Wisconsin Clauses Relating to Initial Capital Contributions are legal provisions that govern the contributions made by members or shareholders to a limited liability company (LLC) or corporation in the state of Wisconsin. These clauses outline important details regarding the initial capital investments required from the owners or shareholders when forming a new business or raising additional capital. In Wisconsin, there are primarily two types of Clauses Relating to Initial Capital Contributions: Mandatory Capital Contribution Clause and Voluntary Capital Contribution Clause. 1. Mandatory Capital Contribution Clause: This clause specifies the minimum amount of capital that each member or shareholder must contribute to the company before or during its formation. It is often expressed as a percentage of ownership or defined in monetary terms. The purpose of this clause is to ensure that each member makes a fair and equitable contribution to the company's financial resources, promoting the sustainability and stability of the business. 2. Voluntary Capital Contribution Clause: This clause allows members or shareholders to make additional contributions to the company's capital on a voluntary basis, beyond the mandatory requirements. While not obligatory, voluntary capital contributions can be made by the owners at any time during the existence of the company. The clause may stipulate the process for making the contribution, the rights associated with additional contributions, and how these contributions will be allocated among the members or shareholders. Both of these clauses are crucial for companies in Wisconsin, as they define the financial obligations and responsibilities of each member or shareholder. They provide a clear framework for initial and ongoing capital contributions, ensuring fairness and transparency among all parties involved. By specifying the capital required for participation, these clauses protect the interests of those contributing significant financial resources and contribute to the overall financial health and success of the business. In conclusion, Wisconsin Clauses Relating to Initial Capital Contributions define the minimum and voluntary contributions that members or shareholders must make to an LLC or corporation. These clauses ensure fairness, equity, and stability within the company, benefiting all stakeholders involved. It is essential for businesses in Wisconsin to include these clauses in their formation documents or operating agreements to establish clear guidelines for capital contributions and promote a healthy and prosperous business environment.

Wisconsin Clauses Relating to Initial Capital contributions

Description

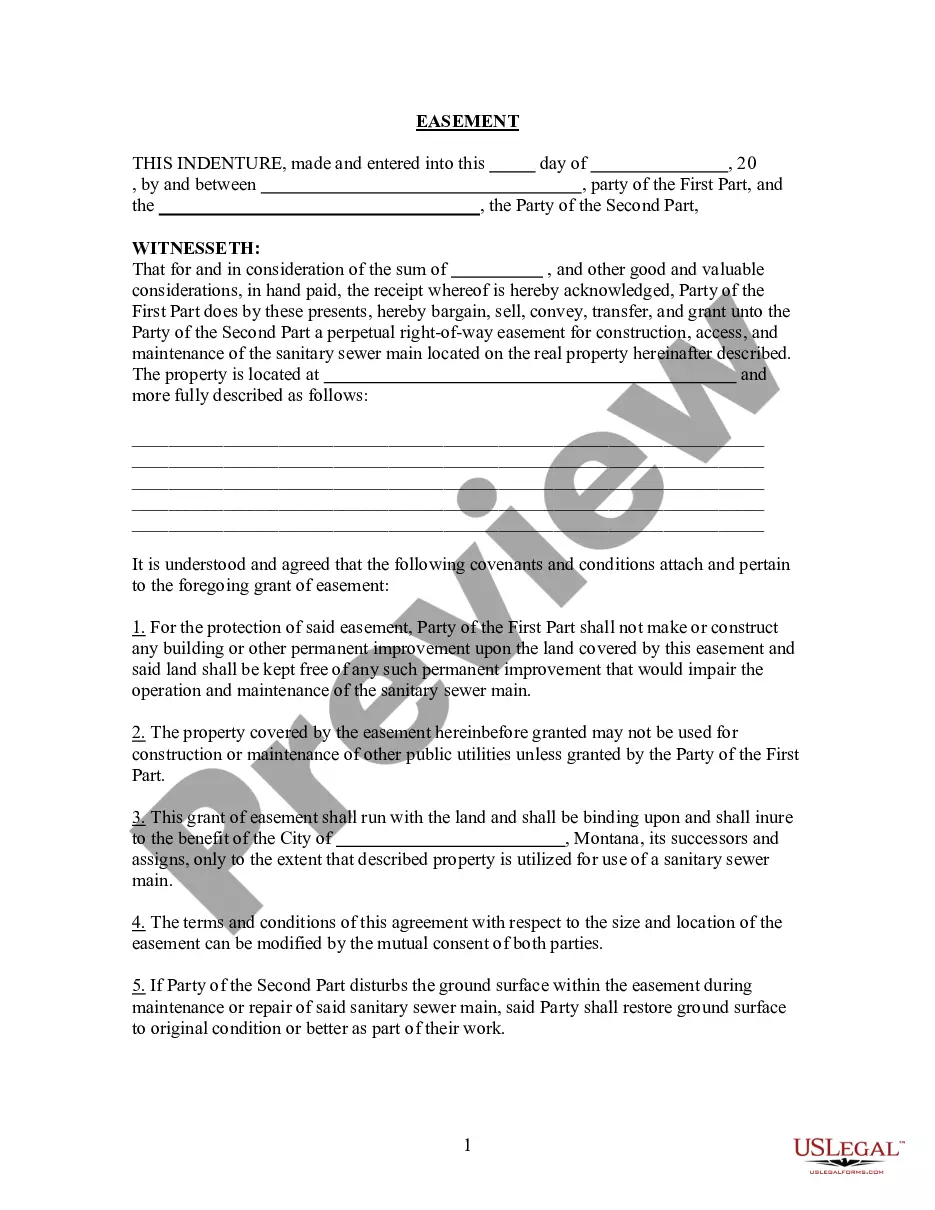

How to fill out Wisconsin Clauses Relating To Initial Capital Contributions?

Are you presently inside a situation in which you need to have papers for either company or specific uses nearly every time? There are a lot of authorized papers templates accessible on the Internet, but getting versions you can trust is not simple. US Legal Forms delivers a large number of form templates, much like the Wisconsin Clauses Relating to Initial Capital contributions, that happen to be written to meet state and federal needs.

In case you are previously knowledgeable about US Legal Forms site and also have a free account, merely log in. Afterward, it is possible to acquire the Wisconsin Clauses Relating to Initial Capital contributions design.

If you do not offer an account and wish to begin using US Legal Forms, adopt these measures:

- Discover the form you require and ensure it is for the correct area/region.

- Utilize the Review key to analyze the form.

- Read the explanation to actually have selected the appropriate form.

- In case the form is not what you are searching for, make use of the Search industry to obtain the form that meets your needs and needs.

- Once you find the correct form, click on Acquire now.

- Pick the costs program you would like, fill out the required information to produce your account, and pay for the order with your PayPal or charge card.

- Decide on a hassle-free document file format and acquire your copy.

Discover all the papers templates you have purchased in the My Forms menu. You may get a extra copy of Wisconsin Clauses Relating to Initial Capital contributions at any time, if necessary. Just click on the essential form to acquire or print the papers design.

Use US Legal Forms, the most considerable variety of authorized types, to save some time and prevent blunders. The services delivers skillfully created authorized papers templates that can be used for an array of uses. Produce a free account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

Hear this out loud PauseCash or assets given to an entity in exchange for an equity interest or as part of an ongoing obligation, or capital commitment, to fund the entity. For example, a capital contribution is often made in exchange for additional common stock, partnership interests or limited liability company interests of an entity.

Hear this out loud PauseThe most common capital contribution is cash, but you can also contribute property, such as office space, vehicles, and equipment. It's also possible to contribute services to an LLC.

Hear this out loud PauseA capital contribution is a business owner putting their own financial resources or material into their company in order to increase equity capital and improve liquidity. The same applies to partnerships: Each shareholder has the option of making their own assets available to the company.

An Initial Capital Stock Contribution is a specific amount of money you noted on your Operating Agreement that you as a shareholder in your LLC with S Corp tax formation would 'contribute' to get the business up and running.

Capital contributions are the money or other assets members give to the LLC in exchange for ownership interest. Members fund the LLC with initial capital contributions?these are usually recorded in the operating agreement. Additional capital contributions can be made at any time later on.

Hear this out loud PauseOne of the most important sections in the operating agreement is the capital contribution section. A capital contribution section usually addresses what happens if members fail to contribute their portion of the initial start-up capital.

After you have made your capital contributions to the business, each member's contribution should be recorded on the balance sheet as an equity account. You should have a capital contribution account for each member's contributions and record their initial contribution as well as additional contributions there.

Your Capital Contribution should be equal (proportionate) to your Membership Interest. For example, if Bob and Jose each own 50% of their LLC, they will each contribute the same amount of money. For example, they can both contribute $500, $1,000, or $25,000. The amount doesn't matter, as long as it's the same.