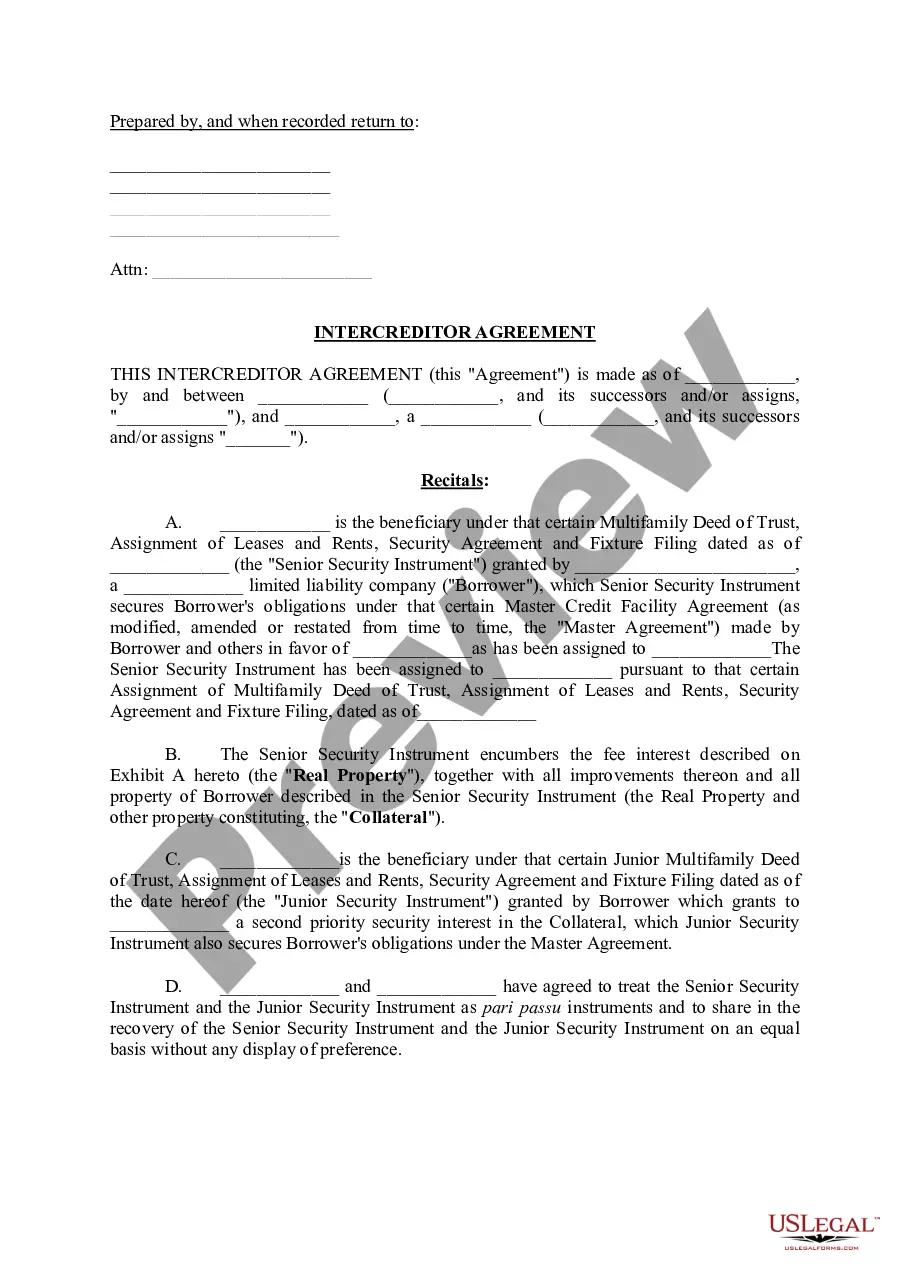

Wisconsin Clauses Relating to Dividends, Distributions

Description

How to fill out Clauses Relating To Dividends, Distributions?

If you have to full, download, or print out authorized record templates, use US Legal Forms, the most important collection of authorized varieties, which can be found on-line. Utilize the site`s easy and handy research to discover the paperwork you need. Various templates for business and person uses are categorized by classes and says, or search phrases. Use US Legal Forms to discover the Wisconsin Clauses Relating to Dividends, Distributions with a couple of clicks.

When you are previously a US Legal Forms client, log in for your accounts and click on the Download option to find the Wisconsin Clauses Relating to Dividends, Distributions. Also you can access varieties you previously delivered electronically from the My Forms tab of your own accounts.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for that right area/country.

- Step 2. Take advantage of the Review method to examine the form`s content. Never overlook to read through the outline.

- Step 3. When you are unsatisfied together with the type, use the Lookup area on top of the monitor to discover other types of the authorized type template.

- Step 4. When you have identified the shape you need, click the Acquire now option. Pick the rates strategy you like and add your credentials to register on an accounts.

- Step 5. Procedure the transaction. You can utilize your credit card or PayPal accounts to accomplish the transaction.

- Step 6. Find the formatting of the authorized type and download it in your system.

- Step 7. Full, modify and print out or signal the Wisconsin Clauses Relating to Dividends, Distributions.

Each authorized record template you buy is yours eternally. You may have acces to every type you delivered electronically with your acccount. Click the My Forms section and pick a type to print out or download yet again.

Compete and download, and print out the Wisconsin Clauses Relating to Dividends, Distributions with US Legal Forms. There are thousands of specialist and express-particular varieties you may use for your personal business or person demands.

Form popularity

FAQ

Generally, liquidated damages are meant to be compensatory rather than punitive. This is why the amount of compensation that a party is required to pay in a liquidated damages clause should be a genuine estimation of the loss that would result from a breach of contract.

A liquidated damages clause is a means of ensuring that you are compensated if the party you hired fails to do the job. It should include a clause that sets out the specific amount of damages you are to receive if a specific type of breach occurs.

The main difference between a penalty clause and liquidated damages is that the former is intended as a punishment and the latter simply attempts to make amends or rectify a problem.

Liquidated Damages: These types of damages are awarded when there is a provision in a contract which states the amount of damages that shall be awarded in the event of a breach. Liquidated damages cannot be used as punishment to a party or to harm the party for the breach.

Where property is not destroyed, one measure of damages is the difference between the value before and the value after; a second measure is what it would reasonably cost to put the property in such condition as it was before the ? not the actual cost of repair. Chapleau v. Manhattan Oil Co., 178 Wis. 545, 190 N.W.

(1) An action for breach of any contract for sale must be commenced within 6 years after the cause of action has accrued. By the original agreement the parties, if they are merchants, may reduce the period of limitation to not less than one year. The period of limitation may not otherwise be varied by agreement.

To be enforceable in Wisconsin, liquidated damages must be reasonable. That is, they must reflect a rational estimate of the owner's likely damages caused by delay. Liquidated damages that are far greater than the owner's actual damages will be deemed unreasonable and unenforceable.