Wisconsin Medical Representative Agreement - Self-Employed Independent Contractor

Description

How to fill out Wisconsin Medical Representative Agreement - Self-Employed Independent Contractor?

Finding the right authorized record template might be a struggle. Obviously, there are tons of themes available on the net, but how would you discover the authorized form you need? Make use of the US Legal Forms internet site. The support gives 1000s of themes, for example the Wisconsin Medical Representative Agreement - Self-Employed Independent Contractor, which you can use for business and personal requires. Every one of the varieties are inspected by pros and satisfy state and federal requirements.

When you are previously signed up, log in to the account and click the Acquire switch to obtain the Wisconsin Medical Representative Agreement - Self-Employed Independent Contractor. Use your account to check with the authorized varieties you have bought earlier. Proceed to the My Forms tab of your respective account and have an additional copy in the record you need.

When you are a brand new end user of US Legal Forms, listed below are straightforward instructions that you should stick to:

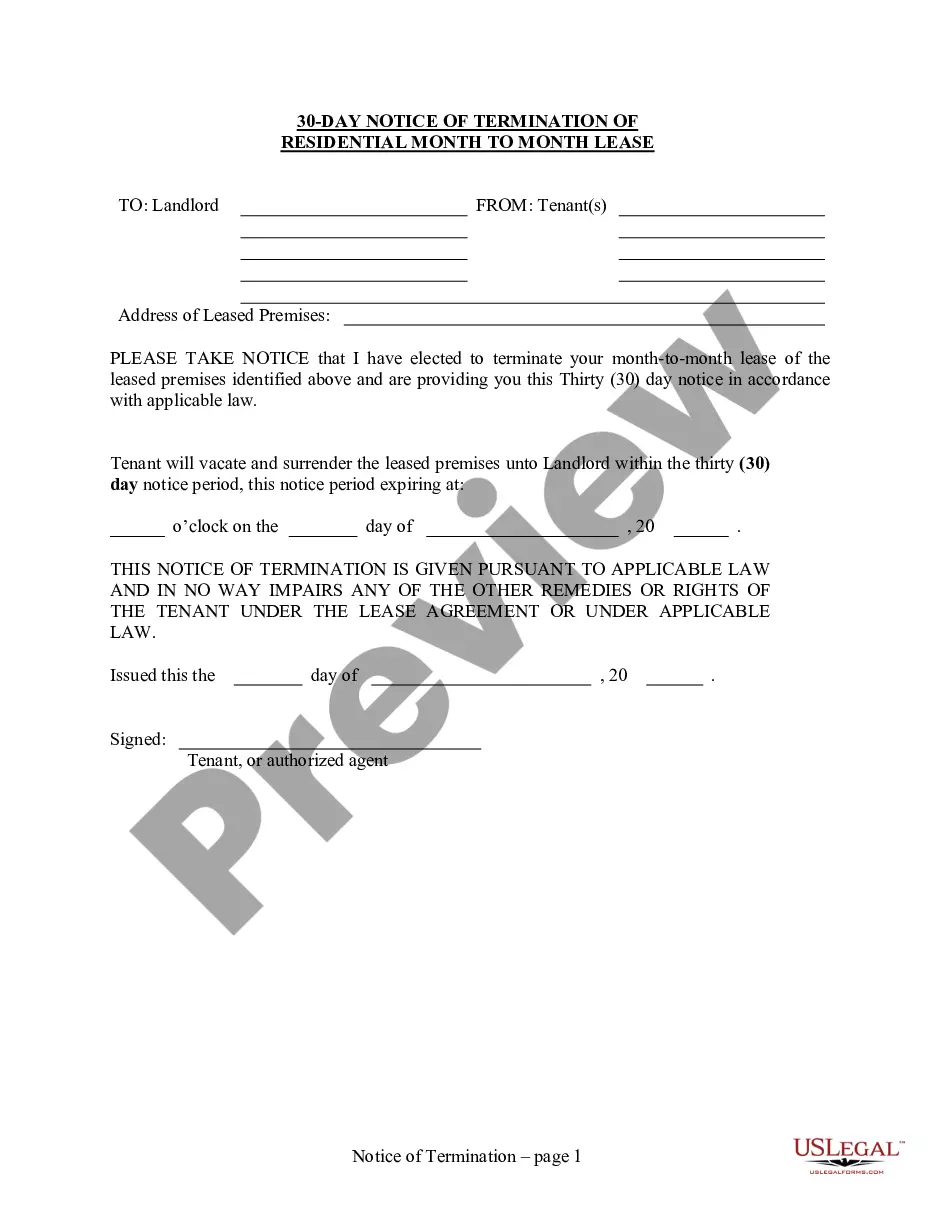

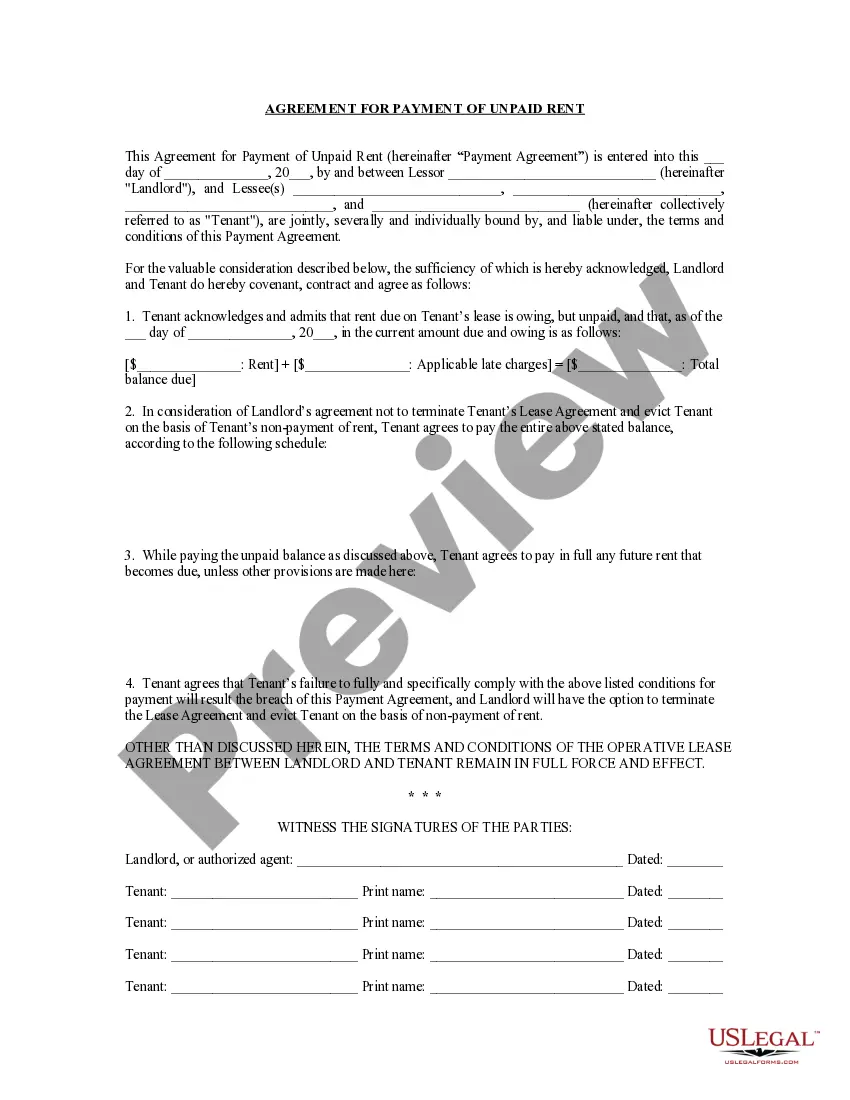

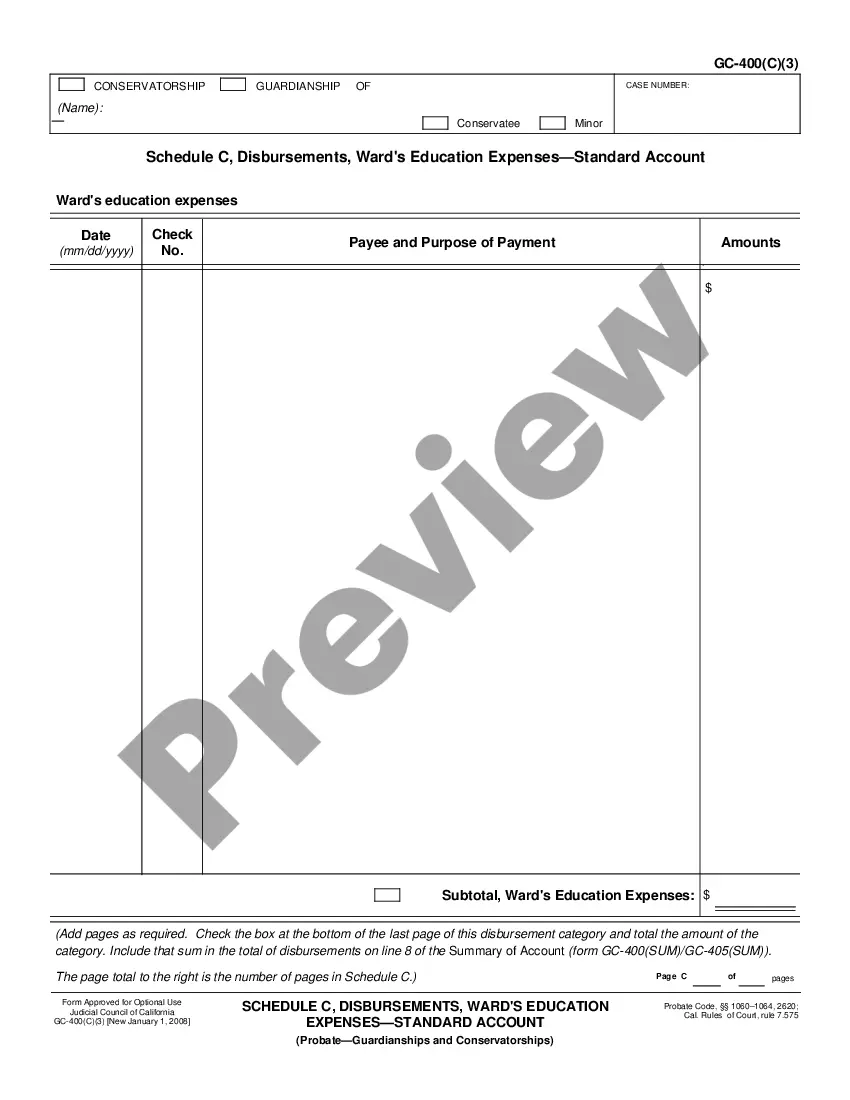

- Initial, make sure you have selected the right form to your town/county. You are able to look over the form utilizing the Preview switch and read the form information to guarantee this is basically the best for you.

- If the form is not going to satisfy your needs, make use of the Seach industry to obtain the correct form.

- Once you are sure that the form is suitable, go through the Acquire now switch to obtain the form.

- Select the costs program you need and enter the needed information and facts. Build your account and pay money for the order with your PayPal account or bank card.

- Opt for the file file format and down load the authorized record template to the gadget.

- Comprehensive, modify and print and signal the obtained Wisconsin Medical Representative Agreement - Self-Employed Independent Contractor.

US Legal Forms will be the largest catalogue of authorized varieties in which you will find a variety of record themes. Make use of the service to down load expertly-made paperwork that stick to state requirements.

Form popularity

FAQ

To be eligible for PUA, you must be unemployed, partially unemployed, or unable or unavailable to work due to one of the COVID-19 related reasons listed below: You have been diagnosed with COVID-19 or are experiencing symptoms of COVID-19 and are seeking a medical diagnosis.

Even if you have been paid enough wages from covered employment to qualify for unemployment benefits, you will not receive benefits if you: quit a job without good cause. UI law suspends your benefits until you earn 6 times your WBR. are fired for misconduct.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Employees are covered by the unemployment insurance law; independent contractors are not covered. If a worker is or has been "performing services for pay" for an employing unit, there is a presumption in the law that the worker is an "employee," not an independent contractor.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

A Wisconsin independent contractor agreement is a contract made between an employer conducting business in the state of Wisconsin and an independent worker who is not an employee of the company.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.