Wisconsin Self-Employed Drywall Services Contract

Description

How to fill out Wisconsin Self-Employed Drywall Services Contract?

US Legal Forms - one of several most significant libraries of legitimate kinds in America - delivers a wide range of legitimate file web templates you can download or produce. Utilizing the site, you can get 1000s of kinds for business and personal reasons, sorted by types, claims, or keywords.You will discover the latest models of kinds such as the Wisconsin Self-Employed Drywall Services Contract in seconds.

If you have a subscription, log in and download Wisconsin Self-Employed Drywall Services Contract from the US Legal Forms catalogue. The Acquire button can look on every single form you look at. You get access to all earlier acquired kinds in the My Forms tab of the account.

In order to use US Legal Forms the very first time, listed here are simple recommendations to get you began:

- Make sure you have picked out the proper form for the town/county. Select the Review button to analyze the form`s content material. Browse the form description to actually have selected the right form.

- In case the form doesn`t suit your specifications, take advantage of the Search discipline on top of the screen to find the one who does.

- When you are happy with the form, validate your selection by visiting the Buy now button. Then, opt for the costs strategy you want and offer your qualifications to sign up for the account.

- Method the transaction. Make use of your Visa or Mastercard or PayPal account to finish the transaction.

- Select the formatting and download the form on the product.

- Make changes. Fill out, edit and produce and indicator the acquired Wisconsin Self-Employed Drywall Services Contract.

Each web template you added to your account lacks an expiration date which is the one you have permanently. So, if you want to download or produce another copy, just proceed to the My Forms portion and click on the form you will need.

Obtain access to the Wisconsin Self-Employed Drywall Services Contract with US Legal Forms, by far the most comprehensive catalogue of legitimate file web templates. Use 1000s of expert and status-certain web templates that satisfy your organization or personal needs and specifications.

Form popularity

FAQ

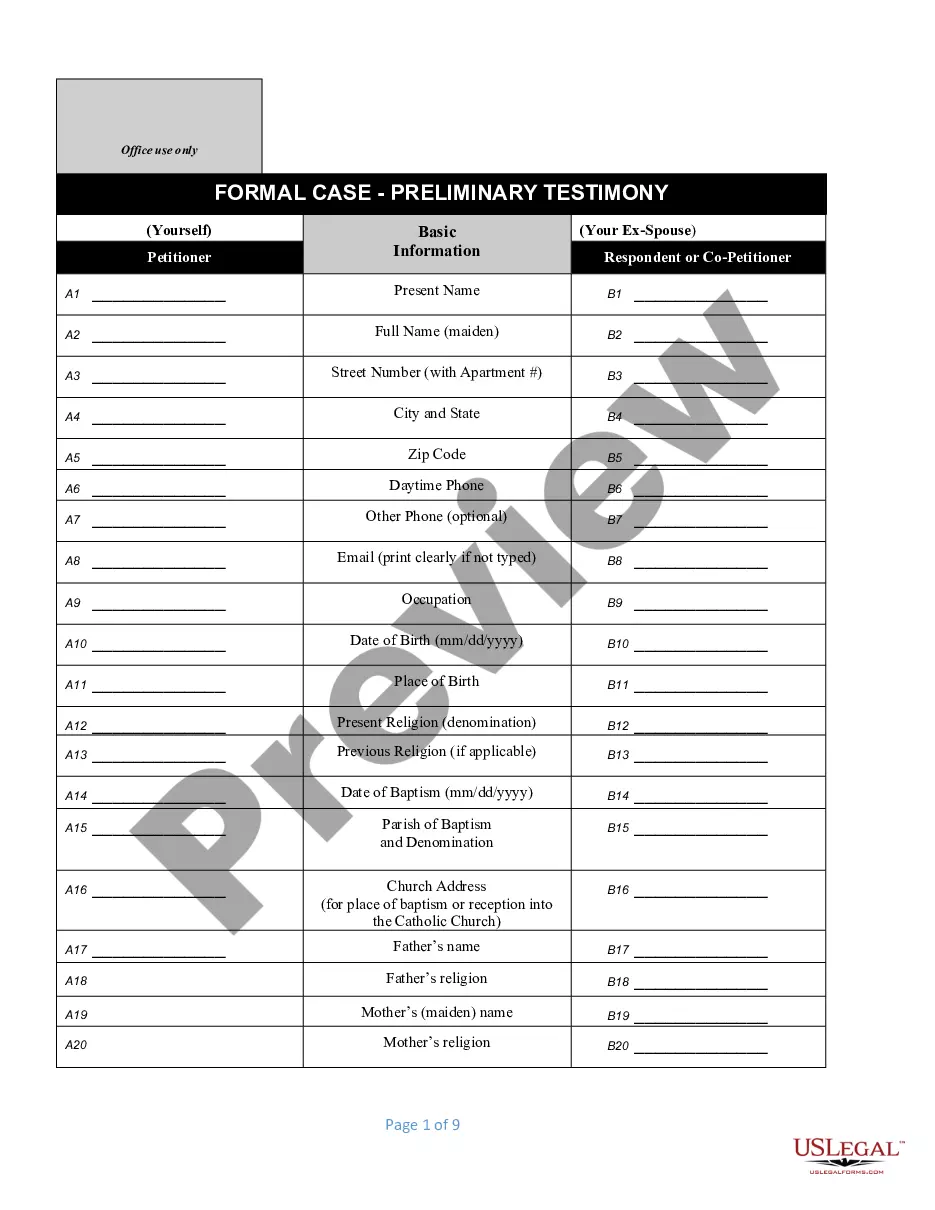

But in a strict sense, self-employed contractors do not have the rights and protections afforded to employees and workers. However, even if someone is described as being self-employed in their contract and pays tax as a self-employed person, they may in fact have 'worker' or, in some cases, 'employee' status.

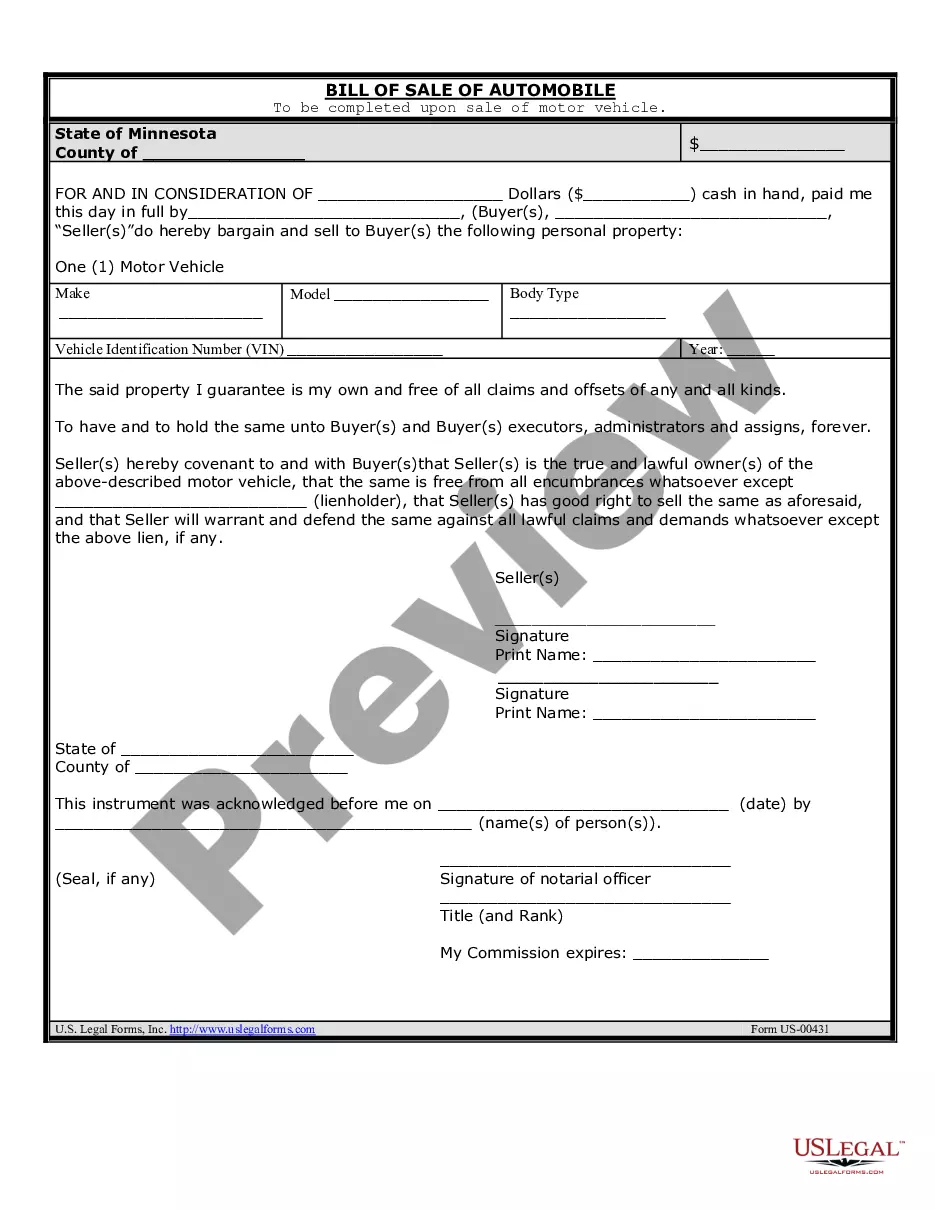

This agreement should clearly state what tasks the contractor is to perform. The agreement will also include what tasks will be performed and how much the contractor will be paid for his or her work. A contractor agreement can also help demonstrate that the person is truly an independent contractor and not an employee.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.