Wisconsin Public Relations Agreement - Self-Employed Independent Contractor

Description

How to fill out Wisconsin Public Relations Agreement - Self-Employed Independent Contractor?

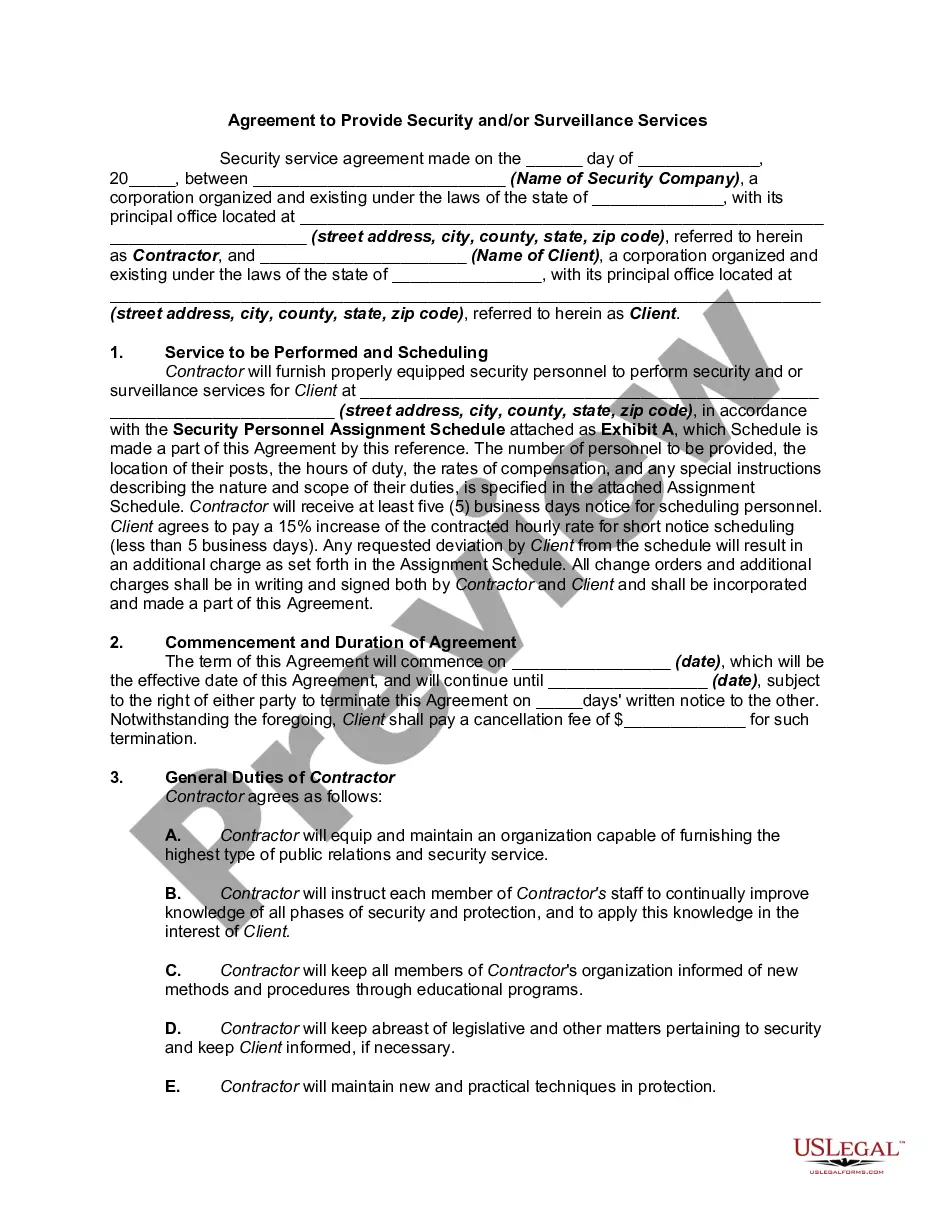

Finding the right lawful file design can be a have a problem. Obviously, there are a lot of layouts available on the net, but how can you discover the lawful form you will need? Utilize the US Legal Forms site. The service gives 1000s of layouts, like the Wisconsin Public Relations Agreement - Self-Employed Independent Contractor, that you can use for company and private requirements. Each of the kinds are checked by pros and satisfy federal and state demands.

Should you be already authorized, log in to the bank account and then click the Download button to have the Wisconsin Public Relations Agreement - Self-Employed Independent Contractor. Make use of bank account to appear from the lawful kinds you may have acquired formerly. Visit the My Forms tab of your bank account and get yet another duplicate from the file you will need.

Should you be a new customer of US Legal Forms, listed below are easy instructions for you to follow:

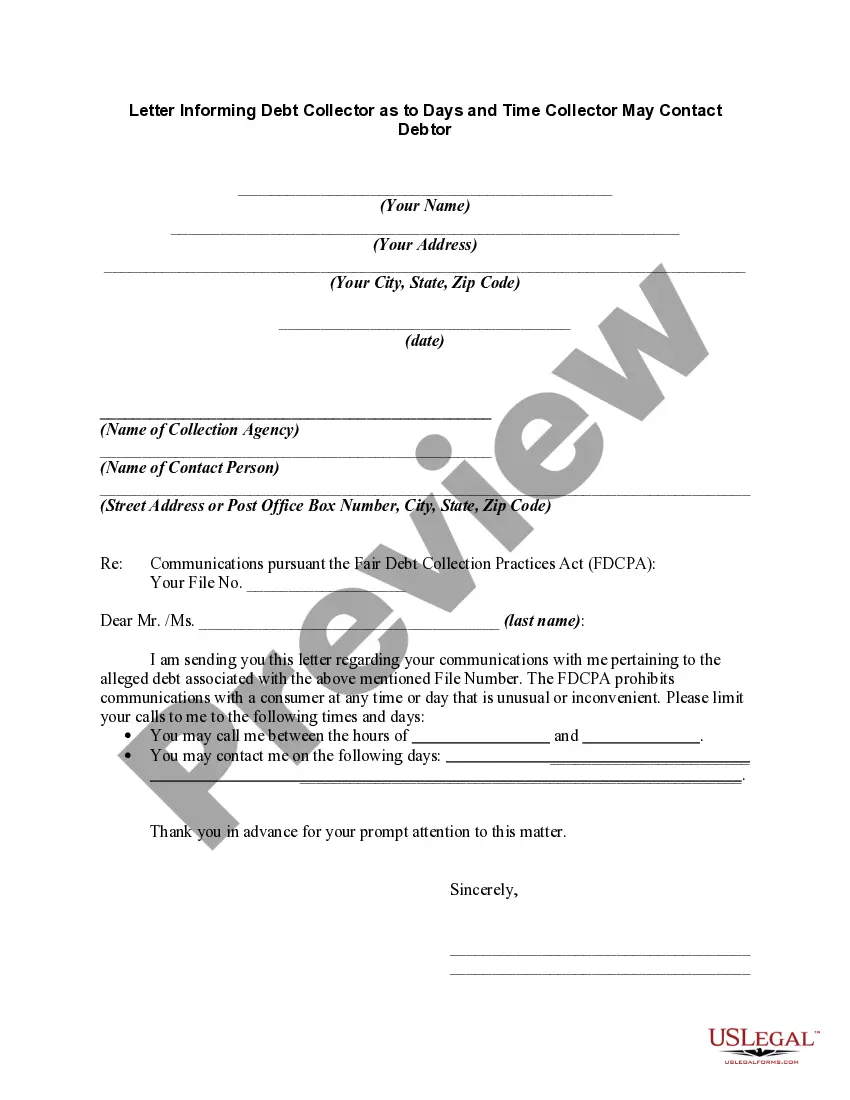

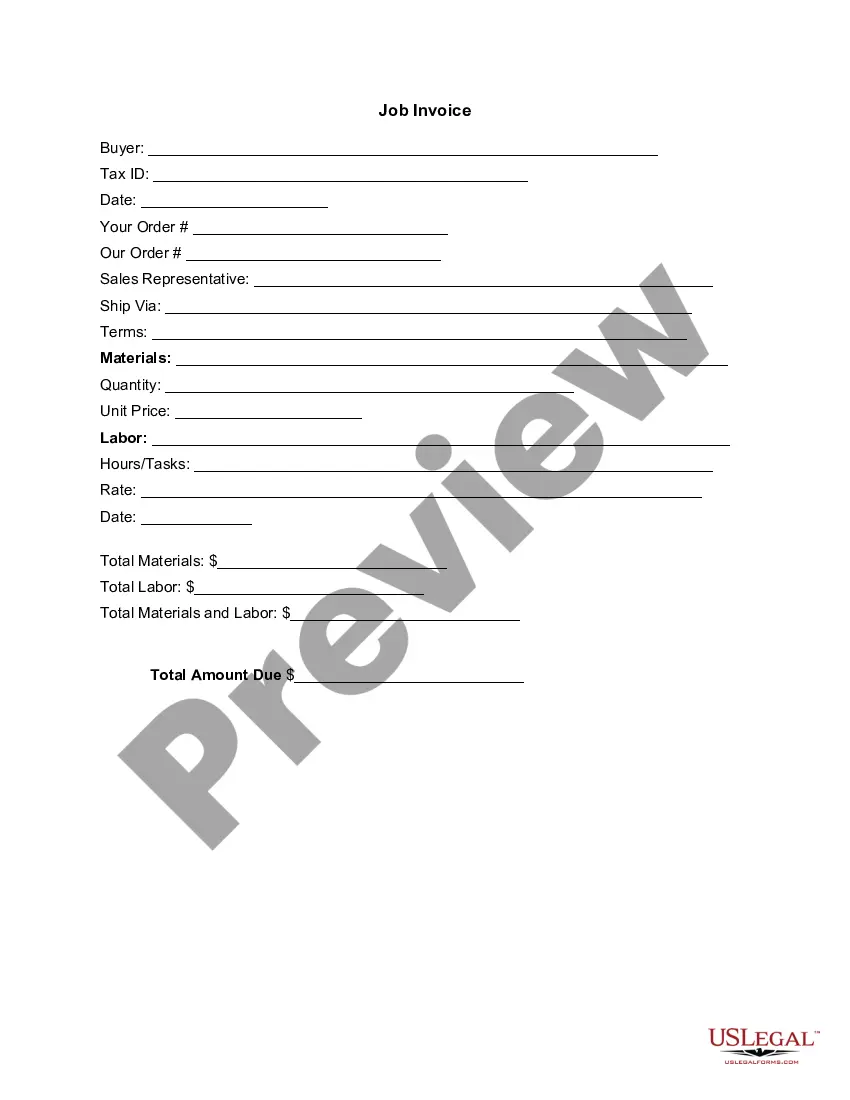

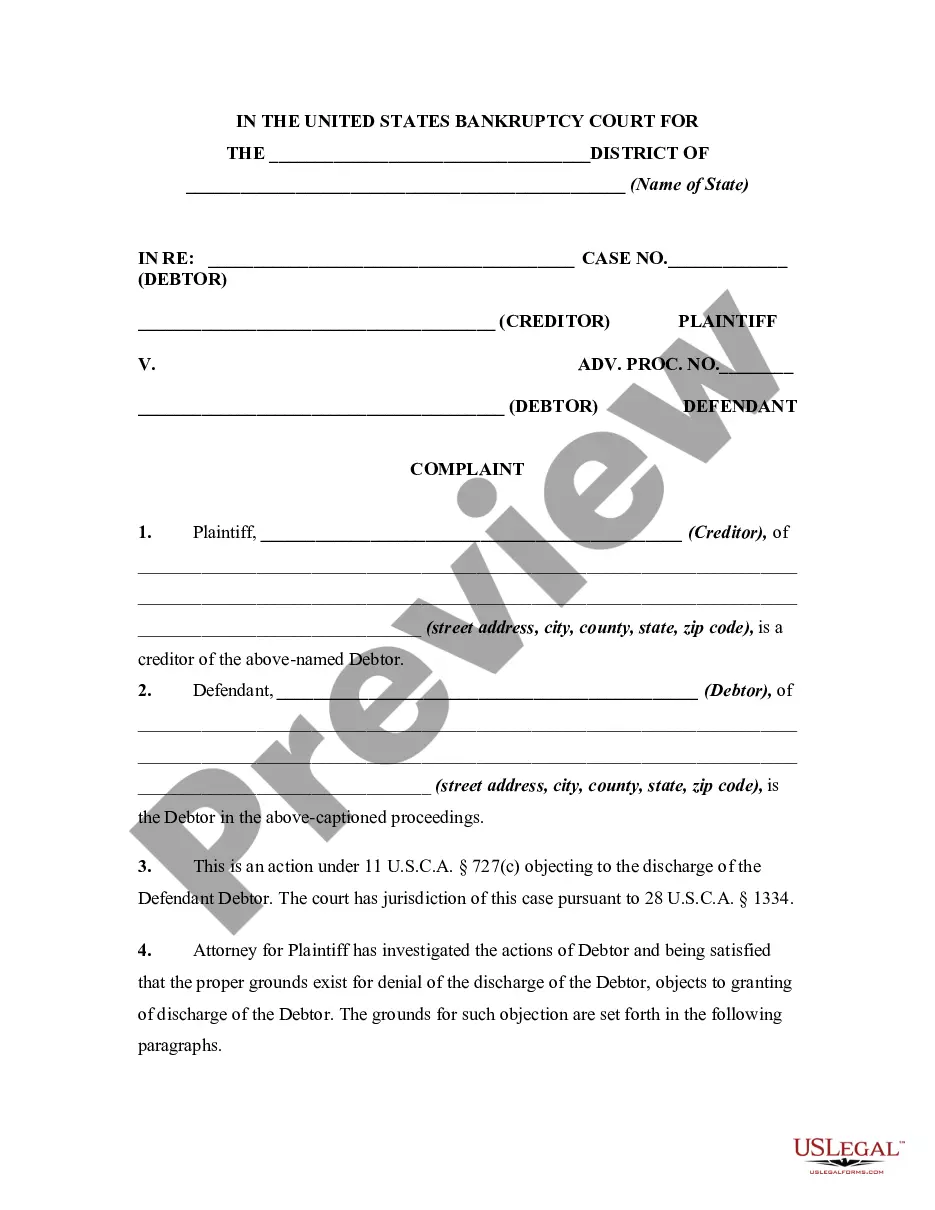

- Initial, ensure you have chosen the appropriate form to your metropolis/state. You are able to check out the shape making use of the Review button and look at the shape information to guarantee this is basically the right one for you.

- If the form is not going to satisfy your requirements, make use of the Seach area to obtain the appropriate form.

- Once you are sure that the shape would work, click the Get now button to have the form.

- Choose the prices program you need and enter the required info. Make your bank account and purchase an order with your PayPal bank account or bank card.

- Select the submit structure and download the lawful file design to the gadget.

- Complete, edit and print and indicator the acquired Wisconsin Public Relations Agreement - Self-Employed Independent Contractor.

US Legal Forms may be the largest local library of lawful kinds for which you can find numerous file layouts. Utilize the company to download expertly-manufactured papers that follow condition demands.

Form popularity

FAQ

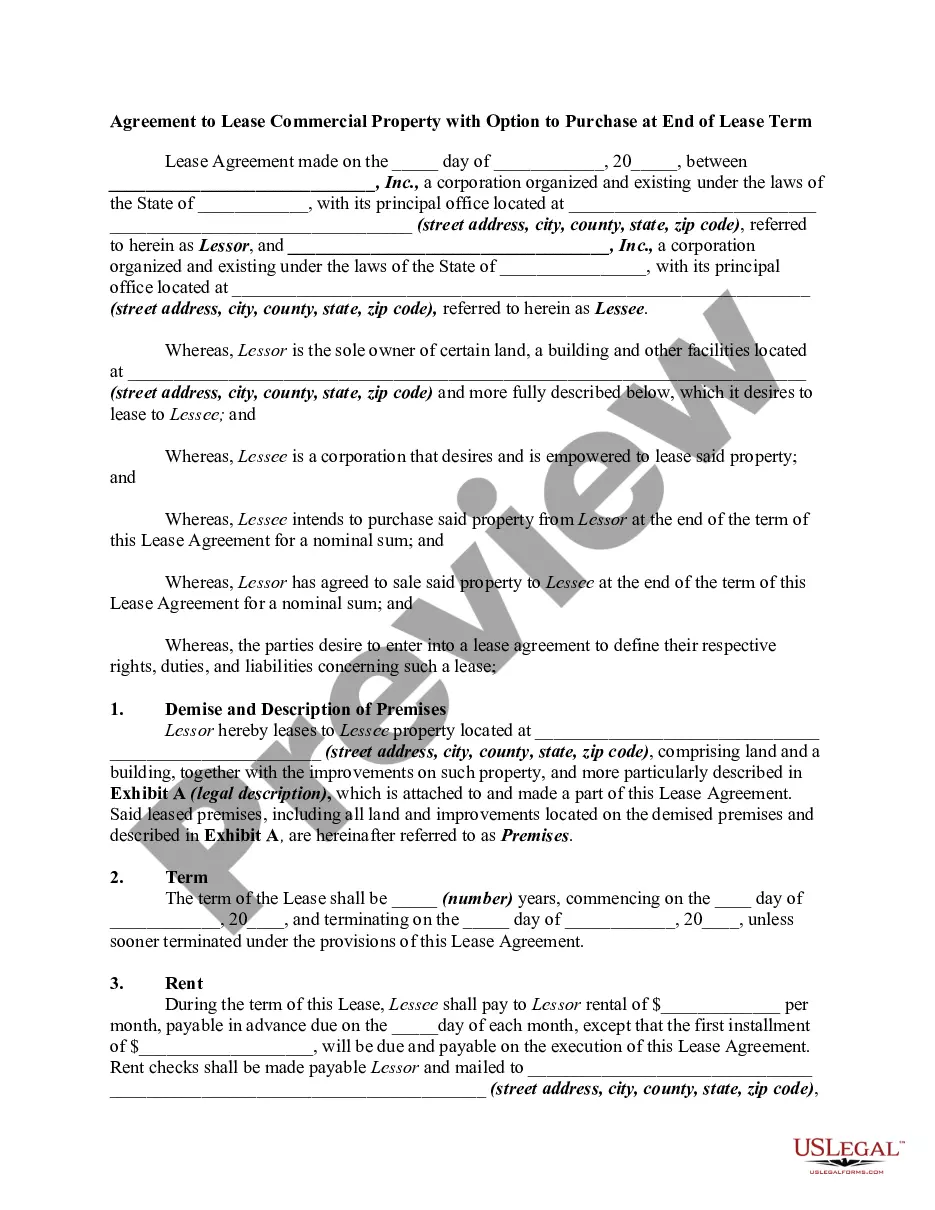

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Nine Requirements Test - Independent ContractorRequirement One - Maintain a Separate Business.Requirement Two - Obtain a FEIN or Have Filed Business or Self-Employment Tax Returns.Requirement Three - Operate Under Specific Contracts.Requirement Four - Responsible For Main Expenses.More items...

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

A Wisconsin independent contractor agreement is a contract made between an employer conducting business in the state of Wisconsin and an independent worker who is not an employee of the company.

To be eligible for PUA, you must be unemployed, partially unemployed, or unable or unavailable to work due to one of the COVID-19 related reasons listed below: You have been diagnosed with COVID-19 or are experiencing symptoms of COVID-19 and are seeking a medical diagnosis.

Even if you have been paid enough wages from covered employment to qualify for unemployment benefits, you will not receive benefits if you: quit a job without good cause. UI law suspends your benefits until you earn 6 times your WBR. are fired for misconduct.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Employees are covered by the unemployment insurance law; independent contractors are not covered. If a worker is or has been "performing services for pay" for an employing unit, there is a presumption in the law that the worker is an "employee," not an independent contractor.