wisconsin are not taxable. Contracts for future performance of services are subject to tax as are digital goods.

Sales Tax Exemptions in Wisconsin There are many exemptions to state sales tax. This includes, burial caskets, certain agricultural items, certain grocery items, prescription medicine and medical devices, modular or manufactured homes, and certain pieces of manufacturing equipment.

Traditional Goods or Services Goods that are subject to sales tax in Wisconsin include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, and gasoline are all tax-exempt.

Per Wisconsin law, if a contractor purchases construction materials for use in a real property construction project or repair, the contractor is considered the end user of those materials. That means the contractor must pay sales or use tax on those purchases, and the contractor's sale to their customer is not taxable.

Wisconsin sales tax is 5% on purchases of tangible items which include things like clothes or furniture.

Sales of food and food ingredients, except candy, dietary supplements, prepared foods, and soft drinks are exempt from tax under s. 77.54 (20n), Stats.

Traditional Goods or Services Goods that are subject to sales tax in Wisconsin include physical property, like furniture, home appliances, and motor vehicles. Prescription medicine, groceries, and gasoline are all tax-exempt.

The Wisconsin DOR issued guidance for painting and finishing contractors on the taxability of their sales and purchases. Sales of tangible personal property by contractors are taxable, unless an exemption applies.