Wisconsin State of Delaware Limited Partnership Tax Notice

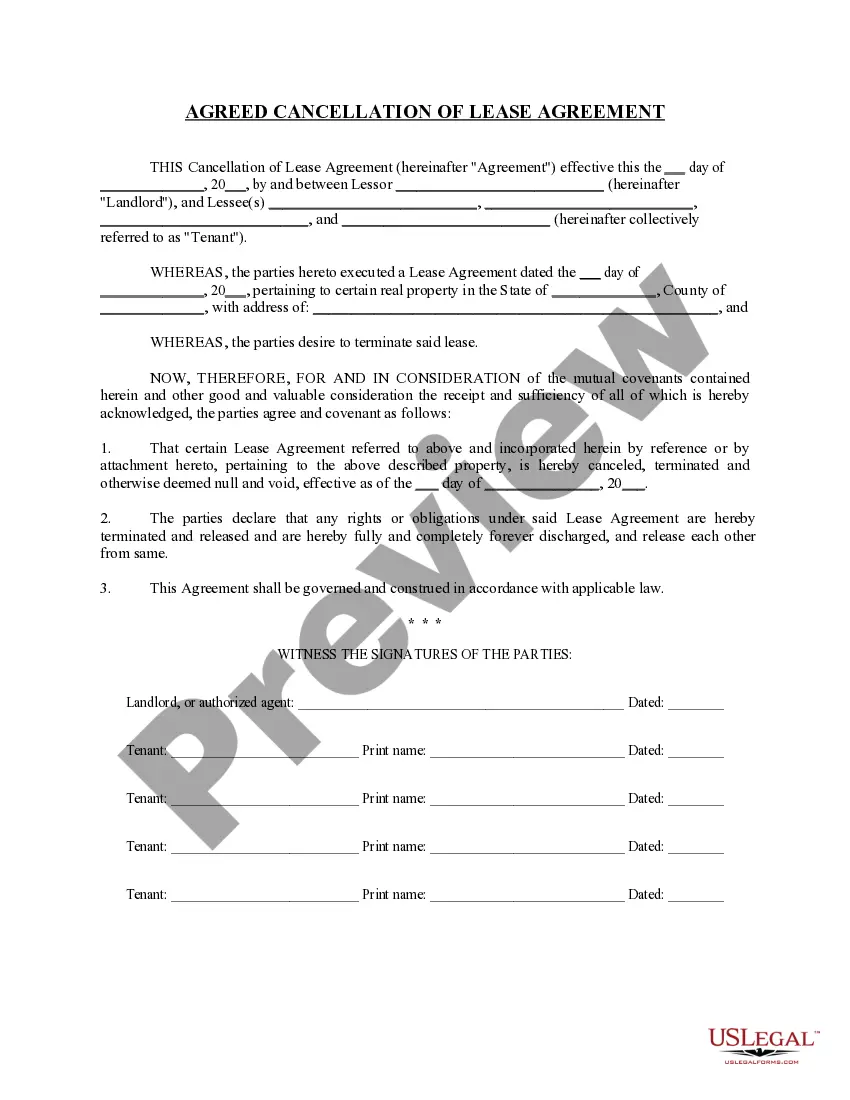

Description

How to fill out State Of Delaware Limited Partnership Tax Notice?

If you want to total, acquire, or printing authorized file templates, use US Legal Forms, the most important variety of authorized types, which can be found online. Use the site`s simple and easy hassle-free research to find the paperwork you want. Different templates for company and specific uses are sorted by types and suggests, or keywords. Use US Legal Forms to find the Wisconsin State of Delaware Limited Partnership Tax Notice in just a number of mouse clicks.

When you are previously a US Legal Forms customer, log in to your profile and click on the Download option to obtain the Wisconsin State of Delaware Limited Partnership Tax Notice. You can also access types you in the past acquired in the My Forms tab of your profile.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for the right city/region.

- Step 2. Make use of the Preview solution to check out the form`s content material. Don`t forget about to read through the information.

- Step 3. When you are unsatisfied with all the develop, take advantage of the Look for discipline at the top of the display screen to discover other models in the authorized develop format.

- Step 4. Once you have discovered the shape you want, click the Acquire now option. Opt for the costs prepare you prefer and put your credentials to register on an profile.

- Step 5. Approach the transaction. You may use your charge card or PayPal profile to perform the transaction.

- Step 6. Find the structure in the authorized develop and acquire it in your system.

- Step 7. Total, revise and printing or indication the Wisconsin State of Delaware Limited Partnership Tax Notice.

Every single authorized file format you acquire is your own property for a long time. You have acces to every develop you acquired within your acccount. Click the My Forms portion and decide on a develop to printing or acquire once again.

Contend and acquire, and printing the Wisconsin State of Delaware Limited Partnership Tax Notice with US Legal Forms. There are millions of professional and state-certain types you can utilize for the company or specific requires.

Form popularity

FAQ

Note: While most partnerships in Delaware are not subject to income taxes, they are required to file yearly state income tax returns and are required to pay an annual tax to the Secretary of State.

A resident partner must file Form PIT-RES (Delaware Resident Income Tax Return, formerly known as 200-01) and must report their share of partnership income or loss. Partnerships must file by the 15th day of the third month following the expiration of the taxable period (March 15 for calendar year taxpayers).

Delaware has a graduated tax rate ranging from 2.2% to 5.55% on income under $60,000. The maximum income tax rate is 6.60% on income of $60,000 or over.

Generally, you must keep your tax records at least until the statute of limitations expires for the tax return on which any of those items of income, deductions, apportionment percentages or credits appear. Usually this is 4 to 7 years from the due date of the return, or the date filed, whichever is later.

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

Limited partnerships do not pay income tax. Instead, they will "pass through" any profits or losses to partners. Each partner will include their share of a partnership's income or loss on their tax return. A partnership is created when two or more persons join together in order to carry on business or trade.

Are partnerships required to file a Wisconsin partnership return? A partnership or limited liability company treated as a partnership with income from Wisconsin sources, regardless of the amount, must file Form 3, Wisconsin Partnership Return.

Delaware treats a single-member ?disregarded entity? as a sole proprietorship for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware.