Wisconsin Tree Surgeon Agreement - Self-Employed Independent Contractor

Description

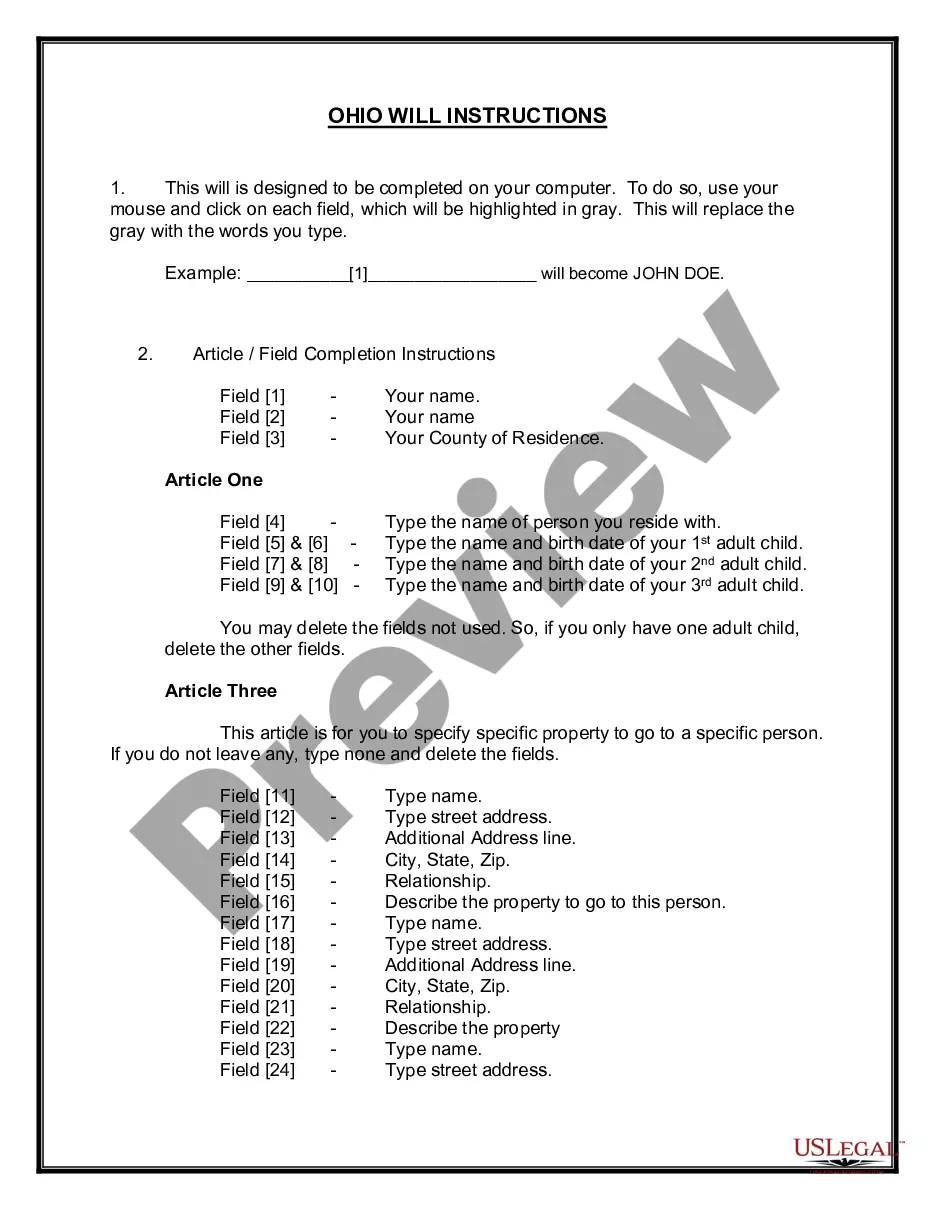

How to fill out Tree Surgeon Agreement - Self-Employed Independent Contractor?

Finding the right legitimate file format might be a struggle. Naturally, there are plenty of layouts available on the net, but how will you find the legitimate form you require? Make use of the US Legal Forms internet site. The support provides thousands of layouts, such as the Wisconsin Tree Surgeon Agreement - Self-Employed Independent Contractor, that you can use for company and personal requirements. Each of the varieties are examined by pros and meet federal and state demands.

Should you be previously signed up, log in to the account and click on the Acquire button to obtain the Wisconsin Tree Surgeon Agreement - Self-Employed Independent Contractor. Make use of your account to appear with the legitimate varieties you may have purchased previously. Visit the My Forms tab of the account and have another copy of the file you require.

Should you be a brand new user of US Legal Forms, listed here are easy instructions that you should stick to:

- Very first, make sure you have chosen the proper form for your personal area/region. You are able to look over the form utilizing the Preview button and browse the form information to make sure this is the best for you.

- When the form does not meet your needs, use the Seach industry to discover the correct form.

- When you are certain that the form is proper, go through the Purchase now button to obtain the form.

- Choose the prices prepare you desire and enter the essential details. Build your account and buy your order making use of your PayPal account or credit card.

- Choose the file file format and acquire the legitimate file format to the gadget.

- Full, modify and produce and signal the obtained Wisconsin Tree Surgeon Agreement - Self-Employed Independent Contractor.

US Legal Forms may be the largest library of legitimate varieties that you can see a variety of file layouts. Make use of the company to acquire expertly-manufactured files that stick to state demands.

Form popularity

FAQ

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Nine Requirements Test - Independent ContractorRequirement One - Maintain a Separate Business.Requirement Two - Obtain a FEIN or Have Filed Business or Self-Employment Tax Returns.Requirement Three - Operate Under Specific Contracts.Requirement Four - Responsible For Main Expenses.More items...

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.