Wisconsin Subordination Agreement (Deed of Trust)

Description

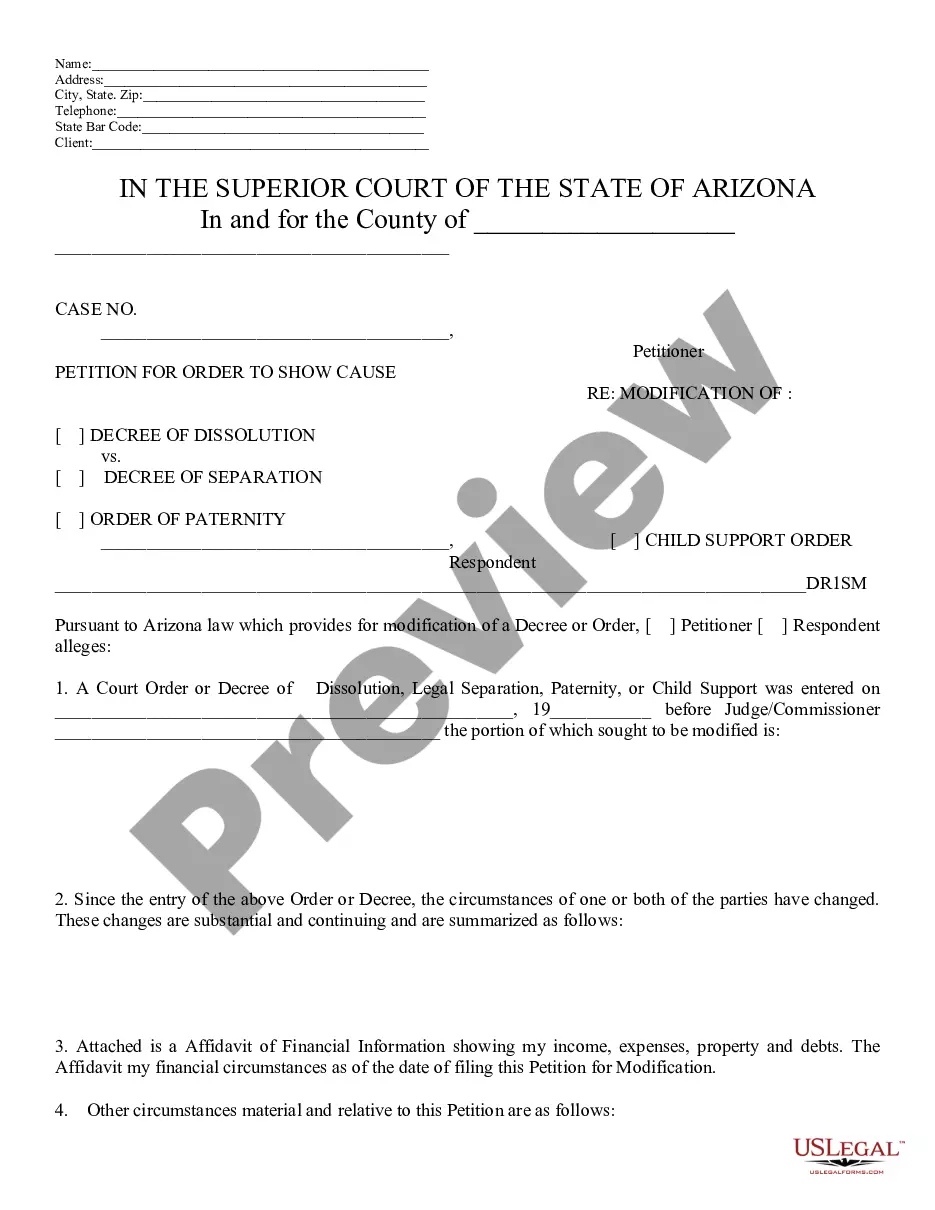

How to fill out Subordination Agreement (Deed Of Trust)?

Are you currently within a situation the place you require files for either business or person reasons virtually every time? There are tons of authorized file web templates accessible on the Internet, but locating ones you can rely on isn`t easy. US Legal Forms delivers 1000s of type web templates, much like the Wisconsin Subordination Agreement (Deed of Trust), which are created to fulfill federal and state specifications.

In case you are previously acquainted with US Legal Forms site and also have your account, merely log in. Following that, you can download the Wisconsin Subordination Agreement (Deed of Trust) design.

If you do not provide an bank account and would like to begin using US Legal Forms, abide by these steps:

- Discover the type you require and ensure it is for your right town/area.

- Take advantage of the Preview switch to check the shape.

- Read the information to ensure that you have selected the proper type.

- In case the type isn`t what you`re looking for, make use of the Look for area to find the type that meets your needs and specifications.

- Whenever you get the right type, simply click Purchase now.

- Choose the rates program you want, fill in the desired information and facts to make your money, and buy an order making use of your PayPal or credit card.

- Select a hassle-free paper structure and download your duplicate.

Get each of the file web templates you might have purchased in the My Forms food selection. You can obtain a more duplicate of Wisconsin Subordination Agreement (Deed of Trust) whenever, if necessary. Just click on the necessary type to download or print the file design.

Use US Legal Forms, by far the most substantial collection of authorized forms, to conserve efforts and avoid errors. The services delivers professionally manufactured authorized file web templates which you can use for an array of reasons. Generate your account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

The creditor usually will require the debtor to sign a subordination agreement which ensures they get paid before other creditors, ensuring they are not taking on high risks.

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future.

What is subordination? Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance. When you have a home equity line of credit, for example, you actually have two loans ? your mortgage and HELOC. Both are secured by the collateral in your home at the same time.

A subordination agreement must be signed and acknowledged by a notary and recorded in the official records of the county to be enforceable.

Example of a Subordination Agreement A standard subordination agreement covers property owners that take a second mortgage against a property. One loan becomes the subordinated debt, and the other becomes (or remains) the senior debt. Senior debt has higher claim priority than junior debt.

Let's illustrate a subordinate clause in a sentence: 'I played out until it went dark. ' The phrase 'until it went dark' is the subordinate clause because it requires additional information in order to make sense.

This Lease and any Option granted hereby shall be subject and subordinate to any ground lease, mortgage, deed of trust, or other hypothecation or security device (collectively, ?Security Device?), now or hereafter placed upon the Premises, to any and all advances made on the security thereof, and to all renewals, ...

A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first. If other subordinate mortgages are involved, the secondary liens will take a backseat in this process.