Wisconsin Production Assistant Contract - Self-Employed Independent Contractor

Description

How to fill out Wisconsin Production Assistant Contract - Self-Employed Independent Contractor?

Are you currently in the place in which you need to have paperwork for sometimes enterprise or specific functions just about every working day? There are a variety of legal papers themes available on the net, but getting kinds you can rely on is not simple. US Legal Forms provides a huge number of form themes, much like the Wisconsin Production Assistant Contract - Self-Employed Independent Contractor, which can be created to satisfy state and federal demands.

Should you be presently knowledgeable about US Legal Forms website and have a merchant account, just log in. Following that, you may acquire the Wisconsin Production Assistant Contract - Self-Employed Independent Contractor template.

Should you not provide an profile and need to start using US Legal Forms, follow these steps:

- Find the form you require and make sure it is for your appropriate city/county.

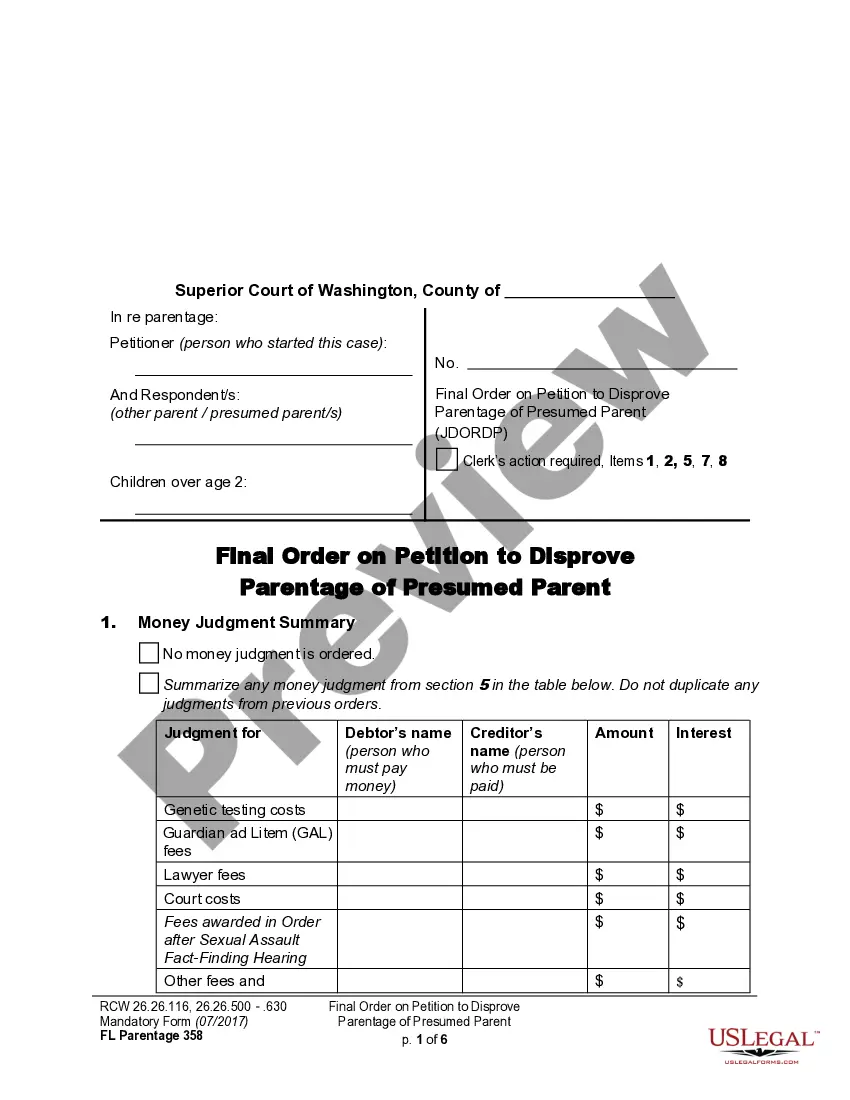

- Utilize the Review button to review the shape.

- See the outline to ensure that you have chosen the proper form.

- When the form is not what you are seeking, utilize the Look for field to get the form that suits you and demands.

- If you find the appropriate form, just click Purchase now.

- Pick the costs program you would like, submit the desired information to produce your account, and purchase your order utilizing your PayPal or credit card.

- Decide on a hassle-free file structure and acquire your version.

Discover all of the papers themes you have purchased in the My Forms menus. You may get a extra version of Wisconsin Production Assistant Contract - Self-Employed Independent Contractor whenever, if needed. Just select the essential form to acquire or printing the papers template.

Use US Legal Forms, the most extensive collection of legal types, to save lots of some time and steer clear of faults. The support provides appropriately made legal papers themes which can be used for a variety of functions. Make a merchant account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Whatever you call yourself, if you are self-employed, an independent contractor, or a sole proprietor, a partner in a partnership, or an LLC member, you must pay self-employment taxes (Social Security and Medicare). Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.