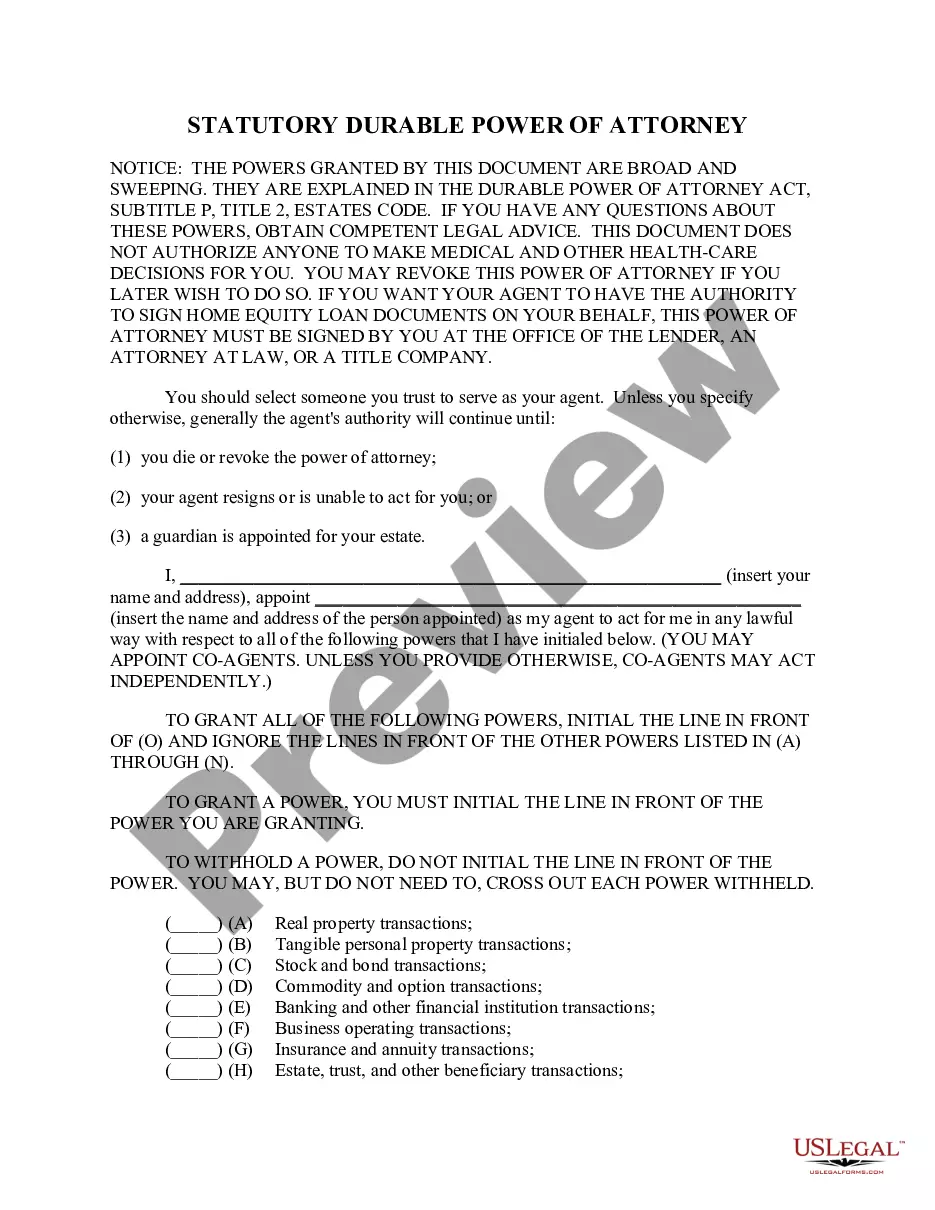

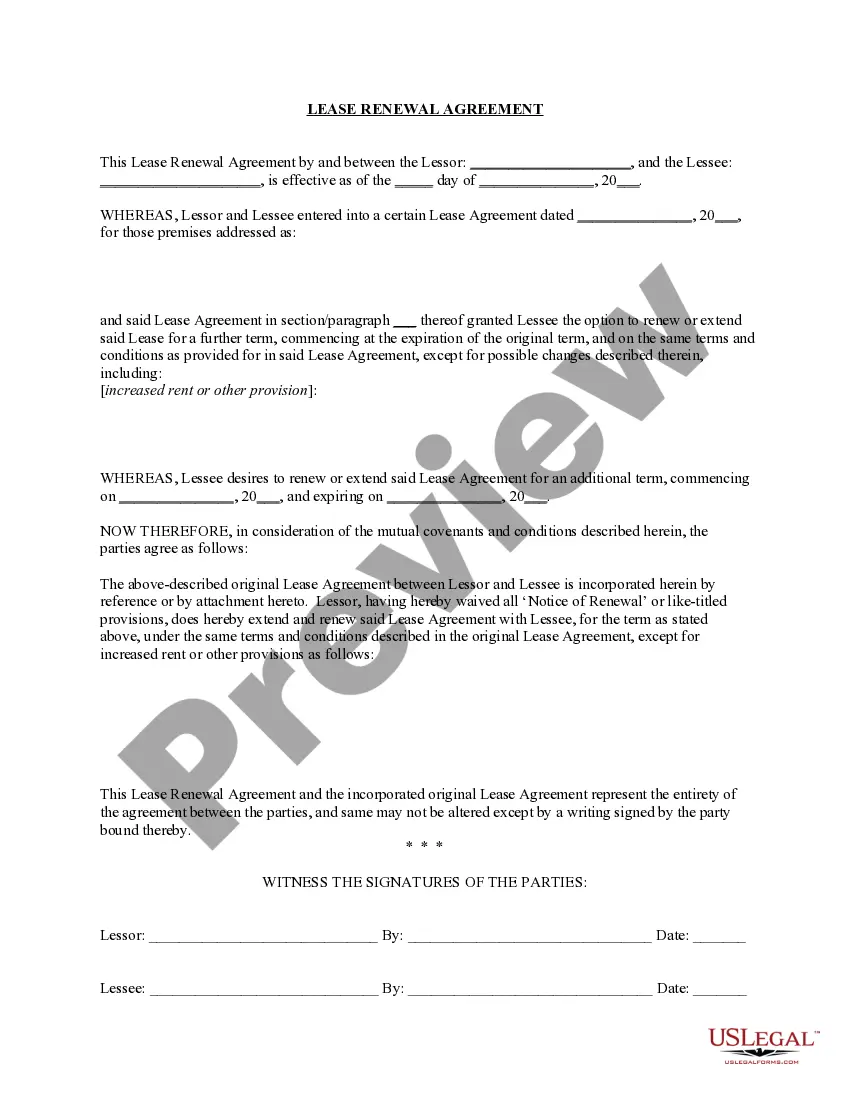

This office lease form states that a guaranty in which a corporate guarantor has the authority of the signatory to bind a corporation. This guaranty gives the guarantor full power, authority and legal right to execute and deliver this guaranty and that this guaranty constitutes the valid and binding obligation of the guarantor.

Wisconsin Authority of Signatory to Bind the Guarantor

Description

How to fill out Authority Of Signatory To Bind The Guarantor?

If you have to comprehensive, acquire, or print out legal record web templates, use US Legal Forms, the biggest assortment of legal kinds, which can be found on the web. Use the site`s simple and easy handy search to discover the documents you want. A variety of web templates for organization and personal uses are sorted by groups and says, or keywords and phrases. Use US Legal Forms to discover the Wisconsin Authority of Signatory to Bind the Guarantor in just a few mouse clicks.

When you are already a US Legal Forms client, log in in your accounts and click the Acquire key to get the Wisconsin Authority of Signatory to Bind the Guarantor. You may also gain access to kinds you formerly acquired inside the My Forms tab of the accounts.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for the right metropolis/nation.

- Step 2. Use the Preview choice to look over the form`s articles. Never overlook to read through the description.

- Step 3. When you are unsatisfied together with the develop, utilize the Research field on top of the screen to find other versions in the legal develop format.

- Step 4. Upon having located the form you want, click on the Acquire now key. Select the pricing prepare you prefer and add your references to register on an accounts.

- Step 5. Approach the financial transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to complete the financial transaction.

- Step 6. Select the format in the legal develop and acquire it on the gadget.

- Step 7. Comprehensive, change and print out or signal the Wisconsin Authority of Signatory to Bind the Guarantor.

Each legal record format you get is your own property forever. You may have acces to each and every develop you acquired with your acccount. Click on the My Forms section and choose a develop to print out or acquire again.

Be competitive and acquire, and print out the Wisconsin Authority of Signatory to Bind the Guarantor with US Legal Forms. There are many professional and express-specific kinds you can use for your organization or personal requires.

Form popularity

FAQ

The statute of frauds requires that if one wishes to enforce a contract for the sale/purchase of real estate, the contract must be in writing, set forth all the essential terms with particularity, and be signed by all parties to the transaction. See WIS. STAT. § 706.02 (2009-10).

Wisconsin's Uniform Electronic Transactions Act provides that a contract, signature, or record may not be denied legal effect or enforceability solely because it is in electronic form. Read how the Act affects your clients and how they, and you, conduct business.

411.506 Statute of limitations. (1) An action for default under a lease contract, including breach of warranty or indemnity, shall be commenced within 4 years after the cause of action accrued.

Section 411.201 - Statute of frauds (1) A lease contract is not enforceable by way of action or defense unless any of the following occurs: (a) The total payments to be made under the lease contract, excluding payments for options to renew or buy, are less than $1,000.

(1) An action for breach of any contract for sale must be commenced within 6 years after the cause of action has accrued. By the original agreement the parties, if they are merchants, may reduce the period of limitation to not less than one year. The period of limitation may not otherwise be varied by agreement.

The Uniform Commercial Code and Wisconsin case law recognize exceptions to the statute of frauds, including waiver and performance. An attempt at modification contemplates a completed oral modification of a written contract that prohibits oral modification.

§ 3, the federal accessory after the fact statute, provides: ?Whoever, knowing that an offense against the United States has been committed, receives, relieves, comforts or assists the offender in order to hinder or prevent his [or her] apprehension, trial or punishment, is an accessory after the fact.? WISCONSIN STAT.

Summary. An individual who is a party to an in-person, telephone or electronic conversation, or who has the consent of one of the parties to the conversation, can lawfully record it or disclose its contents, unless the person is doing so for the purpose of committing a criminal or tortious act. Wis. Stat.