Wisconsin Self-Employed Tennis Professional Services Contract

Description

How to fill out Wisconsin Self-Employed Tennis Professional Services Contract?

Are you presently within a placement the place you will need papers for possibly company or personal uses just about every time? There are a lot of lawful record themes accessible on the Internet, but getting types you can trust isn`t simple. US Legal Forms delivers thousands of type themes, much like the Wisconsin Self-Employed Tennis Professional Services Contract, which can be published to fulfill federal and state demands.

When you are presently knowledgeable about US Legal Forms site and get your account, just log in. Afterward, you are able to obtain the Wisconsin Self-Employed Tennis Professional Services Contract template.

If you do not offer an profile and want to begin to use US Legal Forms, abide by these steps:

- Get the type you need and ensure it is to the appropriate town/county.

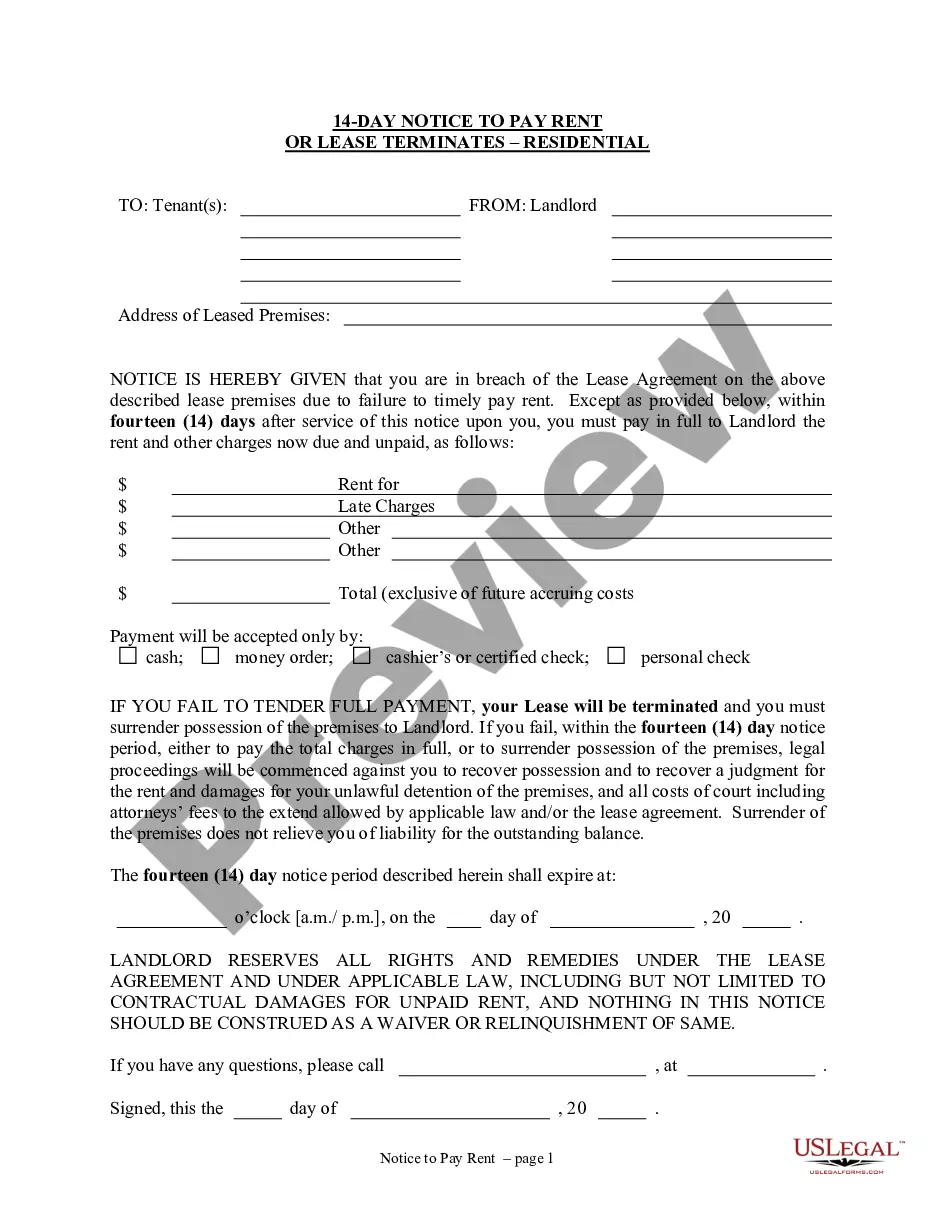

- Utilize the Preview key to examine the form.

- Browse the information to ensure that you have chosen the right type.

- In the event the type isn`t what you`re seeking, utilize the Look for discipline to get the type that meets your needs and demands.

- Whenever you obtain the appropriate type, click Purchase now.

- Opt for the rates prepare you desire, fill in the specified info to create your account, and buy your order utilizing your PayPal or bank card.

- Select a hassle-free paper formatting and obtain your version.

Find each of the record themes you have purchased in the My Forms menu. You can aquire a extra version of Wisconsin Self-Employed Tennis Professional Services Contract anytime, if necessary. Just click on the needed type to obtain or produce the record template.

Use US Legal Forms, one of the most extensive variety of lawful forms, in order to save time and avoid faults. The support delivers professionally created lawful record themes that can be used for a range of uses. Create your account on US Legal Forms and begin creating your life easier.

Form popularity

FAQ

Professional AthleteAn athlete is an employee or an independent contractor depending upon the sport involved and the terms of the contract under which he/she performs. In team sports, such as football and baseball, where the player competes under the direction and control of a coach or manager, he/she is an employee.

As the country club industry in the USA contracts and clubs look to minimize costs, more and more often Directors of Tennis and, indeed, assistant professionals, are independent contractors and not employees.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

A Wisconsin independent contractor agreement is a contract made between an employer conducting business in the state of Wisconsin and an independent worker who is not an employee of the company.

Nine Requirements Test - Independent ContractorRequirement One - Maintain a Separate Business.Requirement Two - Obtain a FEIN or Have Filed Business or Self-Employment Tax Returns.Requirement Three - Operate Under Specific Contracts.Requirement Four - Responsible For Main Expenses.More items...

Contract work provides greater independence, it can give you more predictable control of your work, and for many people, greater job security than traditional full-time employment. However, you are responsible for your own taxes, contracts, benefits and vacations.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

In sports, the N.B.A. players are employees, part of a union, therefore not independent contractors, Ms. Zavian said, making their refusal to play a strike.

PERFORMING ARTISTS These are persons who are actually in business for themselves and hold themselves available to the general public to perform services. A person is an independent contractor only when free from control and direction in the performance of services.