Title: Understanding Wisconsin Direction for Payment of Royalty to Trustee by Royalty Owners Keywords: Wisconsin, Direction for Payment, Royalty, Trustee, Royalty Owners, Types. Introduction: In Wisconsin, the Direction for Payment of Royalty to Trustee by Royalty Owners provides important guidelines for distributing royalties among trust beneficiaries. This document ensures that royalty owners receive their rightful share of income generated from mineral, gas, or oil rights. Let's explore the intricacies of this process and understand the different types of Wisconsin Directions for Payment. 1. Definition of Wisconsin Direction for Payment: The Wisconsin Direction for Payment of Royalty to Trustee by Royalty Owners is a legally binding document that authorizes the trustee to collect royalty income on behalf of the royalty owners. It outlines the specific procedures, terms, and conditions for disbursing the funds. 2. Types of Wisconsin Direction for Payment to Trustee: a) Mineral Rights Direction for Payment: This type of Wisconsin Direction for Payment primarily focuses on royalty income generated from minerals, such as coal, gold, iron ore, etc. It outlines the procedures for calculating and distributing the income to the designated trust beneficiaries. b) Gas Rights Direction for Payment: This type of Wisconsin Direction for Payment caters to the royalties derived from gas rights. It addresses the specific procedures for managing and disbursing income obtained from the extraction and sale of natural gas. c) Oil Rights Direction for Payment: Similar to the Gas Rights Direction for Payment, this specific type deals with royalties earned from oil extraction. It provides direction on royalty collection, distribution calculations, and periodic payment methods for oil rights beneficiaries. 3. Role of Trustee: The trustee plays a significant role in carrying out the directions mentioned in the Wisconsin Direction for Payment. They have the fiduciary duty to act in the best interest of the royalty owners, ensuring fair and accurate distribution of royalty income as per the instructions outlined in the document. 4. Royalty Owner's Responsibilities: i) Reviewing and Approving the Wisconsin Direction for Payment: Royalty owners should carefully review and understand the directives mentioned in the document before approving it. Seek legal advice when necessary. ii) Providing Accurate Information: It is crucial for royalty owners to furnish reliable and up-to-date information to the trustee regarding their ownership interests. This helps facilitate an accurate calculation of royalty shares. iii) Regular Communication with the Trustee: Royalty owners should maintain effective communication with the trustee to stay informed about the status of royalty payments and any changes in the distribution process. Conclusion: The Wisconsin Direction for Payment of Royalty to Trustee by Royalty Owners is a vital document for ensuring fair and equitable distribution of royalty income. Whether it focuses on mineral, gas, or oil rights, this direction sets guidelines for trustees and clarifies the responsibilities of royalty owners. By adhering to these directives, both parties can maintain transparency and integrity in the payment process.

Wisconsin Direction For Payment of Royalty to Trustee by Royalty Owners

Description

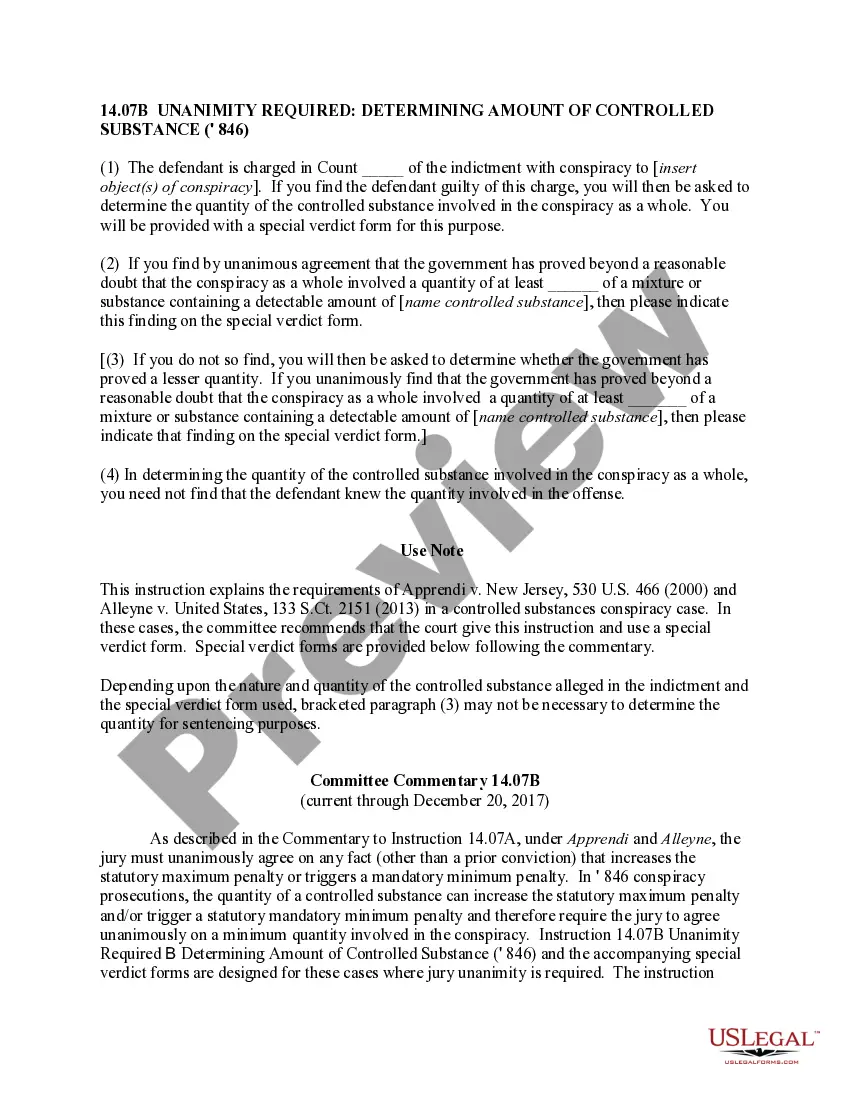

How to fill out Wisconsin Direction For Payment Of Royalty To Trustee By Royalty Owners?

You are able to invest hours online looking for the legitimate document web template that fits the federal and state demands you require. US Legal Forms offers a huge number of legitimate varieties that happen to be analyzed by experts. It is simple to down load or printing the Wisconsin Direction For Payment of Royalty to Trustee by Royalty Owners from your support.

If you already possess a US Legal Forms profile, you can log in and click the Download button. Next, you can full, change, printing, or indicator the Wisconsin Direction For Payment of Royalty to Trustee by Royalty Owners. Every legitimate document web template you acquire is yours forever. To obtain one more version of any acquired develop, proceed to the My Forms tab and click the corresponding button.

Should you use the US Legal Forms website the first time, follow the basic instructions below:

- Very first, ensure that you have chosen the right document web template for your state/town of your liking. Read the develop description to make sure you have picked the right develop. If readily available, take advantage of the Review button to appear from the document web template as well.

- If you wish to discover one more model of the develop, take advantage of the Search industry to discover the web template that suits you and demands.

- When you have identified the web template you want, click on Purchase now to proceed.

- Select the rates plan you want, type in your qualifications, and register for your account on US Legal Forms.

- Full the purchase. You can use your Visa or Mastercard or PayPal profile to cover the legitimate develop.

- Select the formatting of the document and down load it for your system.

- Make adjustments for your document if possible. You are able to full, change and indicator and printing Wisconsin Direction For Payment of Royalty to Trustee by Royalty Owners.

Download and printing a huge number of document themes using the US Legal Forms website, that offers the greatest assortment of legitimate varieties. Use specialist and express-certain themes to tackle your small business or personal demands.