Wisconsin Marketing of Production

Description

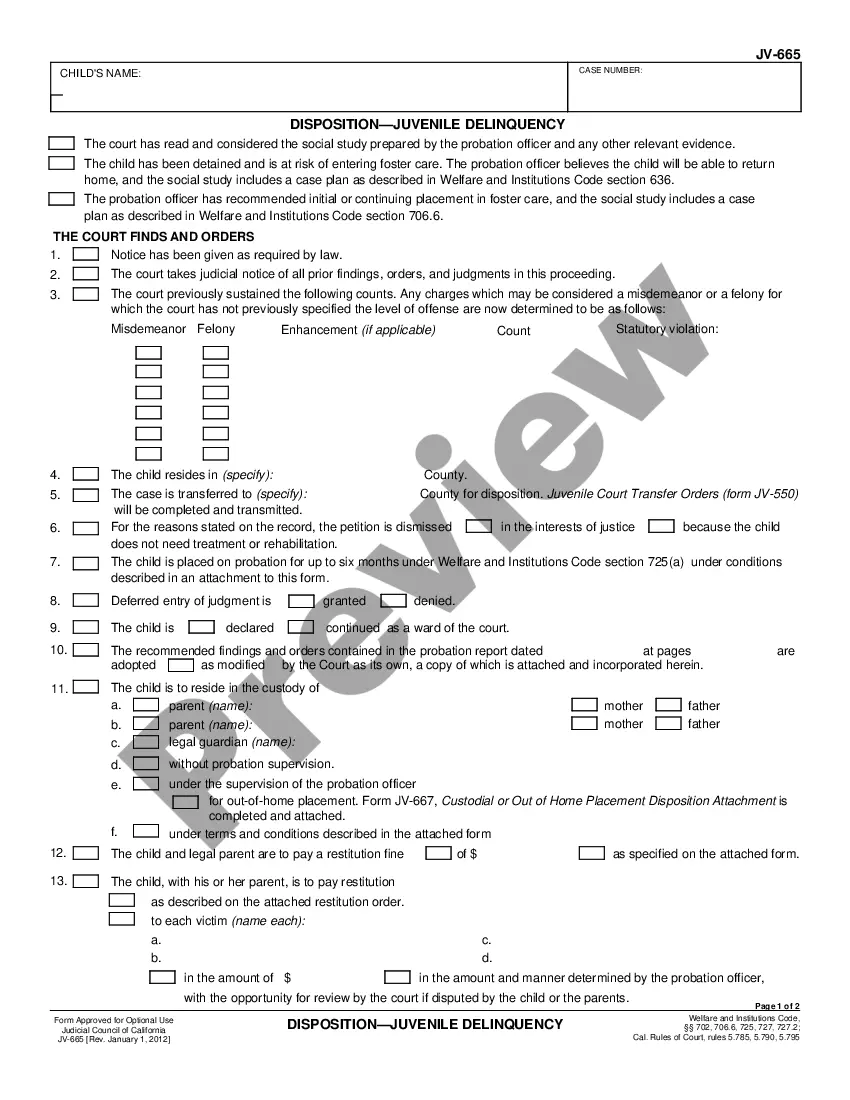

How to fill out Marketing Of Production?

US Legal Forms - one of the most significant libraries of legitimate kinds in the States - delivers an array of legitimate file web templates it is possible to download or produce. Using the website, you can find a huge number of kinds for business and specific uses, sorted by classes, suggests, or keywords and phrases.You can find the newest models of kinds such as the Wisconsin Marketing of Production in seconds.

If you already have a monthly subscription, log in and download Wisconsin Marketing of Production through the US Legal Forms collection. The Download switch will appear on every develop you view. You have access to all in the past downloaded kinds from the My Forms tab of the profile.

If you wish to use US Legal Forms initially, allow me to share easy directions to obtain started out:

- Be sure you have picked out the best develop for your metropolis/area. Click the Review switch to check the form`s articles. Browse the develop information to ensure that you have selected the correct develop.

- In the event the develop doesn`t satisfy your needs, utilize the Research discipline near the top of the monitor to obtain the one which does.

- When you are pleased with the form, affirm your decision by simply clicking the Purchase now switch. Then, choose the pricing prepare you want and give your accreditations to sign up for the profile.

- Method the financial transaction. Make use of Visa or Mastercard or PayPal profile to accomplish the financial transaction.

- Pick the file format and download the form on your own product.

- Make adjustments. Fill out, edit and produce and indication the downloaded Wisconsin Marketing of Production.

Every web template you put into your money does not have an expiration date and it is your own forever. So, if you would like download or produce yet another version, just go to the My Forms section and click on about the develop you will need.

Get access to the Wisconsin Marketing of Production with US Legal Forms, the most considerable collection of legitimate file web templates. Use a huge number of expert and express-particular web templates that satisfy your small business or specific requirements and needs.

Form popularity

FAQ

As shown in Table 1, for 2022, a single tax- payer with Wisconsin AGI less than $16,990 has a standard deduction of $11,790; for single tax- payers with AGI in excess of $115,240, no standard deduction is provided.

The manufacturing and agriculture credit is available to claimants that derive qualified production activities income from property located in Wisconsin that is assessed as either manufacturing or agricultural.

Assuming all of a corporation's income is derived from manufacturing and agriculture property lo- cated in Wisconsin, the MAC has the effect of re- ducing the statutory corporate tax rate of 7.9% to an effective rate of 0.4% on the corporation's tax- able income (7.9% - 7.5% = 0.4%).

Effective Tax Rates under the MAC Under both taxes, the MAC equals 7.5% of the claimant's eligible QPAI derived from Wisconsin property that is assessed as manufacturing or agri- cultural under state property tax law. The tax credit is nonrefundable.

Itemized Deduction Credit: If the total of your itemized deductions exceed your WI standard deduction, you can claim the itemized deduction credit. These items are pulled from your federal return and include: Medical and dental expenses. Interest paid form federal Schedule A.

The personal exemptions are $700 for individuals, their spouses, and dependents, and an additional $250 for taxpayers and their spouses (if filing a joint return) who have reached the age of 65 before the close of the taxable year.