Wisconsin Special Improvement Project and Assessment (WISPA) is an initiative established by the state government of Wisconsin aimed at enhancing various aspects of infrastructure and development within the state. This program focuses on identifying areas that require improvement and providing necessary resources and funding for their enhancement. Leveraging various assessment methodologies, WISPA evaluates the current state of infrastructure, facilities, transportation systems, and public services across different regions of Wisconsin. The assessment process includes comprehensive analysis, data collection, and consultation with local authorities, communities, and stakeholders. By identifying existing deficiencies and potential improvements, WISPA aims to guide resource allocation and project prioritization effectively. The Wisconsin Special Improvement Project and Assessment encompasses different types of initiatives, each tailored to address specific needs and challenges: 1. Transportation Improvement Projects: These projects primarily aim to enhance the state's transportation infrastructure, including roads, highways, bridges, and public transit systems. WISPA identifies areas with high traffic congestion, safety concerns, or inadequate transportation facilities and initiates projects to alleviate these issues. 2. Public Facilities Enhancement: This category focuses on improving public facilities and amenities such as schools, libraries, parks, and community centers. WISPA assesses the condition and capacity of existing facilities, identifies areas requiring upgrades or reconstruction, and allocates resources accordingly. 3. Environmental Conservation and Preservation: Recognizing the importance of sustainable practices, WISPA includes projects that aim to preserve natural resources, protect the environment, and address climate change concerns. This includes initiatives related to renewable energy, waste management, clean water supply, and conservation efforts. 4. Urban Development and Revitalization: To cater to the evolving needs of urban areas, WISPA implements projects aimed at revitalizing neighborhoods, fostering economic growth, and improving the quality of life in cities. This may include initiatives such as downtown redevelopment, housing improvements, and community development initiatives. 5. Rural Infrastructure Development: WISPA recognizes the unique challenges faced by rural areas and aims to improve their infrastructure, connectivity, and access to services. It focuses on projects like road improvements, broadband expansion, rural healthcare facilities, and agricultural infrastructure enhancement to support rural communities. Through the Wisconsin Special Improvement Project and Assessment, the state of Wisconsin is dedicated to enhancing the overall living conditions and infrastructure for its residents. By utilizing data-driven assessments and collaborating with local authorities and communities, WISPA ensures that resources are allocated efficiently to address the specific needs of various regions across the state.

Wisconsin Special Improvement Project and Assessment

Description

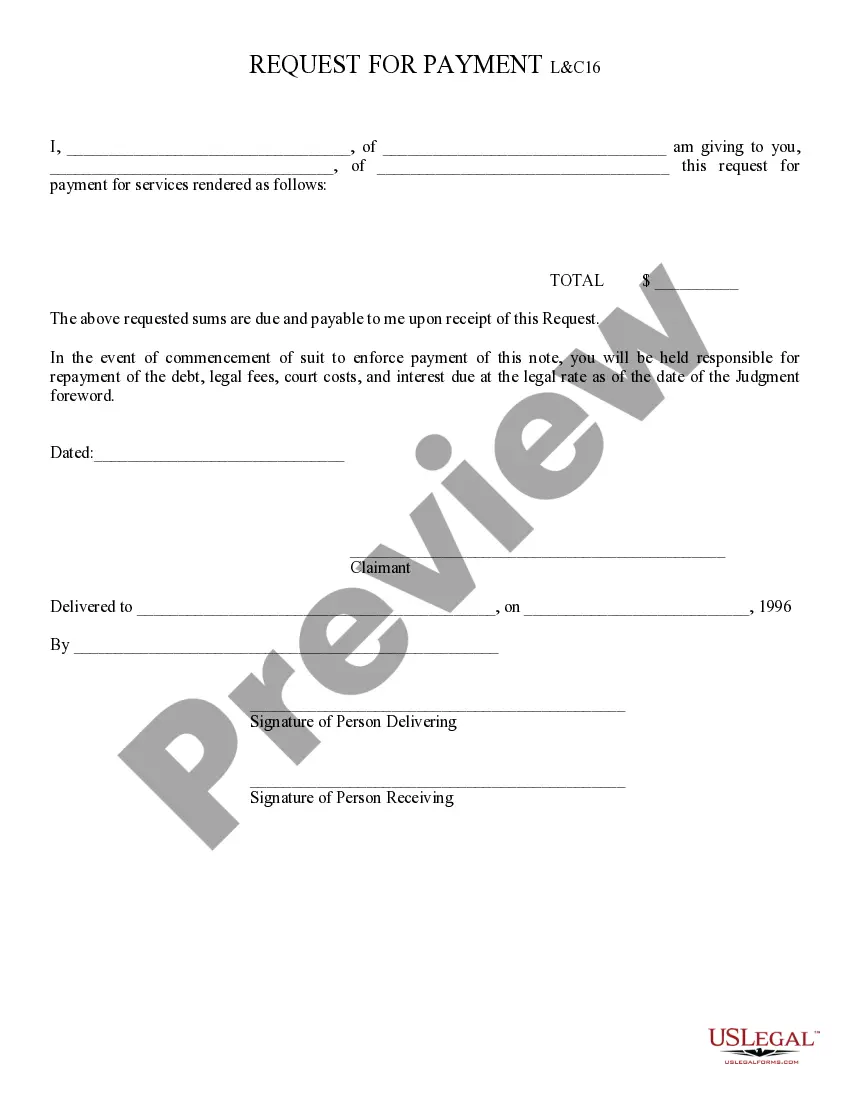

How to fill out Wisconsin Special Improvement Project And Assessment?

Have you been within a situation the place you need documents for both enterprise or specific uses just about every day? There are a lot of lawful papers templates available on the Internet, but locating types you can rely isn`t effortless. US Legal Forms provides 1000s of kind templates, like the Wisconsin Special Improvement Project and Assessment, that happen to be created to meet state and federal requirements.

When you are presently informed about US Legal Forms web site and possess an account, simply log in. Afterward, you can down load the Wisconsin Special Improvement Project and Assessment template.

If you do not offer an bank account and wish to begin using US Legal Forms, abide by these steps:

- Get the kind you will need and make sure it is for the right city/region.

- Make use of the Preview key to examine the shape.

- Look at the information to actually have selected the right kind.

- If the kind isn`t what you are seeking, utilize the Lookup industry to obtain the kind that meets your needs and requirements.

- Once you get the right kind, click on Acquire now.

- Pick the pricing program you would like, complete the desired details to create your bank account, and purchase your order using your PayPal or Visa or Mastercard.

- Pick a convenient file formatting and down load your duplicate.

Get all the papers templates you may have purchased in the My Forms food list. You can obtain a further duplicate of Wisconsin Special Improvement Project and Assessment at any time, if possible. Just select the essential kind to down load or produce the papers template.

Use US Legal Forms, one of the most comprehensive selection of lawful kinds, to save lots of time and stay away from blunders. The service provides appropriately made lawful papers templates that you can use for a range of uses. Produce an account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

A special assessment is an additional fee that is levied by a condominium association on top of regular condominium fees to cover unexpected expenses or make up for a shortfall in the reserve fund.

Note: In Wisconsin, buyers typically assume the cost of the future or pending assessments. Sellers will typically pay an assessment that has already been levied.

Neither taxes nor special assessments are paid by the acquiring authority during its period of ownership. Once a property is sold, the new buyer will be responsible for tax payments and special assessment responsibilities prorated from the date of the purchase.

Sometimes, the terms of a mortgage loan obtained by the buyer will require the seller to pay all special assessments which have been levied by the closing date ? even if they are not payable in the current year.

A special assessment tax is a surtax levied on property owners to pay for specific local infrastructure projects such as the construction or maintenance of roads or sewer lines. The tax is charged only to the owners of property in the neighborhood that will benefit from the project.

Wisconsin Stat. sec 66.0707(1) authorizes a municipality to levy a special assessment on property in an adjacent city, village or town, if the property benefits from the work or improvement. However, such a levy must be approved by resolution of the governing body of the municipality where the property is located.