Wisconsin Subordination of Lien (Deed of Trust/Mortgage)

Description

How to fill out Subordination Of Lien (Deed Of Trust/Mortgage)?

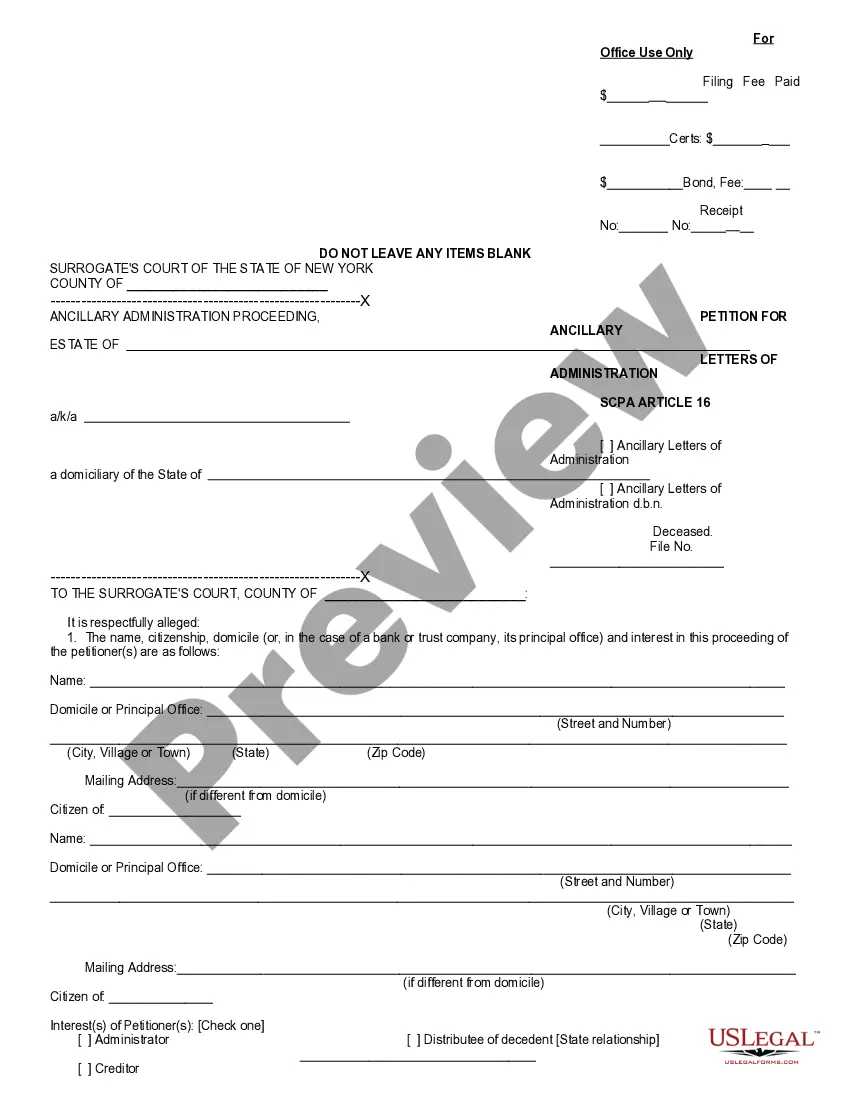

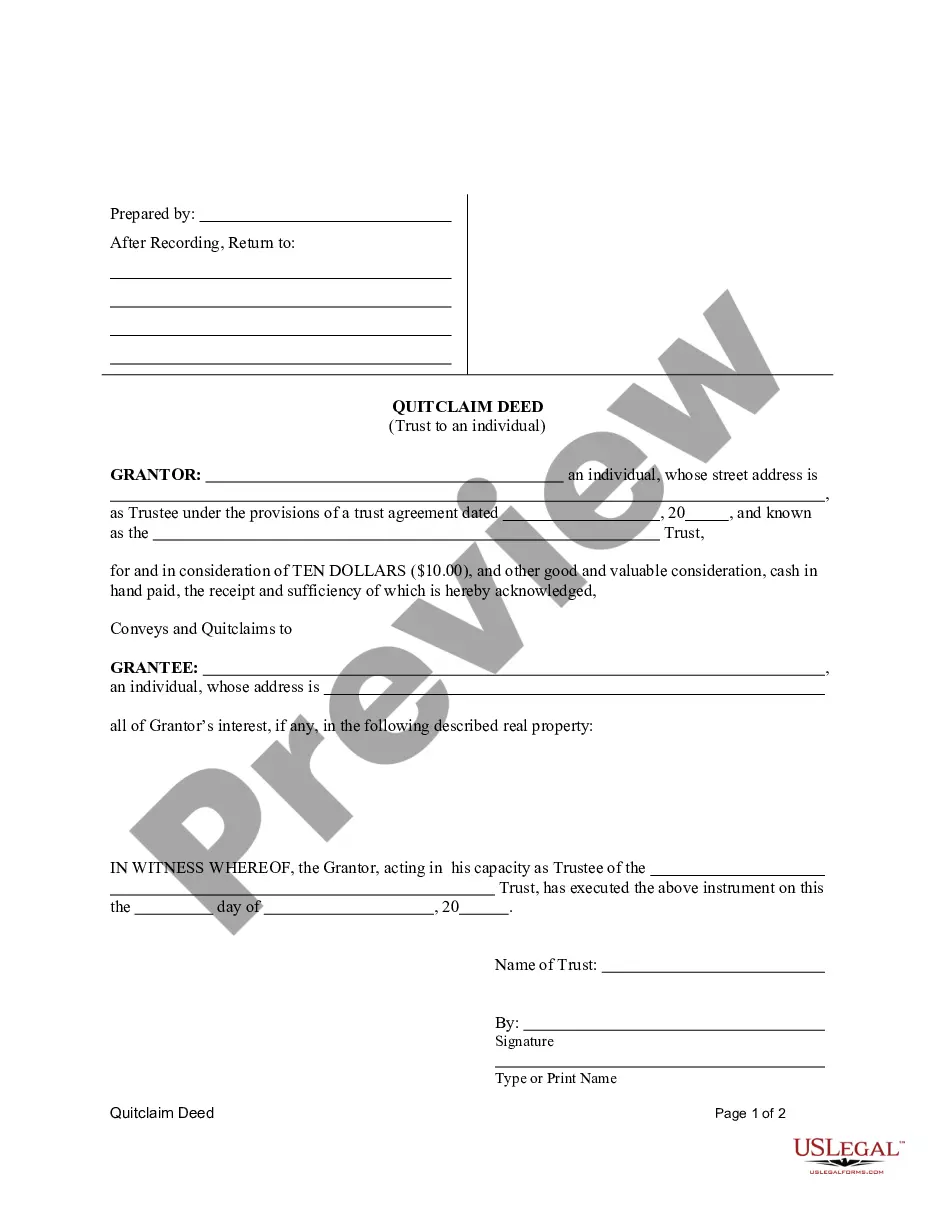

Are you currently in a placement that you require papers for both organization or personal functions virtually every time? There are plenty of lawful record web templates available on the Internet, but getting kinds you can depend on is not easy. US Legal Forms provides 1000s of kind web templates, much like the Wisconsin Subordination of Lien (Deed of Trust/Mortgage), that happen to be composed in order to meet federal and state needs.

When you are currently acquainted with US Legal Forms website and get an account, just log in. After that, it is possible to obtain the Wisconsin Subordination of Lien (Deed of Trust/Mortgage) design.

Unless you offer an bank account and wish to begin using US Legal Forms, follow these steps:

- Obtain the kind you will need and make sure it is for that right city/region.

- Utilize the Preview switch to examine the shape.

- Look at the description to actually have selected the right kind.

- In case the kind is not what you`re looking for, make use of the Research industry to find the kind that suits you and needs.

- When you obtain the right kind, click Buy now.

- Pick the pricing strategy you desire, fill out the required details to generate your money, and pay for an order making use of your PayPal or charge card.

- Pick a practical file format and obtain your duplicate.

Find each of the record web templates you might have purchased in the My Forms menus. You can obtain a more duplicate of Wisconsin Subordination of Lien (Deed of Trust/Mortgage) whenever, if necessary. Just click the required kind to obtain or produce the record design.

Use US Legal Forms, probably the most considerable assortment of lawful forms, to conserve time as well as steer clear of blunders. The services provides appropriately created lawful record web templates that you can use for a range of functions. Generate an account on US Legal Forms and initiate making your life a little easier.

Form popularity

FAQ

The creditor usually will require the debtor to sign a subordination agreement which ensures they get paid before other creditors, ensuring they are not taking on high risks.

When you get a mortgage loan, the lender will likely include a subordination clause essentially stating that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender if a homeowner defaults.

A mortgage subordination refers to the order the outstanding liens on your property get repaid if you stop making your mortgage payments. For example, your first home loan (primary mortgage) is repaid first, with any remaining funds paying off additional liens, including second mortgages, HELOCs and home equity loans.

To adjust their priority, subordinate lienholders must sign subordination agreements, making their loans lower in priority than the new lender. A subordination agreement puts the new lender into first position and reassigns an existing mortgage to second position or third position, and so on.

A subordination agreement is an instrument that allows a first lien or interest to be paid off and allows another first mortgage company to come in and be the first priority lien holder. It is very common for the borrower to pay subordination fees.

The party that primarily benefits from a subordination clause in real estate is the lender. However, if you decide to pursue a second mortgage, then the subordination clause prioritizes the first lender's repayment and contract rights. The most common application of subordination clauses is when refinancing a property.

Get the terminology right In addition, a deed of priority usually addresses what steps each lender may take to enforce its security. Subordination deed ? this deals with the entitlement of the different creditors to receive payments .

A subordinated loan is also known as subordinated debt, subordinated debenture, and junior debt. Subordinated debt holders receive payment after the senior debt has been fully settled in the event of a liquidation. High yield bonds and mezzanine debt are two examples of subordinated loans.