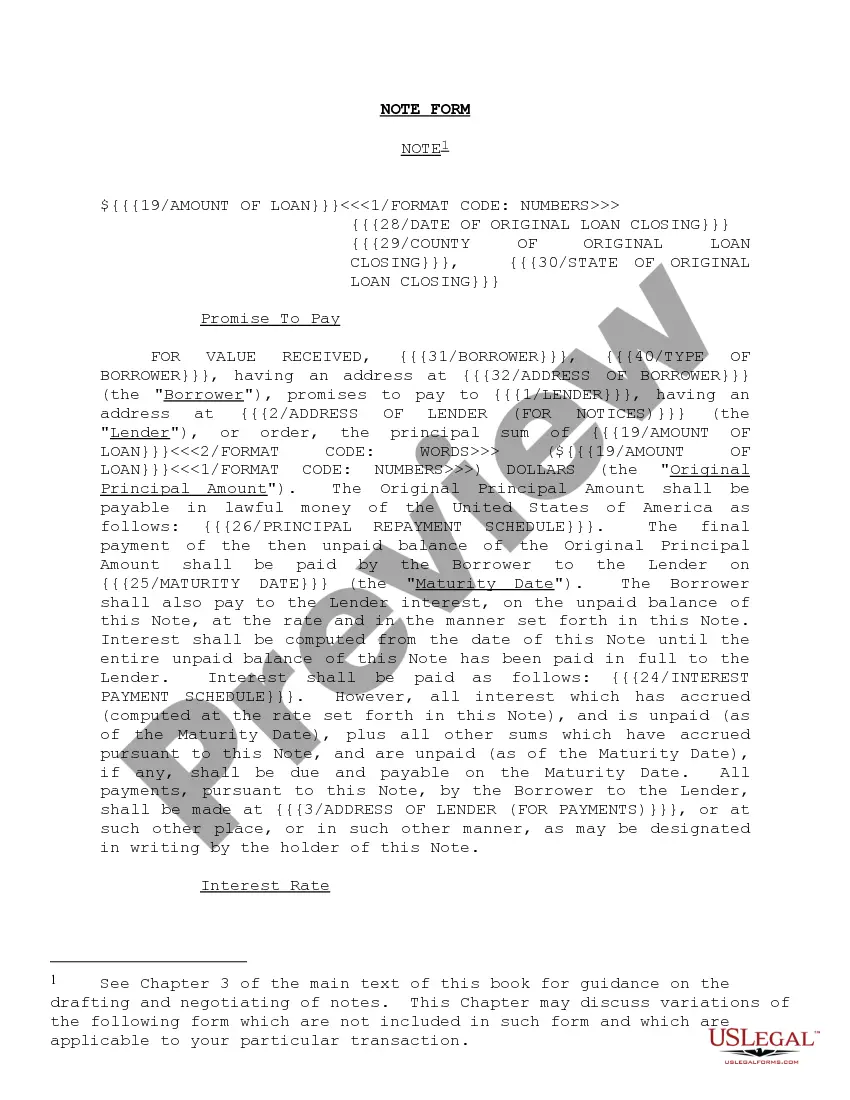

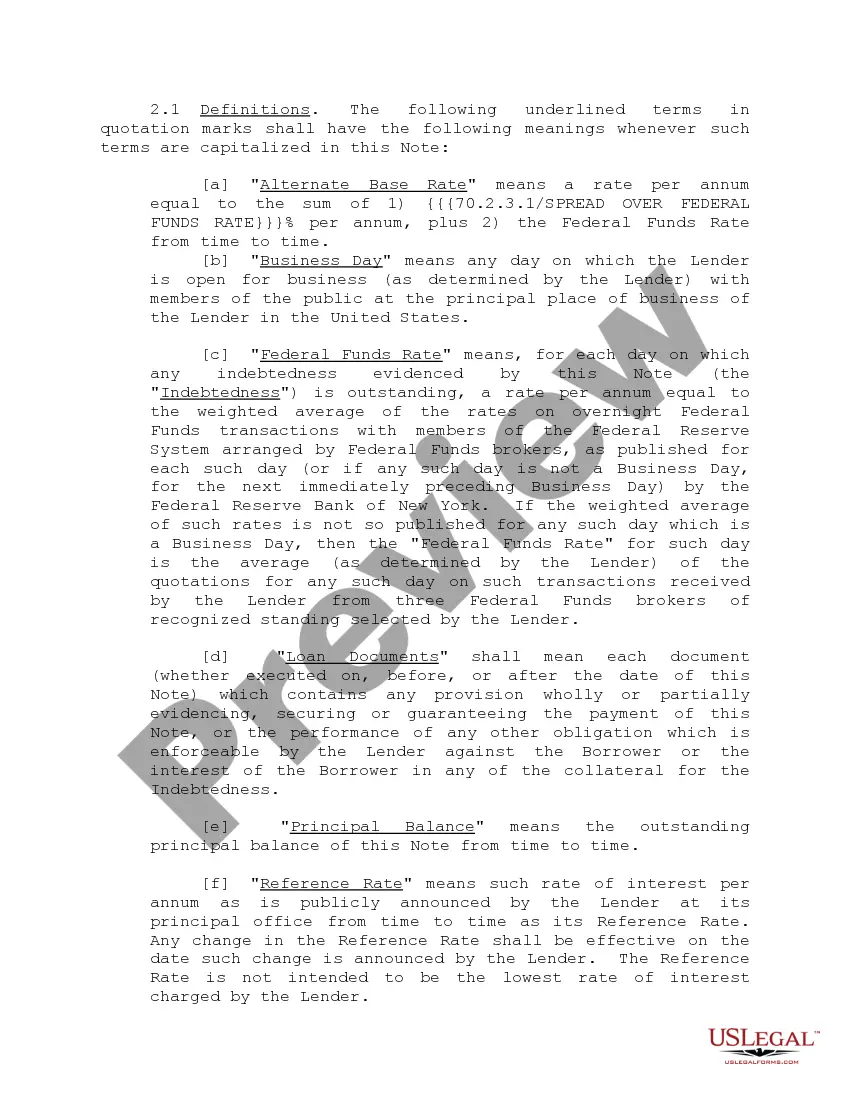

"Note Form and Variations" is a American Lawyer Media form. This form is for your note payments with different variations.

Wisconsin Note Form and Variations

Description

How to fill out Note Form And Variations?

If you want to comprehensive, download, or produce lawful record themes, use US Legal Forms, the most important assortment of lawful forms, that can be found online. Use the site`s easy and hassle-free look for to discover the files you want. Numerous themes for business and specific uses are sorted by groups and states, or search phrases. Use US Legal Forms to discover the Wisconsin Note Form and Variations in just a couple of click throughs.

When you are presently a US Legal Forms customer, log in to the account and click the Obtain option to get the Wisconsin Note Form and Variations. Also you can gain access to forms you earlier acquired from the My Forms tab of your own account.

If you work with US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have chosen the form to the appropriate city/region.

- Step 2. Utilize the Review solution to look through the form`s content material. Don`t overlook to read through the description.

- Step 3. When you are unhappy together with the kind, make use of the Research discipline towards the top of the display screen to discover other models from the lawful kind template.

- Step 4. When you have located the form you want, click the Acquire now option. Choose the rates plan you prefer and put your accreditations to register for the account.

- Step 5. Process the financial transaction. You should use your Мisa or Ьastercard or PayPal account to accomplish the financial transaction.

- Step 6. Pick the structure from the lawful kind and download it on the product.

- Step 7. Complete, revise and produce or indication the Wisconsin Note Form and Variations.

Every single lawful record template you acquire is the one you have forever. You might have acces to each and every kind you acquired inside your acccount. Click on the My Forms area and choose a kind to produce or download once more.

Remain competitive and download, and produce the Wisconsin Note Form and Variations with US Legal Forms. There are thousands of professional and condition-particular forms you can use to your business or specific requires.

Form popularity

FAQ

To help individuals calculate their income taxes, the Internal Revenue Service publishes tax tables each year in the instructions to your tax return and in IRS Publication 17.

The use tax rate is 5.5% (5% state tax plus 0.5% Dane County tax). For more information, see county sales and use tax. What are the special county tax rules?

As shown in Table 1, for 2022, a single tax- payer with Wisconsin AGI less than $16,990 has a standard deduction of $11,790; for single tax- payers with AGI in excess of $115,240, no standard deduction is provided.

How much is sales tax in Wisconsin? The base state sales tax rate in Wisconsin is 5%. Local tax rates in Wisconsin range from 0% to 0.6%, making the sales tax range in Wisconsin 5% to 5.6%.

Tangible products are taxable in Wisconsin, with a few exceptions. These exceptions include burial caskets, certain groceries, prescription medicine and medical devices, printed publications, modular or manufactured homes, manufacturing equipment, and some agricultural items.

Here's how to calculate the sales tax on an item or service: Know the retail price and the sales tax percentage. Divide the sales tax percentage by 100 to get a decimal. Multiply the retail price by the decimal to calculate the sales tax amount.

In general, 90% of the net tax shown on your income tax return should be withheld. OVER WITHHOLDING: If you are using Form WT?4 to claim the maximum number of exemptions to which you are entitled and your withholding exceeds your expected income tax liability, you may use Form WT?4A to minimize the over withholding.

Assemble Wisconsin income tax returns in this order: A complete Form 1, Form 1NPR, Form X-NOL, or Form 2. Be sure the pages are in the proper order. Note: If filing Form 804, Claim for Decedent's Wisconsin Income Tax Refund, with the return, place Form 804 on top of Form 1 or Form 1NPR.