Wisconsin Partial Release of Lien on Assigned Overriding Royalty Interest

Description

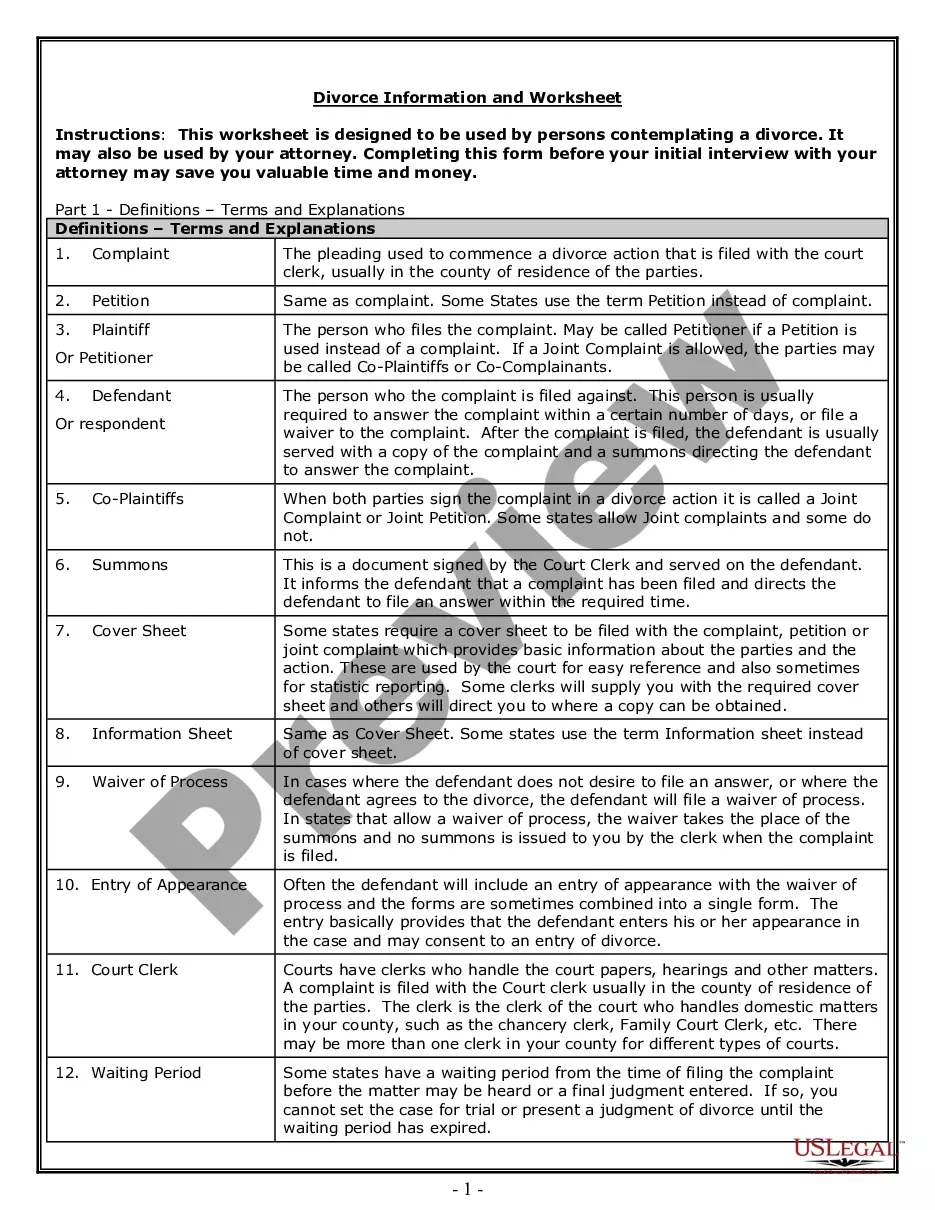

How to fill out Partial Release Of Lien On Assigned Overriding Royalty Interest?

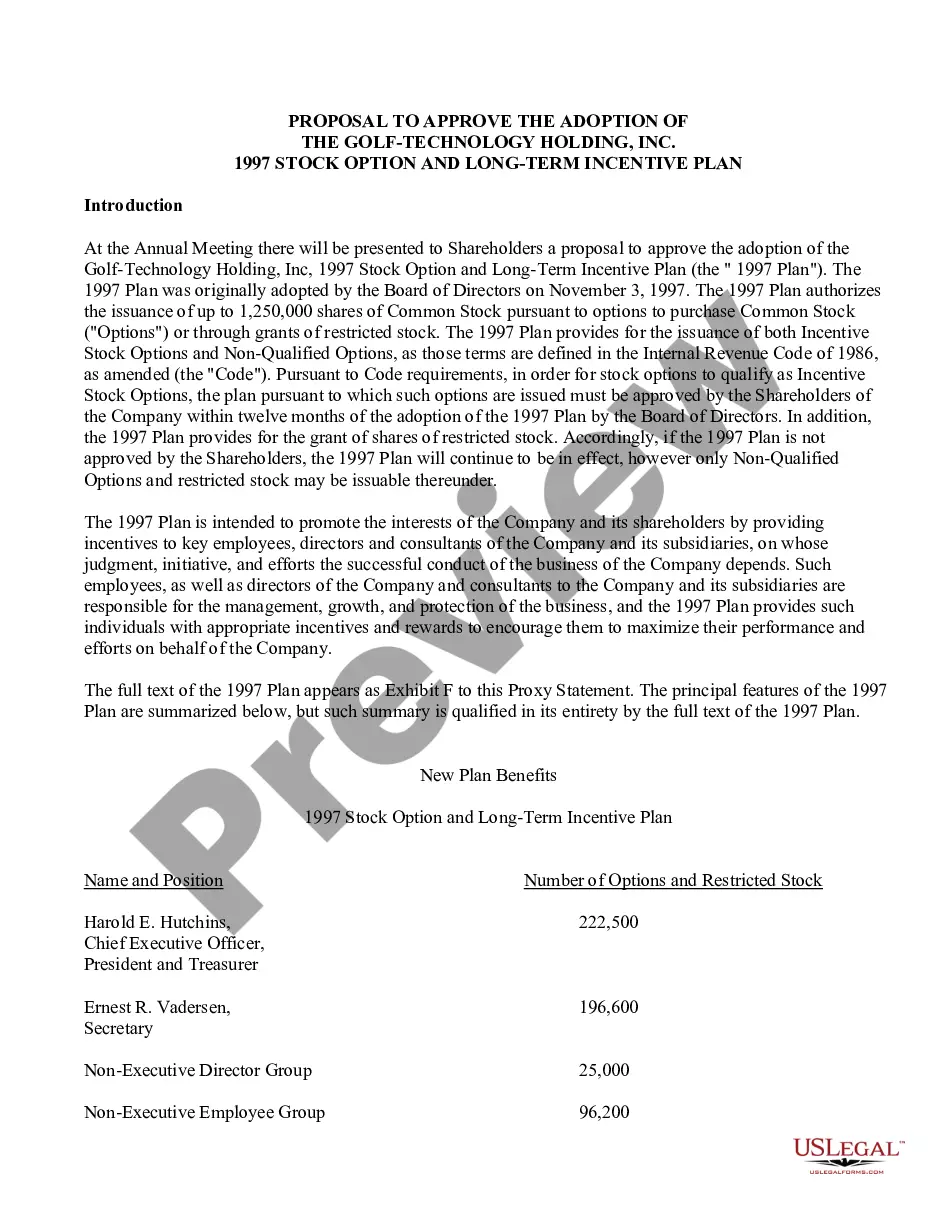

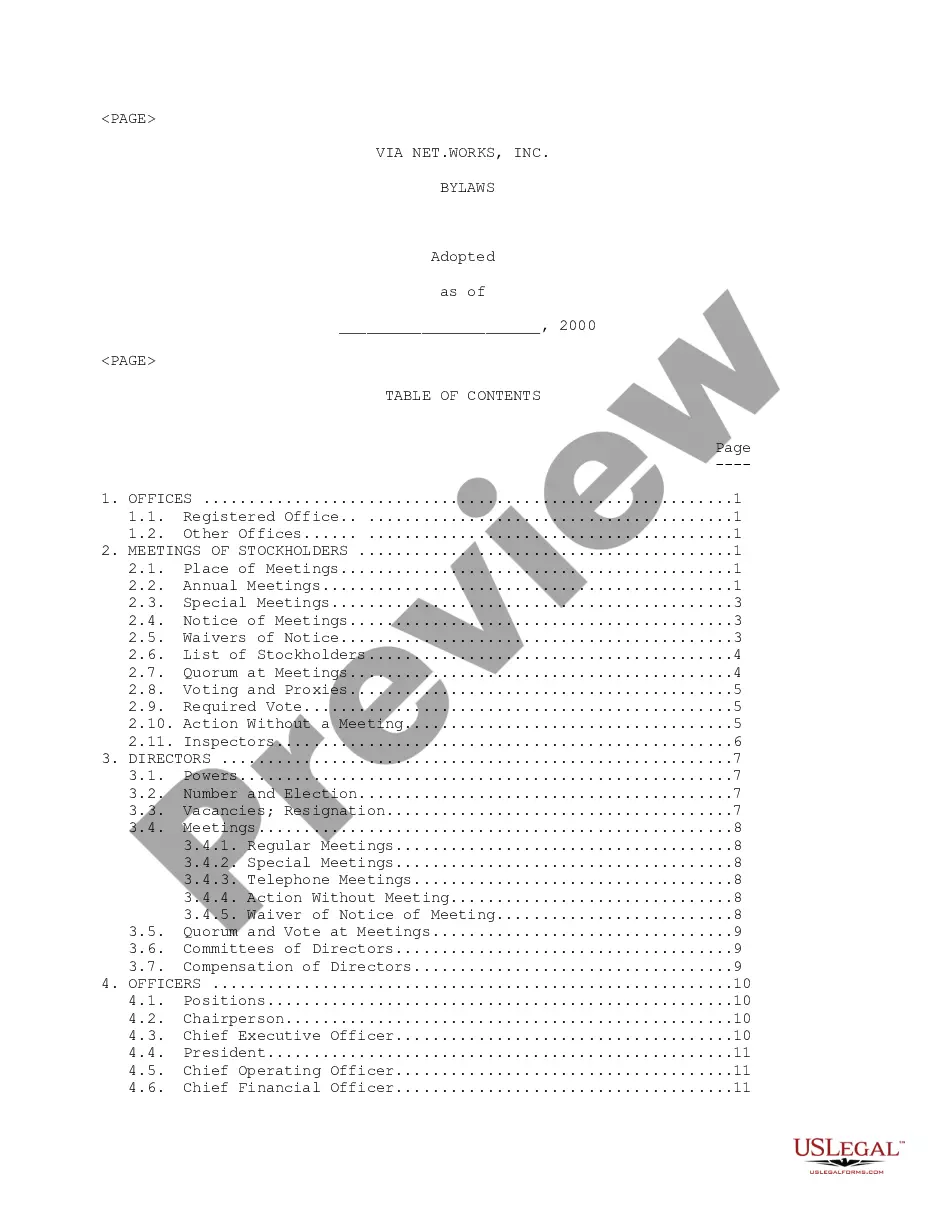

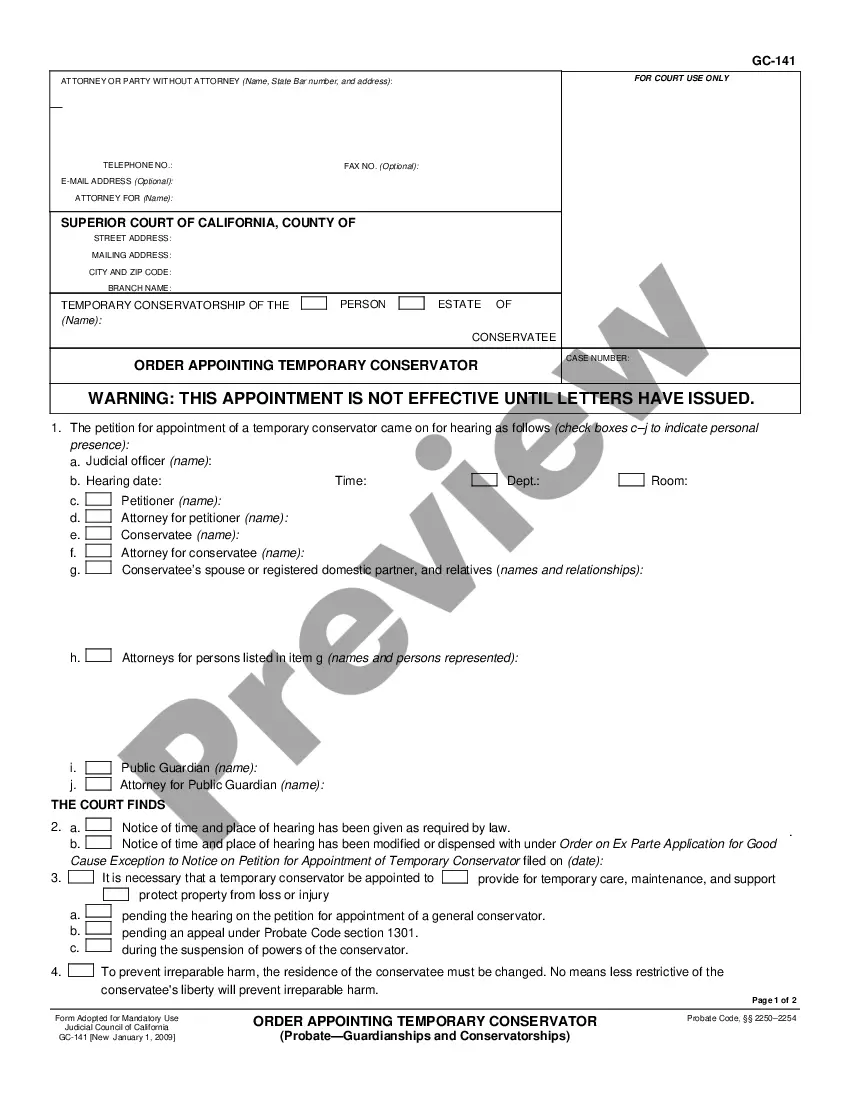

If you wish to complete, acquire, or produce lawful record templates, use US Legal Forms, the largest variety of lawful types, that can be found on the Internet. Use the site`s simple and easy convenient lookup to obtain the files you need. Different templates for company and specific uses are categorized by categories and states, or keywords and phrases. Use US Legal Forms to obtain the Wisconsin Partial Release of Lien on Assigned Overriding Royalty Interest in a few click throughs.

If you are previously a US Legal Forms customer, log in to the account and click the Obtain button to find the Wisconsin Partial Release of Lien on Assigned Overriding Royalty Interest. You can also accessibility types you formerly saved within the My Forms tab of your account.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the form for the appropriate town/nation.

- Step 2. Take advantage of the Preview choice to look over the form`s content. Don`t forget about to read through the description.

- Step 3. If you are not happy with the type, utilize the Search field at the top of the screen to discover other types in the lawful type format.

- Step 4. Upon having discovered the form you need, go through the Get now button. Opt for the pricing plan you favor and put your accreditations to sign up for the account.

- Step 5. Method the financial transaction. You can use your bank card or PayPal account to perform the financial transaction.

- Step 6. Pick the structure in the lawful type and acquire it in your system.

- Step 7. Full, modify and produce or sign the Wisconsin Partial Release of Lien on Assigned Overriding Royalty Interest.

Each and every lawful record format you buy is yours permanently. You may have acces to every single type you saved in your acccount. Select the My Forms segment and pick a type to produce or acquire once again.

Remain competitive and acquire, and produce the Wisconsin Partial Release of Lien on Assigned Overriding Royalty Interest with US Legal Forms. There are thousands of professional and status-certain types you can utilize for your company or specific needs.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

Overriding Royalty Interest Example The mineral estate can be severed from the surface, beginning two separate chains of title. The mineral owner has the right to explore and develop the minerals, but the vast majority do not have the finances or knowledge to drill and operate a well.

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.